Close-up on Ulta: why beauty’s in the eye of the shareholder

It hasn’t looked so glossy since being dumped by Warren Buffett, but Ulta still has a glowing profile. Theodora Lee Joseph explains why this pretty stock might soon turn some heads.

29th November 2024 10:54

by Theodora Lee Joseph from Finimize

When Warren Buffett buys into a stock, investors take notice. And when he sells it, you can bet they note that too. That’s exactly what happened this year with Ulta Beauty Inc (NASDAQ:ULTA) – a company that briefly caught (and then lost) the Oracle of Omaha’s fancy. But, here’s the thing: just because Buffett stepped away doesn’t mean this opportunity should be off the table for the rest of us. In fact, I think Ulta’s current valuation presents an interesting proposition that’s worth paying attention to.

Let me be clear: Ulta isn’t a quality compounding machine like Costco Wholesale Corp (NASDAQ:COST) – a “buy and hold forever” type of stock. And it’s not a market-leading legacy brand that’s navigating past missteps like Nike Inc Class B (NYSE:NKE) either. Ulta’s runway for growth is narrowing, and it’s facing some real challenges. But when I see a high-return business trading at a 12-month forward price-to-earnings ratio of under 14x – a steep discount to its historical average – I sharpen my pencil. And when I factor in Ulta’s “omnichannel” strategy, loyal customer base, and potential to benefit from big-picture tailwinds like rate cuts and the recovery in China’s beauty market, the upside becomes pretty hard to ignore.

Buffett may have moved on, but for those of us looking for a mispriced gem in a resilient industry, Ulta could deliver. Let me show you why I think it deserves a look.

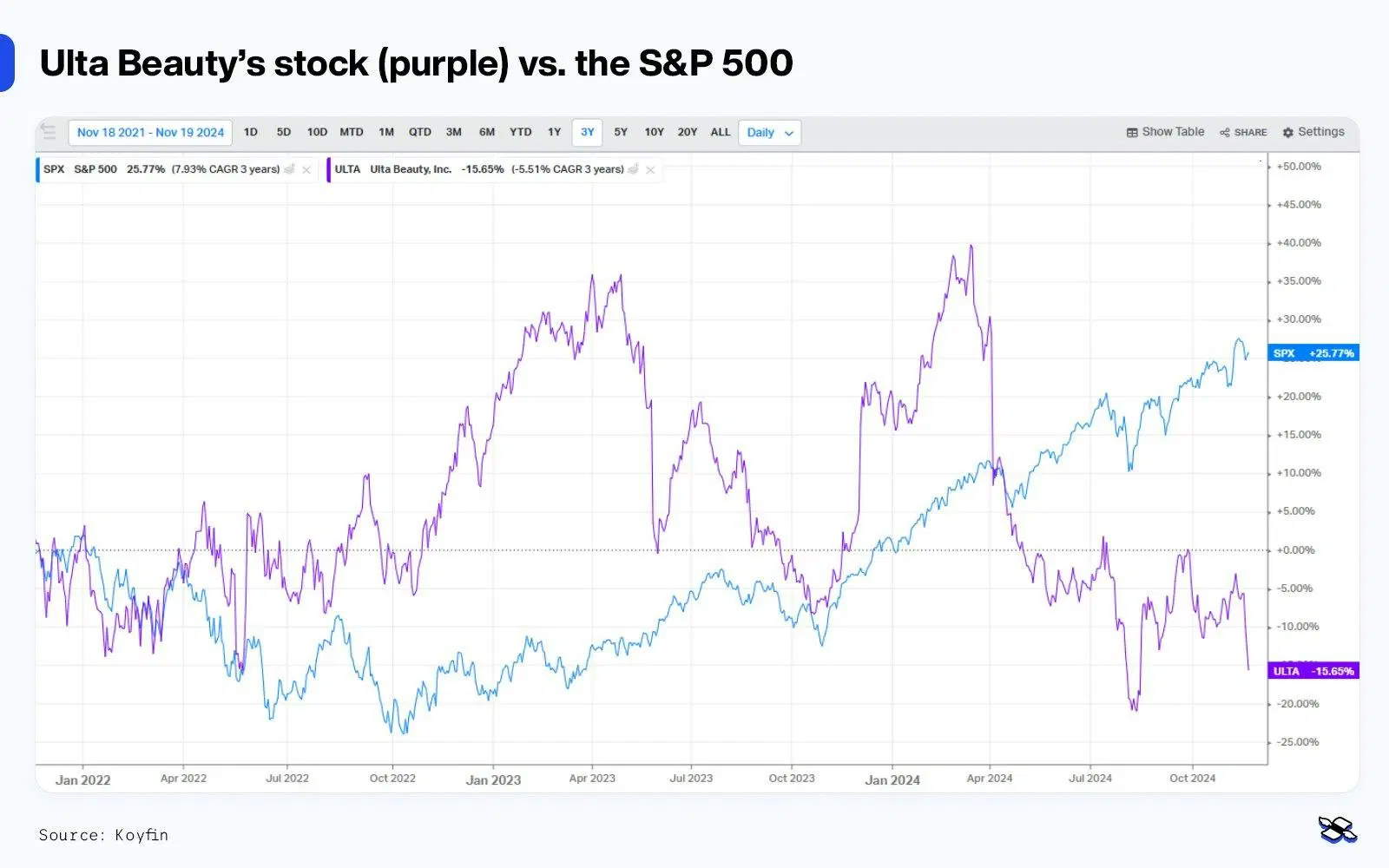

Ulta Beauty’s stock (purple line) hasn’t had an easy time of it in the past three years. Here’s how it has performed compared to the S&P 500 (blue). Source: Koyfin.

Thesis

- Ulta’s got a smartly positioned omnichannel business model. The chain’s blend of physical stores, e-commerce, and loyalty-driven engagement gives it a unique place in the beauty market. After all, omnichannel shoppers spend nearly three times more than in-store-only customers – which lends itself to consistent revenue streams across channels. And with over 44 million loyalty members, the company continues to benefit from high customer retention and spending.

- It’s set to benefit from consumer spending rebounds in China and the US. As a downstream player, Ulta is well-positioned to gain from the pickup in consumer spending that could happen if US interest rates continue to fall. Additionally, a recovery in China’s consumer market could indirectly boost Ulta by broadly boosting the beauty industry worldwide.

- Ulta’s stock has an attractive valuation and asymmetric risk-reward potential. Ulta trades at a 12-month forward price-to-earnings ratio of 13.5x – that’s 40% below its five-year average and far less than the S&P 500. The firm’s valuation already prices in some big challenges, creating a potentially favorable imbalance in the risk-reward potential. With conservative growth projections of 5.8% annually through 2028, Ulta’s share price shows an upside potential of 30% to 68%, based on discounted cash flow and several valuation-multiples scenarios – and that’s with modest growth assumptions.

- Ulta’s management recently authorized $3 billion in stock buybacks, representing 19% of its current market cap. Over the past ten years, that’s reduced the company’s share count by nearly a third, boosting EPS and enhancing shareholder returns. The stock’s low valuation right now only amplifies the value-creation potential of the buybacks, offering an additional margin of safety.

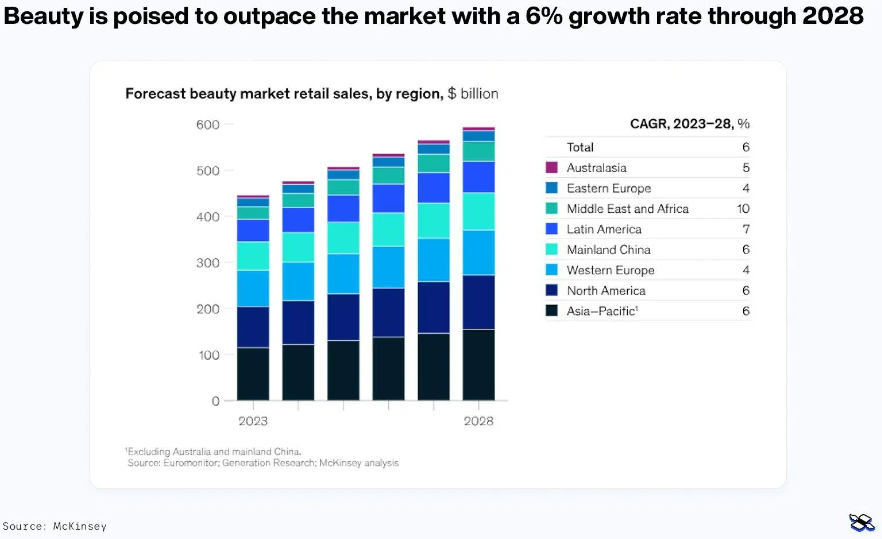

- While expansion has moderated in recent years, the beauty industry is projected to outpace broader markets with a 6% compounded annual growth rate through 2028. Ulta’s revenue normalization reflects wider trends but still positions it as a leader in a growing sector.

Risks

- Economic sensitivities. Ulta depends on consumers’ ability to spend on nice-to-have items, and that’s been under pressure lately because of high interest rates and inflation. And with middle- and lower-income shoppers focusing on essentials, that could further shrink demand for Ulta's products.

- Competitive pressures. Yeah, we’re talking about Sephora here. With over 1,100 distribution points added, the big rival’s growing presence could further erode market share for Ulta and force it to drop prices, which would pressure its margins.

- International expansion. Ulta's planned entry into Mexico will be its first foray into international markets. That diversification could unlock new growth, but it could also go badly. The firm could have trouble adapting to the consumer culture or clearing regulatory hurdles. Or it could turn out that its expected returns were far too high in this unfamiliar market.

So, what is Ulta’s business model?

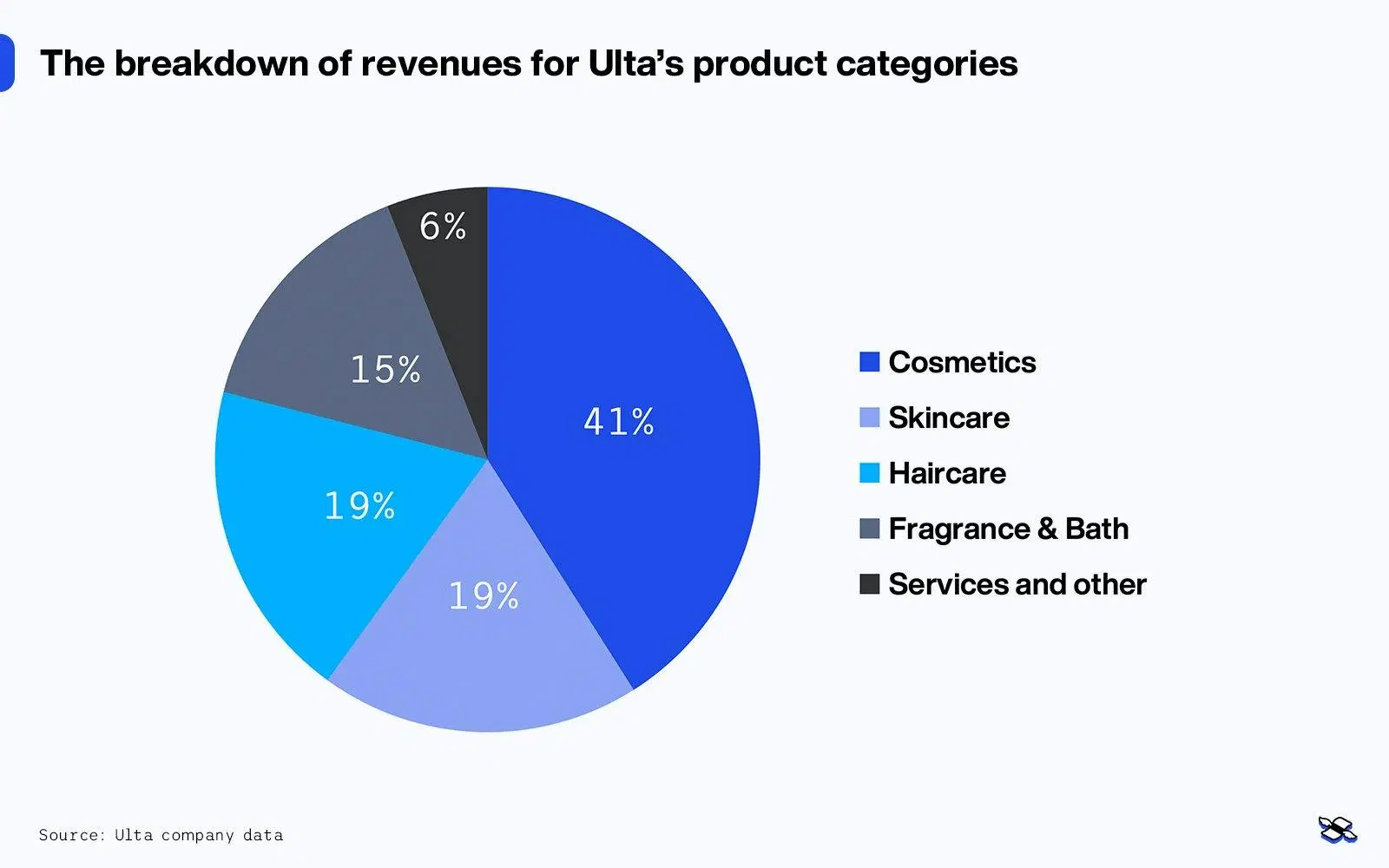

Ulta Beauty is the biggest specialty beauty retailer in the US, blending a range of products – think cosmetics, skincare, fragrances, and haircare – along with some salon services. Its business model is built around an omnichannel strategy that combines brick-and-mortar stores, e-commerce, and digital platforms to meet its customers where they are – and keep them spending.

Ulta was launched nearly 35 years ago in a Chicago suburb – designed as a welcoming one-stop shopping experience for beauty enthusiasts across income levels. Today, it has over 1,400 stores nationwide and a growing e-commerce presence that enhances its brick-and-mortar footprint.

The breakdown of revenues for Ulta’s product categories, 2024. Source: Ulta company data.

Ulta’s omnichannel strategy is a cornerstone of its business model. The “however you shop” approach aims both to drive online sales (currently about 20% of total revenue) and enhance foot traffic to physical locations by boosting customer engagement across channels. Omnichannel shoppers are especially valuable to companies – and that’s not surprising, since they spend nearly three times more than in-store-only customers.

Ulta's business model resembles that of mass retailers like Target Corp (NYSE:TGT) or Walmart Inc (NYSE:WMT), but with a focus on beauty products. It offers a curated selection of over 25,000 items from more than 600 brands, spanning prestige and mass-market categories. In the US market, Ulta competes with Sephora, Sally Beauty Holdings Inc (NYSE:SBH), Walmart, major department stores, drugstores like Walgreens Boots Alliance Inc (NASDAQ:WBA), and online sellers, including Amazon.com Inc (NASDAQ:AMZN).

Ulta has a few levers it can pull to try to expand growth: it can seek to increase in-store spending, boost customer visit frequency, or strategically widen its store network across the US. Of course, it’s not easy: the chain’s extensive physical presence might provide a competitive edge in offering a tactile, immersive shopping experience, but it also comes with high fixed costs. This creates major operational leverage, which means growth can sharply improve profitability, while slowdowns can disproportionately impact earnings.

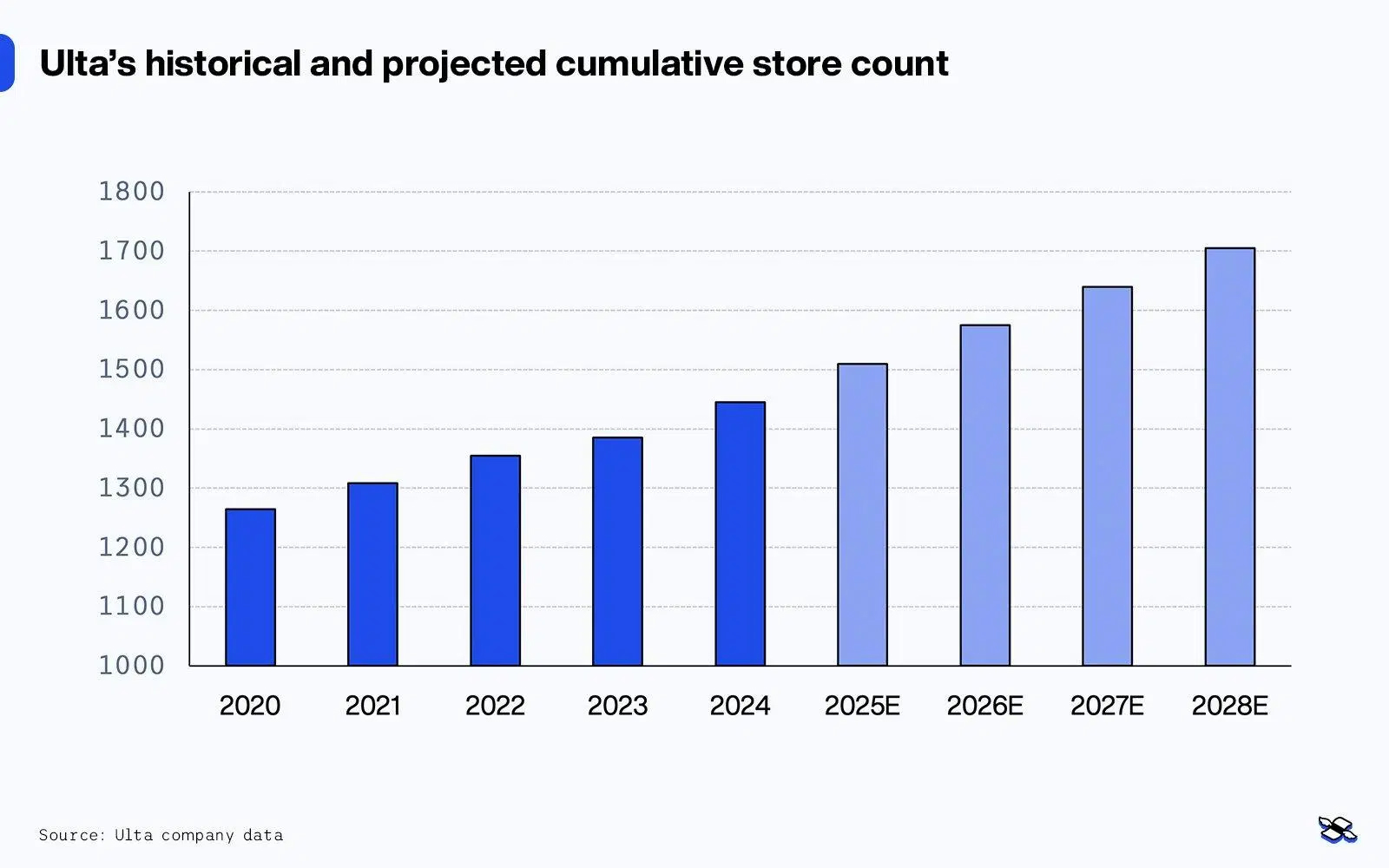

The company has said it hopes to grow its store count to over 1,800 locations and add six million new members to its 44-million-strong loyalty program.

Why has Ulta’s stock taken a beating?

Ulta’s shares have dropped nearly 30% in 2024, thanks to some company-specific and industry-wide challenges. Competitive pressures, particularly from Sephora's latest expansion, and a gloomier financial outlook have been weighing heavily. And slower spending among US and Chinese consumers certainly hasn’t helped matters. So it’s no wonder some investors are wondering whether the firm can keep its radiant glow.

Ulta’s shares have dropped by almost 30% this year and it’s now trading at a 12-month forward price-to-earnings (P/E) multiple of 14x – a 40% drop from its five-year historical average. To make sense of this underperformance and multiples compression, I find it helpful to break Ulta’s challenges into two categories. First, its company issues: the factors affecting the business that Ulta can directly influence. And second, its industry issues: the bigger trends that are largely outside of the firm’s control. Separating these helps me gauge how much the company can actually do to turn things around.

Here are the company issues.

- Increased competitive pressures. Ulta is feeling the heat from stiff competition, especially in the prestige beauty segment. During an earnings call in May, Ulta’s management admitted to losing market share in the category, blaming Sephora’s aggressive expansion into Kohl's Corp (NYSE:KSS)’s department stores as a factor. Since 2021, Sephora has added over 1,000 stores to its lineup. In fact, by the end of this year, it’s set to be in every Kohl’s location – and there are nearly 1,200 of those. That’s a huge footprint. Now, that surge has been a major headwind for Ulta, but the good news is that Sephora’s rollout should slow down in 2025, giving Ulta some welcome breathing room. What’s more, US drugstore chains CVS and Walgreens have announced plans to shutter thousands of stores, which could help Ulta gain market share.

- A gloomier growth and profits outlook. In August 2024, Ulta slashed its financial projections, sending a clear signal to investors that certain challenges were having an impact. Revenue guidance was trimmed to a range of $11 billion to $11.2 billion (down from $11.5 billion to $11.6 billion, previously), and earnings per share (EPS) estimates were lowered to a range of $22.60 to $23.50, from $25.20 to $26.00. Those cuts reflect softer demand for fancier beauty products, inventory shrinkage, heightened promotional pressures, and rising supply chain costs. What’s more, Ulta also dialed back its growth targets, aiming for just 4% to 6% annual sales growth and operating margins of about 12% by 2026 – down from its headier goals of 5% to 7% growth, and 13% to 14% margins. So investors are understandably concerned about what that all means for profitability.

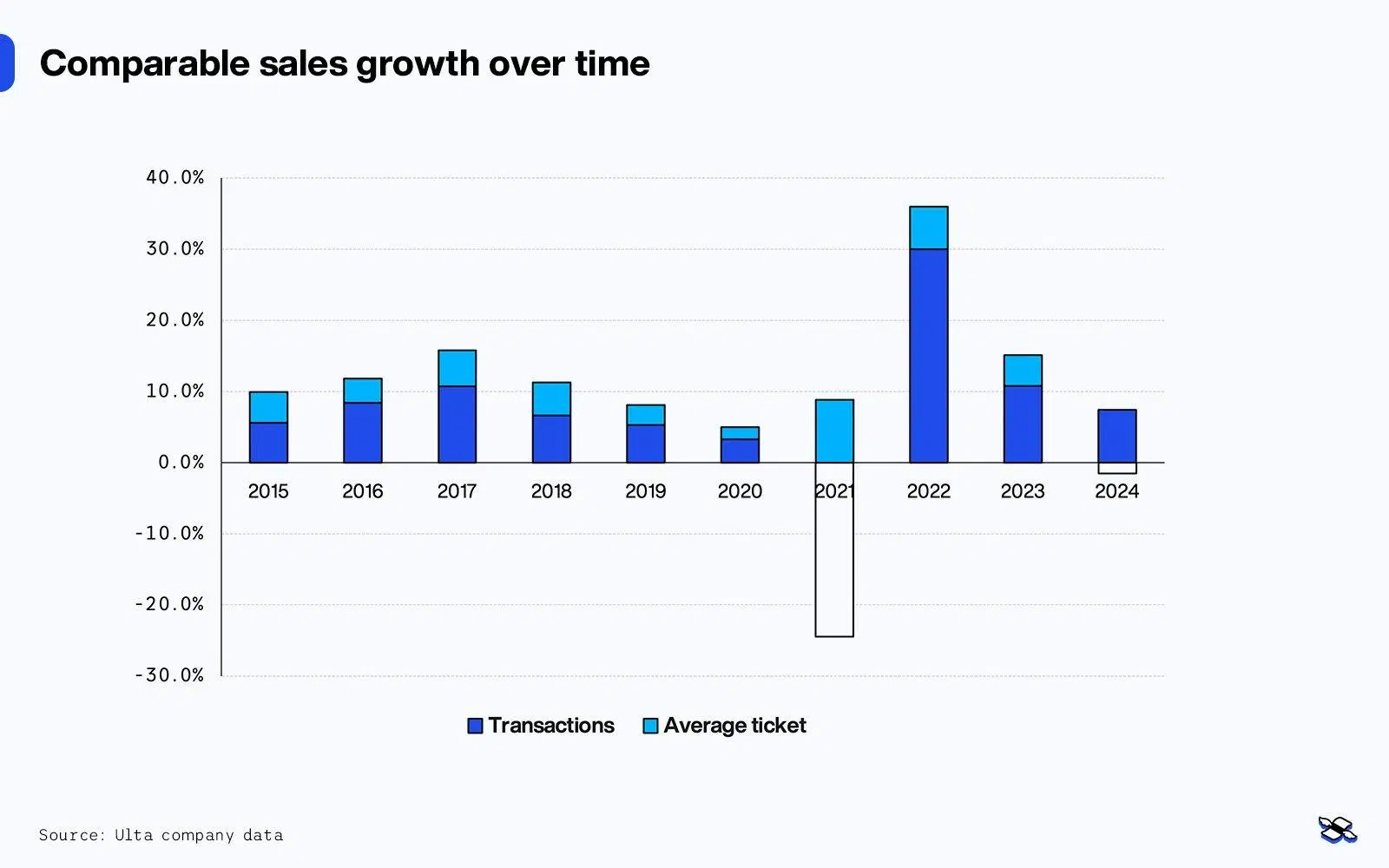

The Covid lockdown era was unusually rough for Ulta, but the period that followed was an anomaly of strong sales growth. Things are only now starting to normalize. Source: Company data.

- Reduced runway for long-term US growth. Ulta’s newer, lower guidance has brought another worry into focus: the fear that the company’s rapid growth phase may soon be over. During the 2010s, Ulta fueled its expansion by opening about 100 stores a year – roughly two new stores a week. That pace has now slowed to as little as 30 per year, with over 1,400 locations already up and running across the country. With a projected US store limit of 1,800, Ulta is steadily approaching market saturation, leaving little room for growth through expansion. That’s got investors wondering whether Ulta can replicate its past success – or if its golden era of growth will simply fade.

To address this challenge, Ulta is planning to enter Mexico’s market next year, aiming to eventually open 100 stores. This marks the chain’s first international move, and to mitigate risks, Ulta is partnering with Grupo Axo, a seasoned player there.

Ulta’s historical and projected cumulative store count. Source: Company data.

Industry issues

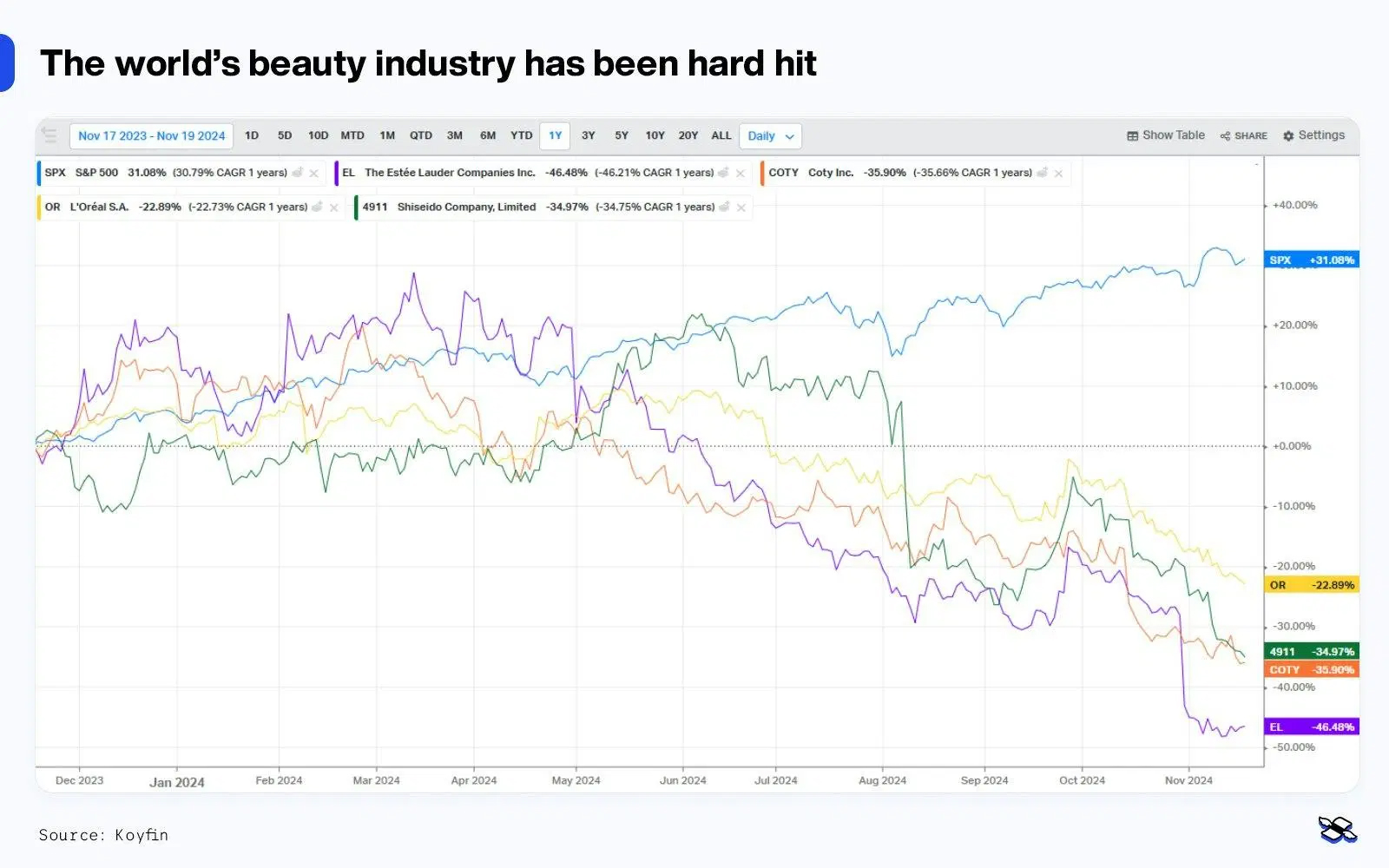

Ulta isn’t the only beauty retailer that’s dealing with new blemishes. The global beauty industry has serious growth challenges, with shares of iconic brands like The Estee Lauder Companies Inc Class A (NYSE:EL), Shiseido, and L'Oreal SA (EURONEXT:OR) all trading at multiyear lows.

The S&P 500 (in blue) over the past year, compared to shares of Estée Lauder (purple), Coty (orange), L’Oréal (yellow), and Shiseido (green). The world’s beauty industry has been hard hit by a slowdown in China, and a normalization of the post-pandemic high growth rates. Source: Koyfin.

- A challenging consumer backdrop. Over the past year, the US beauty industry has experienced a swift deceleration in growth. It’s no mystery why – high interest rates are squeezing people’s wallets, especially among lower- and middle-income shoppers. These folks are focusing on essentials, like groceries and household goods, and indulging less in so-called affordable luxuries, like makeup and skincare.Coty Inc Class A (NYSE:COTY), the parent company behind brands like CoverGirl and Max Factor, recently pointed out in their earnings call that mass beauty sales are now limping along with growth in the low single digits. Compare that to the double-digit boom it saw not long ago.

- China’s slowdown adds pressure. Now, if that weren’t trouble enough, China – one of the world’s biggest beauty markets – is cooling off too. For years, the Chinese market has been the engine of global beauty growth, right behind the US. But its recent economic slowdown has hit beauty brands hard. Feeling the sting, giants like Estée Lauder, Shiseido, and L’Oréal are turning again to the US, pushing harder to drive sales there. The downside is that the strategy has cranked up discounting and put more pressure on prices.

With all those hang-ups, why not just avoid beauty?

I get it: it might sound like beauty is, well, a beast right now. But I see these challenges as an opportunity – a chance to scoop up some high-quality value stocks. And that’s because the industry is still poised to outpace the broader market with an impressive forecasted growth rate of 6% through 2028.

Let me explain why Ulta is my top pick among the battered beauty stocks, but first, let’s step back and check out the bigger picture.

The geographical breakdown of the global beauty market’s retail sales, from 2023 and forecasted. Source: McKinsey.

The beauty industry’s value chain

The beauty industry runs on a fascinating value chain, which can be broken into two main sections upstream and downstream activities. Together, they take products from raw materials all the way to your face and hair.

Upstream activities

This is where the magic begins – sourcing raw materials, doing research and development (R&D), and making things. The upstream space is dominated by heavyweights like L’Oréal, Unilever (LSE:ULVR), Estée Lauder, Procter & Gamble Co (NYSE:PG), and Shiseido. These brands wield immense power over suppliers and distributors, thanks to their long-standing influence and brand strength.

But the rise of social media platforms like TikTok and Instagram has completely shaken up this space. Now, indie brands can market directly to consumers, that’s led to an explosion of new players like Glossier, ColourPop, and The Ordinary. These nimble newcomers have eroded traditional market shares, forcing legacy brands to innovate faster, adopt cleaner sourcing practices, and create products tailored to local markets. The pressure to adapt is relentless and can have a big impact on growth and profitability.

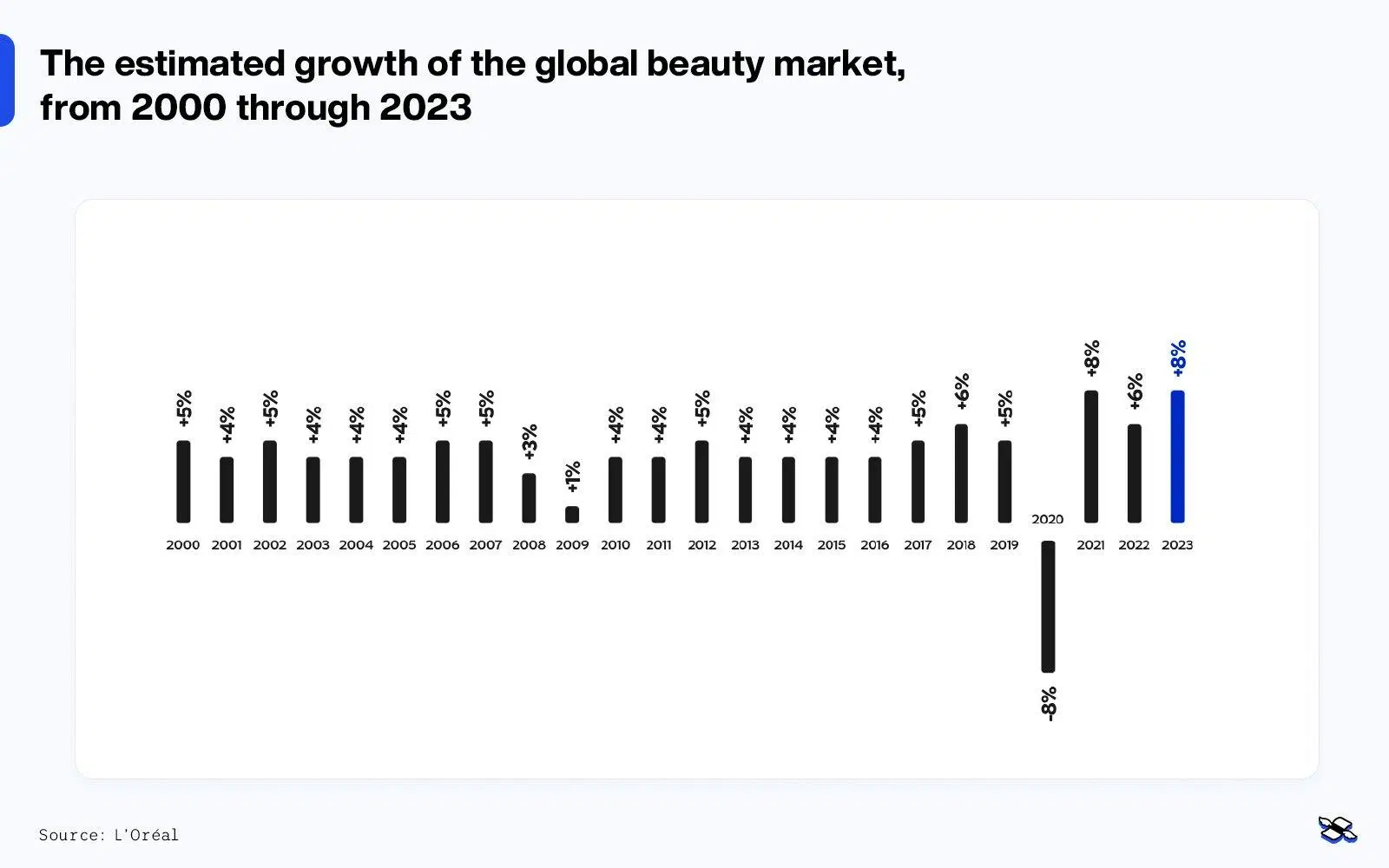

The estimated growth of the global beauty market, from 2000 through 2023. Source: L’Oréal.

Downstream activities

On the flip side, there are the downstream activities: things like marketing, distribution, and retail. You can think of this as the final step in delivering products to consumers – and this is where Ulta competes. But this portion of the value chain isn’t immune to disruption either.

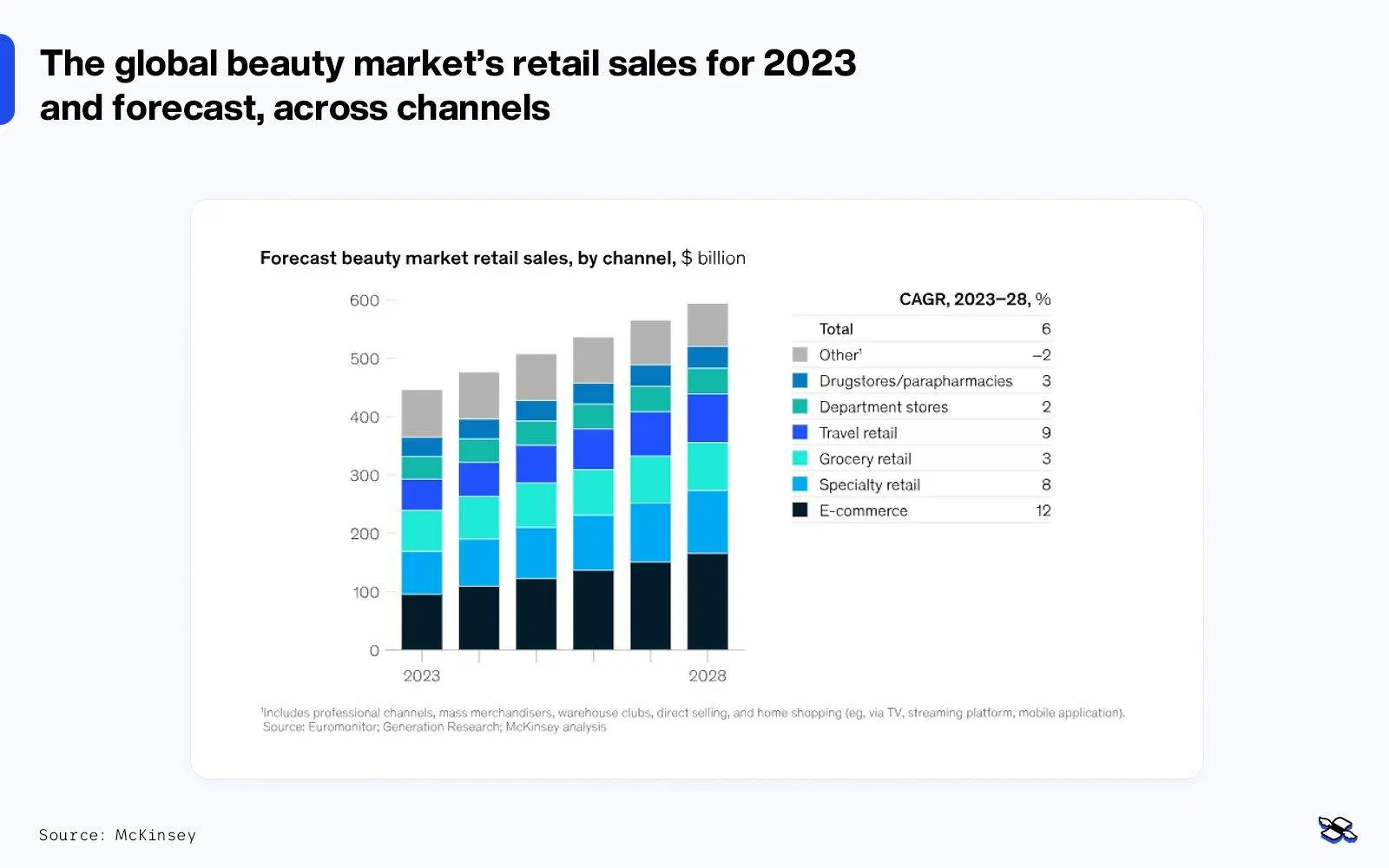

E-commerce has reshaped consumer behavior, and beauty retailers like Ulta are racing to adapt. Online sales have exploded because shoppers now expect seamless digital experiences alongside in-store options. Ulta has leaned into this shift with its omnichannel strategy – basically, blending physical stores with a strong online presence. Initiatives like same-day pickup, delivery services, and personalized online recommendations have helped Ulta stay ahead of the curve.

The approach works because it acknowledges that though e-commerce is thriving, brick-and-mortar is far from dead – especially in beauty. Consumers still crave the tactile, experiential aspect of shopping in person for makeup and skincare. (To say nothing of fragrances: try shopping for a new scent online).

The global beauty market’s retail sales for 2023 and forecast, across channels. Source: McKinsey.

Your investment approach to beauty may depend on your “macro” or big-picture economic view. If you’re betting on a rebound in China’s economy, upstream players like L’Oréal, Estée Lauder, or Coty might give you higher exposure and more leverage to that growth.

On the other hand, if you’re optimistic about a recovery in US or European consumer spending – perhaps spurred by falling interest rates – it’s downstream players like Ulta that demand your attention. And the best part is, even if China’s growth bounces back, beauty retailers like Ulta stand to gain indirectly, as easing pricing pressures from upstream suppliers would improve their margins.

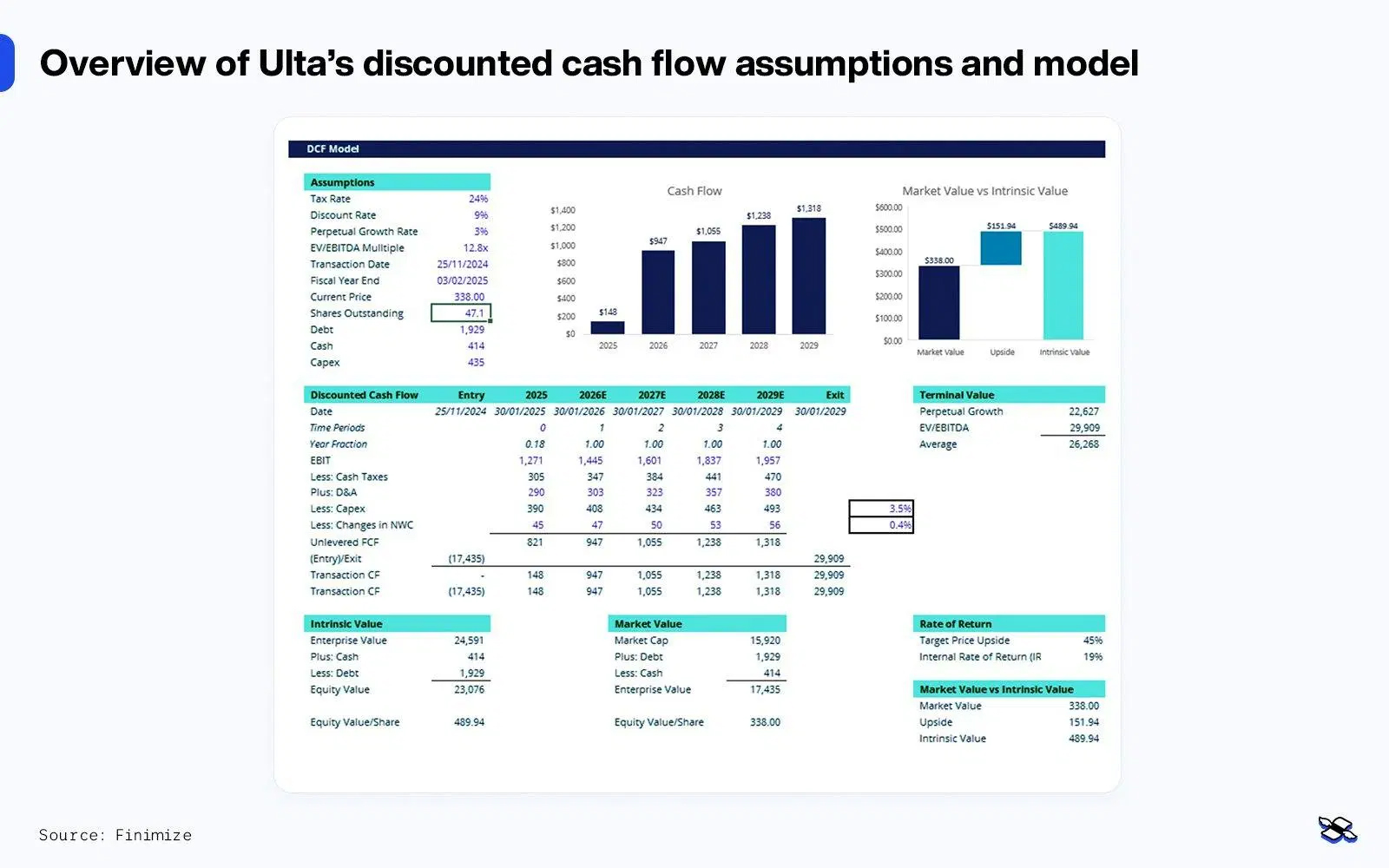

What’s Ulta ultimately worth?

My DCF analysis pegs its fair value at $490, which leaves it with a 45% upside. However, I’d likely look to take profits around $440, aligning with its lower-bound EV/EBITDA valuation. Conservative growth assumptions, a robust share buyback program, and the industry’s resilience further strengthen the investment case.

Face it: there’s no denying the competitive pressures that Ulta is up against, and its growth runway doesn’t exactly scream potential. The company is US-bound with little international expansion experience, unlike its stylish competitor Sephora. But what does make Ulta compelling, at least to me, is that it’s a high-return business whose stock has been unfairly oversold and is now trading at a bargain-basement multiple.

Let’s zoom out for a second. Growth in the beauty industry isn’t what it was during its golden years, but it’s still holding strong at mid-to-high single digits. More importantly, the market has already priced in the disappointment in Ulta’s growth and profitability. In my view, that leaves the risk skewed in the shareholders’ favor.

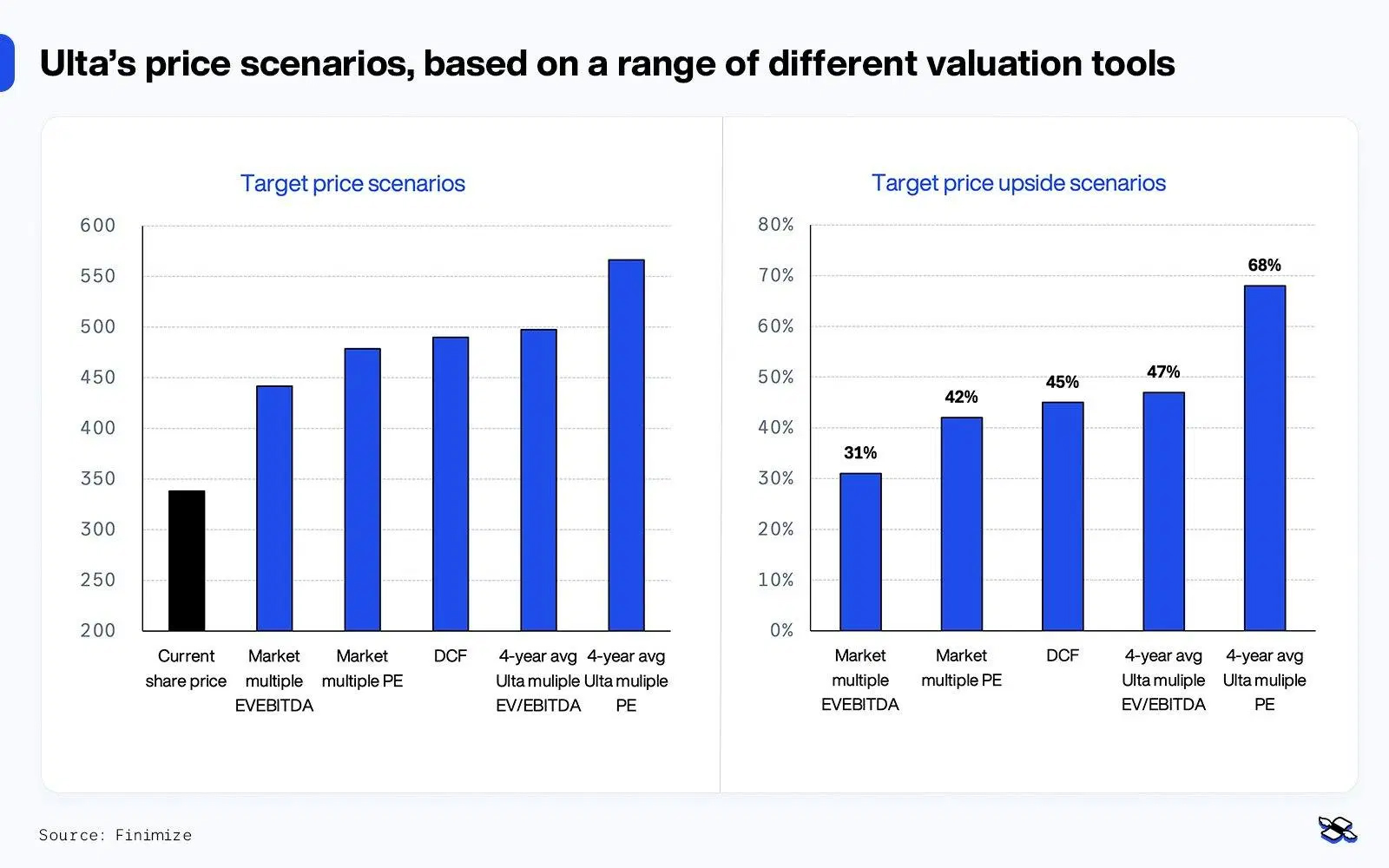

A quick valuation check

I ran the numbers using multiple valuation tools – discounted cash flow (DCF), price-to-earnings (P/E), and EV/EBITDA multiples. Across all three, I see Ulta’s share price having an upside of anywhere from 20% to 55%. You can explore Ulta’s DCF model here. Just note that you’ll need to make a copy of the template before you can play around with the assumptions in the cells and stress-test the price.

Take the DCF model, for example. Based on my assumptions (laid out in detail below), I estimate a 45% upside to Ulta’s share price. I’ve paired this with an exit enterprise value to earnings before interest, taxes, depreciation, and amortization (EV/EBITDA) multiple of 12.8x for its 2029 earnings. That’s a cautious call, pegged to a 10% discount on Ulta’s three-year historical average.

Overview of Ulta’s discounted cash flow assumptions and model. Source: Finimize.

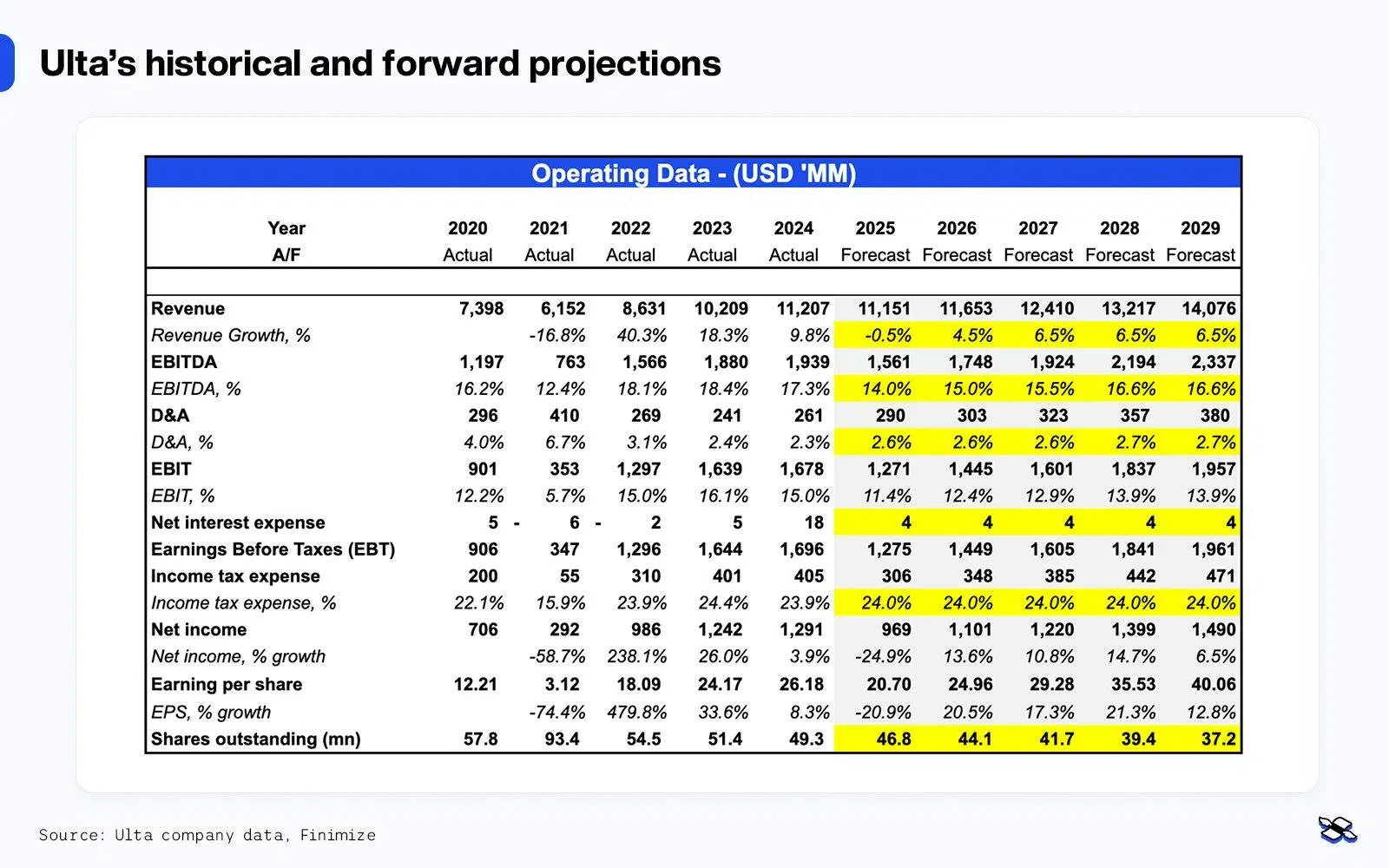

In terms of sales growth, I’ve kept my estimates conservative. I’m projecting 5.8% annual growth through 2028, slightly below Ulta’s own 6% guidance and well under its decade-long average of 10.3%. This is even more cautious when you consider that McKinsey’s consultants project that specialty beauty retailers will grow at an average of 8% through 2028.

Ulta’s historical and forward projections. Source: Company data, Finimize.

Next, let’s talk multiples. Ulta is trading at a 12-month forward P/E of 13.5x – a steep 40% discount to the S&P 500. That’s also the lowest it’s traded at in the past 10 years. Historically, Ulta’s average P/E multiple was 24.6x, which carried a hefty 38% premium over the broader market. Sure, future growth might not hit the same heights as it did in the past, so a multiple compression makes sense. But the real question is, how far should it compress? If Ulta still outpaces the market and delivers strong returns, there’s a case to be made for a rebound.

Using the market’s three-year average P/E and EV/EBITDA multiples (19.2x and 12.8x, respectively), I estimate a 42% and 31% upside, even with these more tempered assumptions. Best case scenario: if Ulta reclaims its historical multiples, the upside could shoot to 68% (P/E) and 47% (EV/EBITDA).

Ulta’s price scenarios, based on a range of different valuation tools. Source: Finimize.

Ulta as a corporate cannibal

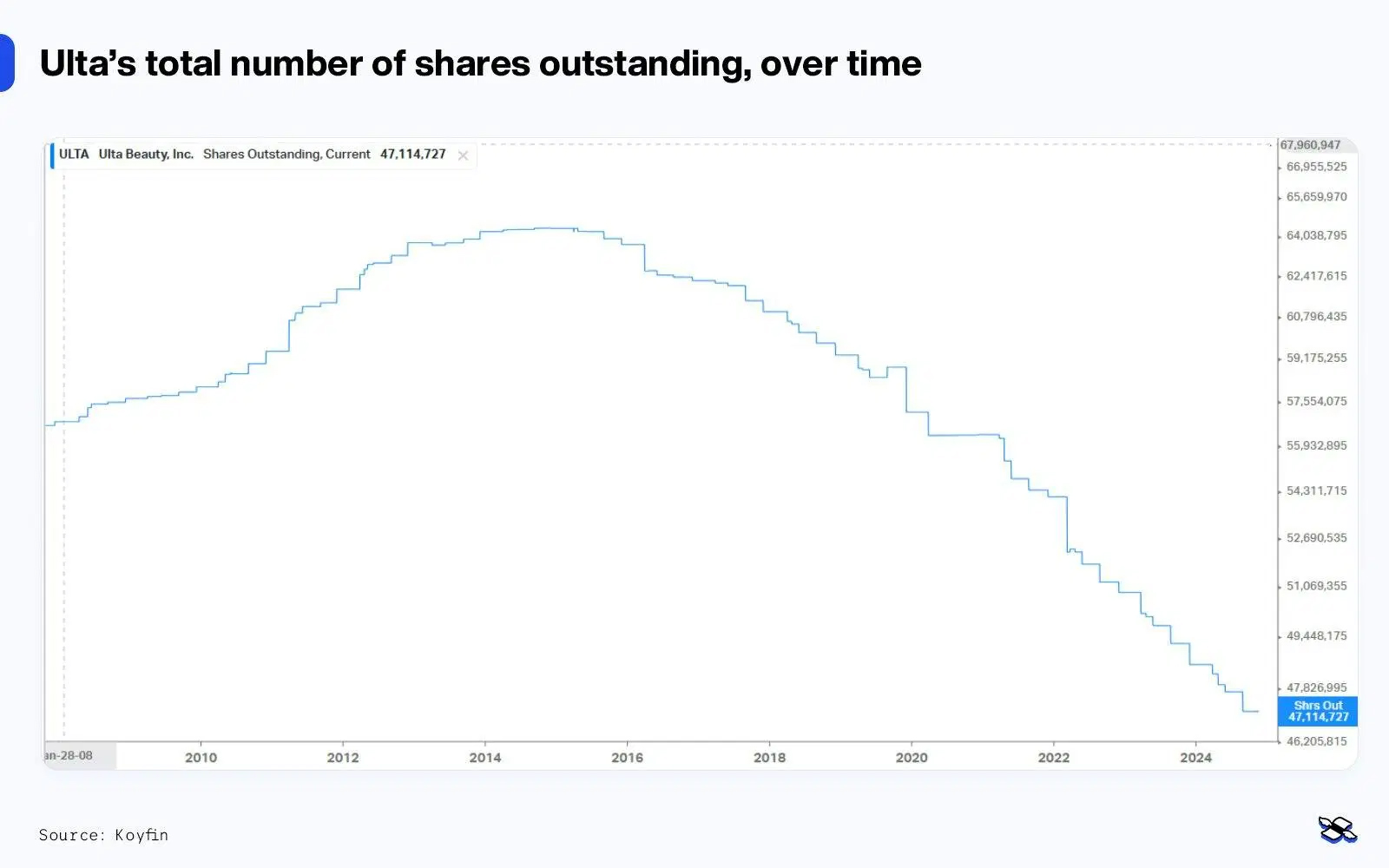

But wait, as they say, that’s not all. Ulta isn’t just a solid business: it’s also a share-buyback machine. Its management has authorized $3 billion in buybacks over the next three years – a whopping 19% of its current market cap.

Ulta’s total number of shares outstanding, over time. Source: Koyfin.

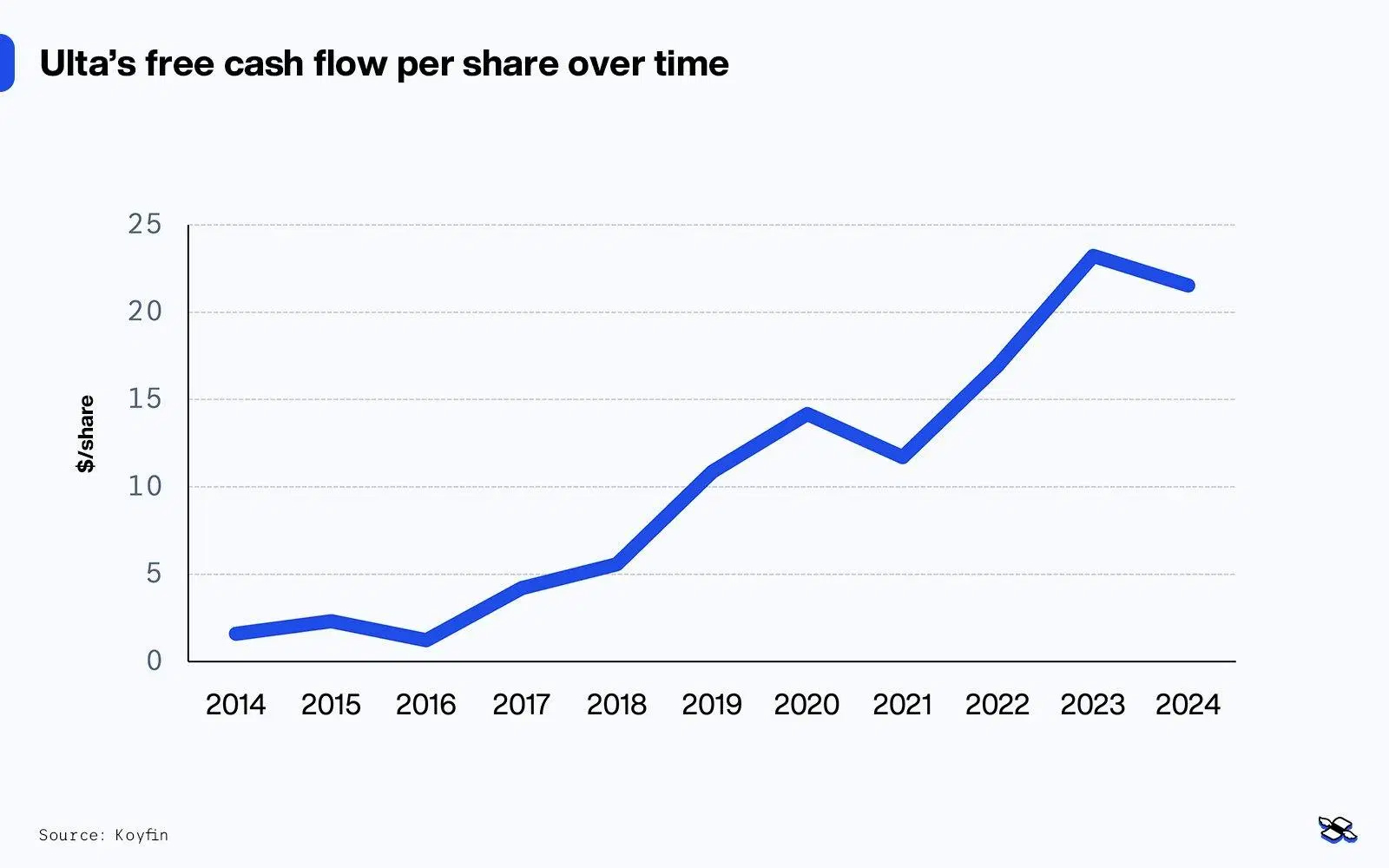

That’s good news for investors: buying back shares at today’s discounted levels only amplifies shareholder value. And this isn’t a new strategy for Ulta: since 2014, the company has repurchased over 18 million shares at an average price of $313 – reducing its total share count by nearly a third and returning $5.8 billion to shareholders. That’s the power of a cash-generating, low-debt business.

Ulta’s free cash flow per share over time. Source: Koyfin.

The math is blissfully simple: as Ulta continues its aggressive buyback program, the shrinking share count boosts earnings per share and, by extension, the potential returns for investors. This “share cannibal” approach creates a margin of safety I find hard to ignore.

No, Ulta isn’t perfect, and it’s not immune to challenges. But it’s an oversold, high-return business trading at an unjustifiably low valuation. With its resilient industry, conservative growth assumptions, and massive buyback program, I see plenty of upside from here. So if you’re looking for a stock that combines value, upside potential, and a proven ability to reward shareholders, this one deserves a look. For me, the upside outweighs the risks – and the numbers back it up.

Theodora Lee Joseph is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.