City of London on track for 56th consecutive year of dividend growth

The UK equity income investment trust’s exposure to miners, oil and banks has been paying off.

18th February 2022 11:21

by Kyle Caldwell from interactive investor

The UK equity income investment trust’s exposure to miners, oil and banks has been paying off.

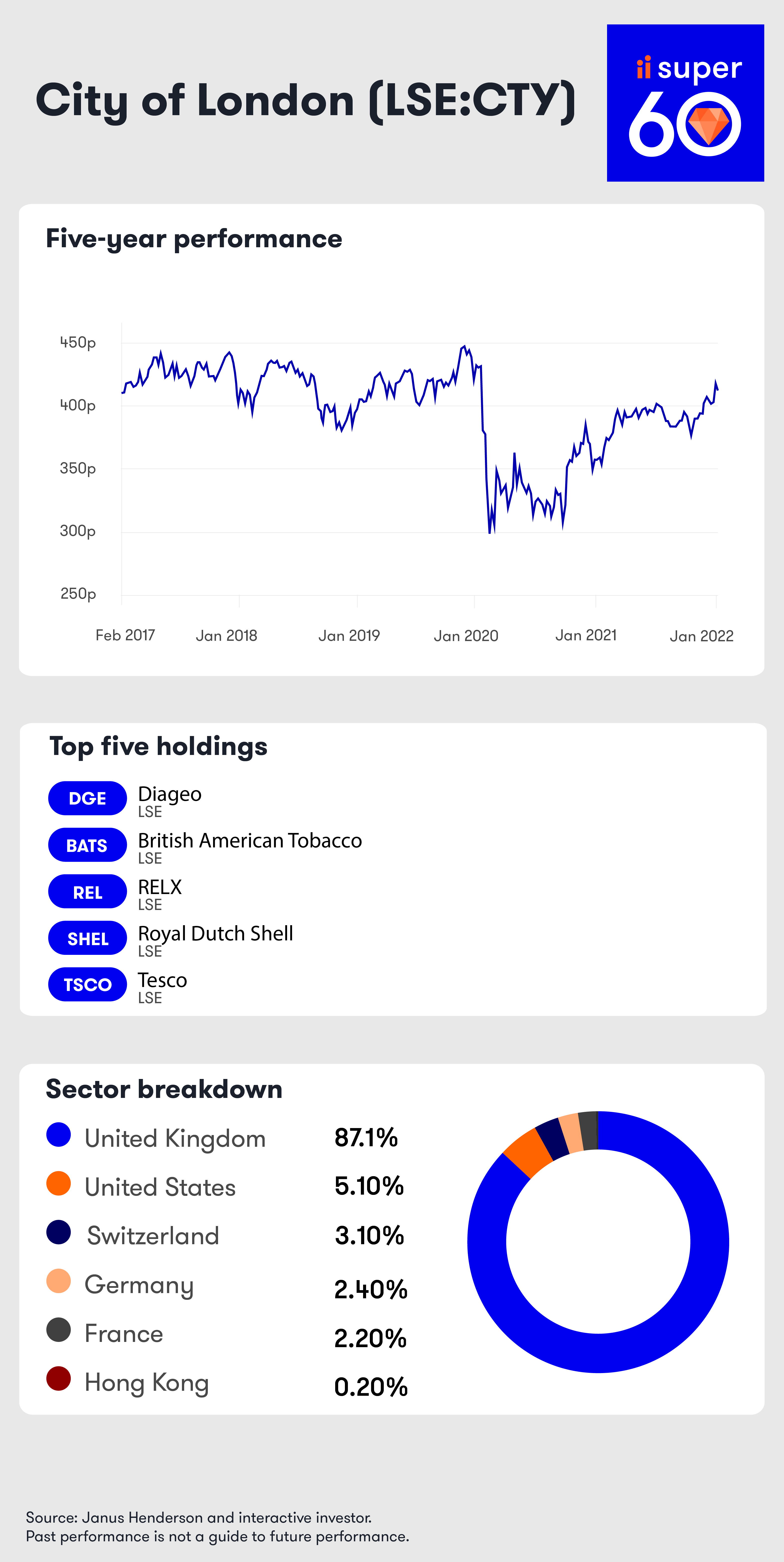

City of London (LSE:CTY), which has a formidable reputation as an income-producing investment trust, has lately seen its performance boosted by its exposure to miners, oils and banks.

Today (18 February), the trust reported in its half-yearly results to 31 December 2021 that it had outperformed the FTSE All-Share index in terms of its net asset value (NAV) return. Its NAV was up 6.9% over the six-month period versus 6.5% for the index. Its NAV performance was also ahead of the average rival as the Association of Investment Companies' (AIC) UK Equity Income sector returned 6%.

- 11 investment trusts to earn £10,000 income in 2022

- Here's why UK shares will pay lower dividends in 2022

- 12 funds for the £10,000 income challenge in 2022

City of London’s share price, however, fell short of the index. It was up 3.5%, hindered by the trust moving from a small premium to a small discount over the period. The same trend has played out over one year. Its NAV return, of 20.1%, is ahead of the FTSE All-Share index gain of 18.3%. Its share price return is lower, up 11.8%.

Over three and five years, however, both the NAV return and share price return have underperformed the index.

The trust is a member of interactive investor's Super 60 list.

Fuelling City of London’s performance over the six-month period were dividend increases from its holdings in mining companies, with Anglo American (LSE:AAL) and Rio Tinto (LSE:RIO) also paying special dividends. The trust also benefited from a recovery in dividends from banks. HSBC (LSE:HSBA), Barclays (LSE:BARC) and Lloyds (LSE:LLOY) are all held by the trust. Its positions in oil majors BP (LSE:BP) and Royal Dutch Shell (LSE:SHEL) also paid off as dividends were partially restored.

The food retail sector was another key performance driver, with the trust benefiting from stakes in Tesco (LSE:TSCO)and Wm Morrison. The latter was the subject of a bidding war between two private equity groups, which lifted its takeover price.

Other important stock contributors over the six-month period were RELX (LSE:REL), Microsoft (NASDAQ:MSFT) and St James's Place (LSE:STJ).

The two biggest detractors were M&G (LSE:MNG) and French national lottery operator La Française des Jeux. City of London said that both had been among the best contributors in its last financial year.

- Fund and trust ideas to income-boost portfolios to beat inflation

- Income tips for 2022: should investors go global or back the UK?

- Funds Fan: market rotation, unloved UK, and fund yielding 5% plus

The trust is on track to continue its stellar dividend growth track record. Sir Laurie Magnus, the chair of City of London, said:“City of London has declared two interim dividends of 4.80p each so far during this financial year. The company's diverse portfolio, strong cash flow and revenue reserve give the board confidence that it will be able to increase the dividend for the 56th consecutive year. The quarterly dividend rate will be reviewed by the board before the third interim dividend is declared in April 2022.”

Giving his outlook for the UK equity market for the next six months, Magnus said: “At present, no more than a slowdown in economic growth is expected and therefore corporate profits and dividends during the rest of the current financial year should continue to increase.

“Households in aggregate still have a high level of enforced savings from the lockdowns to support consumption, although their discretionary real spending power may be reduced by inflation, tax increases and rising interest rates in the next financial year and beyond. The dividend yield from many high-quality UK equities remains attractive, with the continuing trend of takeovers demonstrating potential additional overall upside.”

The trust’s dividend yield stood at 4.9% at the end of 2021 versus 3.6% for the FTSE All-Share index.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.