A cheap, high yielding stock with limited downside

Our industry commentator, author and columnist finds a share offering excellent buying opportunities.

20th February 2019 10:47

by Rodney Hobson from interactive investor

Our industry commentator, author and columnist finds a share offering excellent buying opportunities.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

There's much to be said for picking large, solid and profitable companies as the basis for any investment portfolio – the drawback is that they tend to be fully valued so they provide few opportunities for capital gains.

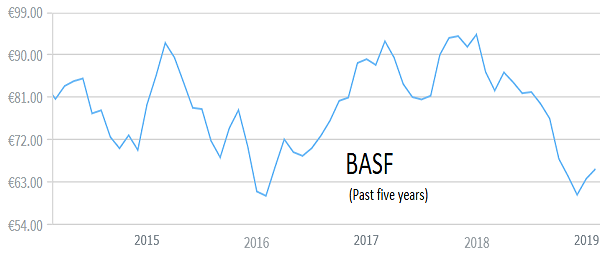

An exception is BASF (XETRA:BAS), which, despite being one of the two largest chemical producers in the world, has a volatile share price that has swung wildly between €57 and €94 over the past five years.

BASF, a component of the Euro Stoxx 50 stock market index, is based in Germany where it was founded 160 years ago, but it has subsidiaries and joint ventures in more than 80 countries and operates nearly 400 production sites in Europe, Asia, Australia, the Americas and Africa. The geographic spread could be a useful bulwark given the current slowdown in Europe and the trade war between US and China.

From its origins in making dyes, the company has constantly evolved and has developed a knack of spotting opportunities in higher valued products that have over the years included synthetic fibres, coatings, pharmaceuticals, pesticides and fertilisers. In 1990 the company dropped all its consumer product lines and focused on industrial products only.

BASF companies supply raw materials to most industries in the UK, including agriculture, automotive, chemicals, construction, energy and pharmaceuticals. It has been quite active in selling off subsidiaries and buying other companies, a strategy that can backfire if the deals are badly priced, but BASF seems to have made a reasonable success of it.

Source: interactive investor Past performance is not a guide to future performance

BASF's volatile share price may be bad for the nerves but good for the pocket as it provides excellent buying opportunities. The shares are currently trading at around €66, which does not look expensive as the price/earnings ratio is an undemanding 10.7 and the yield is an attractive 4.7%.

The downside looks limited, as €57 has provided a floor earlier this year and before that in 2016. However, it would be surprising if the shares slip below €60.

If BASF has been active in the M&A department, DowDuPont (NYSE:DWDP) is taking it to extremes by first amalgamating two already massive chemicals companies to overtake BASF, then proposing to split into three specialised parts by June.

The all-stock merger of America's two largest chemicals companies was completed on 31 August 2017. Getting together was touted as bringing together complementary portfolios with leading positions in agriculture, materials and specialist products.

However, the intention was always to split subsequently into three independent specialist companies, each publicly listed. The agriculture division will be named Corteva Agriscience, the materials science division Dow, and the specialty products division DuPont. They will, it is claimed, be more profitable on their own.

This probably makes a lot of sense in the long term but it does produce a great deal of upheaval and could distract management from concentrating on the day-to-day running of the business.

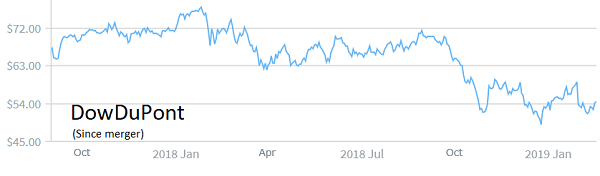

Source: interactive investor Past performance is not a guide to future performance

DowDuPont shares have seen some volatility in their short life. The combined group started trading at $67 and reached a peak of $77 in January last year, but they slipped to a low of $49 in December.

They are struggling to recover despite having edged back to $54.50 and the downside is probably limited to $51. However, the PE is a far more demanding 32.9 and the yield a less appealing 2.8%.

Hobson's choice: Buy BASF below €65. It would be worth considering taking profits if the shares reach €80, and most certainly if they top €90 as they did at the start of last year. DowDuPont is a less obvious buy, but it would not be a mistake to venture in at up to $55 as a long-term investment aimed at benefiting if and when the perceived advantages of the reorganisation come through.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.