Chart of the week: should you buy this stock market dip?

With stock markets near a one-month high, our technical analyst reveals if he’s found his buying boots.

14th April 2020 11:06

by John Burford from interactive investor

With stock markets near a one-month high, our technical analyst reveals if he’s found his buying boots.

Buying the dip? I am avoiding it like the plague

As a market observer that was there for the 1987 Black Monday event where the Dow collapsed by 22% in one day – and all subsequent panics (both of the selling and buying kind!) - I could say that I have seen it all before.

But in fact, I haven’t. I have never seen anything approaching the level of social fear now stalking the markets.

This week, I want to lay out my case that stock markets have a lot further to fall over the next several months.

Last year, just prior to the virus discovery, bullish sentiment was off-the-scale rampant with bond yields razor-thin and the much-watched US Treasury ‘yield inversion’ making mainstream media headlines, as a warning to expect at least a recession ahead and a clue to get defensive.

How prescient that indicator was, although it was derided by the perma-bulls at the time as being irrelevant.

There is none so blind as they that will not see.

In fact, it was very relevant – and was one of the many factors that prompted me to issue a big Sell Signal earlier this year.

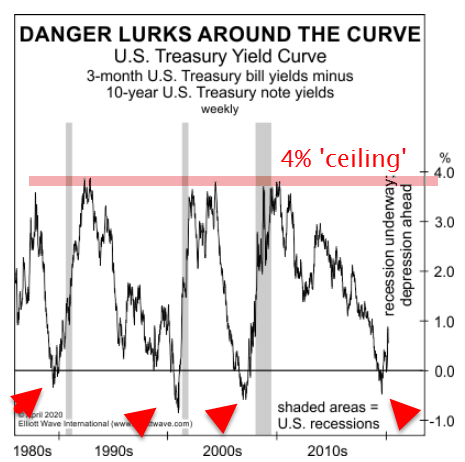

Here is the Yield Curve updated:

Source: interactive investor. Past performance is not a guide to future performance.

Note that all previous inversions (red arrows) preceded the approaching recessions. It appears that all recessions require such a yield inversion as a necessary trigger. Now, the spread is widening fast into the now established recession.

And note that since the 1970s, the maximum yield spread has been 4% on the economic rebounds.

Because this new recession is quickly turning into a depression where unemployment rates are already approaching levels last seen in the 1930s Great Depression, I believe the yield spread will widen far above the 4% ‘ceiling’ of previous recoveries.

Long bond yields are about to surge.

Another clue last year that a recession lay ahead was the near-record low unemployment rate.

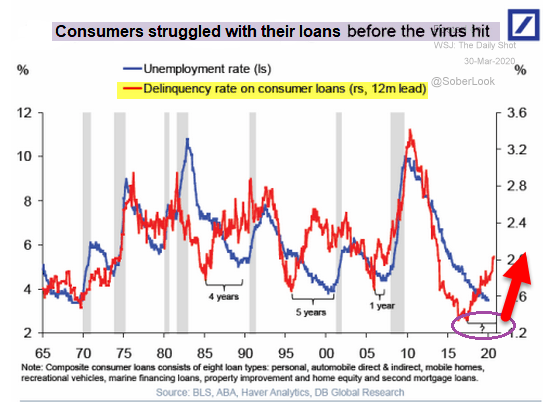

Most recessions begin when unemployment is super low. And here is the US unemployment rate plotted against loan delinquency rates (updated to end 2019)

Source: interactive investor. Past performance is not a guide to future performance.

While the unemployment rate (blue line) plumbed new depths last year with stocks making all-tie highs and as President Trump proclaimed it as ‘the greatest economy ever’, loan delinquency rates were already surging off the 2017 lows (red arrow).

No wonder bank shares are plunging – they are building up a whole mountain of toxic debts.

My question is this: how come consumers were having mounting problems paying off their loans when the economy was supposedly so great?

Fast forward to today, and they must be having even greater problems paying off their loans with their vastly reduced incomes.

So, will the $2 trillion ‘bail-out’ repair this damage (with more to come) and get the economy humming again as the dip-buyers hope? With unemployment growing at a rate of knots, I believe little of this money will be spent on non-essentials and much will go on paying off high interest credit card debt, auto loans and student debt that will hardly boost the economy. And on food.

Of course, most investors are confirmed bulls who have been trained to Buy the Dips and to expect a return on their investments almost as a human right. Years of bull markets have ensured that.

For obvious reasons, most pundits are natural bulls and here is some typical advice for retail investors who have seen a 40% cut to their investments - and their dividend income:

The bottom line: As bleak as things might seem, as long as investors have a well-thought-out plan and stick to it - not allowing their emotions to get the better of them - everything will be alright.

So what would that well thought-out plan look like? Would it include averaging down and buying ‘cheap’ shares here on this manna-from-heaven dip? Would it include drip-feeding money into the market? Or would it include hanging in there and praying their shares will recover ‘because they always have’?

In the US, there has been little sign of panic among retail investors yet, despite the jaw-dropping plunges. A bank survey of US investors between 20th and 24th March showed that just 11% had cashed any of their holdings in.

In other words, a full 89% either did nothing or added to their portfolios on the 40% crash! So where is the panic selling many pundits claim to see? And stocks remain as popular as ever. To me, that is a very bearish warning.

Many are eyeing the possible imminent relaxation of public movement restrictions and the decline in the virus death rates as signs the market lows are in. I cannot agree. The world has changed.

Human behaviour is being transformed. Investors are now turning more cautious and fearful after the fastest ever 30% reversal in the Dow off its all-time high set only in February. That sent shock waves through the markets. The appetite for risk is being squashed for a long time.

And even when industry gets back to work in some measure, will the customers still be there? And will they have the income to resume their old spending habits?

Of course, all eyes are on the current pandemic, but what if this is the first of many to come?

As fear of new pandemics spreads (a likely scenario), stock markets will bear the brunt. Key will be social order. If, as I suspect, major unrest erupts, trust in governments will fail. And that would lead the way to the deflationary depression I have been warning about.

And what a time for stocks to turn sharply lower again as quarantine restrictions are being lifted in various countries to push up investors’ expectations!

So no, I will not be buying this or any dip for some time, except for some special situations, such as Fresnillo (LSE:FRES) (see last week’s COTW).

For me, it’s all about preserving cash now for the harder times ahead. And if anyone doubts deflation is with us, UK petrol prices have just sunk to under £1 a litre for the first time in many years.

For more information about Tramline Traders, or to take a three-week free trial, go to www.tramlinetraders.com.

John Burford is the author of the definitive text on his trading method, Tramline Trading. He is also a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.