Chart of the week: Outlook for FTSE 100 in 2020

Bulls still dominate as we approach the New Year, but will they be right? Our chartist gives his view.

23rd December 2019 09:16

by John Burford from interactive investor

Bulls still dominate as we approach the New Year, but will they be right? Our chartist gives his view.

Is it a concern that the FTSE 100 has gone nowhere since May?

Let’s face it, stock picking is currently out of fashion. Most retail investors have flocked to index funds this year as they offer a cheaper way into the stock market (lower annual management fees) and they are held up as a ‘set and forget’ investment. And there has been a ready audience as stocks keep climbing.

While that has been OK while shares are mostly in bull trends, it definitely won’t be when a new bear trend emerges. And I see one teeny problem with index investing – the FTSE 100 has gone nowhere since May (unlike the US indexes and many individual shares).

Here is this year’s action:

Source: interactive investor Past performance is not a guide to future performance

Incidentally, this year’s bull surge off the 2016 lows was clearly flagged by the textbook Head and Shoulders reversal pattern. Note; both Shoulders and the Head occurred on spike lows – a bullish sign. Also note the huge momentum divergence at the Head where astute aggressive investors/traders would have been looking to buy.

Sadly, most investors do not heed technical signals and so were likely swept up by the bearish mainstream media coverage of the approaching Brexit referendum (the world expected Remain to win).

As is usual, the so-called ‘experts’ got it wrong on Brexit and presented contrarian investors/traders with a magnificent opportunity to trade against them. These are the kinds of set-ups I relish, as you know.

As we head into the New Year on a strong bull run in a Boris Bounce, the ‘experts’ are calling for more of the same into 2020. I see one such calling for at least 8,000 – a gain of about 500 points, although this is relatively a modest call compared with some.

So, how are FTSE index fund buyers feeling now with no progress since May? Are they getting itchy fingers?

There is one trait we can rely on: the vast majority will hold through thick and thin until there have been sharp declines. Then they will throw in the towel – right near the low. They buy high and sell low. I sincerely hope you are not among this cohort.

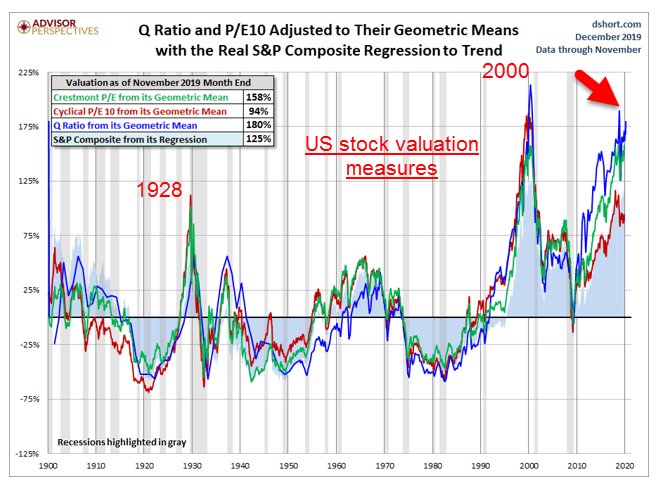

I expect a bear market in 2020. Here is an interesting chart of the extreme valuation measures currently in US shares:

chart courtesy www.advisorperspectives.com

I rest my case.

Are cryptos a buy here?

I have been following RIPPLE, one of the minor cryptos that has seen a stunning 95% collapse off its all-time high to the recent $17.50 low. But I see signs of an imminent reversal. Here is RIPLE:

Source: interactive investor Past performance is not a guide to future performance

The decline since the June/July highs appears corrective in an a-b-c. And the latter stages have traded inside the trading channel between my tramlines. And last week, the 17.50 low hit the lower tramline support and bounced.

With the momentum divergence, I expect the rally to continue and thus we have a low risk buy opportunity. First target is upper tramline around $26. But a move below the $17.50 low would send me back to the drawing board.

Monday morning Flash: Cryptos are surging over the weekend with Ripple at $19.50 and Bitcoin at $7,600.

My final COTW for the year next Monday will review some of my year’s winners (and a few losers). I may have a lesson or two in there!

For more information about Tramline Traders, or to take a three-week free trial, go to www.tramlinetraders.com.

John Burford is the author of the definitive text on his trading method, Tramline Trading. He is also a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.