Chart of the week: How to extend this winning trade

After correctly predicting an 11% slump in the share price, our chartist explains possible next moves.

2nd December 2019 12:03

by John Burford from interactive investor

After correctly predicting an 11% slump in the share price, our chartist explains possible next moves.

I am still bearish on McDonalds

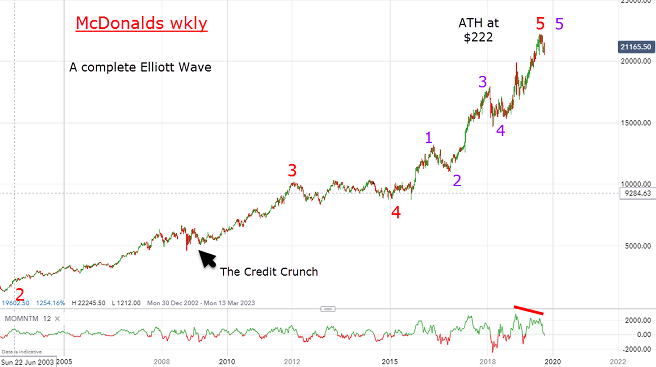

It is always gratifying to nail the top of a super-long multi-decade bull market. Of course, scanning the market as the top is being made in real time is most unusual. In the many decades since these shares were first listed, there will only be one all-time high (ATH) set at a precise moment in time at top tick. And only in hindsight can you label it with total confidence as an ATH.

At the ATH region, the bulls will have extracted the maximum profit that is practically and humanly possible, while the bears have entered short trades at the most opportune time at relatively low risk. A unique moment in stock market history – provided my roadmap is correct.

I started covering McDonald’s NYSE:MCD in my October 7 Chart of the week as my Tramline method highlighted a likely top at the $222 high in August. I based that assessment on the Elliott wave patterns and my unique Tramline system.

This is the multi-year chart I showed then:

Source: interactive investor Past performance is not a guide to future performance

I rather brazenly set the August high as my ATH – but I had good reason. Here is the daily chart of last time:

Source: interactive investor Past performance is not a guide to future performance

In fact, I had four ‘fifth waves’ potentially terminating at $222 as they hit the upper blue tramline together on a momentum divergence (on the weekly chart). Since fifth waves are ending waves, that was powerful evidence the top was likely in and this is what I wrote early October:

Putting all these factors together points to my bearish stance being of high probability. Long term investors could well look to engage in some profit-taking plan. Swing traders can start to look for short entries with my first major target in the $150 region.

Let’s see if my roadmap is accurate on this updated daily chart:

Source: interactive investor Past performance is not a guide to future performance

Indeed, the market has come off the August highs and has moved down quite swiftly to the lower tramline in textbook action following the termination of multiple fifth waves.

But we are not totally out of the woods yet – the decline looks like a ‘three’ so far, and I need to see a sharp move lower to confirm my analysis. Until then, my call for the top is ever so slightly on hold but it remains my favourite option.

For more information about Tramline Traders, or to take a three-week free trial, go to www.tramlinetraders.com.

John Burford is the author of the definitive text on his trading method, Tramline Trading. He is also a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.