Chart of the week: the future for Tesla shares

After more than quadrupling since March, here’s what analyst John Burford thinks might happen next.

13th July 2020 10:52

by John Burford from interactive investor

After more than quadrupling since March, here’s what analyst John Burford thinks might happen next.

Is Tesla today’s Radio Corporation of America?

Where do I start with today’s manic bids for stocks? I should say the mania exists at its most intense in the big-name US FAANGs high-tech (and also in major biotech names). But the poster child of Nasdaq’s near-vertical ascent must be electric vehicle company Tesla (NASDAQ:TSLA) with its ‘unconventional’ CEO, Elon Musk.

And please note that the US Nasdaq is the only major index that is making new all-time highs. Every other global major index is in a bear trend. That needs to be kept very firmly in mind.

One of the many measures highlighting the mania for share buying since 2009 must be the amazing performance of Tesla shares – from $25 eight years ago to the current highly bubblicious $1,540 today (and climbing). All the while, the company only made its first (minute) profit in Q1 of this year.

Oh, and although it sells a tiny fraction of the output of the automotive majors, its market cap is almost on a par with that of the top five of Ford (NYSE:F), General Motors (NYSE:GM), Fiat Chrysler (NYSE:FCAU), Honda (NYSE:HMC) and Toyota (NYSE:TM) combined. That is some achievement.

But, of course, it is the story that drives ‘investors’ to buy the shares, not the financials. We all know electric vehicles are likely to be part of the future – and Tesla is leading the way forward. The fossil-fuelled dinosaurs produced by the others are so last century, or so the story goes.

That story may well be true, but while technology may be favouring Tesla, the share price performance could tell a different story later on.

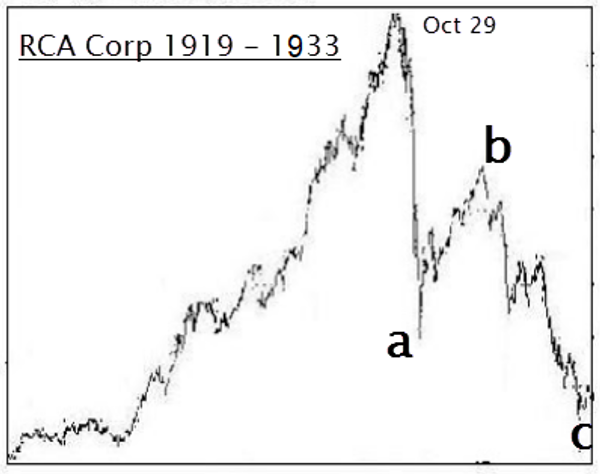

In fact, there is an historic precedence for the spectacular bursting of a tech bubble in the example of Radio Corporation of America (RCA). This company was the leader in the new radio technology and was leading research into television in the 1920s. Then, that company was the future and where massive profits seemed assured. It was the hot tech momentum stock of its day.

But then, in October 1929, as the shares were making new highs, the Wall Street Crash intervened, and this is the result:

Source: interactive investor. Past performance is not a guide to future performance.

Ouch! The company did go ahead and make lots of TVs and make big profits in the 1930s into the 1960s, but those buying the shares at the top experienced much pain that endured for years.

Here is Tesla’s amazing share chart:

Source: interactive investor. Past performance is not a guide to future performance.

Much of the fuel for the vertical rocket-like rally is the current massive short covering by hedge funds.

They had worked out that shares were highly over-valued, even at $500, as production targets were consistently missed. They built up one of the largest short interest positions on the board, but now they are throwing in the towel in a big way:

Source: zerohedge.com

Now, the short interest is back to levels seen last in 2011 when the share price was a minuscule $25. It is unlikely the shares will get to the moon in much the same way as Musk’s rockets will not. The question is: when will they hit today’s version of the Wall Street Crash – as they will?

To me, it appears prudent for investors to at least reduce their holdings in Tesla and heed the warning from RCA 90 years ago.

For more information about Tramline Traders, or to take a three-week free trial, go to www.tramlinetraders.com.

John Burford is the author of the definitive text on his trading method, Tramline Trading. He is also a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.