Chart of the week: Is Barclays still in a bear trend?

5th March 2018 11:51

by John Burford from interactive investor

Is Barclays still in a bear trend?

One of the many hazards of trading is the phenomenon of getting into a trade too early and then see the market move against you. There are many ways to handle this situation, from the extreme tactic of not entering a protective stop at all (and praying the market will eventually turn your way), to setting too tight a stop and being stopped out on the first setback.

If you decide not to use a stop, it effectively means you are 100% confident in your pick of the entry price and the direction of the coming trend. But because we all know market movements are never 100% predictable, that is a very arrogant attitude: it says I know better than the market.

Of course, arrogance and trading success rarely go hand in hand because such an attitude is dogmatic, and that trader tends to refuse to accept market reality when it goes against their prescribed path. That is why many traders/investors buy high and sell low (when they finally see the error of their ways).

Chart of the week: How to trade Barclays ahead of results day

In my 19 February COTW, I pinpointed a promising short trade in that ticked many boxes. Here is the chart I showed then:

Source: Chart of the week Past performance is not a guide to future performance

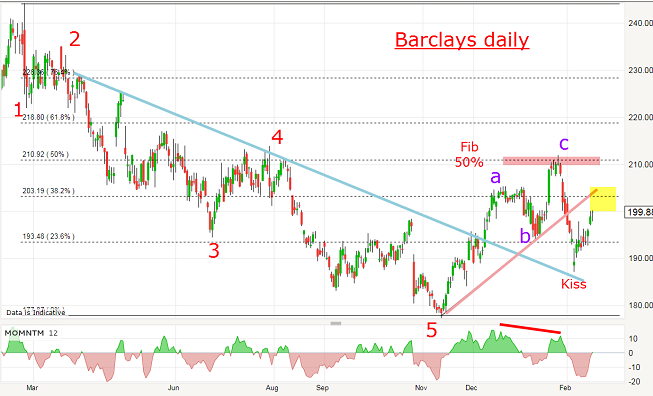

I had a clear five waves down and a three-up in what appeared to be a textbook set-up for a short trade to ride the main downtrend. I identified an ideal place to enter shorts in the yellow zone at the 203p area. My protective stop was just above the pink trendline around 208p.

Bear in mind, I always enter my stop at the same time as I enter the trade, just to ensure I never run an unprotected position. Of course, the market could easily tick off my stop on a temporary surge and then back off, but that is a price I am willing to pay for a 'safety first' stance. I can always re-asses later (which I did here).

The other point is that I never allot a large part of my trading capital to any one trade. I can sometimes carry up to 10 open positions at a time, so my maximum position size on a single trade is restricted to at most 5-10% of capital, and often less. I have a portfolio approach to even out the returns.

So how did that one pan out? Here is the updated chart:

Source: Chart of the week Past performance is not a guide to future performance

After my short entry, the market gapped up and made a high at 216p last Wednesday - and that little excursion took me out of my trade at my stop. But I kept monitoring because I had not abandoned my bearish stance on bank shares.

Only now I had new wave labels to work with - and they are a better fit than my first attempt. The a-wave has a nice five sub-waves and the c-wave has a large gap indicating strong buying. But it could not push much above the pink Fibonacci 50% resistance zone - and that gave me a clue the high of wave c was likely in place and I should enter a short trade looking for a sharp move down.

And if my large wave labels are correct, we are now starting a major wave 3 down to take the market to well below the low of wave 1 at 180p. In fact, I fully expect the 2009 Credit Crunch low of 47p to be at least tested in due course. But my first major target is the 186p b-wave low.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.