Chart of the week: are Rolls-Royce shares still a bargain here?

After doubling from their recent 17-year low, our chartist discusses the best way to trade the shares.

12th October 2020 09:43

by John Burford from interactive investor

After doubling from their recent 17-year low, our chartist discusses the best way to trade the shares.

As long-time readers know, I love bargains in shares. And recently, I have been finding some. So, with this share suddenly on many investors’ radar, is it another candidate for my Buy Low/Sell High list?

The glory days of aviation are long gone – but will return - and the engine-maker once sported a share price of £11 as recently as August 2018, but it has since collapsed to the recent low at the 100p area.

- Invest with ii: Top UK Shares | Share Prices Today | Open a Trading Account

There is currently a rights issue underway, which has implications for anyone buying and holding shares in Rolls-Royce Holdings (LSE:RR.), but trading in the shares is very active.

Favourable sentiment towards aviation is practically non-existent given the pandemic-mandated travel bans – and that is why my antennae are twitching.

Here is the long-term monthly chart:

Source: interactive investor. Past performance is not a guide to future performance.

What a fascinating chart! I have a clear ‘three down’ (corrective) wave off the February 2014 top at £14, taking it to set a possible Double Bottom with the 2003 low.

It is well said that investing in aviation stocks is like riding a rollercoaster.

So we now have a possible basis for a decent rally. But are there more clues on the shorter-term charts?

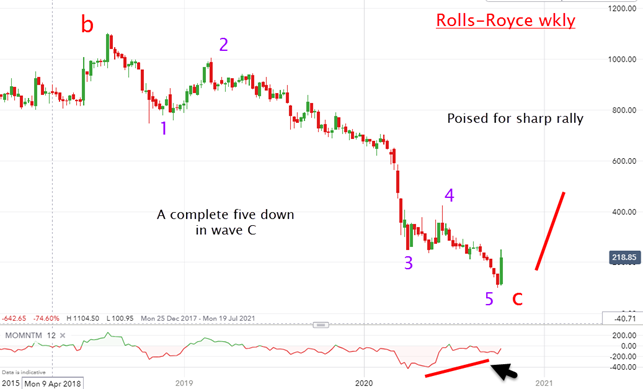

Source: interactive investor. Past performance is not a guide to future performance.

Indeed there are! Last week’s sharp reversal has very likely capped the five wave pattern in wave C, paving the way for a solid recovery given the huge momentum divergence at the recent low of 100p.

Very near term, there could well be a pull-back from the current 220p print, but I would consider that to be an even better opportunity to snap up a quality share in what promises to be in a place at the centre of a very dynamic sector up ahead. Revolutionary advances are being made in propulsion types and the near-term travel disruptions have created a very over-sold situation.

For more information about Tramline Traders, or to take a three-week free trial, go to www.tramlinetraders.com.

John Burford is the author of the definitive text on his trading method, Tramline Trading. He is also a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.