CenturyLink: a 10% dividend yield and potential to double in value

This high-yielder has suffered little from coronavirus and some analysts think it’s worth twice as much.

8th July 2020 10:57

by Rodney Hobson from interactive investor

This US company has suffered very little from coronavirus, has a remarkable yield and some analysts believe the shares are worth twice as much.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Searching for stability is not a bad tactic in uncertain times. Even those investors who are looking for spectacular gains, as economies round the world recover, could do well to consider companies such as CenturyLink (NYSE:CTL) in case the rebound is rather less spectacular than governments are hoping.

CenturyLink is one of the largest telecommunications carriers in the United States, with 450,000 miles of fibre-optic cable, including 35,000 miles of cables under the sea providing connections to Europe, Asia and Latin America.

The Louisiana-based company concentrated historically on services to consumers and it still provides broadband, wireless and telephone services across 37 states for 5 million household customers.

However, a series of acquisitions has seen it spread into offering businesses a full range of communications services such as data centres and transmission, telephone and internet. The business services side now accounts for three-quarters of revenue and is generally more profitable and more open to expansion.

Some acquisitions have been paid for with shares but other have added to the debt pile. Possibly the most important one was the takeover in 2017 of Level 3, which predominantly served business customers and was the deal that tilted the balance of the group in that direction. It also greatly expanded CenturyLink’s presence in more areas of the United States and overseas.

This transformational deal not only cost $24 billion in cash and shares, it left CenturyLink taking responsibility for $10.9 billion of Level 3’s debts. Level 3 shareholders ended up with 49% of the combined group and $9.6 billion in cash.

- ii view: speeding Tesla overtakes Toyota

- Hot stocks: Wall Street is where the action is

- Want to buy and sell international shares? It’s easy to do. Here’s how

However, the benefits of becoming a larger, stronger group with a foothold in 60 countries were also felt by CenturyLink shareholders. Before the merger CenturyLink had seen its revenues from legacy services such as broadband and landlines shrink year by year.

The group itself has suffered comparatively little direct impact from the coronavirus crisis, but will inevitably be affected if customers scale back on their operations, or even go out of business. On the other hand, communications and data storage and transmission will grow in the modern business world.

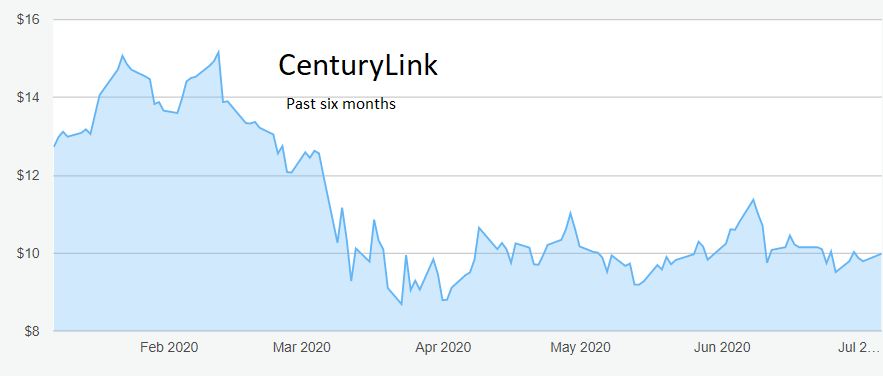

Source: interactive investor. Past performance is not a guide to future performance.

Improving customer services will be a key factor in deciding which businesses thrive so the demand for CenturyLink’s services is likely on balance to increase rather than shrink.

The group’s debt has been a concern for investors despite the persistence of historically low interest rates. CenturyLink has a highly leveraged balance sheet, which leaves it potentially vulnerable when rates eventually rise, although that is not likely to happen this year or next.

- Get exposure to the world’s biggest companies via these ii Super 60 recommended funds

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

The group has, in any case, bought time by actively refinancing its debt since the Level 3 acquisition to push maturities into the future and remove the fear that it will need access to credit markets in the foreseeable future.

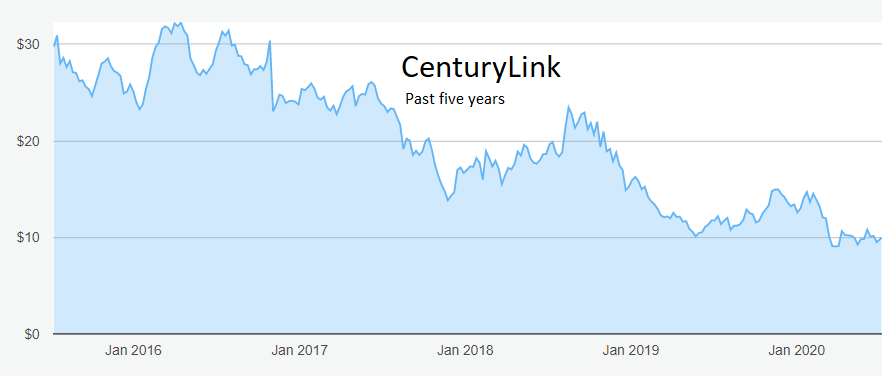

The shares have been in decline since March 2016 when they peaked at $32. They were already down to $14 before the coronavirus crisis sent them plunging below $10, where they still languish.

However, they appeared to have bottomed out at $9, forming a solid floor. Some analysts believe they are worth twice as much.

Source: interactive investor. Past performance is not a guide to future performance.

The yield is remarkably high at 10.2%, especially by the standards of American companies that are generally less generous with dividend payments than their UK counterparts, and the price/earnings ratio is only 8.6.

Presumably, the market fears that CenturyLink will be forced to reduce the payout. Such concerns look to be misplaced unless the company eventually has difficulty refinancing its debt, something that will not happen any time soon.

Hobson’s choice: Buy the shares up to $13, which is below this year’s best level set in January. The downside looks strictly limited and the potential upside is highly attractive.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.