Centrica's dividend survives, for now

31st July 2018 12:53

by Graeme Evans from interactive investor

There are plenty of problems at Centrica, but the shares will yield around 8% if the final dividend is held. Graeme Evans talks us through half-year results.

Centrica high-yielding dividend appears to remain on a knife edge after "another mixed bag" of results did little to inspire confidence in the pay-out.

The 12p-a-share annual dividend, which yields a chunky 8%, has been under threat ever since a huge profits warning from the British Gas owner last November.

Announcing half-year results today, under-pressure boss Iain Conn said nothing had changed in respect of the dividend, which will be maintained as long as net debt stays below £3.25 billion and the company keeps operating cash flow within its target of a £2.1 billion-£2.3 billion range. The interim payout stays at 3.6p.

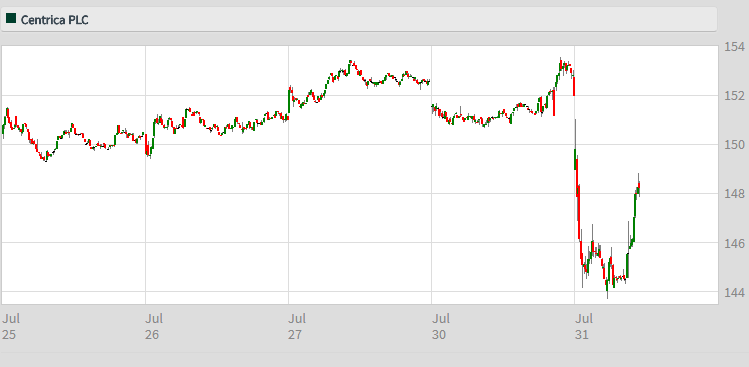

Source: interactive investor Past performance is not a guide to future performance

But it's clear from the results that headwinds remain fierce, thanks to a combination of extreme weather, competitive pressures in consumer and business, and ongoing political and regulatory uncertainty.

Today's half-year gross margin and underlying earnings were stable against last year, but this was against a 2017 performance in which Conn had to apologise for a "very poor shareholder experience".

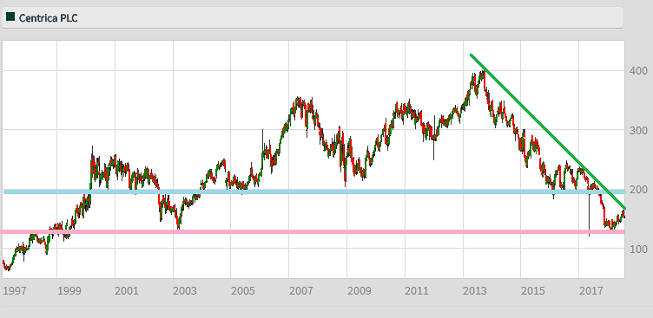

Shares slumped to an 18-year low of 124p in February but then rallied 30% until mid-July, only to fall back in recent days and again after today’s results. The stock is currently trading on a projected 2018 price earnings multiple of 11.3x.

• 10 contrarian blue-chip stocks for daring investors

• Stockwatch: A blue chip to buy for huge yield

UBS noted that the half-year earnings per share figure was 6% below consensus, with the consumer and business divisions missing forecasts by 12% at an earnings level. Exploration and production (E&P) was 34% ahead, but this was offset by a rise in the tax rate to 39% from 29% a year earlier.

Whilst describing today's result as "another mixed bag", UBS did offer some comfort for contrarian investors by pointing out a few reasons for optimism in the second half of year.

These positives include the strong performance by E&P operations, which may get a further benefit in 2019 as older hedging positions unwind.

UBS also notes that Centrica expects North American profitability to increase, while recent price hikes in the UK and Ireland should offset some of the pressure on consumer margins.

UBS continues to have a modest price target of 165p on Centrica, which is where the company’s shares were prior to its November profits warning.

Despite the continued challenges facing the consumer and business divisions, analyst Sam Arie added:

"There are fair reasons to expect a stronger second half. Cashflow was solid and working capital which accumulated in the cold weather should return over the next 12 months."

Source: interactive investor Past performance is not a guide to future performance

Placing a fair value on Centrica's shares remains challenging due to the continued threat of regulatory intervention. One of the biggest uncertainties is the cap that Ofgem has been told by the Government to impose on all default energy tariffs, including the Standard Variable Tariff (SVT).

A consultation is due to commence in August, with the cap expected to be in place by the end of the year.

Centrica has cut the number of customers on SVTs from 4.3 million to 3.5 million, while it pointed out these were “competitively priced” at £52 below the average standard price of the other five largest suppliers.

The company said:

"With targeted cost efficiencies of £20 per dual fuel energy supply customer by 2020, we are relatively well-placed for a price cap on default tariffs."

The rate of losses in account holdings in consumer also slowed in comparison to 2017, falling by 226,000, or 1%. The decline in energy supply accounts was partially offset by growth in services and connected home accounts.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.