Castings: Between a rock and a hard place

3rd August 2018 16:30

by Richard Beddard from interactive investor

Castings has been a great business, but it faces big challenges and it is not saying much about them. Companies analyst Richard Beddard gives his view on the shares.

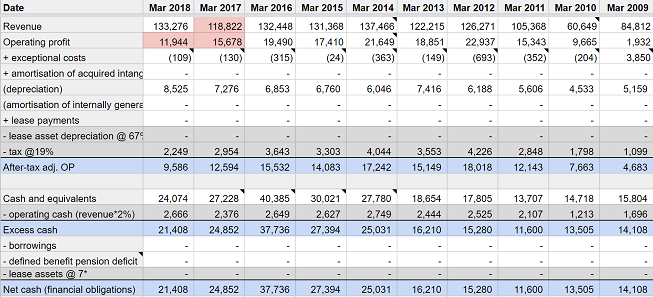

Before I discuss Castings' below-par results, and before I score the business and its market value, I want to share a screenshot of a section of the

spreadsheet I use to evaluate Castings' financial performance.

Source: interactive investor Past performance is not a guide to future performance

The cleanest of accounts

Disregard the numbers and calculations for a moment and take in the white space. Most of these blank spaces usually contain adjustments to the reported figures that, frankly, do my nut in. I suspect many investors just ignore them. In Castings' case there’s no need, because year-in, year-out, Castings’ accounts are clean. No company I follow has so much white space in its spreadsheet.

Now look at the exceptional costs line. In a sense this line is blank too. Every year since the financial crisis when its Icelandic bank went bust and Castings wrote off some of its deposits, it has made an exceptional gain (not a loss, the figures are in brackets because a negative cost is a gain) as it has received the money back.

The absence of amortisation is a blessing. Amortisation allows businesses to spread the cost of acquiring or developing assets of highly uncertain value like brands and product development costs over their often highly uncertain lives. It may well give a more accurate impression of profit but it may also be baloney.

So too is the absence of operating lease payments a blessing. This is an alternative way of financing assets, foundries, CNC machines, warehouses, office space, and vehicles in the case of Castings - if it didn’t own its own assets outright. That’s right, Castings is not dependent on external finance at all. It has no lease obligations, and it has no bank debt.

Castings has a defined benefit pension scheme, the type that has the capacity to open up a yawning deficit and scupper a company, but it is £23m in surplus and it has been in surplus since the 2006, which is as far back as I’ve looked.

For the cleaness of its accounts, I have a lot of love for Castings, but there’s a problem. When things are going well it seems like sufficient justification to buy shares in the business alone. Clean accounts are evidence of honest management, and generally, since things have gone well, the performance is evidence of good management.

Things are not going so well though, which is why there is red on my spreadsheet.

Scoring Castings

As usual I'm scoring Castings to determine whether it is profitable, adaptable, resilient, equitable, and cheap. Each criterion can achieve a maximum score of 2, and a minimum score of zero except the last one. The lowest score for companies trading at very high valuations is -2.

Profitable: Does it make good money?

Score: 2

Castings designs, prototypes, casts and machines iron components. In the year to March 2018 it earned 70% of revenue from manufacturers of commercial vehicles, principally trucks, but it also manufactures components for cars.

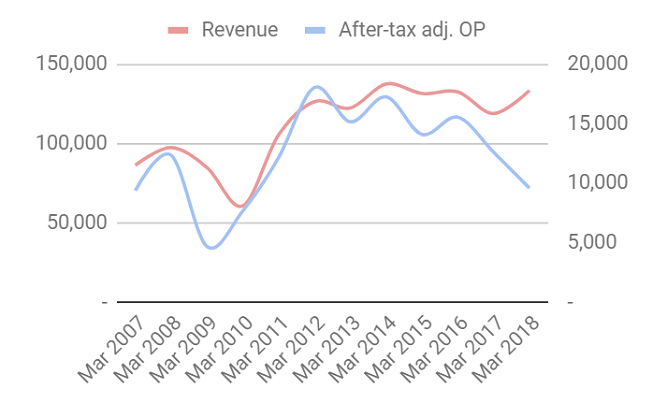

Source: interactive investor Past performance is not a guide to future performance

The 24% fall in profit despite a 12% increase in revenue was due to big losses at Castings' smallest division, machine shop CNC Speedwell.

Castings has two divisions. The biggest operates two foundries which increased their output in 2018. Thanks to ever increasing automation, the growing sales of more complex machined parts, increased scrap prices, and beneficial exchange rates with Castings' predominantly European customers, foundry revenue grew by even more than output. Financially the foundries, which shape the iron into components ready to be machined, are in fine fettle, although higher raw material costs dented profit margins slightly.

CNC Speedwell, which brought in £6m of Castings' £133m of external revenue, made a loss of £4m. This came off the back of substantially reduced revenue and profit in 2017 after CNC Speedwell ceased supplying parts for the discontinued Land Rover Defender.

Reading between the lines of the annual report, always a dangerous game, it seems as though CNC Speedwell was mismanaged. The former managing director resigned and his replacement is supported by a new technical director, quality director and financial controller. Castings says "This team is much stronger and has brought the businesses under operational control."

Operations were in disarray. CNC Speedwell spent £1.2m on express delivery to make good time lost in production and meet its schedules. It has also axed a number of "unsuitable" projects and written off £1m of equipment it no longer needs.

Reorganising the business cost it £3.3m in total, including a £333,000 payoff for the former managing director.

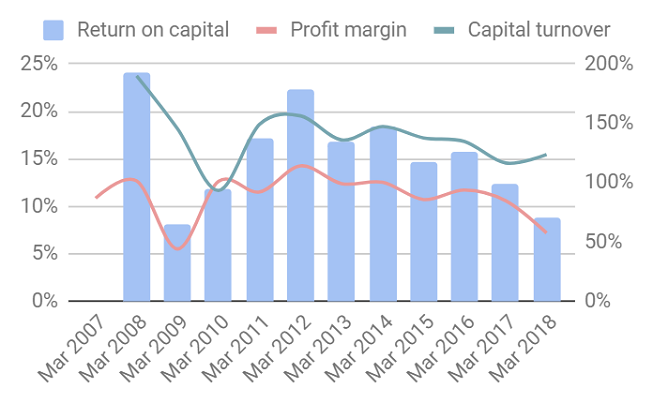

Source: interactive investor Past performance is not a guide to future performance

Almost any other company would adjust the profit figure to exclude these costs and give a better impression of the “underlying” performance of the business, and that would be sufficient to lift Castings’ performance to a similar level as last year - still low by historical standards but enough to take the edge of the alarming downtrend in return on capital since 2012 from more than 20% after tax (excellent) to 9% (adequate) in 2018.

Even if we take the results as they stand, though, Castings is a good business. The only year return on capital has touched 8%, my arbitrary lower-bound was at the nadir of the financial crisis in 2009.

The company has remained so profitable because it is a vital part of the supply chain of three big truck manufacturers: Scania (part of VW), Volvo Trucks and DAF, which together account for more than 50% of total revenue. These companies work closely with parts suppliers when they design a new chassis, typically once every ten years or so, and are most unlikely to change supplier once the parts are designed, tested and approved. Supplier and truck manufacturer put their trust in each other. The supplier must remain solvent, and able to finance demand from the manufacturer, so the manufacturer must pay a fair price to secure supply.

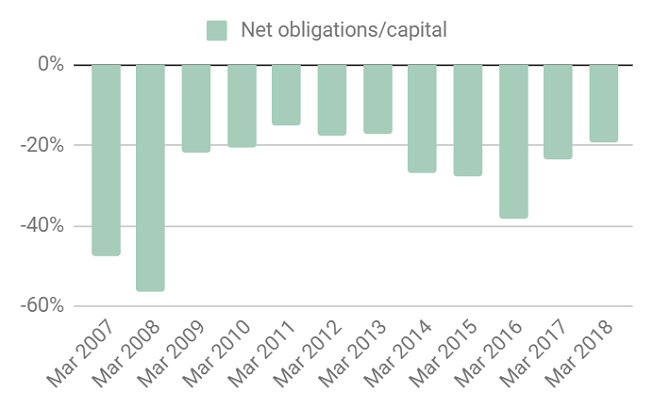

Castings has kept its side of the bargain, which is why Scania has been a customer for more than four decades. Despite heavy investment to automate foundries and keep costs down, Castings not only funds its own capital requirements, but also has sustained a cash surplus that amounts to 20% of operating capital in most years. Even if the industry is in the doldrums, and profits are down, Castings is able to invest to meet future demand:

Source: interactive investor Past performance is not a guide to future performance

That’s the past, the future is a bit more sketchy.

Adaptable: How will it make more money?

Score: 1

Castings is still doing what it does well. Investment in robotic handling improved profitability of the foundries in 2018, and Castings expects to invest more in 2019. Meanwhile CNC Speedwell is in the early stages of a turnaround and its transport costs have returned to normal. Normally, that would be good enough for me, but there some big challenges ahead and I think Castings could be more forthcoming...

Resilient: What could go wrong?

Score: 0

The response to problems at CNC Speedwell has been to refocus on the group’s traditional customer base, but I don’t think it would be easy for Castings to recruit more truck manufacturers and despite their loyalty it might find it harder to keep hold of existing customers in future.

Other European truck manufacturers like Daimler are wedded to big efficient foundries in Germany, a market Castings has found it impossible to break into.

Big European customers might also come under political pressure to buy European parts after Brexit, and the attractiveness of British suppliers might be reduced by tariffs and red tape.

I also wonder whether the problems in the machining division are the result of attempts to diversify the business. While the bulk of CNC Speedwell’s output is iron parts it also machines other materials, like aluminum. I’d like to know whether projects involving new materials have been shut down, and if so a potential avenue of diversification has been closed off now Castings is focusing on its core business.

Electric vehicles use lightweight aluminium components, and according to the current narrative they are the cars, and perhaps the commercial vehicles, of the future.

Equitable: Will we all benefit?

Score: 2

Castings obviously busts a gut for customers, and chairman Brian Cooke is a substantial shareholder. The board’s pay is very transparent and not particularly exhorbitant. I’d be surprised if Castings wasn’t looking after staff and customers.

Cheap: Is the firm’s valuation modest?

Score: 1

Somewhat. The shares cost about 16 times adjusted profit in 2018, but the valuation would be lower if we excluded the reorganisation costs this year.

Verdict: Uncertain

A score of 6/10 means I’m not confident enough in Castings to recommend it, and that breaks my heart, because what we know about the past is so reassuring. It is what we don’t know about the future that introduces doubt.

I plan to go to the AGM in August. And I will have two things on my mind:

1. Is the company trying to reduce its dependence on big customers?

2. If so, how?

Contact Richard Beddard by email: richard@beddard.net or on Twitter:@RichardBeddard

Richard owns shares in Castings.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.