Cashback offers of up to £5K for SIPP and £1.5K for ISA and GIA accounts

interactive investor kicks off the new year helping investors gain control of their financial futures in 2024.

4th January 2024 10:14

by Camilla Esmund from interactive investor

- A stark contrast to the rest of the market: ii cashback won’t be ‘taken back’ in fees because of its flat-fee pricing, whereas traditional platform percentage fees can take a big chunk of investors’ wealth over time

- Customers opening a SIPP with ii (both new and existing ii customers, but excluding existing SIPP holders) could receive up to £5,000 in cashback

- New customers who open an ISA or GIA account with ii could receive up to £1,500 in cashback

interactive investor (ii), the UK’s biggest flat-fee investment platform, is helping investors start and continue 2024 strong with two generous cashback offers*. Terms apply – see notes to editors.

- Our Services: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

The cashback offers, which are both live throughout January 2024 (ending on the 31 January), follow interactive investor’s continued innovation to keep offering great value to investors. This includes the game-changing launch of its Pension Essentials SIPP in October last year.

Alice Guy, Head of Pensions and Savings, interactive investor, explains: “With some cashback deals, a seemingly tempting offer is often soon wiped out by swelling percentage-based fees as your wealth grows. The more you make, the more they take.

“interactive investor’s cashback offers are a great way to kick-start 2024 and give your pension and investments a New Year boost. Moving to a great value platform will help investors take control of their investment fees and boost their long-term wealth.

“But it’s not about quick wins, our cashback payments are paid after 12 months, and this is to encourage investors to stick with it and make investing a habit. Investing is a long-term game, and history has shown that investing can yield better results than cash savings over the long term.”

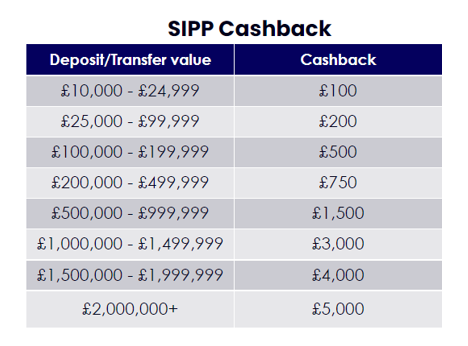

- SIPP cashback offer

interactive investor is offering up to £5,000 per person to investors opening or transferring into its great value, award-winning SIPP throughout the month of January, ending 31 January 2024.

The SIPP offer begins at £100 cashback for those who deposit/transfer the minimum qualifying amount of £10,000. The cashback then scales up with the amount deposited/transferred, increasing to £5,000 on assets over £2million. This sizeable offer applies to both new customers and current ii customers who do not have a pension with ii. It does not apply to investments already held in an ii account.

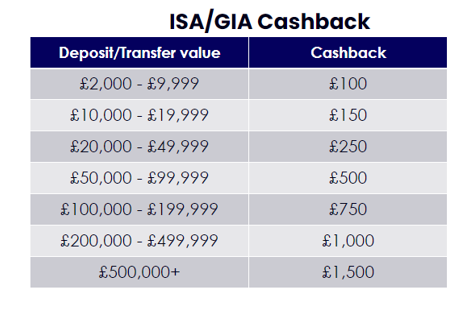

- ISA / GIA cashback offer

interactive investor is also offering a generous cashback payment of between £100 and £1,500 to new customers who open an ISA or GIA before 31 January 2024 (minimum transfer/deposit of £2,000).

The cashback offered scales up from £100 on deposits/transfer value of £2,000, to £1,500 for values over £500,000.

Underpinning interactive investor’s ISA, GIA, and SIPP products is the added benefit offree regular investing for funds, investment trusts, and popular UK shares. The ability to make regular monthly contributions for free can also prove to be powerful for investors.

- Over time, investors will be gaining much more than this cashback offer

Crucially, the value doesn’t stop when investors get their cashback with ii.

They will be moving to an investment platform which gives them a better chance of building their wealth over time because of its flat-fee pricing. Investors will know how much they are paying ahead of time, they will control their costs and they will get to keep more of their wealth, helping them reach their financial goals quicker. They will be making their money work for them – not their providers or platform.

Alice Guy adds: “At interactive investor, the way our flat fees work means your fees stay the same over time as your pension or investment wealth grows. Our customers know what they’re paying and get to keep more of their money. It’s a win-win.

“In a time of uncertainty, it’s great to know you can have certainty about your investment fees. Taking advantage of this compelling cash-back offer and our great value fees could be a great way to boost your short-term and your long-term wealth.”

- That’s not all - investors that recommend ii could get £200

interactive investor has an extra bonus for investors: £200 cashback to those who refer a friend or family member to ii. Terms apply – see notes to editors.

Notes to editors:

*Terms and conditions for offers below:

SIPP cashback offer terms & conditions.

ISA/GIA cashback offer terms & conditions.

‘Recommend ii’ offer terms & conditions can also be found here.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.