Cash cushion protected portfolios from market mayhem

29th November 2021 14:54

by Douglas Chadwick from ii contributor

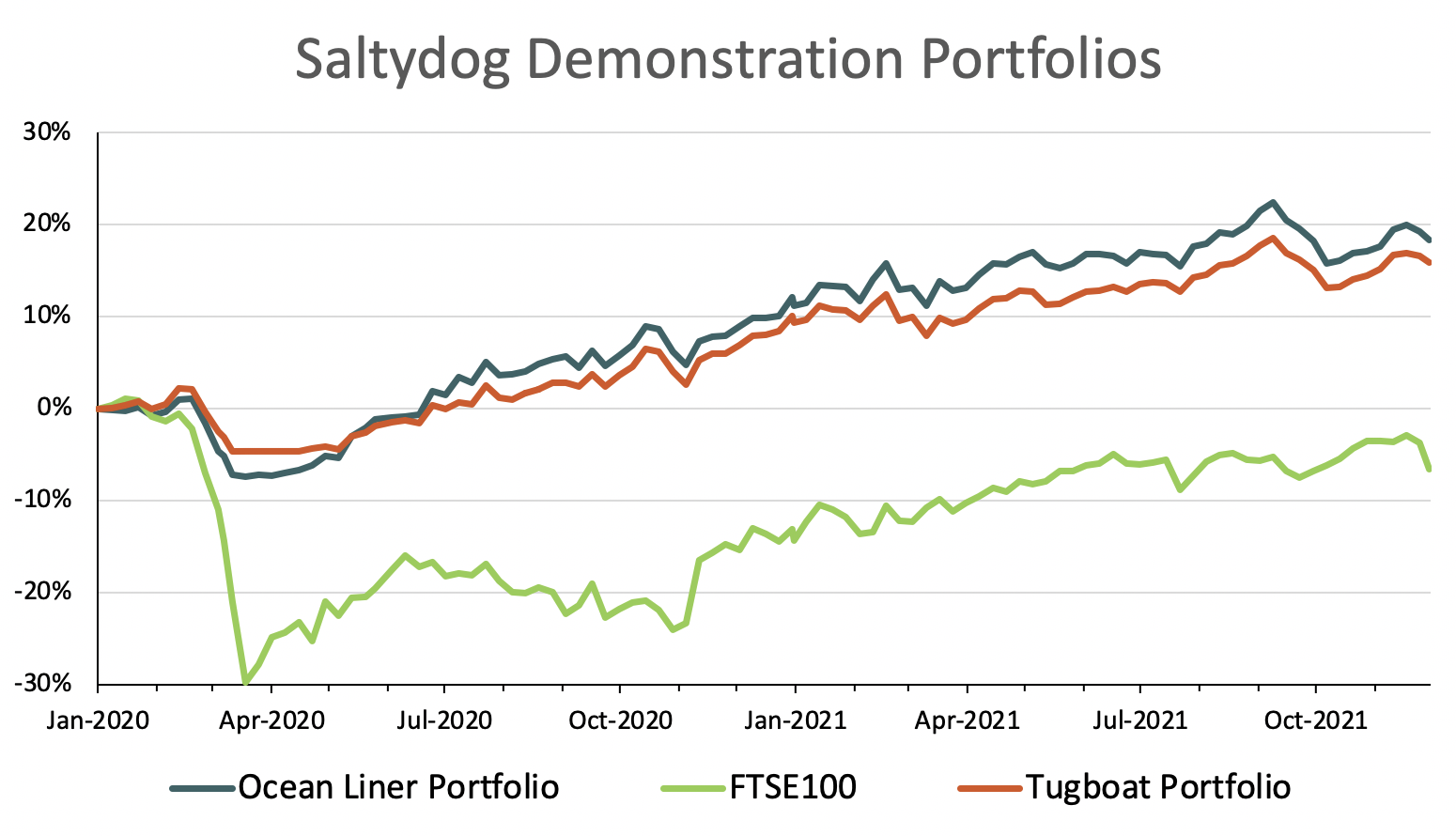

Saltydog Investor highlights how its approach of not being fully invested in equity markets paid off when markets fell heavily at the end of last week.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Last Friday, stock markets around the world plummeted due to concerns over the spread of a new variant of the Covid-19 virus. This latest version, Omicron (or B.1.1.529), was first discovered in South Africa but has now been detected in Europe and South Asia.

Scientists are concerned that it may spread faster than the Delta variant, which is currently the most widespread, and they are not sure how effective the current vaccines will be.

The FTSE 100 fell by 3.6% and the FTSE 250 ended the day down 3.2%. In continental Europe, the situation was even worse, the German DAX lost 4.2% and the French CAC 40 dropped by 4.8%.

- How Saltydog invests: a guide to its momentum approach

- Are growth, value and quality labels misleading?

- Will stock markets be full of festive cheer in December?

The Saltydog demonstration portfolios were not immune, but the losses were significantly smaller. The Tugboat and the Ocean Liner both lost around 0.5%.

Past performance is not a guide to future performance.

There are several reasons why our portfolios did not feel the full force of Friday’s drop.

Both portfolios are designed to be relatively cautious and so do not fully invest in the equity markets. This may restrict their returns when markets are performing well but helps when things take a turn for the worse. In the Tugboat portfolio, we always have 70% in cash or funds from our ‘Safe Haven’ or ‘Slow Ahead’ groups. The ‘Safe Haven’ group contains the funds from the Standard Money Market and Short-Term Money Market sectors. The ‘Slow Ahead’ group is made up of funds from the sectors investing in bonds, and the mixed investment sectors, which hold a combination of bonds and equities. It also includes the Targeted Absolute Returns sector. This portfolio is currently holding 30% in cash.

The Ocean Liner, which is slightly more adventurous, always has at least 30% in cash, or funds from our ‘Safe Haven’ or ‘Slow Ahead’ groups. However, at the moment that figure is more than 70%.

We actively manage the portfolios, reacting to the latest market conditions, and so do not currently have much exposure to the UK or Europe. We do not currently hold any funds from the UK All Companies, UK Smaller Companies, UK Equity Income or European sectors.

Our largest holdings are in funds from the Mixed Investment 40-85% Shares sector, but we have chosen ones with a bias towards the US. Then we have two funds from the Technology and Technology Innovations sector, a North American fund, a ‘gold’ fund, and a couple of funds investing in clean energy. At the moment, these sectors do not appear to have suffered too much.

When the original coronavirus struck, stock markets were initially fairly resilient. However, once investors realised that the world was heading into a global lockdown the mood rapidly changed. At the end of February/beginning of March, we witnessed one of the fastest market crashes ever. UK stock markets still have not fully recovered. Our portfolios moved into cash, and we were fortunate enough to avoid the worst of the falls.

Is something similar about to happen?

If new restrictions are imposed, then the recovery will definitely be put under pressure, and it feels fairly fragile at the moment. However, we are in a very different place to where we were in February 2020. Then the pandemic was spreading around the world and medics had not worked out the best way to treat it; some people were suggesting that a vaccine might be 10 years away. Nobody knew what it would be like to have whole countries in lockdown or how businesses would survive.

Hopefully scientists and governments can quickly put together a plan to limit the negative effects of this latest variant, and if the worst comes to the worst, then at least we have got plenty of recent experience to call on.

- How fund investors can protect and profit from higher interest rates

- Friends & Family: ii customers can give up to 5 people a free subscription to ii, for just £5 a month extra. Learn more

Quite what will happen to the markets nobody knows, and at Saltydog we are not in the business of trying to predict them. This morning, the UK and European indices have recovered some of the losses from Friday, which is a positive start. We are in the process of analysing last week’s fund data and plan to review the portfolios again on Wednesday as usual.

In the past, we have occasionally had to make unplanned changes when the financial landscape suddenly shifts, but for now, we are holding our nerve.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.