Capital gains tax bill could more than double

interactive investor calculations reveal the impact if a mooted changes to the regime is announced in the October Budget, with ii's Myron Jobson outlining tips to reduce CGT liability.

3rd September 2024 14:03

by Myron Jobson from interactive investor

- Alignment of capital gains tax (CGT) rates with income tax would result in gains being taxed as high as 45%

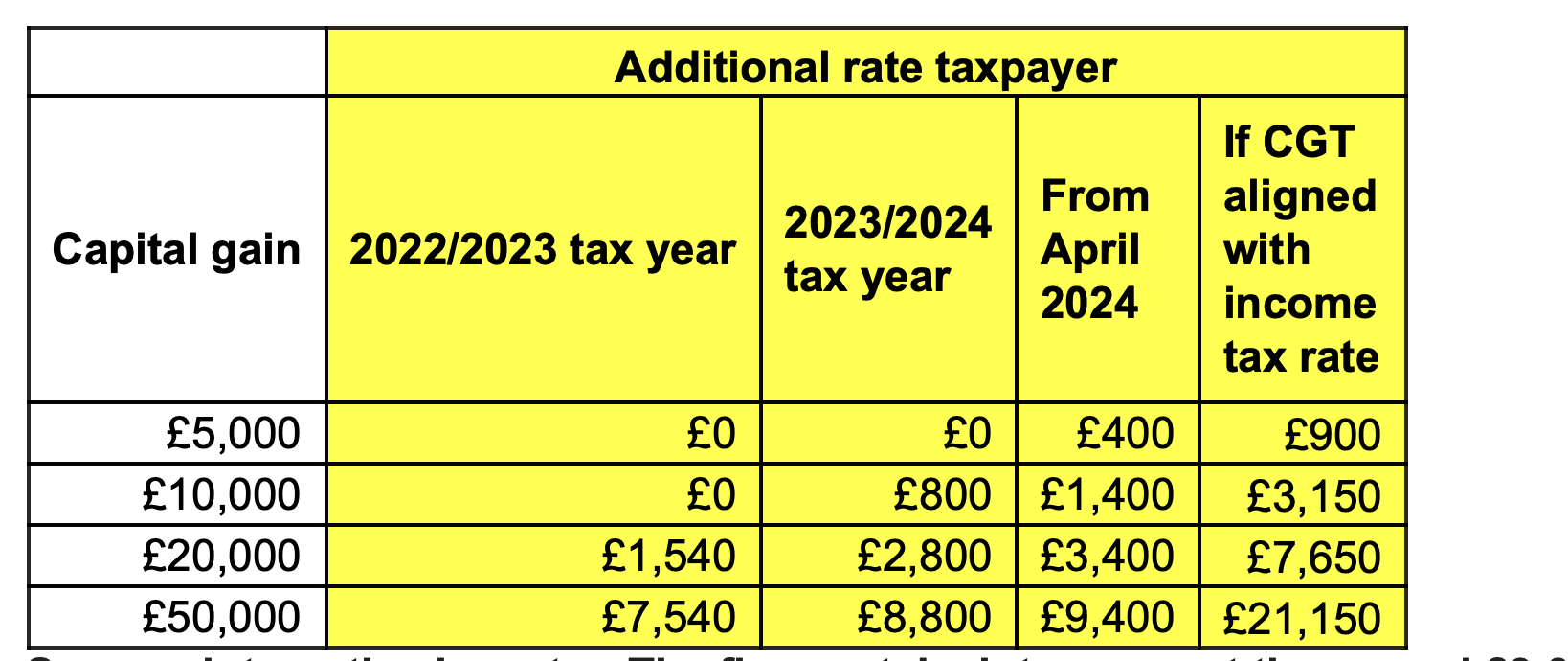

- Additional-rate taxpayers could face a tax charge of £21,150 on an £50,000 capital gain: £11,750 more than the current tax liability under the existing CGT regime (£9,400)

- Even those on the opposite end of the income spectrum face a higher tax burden if CGT is aligned to income tax: the CGT rate would rise for basic-rate taxpayers from 10% to 20%

- ii’s senior personal finance analyst outlines tips to reduce CGT liability.

New calculations by interactive investor, the UK’s second-largest DIY investment platform, illustrate the potential pounds and pence impact of the much-discussed changes to capital gains tax (CGT) ahead of the October Budget.

- Learn with ii: What is Bed & ISA? | How to become an ISA millionaire | How many ISAs can I have?

There has been growing speculation that CGT rates could be aligned with income tax, which would result in gains being taxed as high as 45% for the highest earners.

If this occurs, additional-rate taxpayers could face a tax charge of £21,150 on a £50,000 capital gain made by an investment held outside a tax wrapper such as an ISA and SIPP. This would be £11,750 more than the current tax liability under the existing CGT regime (£9,400).

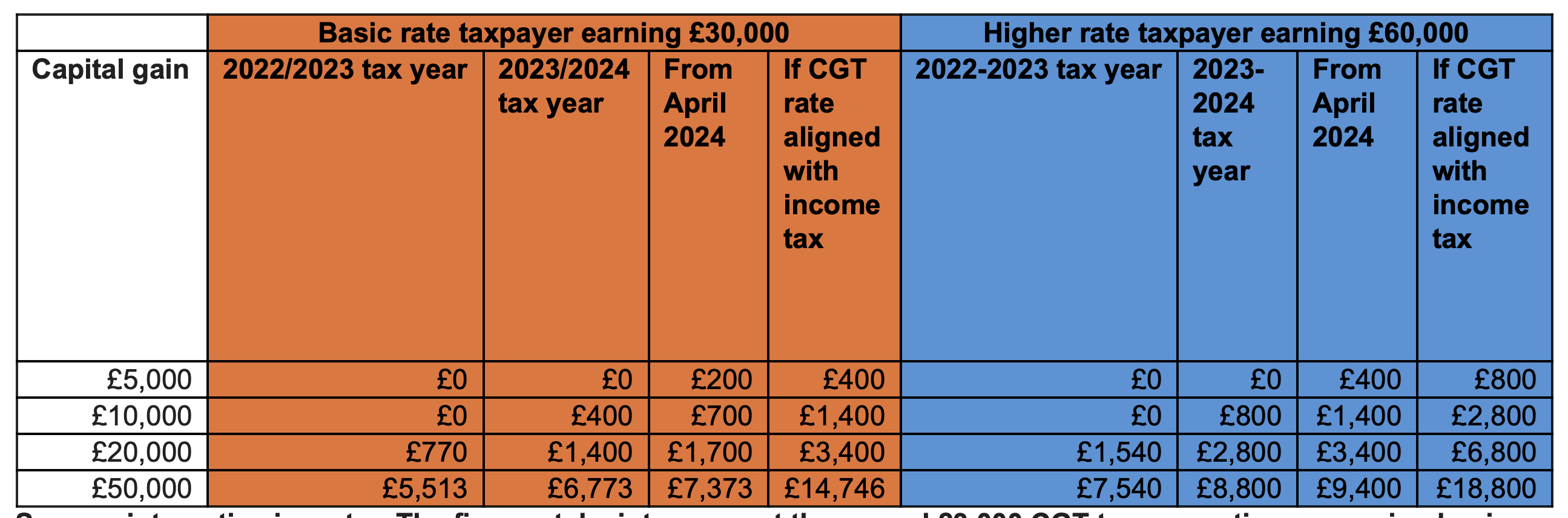

Even those at the opposite end of the income spectrum would face a higher tax burden. If aligned with income tax, the CGT rate for basic-rate taxpayers would rise from 10% to 20%, doubling the amount paid in tax above the £3,000 tax-free allowance. This translates to a CGT liability of £400 on capital gains of £5,000 (up from £200 under the current CGT regime); £1,400 on capital gains of £10,000 (up from £700); and £3,400 on capital gains of £20,000 (up from £1,700).

The situation is similar for higher-rate taxpayers, who would also face a heightened tax burden if their CGT rate doubled from 20% to 40%. The CGT liability would double from £400 to £800 on capital gains of £5,000. On gains of £10,000, £20,000, and £50,000, the CGT liability would increase to £2,800, £6,800, and £18,800, respectively.

These potential increases could be even more painful for basic-rate taxpayers with larger gains, who could be pushed into a higher tax bracket. If CGT rates increase to 20% and 40%, a basic-rate taxpayer earning £30,000 could end up paying £14,746 tax on a £50,000 gain, of which over £10,000 is higher-rate tax.

Source: interactive investor. The figures take into account the annual £3,000 CGT tax exemption, assuming basic rate taxpayer earns £30,000 and higher rate taxpayer earns £60,000

Source: interactive investor. The figures take into account the annual £3,000 CGT tax exemption.

Myron Jobson, Senior Personal Finance Analyst at interactive investor, says: “Reading between the lines of what both the prime minister and the chancellor have publicly stated, increasing CGT rates seems the likely course of action in the upcoming Budget. Our calculations show that CGT liability for investors across the income spectrum could double, at best, if CGT rates are aligned with income tax.

"Sorting out your capital gains tax affairs shouldn't just be a reaction to potential changes in the tax regime. Whether or not the chancellor tweaks the rules, taking a proactive approach ensures you're not leaving money on the table. By staying on top of your investments and understanding your tax liabilities, you can make more informed decisions that stand the test of time. It’s about being prepared - not just for what's coming, but for managing your wealth effectively in any scenario.”

Myron Jobson outlines tips to reduce CGT liability

Bed & ISA

“Shifting investments into an ISA protects future gains and dividends from the clutches of tax. Known as Bed & ISA, the process is a valuable tool as part of a broader portfolio spring-clean strategy. The transfer, however, will involve selling and buying back shares, which could trigger a capital gains tax bill.”

“Bed & ISA is a tried-and-tested route to wrapping existing investments to generate the long-term benefits of a tax-efficient ISA – which over the long term is likely to outweigh the charges that might apply.”

- Bed and ISA transactions on interactive investor increased by 27% between 1 June and 31 August 2024 compared to the same period in 2023

- Transactions up 99% compared to summer 2022.

Spread gains across two or more tax years

“Like the ISA allowance, CGT and dividend allowances work on a use it or lose it basis. As such, an option for those facing a tax bill is to delay capital gains by spreading them across two or more tax years. Theoretically, they could sell half their position on 5 April and sell the other half on 6 April – the start of the new tax year.

“It’s also important to keep an eye on your overall finances to minimise your tax bill. With frozen tax thresholds, basic-rate taxpayers may find a capital gain pushes them into paying higher-rate tax for the first time. One option is to consider selling shares gradually over a number of years to keep your gain below the tax threshold for higher-rate tax. Capital gains tax can be complicated so it’s worth getting financial advice if you’re not sure.”

Using losses to reduce your gain

“Capital losses can be used to offset capital gains. If you have investments that have incurred losses, you can use these losses to offset gains realised on other investments, thereby reducing your overall tax liability.”

Transfer assets to partner/spouse

“Also, people forget that they can mitigate CGT and dividend tax by transferring assets between partners and spouses, which are usually tax-free. This is because we each have our own allowance, meaning that married couples could potentially benefit from double the CGT and dividend tax allowances. The benefit is greater if the recipient who sells the assets is subject to a lower tax rate.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.