Can tech shares keep rising under Trump?

Saltydog Investor looks into the reasons for the tech sector’s strong run and highlights the top-performing funds.

20th January 2025 14:01

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

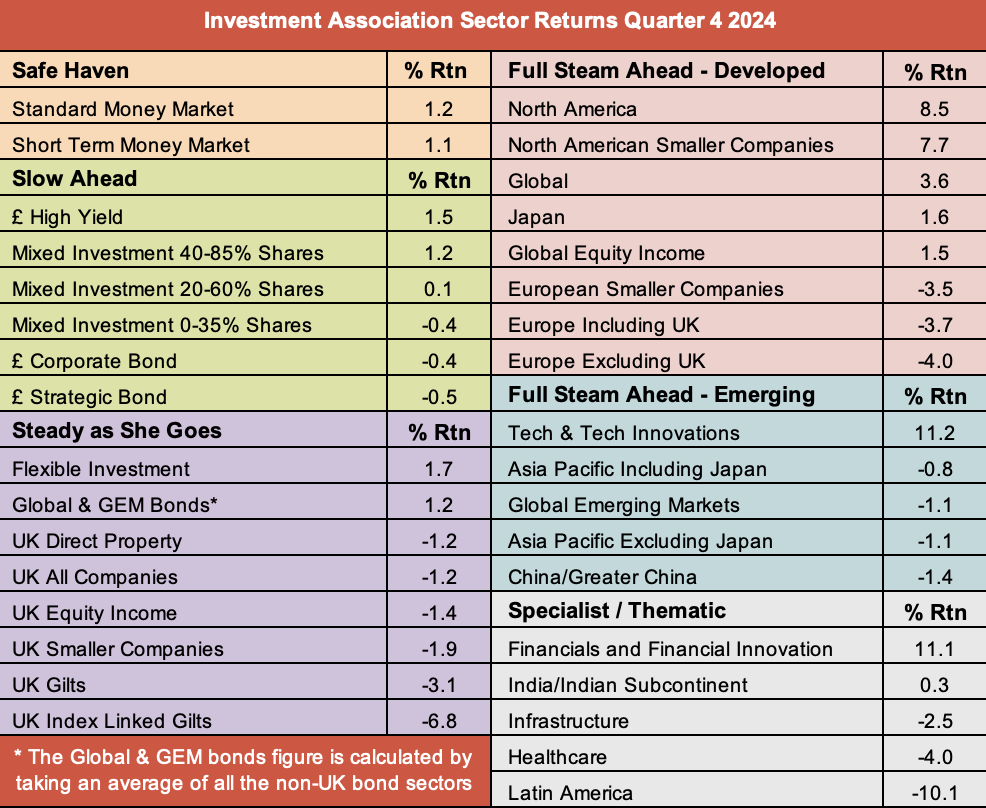

When investing, there tends to be a correlation between risk and reward. We see this in the performance of the Investment Association (IA) sectors. The sectors that sometimes generate the largest gains can also suffer the biggest losses.

The Technology & Technology Innovations sector is one of the most volatile sectors. In 2022, it fell by 27%, but the following year it was the top-performing sector, with an annual return of 38.7%. Last year was another good year; it went up by 23.5% and was beaten by only one sector, Financials and Financial Innovation, which rose by 23.8%.

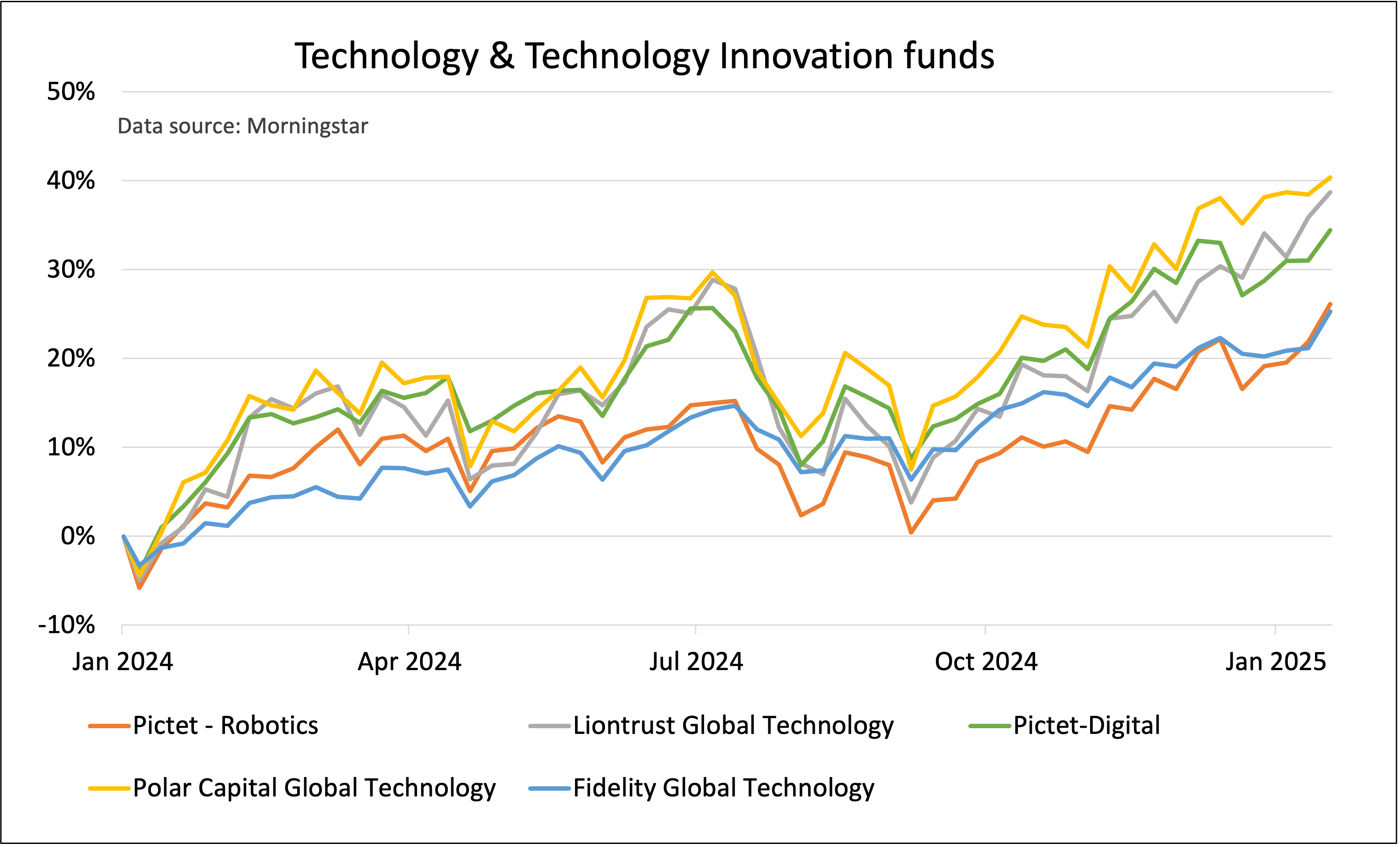

However, it was not a smooth ride and during the year it also had its fair share of ups and downs.

- Invest with ii: SIPP Account | Stocks & Shares ISA | See all Investment Accounts

It made gains in January, February and March, and was the leading sector at the end of the first quarter, posting an impressive 11% three-month return. In April, it fell by 3.7%, but recovered during May and June to end the second quarter up 5.1%.

In July, it suffered a 4.4% loss, and it went down by a further 0.5% in August. It made a small gain in September, but still ended the quarter down 4.8%.

It was then the best-performing sector in the final three months of the year.

Data source: Morningstar. Past performance is not a guide to future performance.

Overall, the final three months of 2024 were a bit disappointing. Only 15 out of the 34 sectors shown in the table went up. That is a significant drop from the 29 sectors that went up in quarter three, and the lowest number for over a year.

In the UK, the UK All Companies, UK Equity Income, and UK Smaller Companies sectors all fell. The UK Gilts sector fell by 3.1%, and UK Index-Linked Gilts ended the month down 6.8%.

- What Trump 2.0 means for investments – and funds that could benefit

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

The European sectors also went down, as did China/Greater China, Global Emerging Markets, and the two Asia-Pacific sectors. The worst-performing sector was Latin America, with a 10.1% one-month loss.

The North American sectors jumped after the presidential election in November, and that also lifted the Global and Global Equity Income sectors.

The Technology & Technology Innovation sector rose by 3.3% in October, 6.4% in November, and was one of the few sectors to make a gain in December, although it only rose by 1.1%. It ended the quarter up 11.2%.

So far this year, the sector has already gained a further 4.1%, and the leading funds have done even better.

Leading technology funds in 2025

| Fund | % Return (1 to 17 Jan) |

| Pictet - Robotics | 6.8% |

| Liontrust Global Technology | 6.6% |

| Pictet-Digital | 5.1% |

| Polar Capital Global Tech | 5.0% |

| Fidelity Global Technology | 4.6% |

Data source: Morningstar. Past performance is not a guide to future performance.

Since the beginning of last year, all these funds have risen by more than 25%, and the Polar Capital Global Technology fund has made a gain of 40%.

Past performance is not a guide to future performance.

Investors are hoping that the new Trump administration will be pro-business, and will benefit the technology sector in particular. Trump has indicated that his government will invest heavily in artificial intelligence (AI), and is expected to reduce regulation and promote innovation.

The main concern is that after two years of strong growth, the leading technology companies have seen their valuations soar to levels that some analysts already believe are unsustainable. The market has priced in extremely high growth expectations, and if they are not met we could see a swift correction.

In our demonstration portfolios, we are still comfortable holding funds exposed to the technology sector, but they only make up a relatively small proportion of our overall investment.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.