Can tech funds maintain their lead?

Tech shares wobbled last week: was this a blip or the start of a more serious correction?

7th September 2020 13:48

by Douglas Chadwick from ii contributor

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Tech shares wobbled last week. Was this a blip or the start of a more serious correction, asks our Saltydog investor.

This content is provided by Saltydog Investor. It is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

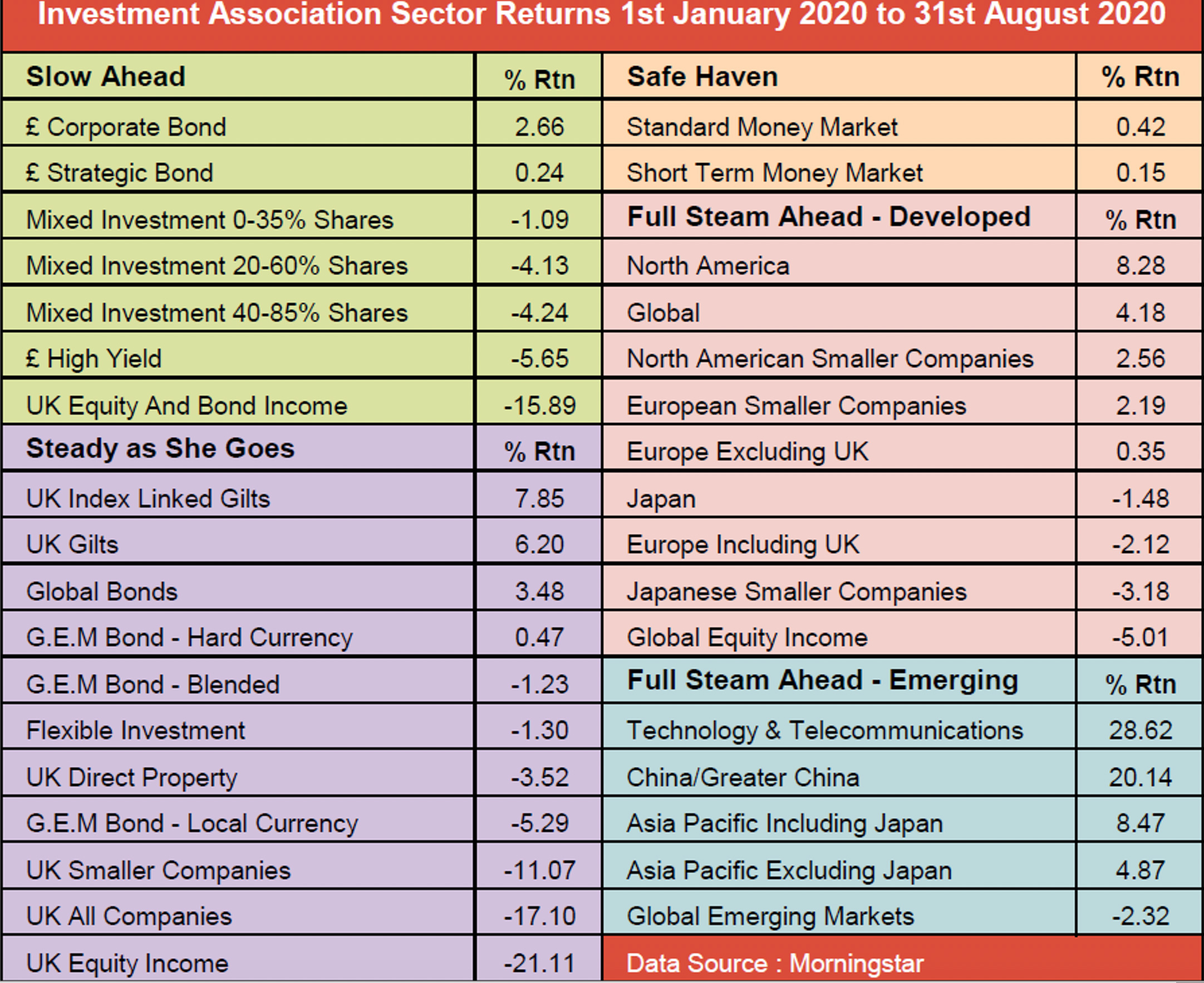

During August, the Investment Association’s Technology and Telecommunications sector went up by 5%.

Although a couple of sectors did better over the month, Japanese Smaller Companies rose by 5.7% and UK Smaller Companies gained 5.6%, the tech sector is clearly ahead so far this year, one of two sectors to have gained in excess of 20%, with the other being China/Greater China.

Past performance is not a guide to future performance.

The range in returns over the last eight months is quite dramatic. At the bottom of the table is the UK Equity Income sector, which has fallen by 21%. The UK All Companies sector has not done much better, down 17%, while the UK Smaller Companies sector is also towards the bottom of the rankings, having lost 11.1%.

Only half the sectors in the table are showing gains so far this year. The leading sector, Technology and Telecommunications, was showing a year-to-date gain of nearly 29% at the end of August. Considering the sector fell by more than 10% during February and March, that is a pretty impressive recovery.

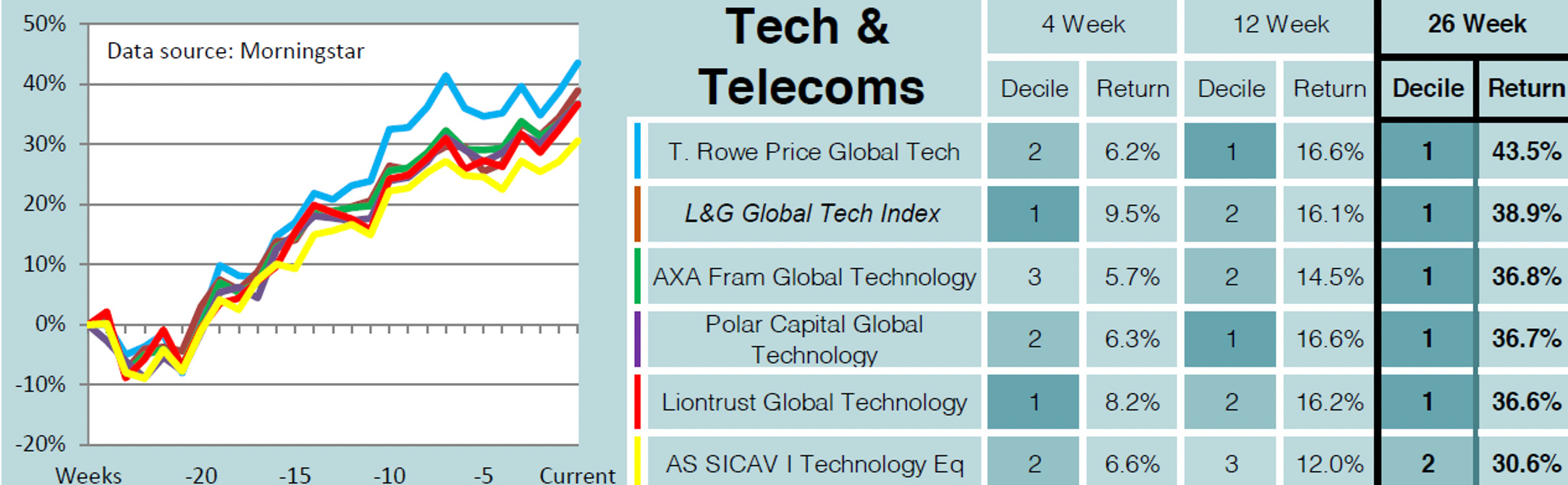

When we looked at our fund performance data last week, there were six funds from the Technology and Telecommunications sector that had gone up by more than 30% in the last 26 weeks.

Past performance is not a guide to future performance.

Fourth in the list is the Polar Capital Global Technology fund. Both of the Saltydog demonstration portfolios bought the fund in April when we saw that stock markets were starting to recover. Since then, it has soft closed (meaning it is no longer accepting money from new investors), following a £1.6 billion increase in the value of its assets during April, May and June.

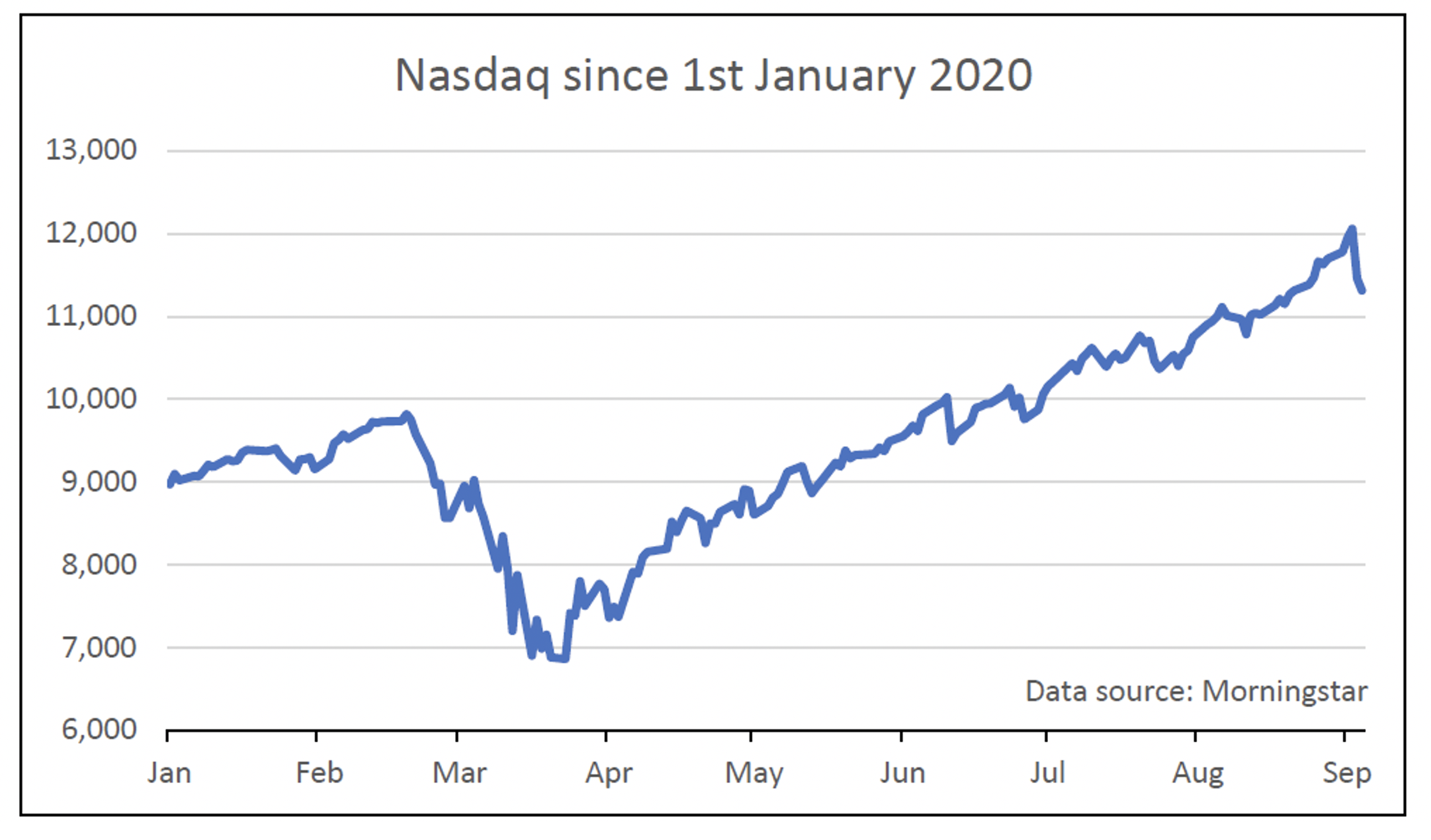

The performance of the Technology and Telecommunications sector is closely correlated with the Nasdaq Composite index. The index includes nearly all the stocks listed on the Nasdaq stock exchange in New York and is heavily weighted towards companies in the technology sector. At the end of August, it was also boasting a year-to-date return of more than 30%.

Since then, it has taken a turn for the worse. Last Thursday, it went down by nearly 5% and then a further 1% on Friday.

Past performance is not a guide to future performance.

It is not unusual to see the index fall before going on to new highs: we have seen it drop several time since the rally that started at the end of March, but the latest correction is slightly larger. This may be another temporary blip, but it could be the start of something more serious.

For a long time, commentators have been saying that the giant US technology companies are overpriced and that a bubble has formed that is about to burst, could this be the beginning?

We will be watching the situation very closely over the next few days.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.