Can Lloyds Bank shares reverse Friday slump?

After a motor finance court ruling put Lloyds at risk of significant claims against it, its shares must start the entire recovery process again. Independent analyst Alistair Strang gives his view on the share price potential.

28th October 2024 07:41

by Alistair Strang from Trends and Targets

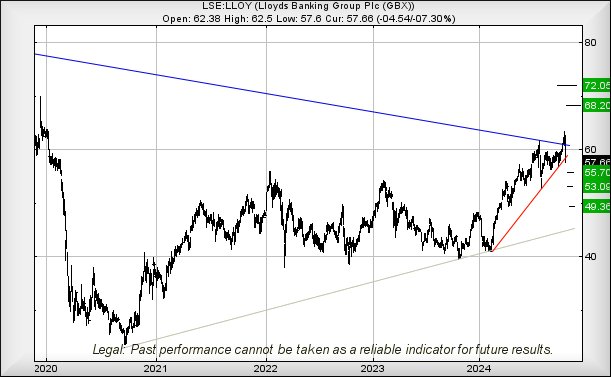

The Lloyds Banking Group (LSE:LLOY) their share price has fallen apart on us. When we reviewed it three weeks ago, the share was supposed to exceed 61.338p to signal happy times ahead, a feat achieved from 17 October.

But everything fell apart on Friday 25th with news of Lloyds' exposure to the car finance court ruling, exposing them to a £3 billion pound hit. It’s all quite messy, doubtless about to spawn an entire industry of “car finance claim” companies similar to the absurd number of leaches which appeared when the Payment Protection thing hit the fan.

- Invest with ii: Open a Stocks & Shares ISA | ISA Investment Ideas | Transfer a Stocks & Shares ISA

The 7% reversal for Lloyds on Friday has dumped the share into some quite nasty territory, suggesting traffic below 56.92p risks a visit to an initial 55.7p with our secondary, if broken, at 53p and hopefully a proper bounce capable of starting the entire recovery process again.

Given the court verdict on Friday is expected to be appealed to the UK Supreme Court, there shall doubtless be plenty of time until all the lawyers decide they’ve clocked up sufficient hours to absorb any successful litigation awards. We’re obviously a bit cynical, but with this sort of class action the legal profession always appear to flourish.

Should Lloyds intend any sort of surprise, it’s now the case where above 61.33p should bring a visit to 68.2p next with our secondary, if beaten, at 72p and some possible hesitation. Unfortunately, for now we expect to see Lloyds pay homage to the 53p level.

Source: Trends and Targets. Past performance is not a guide to future performance.

Alistair Strang has led high-profile and "top secret" software projects since the late 1970s and won the original John Logie Baird Award for inventors and innovators. After the financial crash, he wanted to know "how it worked" with a view to mimicking existing trading formulas and predicting what was coming next. His results speak for themselves as he continually refines the methodology.

Alistair Strang is a freelance contributor and not a direct employee of Interactive Investor. All correspondence is with Alistair Strang, who for these purposes is deemed a third-party supplier. Buying, selling and investing in shares is not without risk. Market and company movement will affect your performance and you may get back less than you invest. Neither Alistair Strang or Interactive Investor will be responsible for any losses that may be incurred as a result of following a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.