Can growth capital survive and thrive?

SPACs have fallen out of favour, but there are several factors potentially about to change the outlook for this investment trust sector, argue Kepler analysts, who examine a handful of trusts.

7th February 2025 14:00

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Commuting in the first few weeks of 2025 has felt really busy. This may just be in contrast to the quiet Christmas period, although it could also be the result of an increasing number of firms enforcing “return to work” policies. If so, this would make another slow rollback of the WFH trend from the pandemic.

As we approach the five-year anniversary of Covid-19, we have seen a number of these trends that initially felt like a new normal begin to retreat back to where they were before. One example in the financial world has been the deflation of the bubbles in certain unlisted assets and early stage growth companies.

However, as these have fallen back, we think there have been some quality assets caught up in this sell-off. With discounts still wide in the growth capital sector, we look at what value may be on offer.

Pandemic excess

A combination of ultra-low interest rates to help struggling economies and potential investors sitting in lockdown with nothing to spend their money on led to massive capital flow into racier investments.

One of the most egregious examples of this was the rapid rise of Special Purpose Acquisition Companies (SPACs), particularly prominent in the US market. SPACs are often referred to as blank cheques or shell companies, that list with considerable capital although no actual investments, and are run with the intention of using this capital to merge (or de-SPAC) with another business, allowing the capital to help this business to grow.

To their supporters, they are a more efficient way of getting growth capital into fast-growing companies, without the burden of overregulation, but to critics, they are simply a way of circumventing the usual scrutiny of an IPO leading to questionable businesses being able to gain investment at eye-watering valuations.

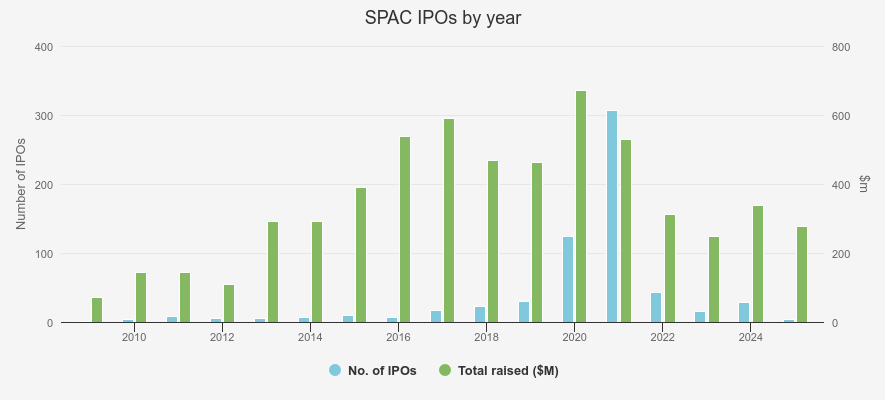

The SPAC market was rocked by a spate of suspected frauds and a collapse in demand, especially as interest rates rose, with IPOs falling from a peak of 613 in 2021, to just 57 in 2024, a fall of 91%. Assets raised by SPACs have come down from a peak of $335.2 million in 2020 to $168.7 million last year, although 2023 was the worst year for both the number of IPOs and assets raised, with 31 companies raising a total of $124.1 million as we have shown in the chart below.

Performance has also failed to meet expectations, with a significant portion failing to acquire a company and returning money to investors, and the median average de-SPAC offering negative returns. In our sector, Bill Ackman, manager of Pershing Square, was responsible for the highest profile SPAC failure, raising $4 billion, and then returning it when he couldn’t find an appropriate target company.

SPAC raises

Source: SPAC Research, as of 31/01/2025

Unlisted companies

While SPACs have understandably fallen out of favour, it is not just the more speculative assets in the private space that have struggled, with a number of sectors seeing pullbacks. The growth capital sector, which contains a number of trusts that focus on late-stage private companies, and on the crossover space into public markets, currently trades at an average discount of c. 36%, wider than the five-year average of 19% but far off the levels seen in the boom times of 2021, where the sector average touched a c. 18% premium. The average performance (in NAV total returns terms) over these five years is broadly flat at -0.9% to 29/01/2025. However, this is far from the full story. The sector average at one point was up c. 15% on a cumulative basis from 30/01/2020 to 22/11/2021, before falling c. 25% to its nadir in July 2023. Since then, there has been a tentative recovery. There have been several trusts with exceptional performance, especially from a share price perspective. Despite this, discounts remain wide on many trusts, which may provide opportunity.

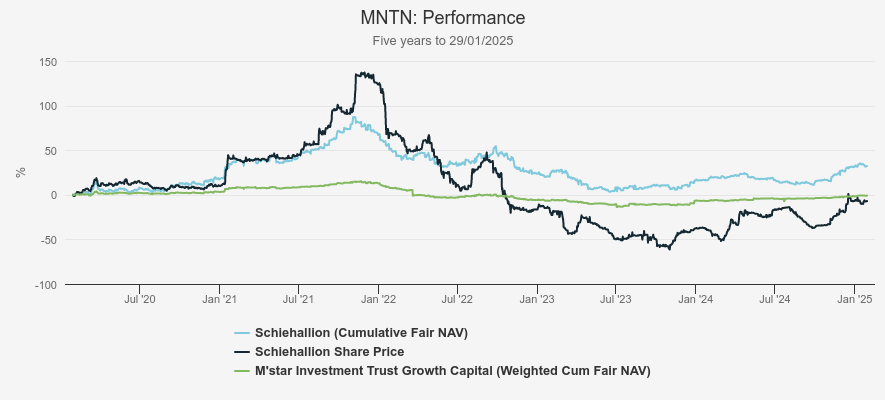

One of the largest growth capital trusts is Schiehallion Fund Ord (LSE:MNTN), managed by Baillie Gifford’s Peter Singlehurst and Robert Natzler. The trust specialises in early-stage private companies, though holds a mix of private and public companies at present following some successful IPOs. The trust originally launched in 2019, and following the conversion of a C-share in 2023, net assets now stand at £1.3 billion (as of 28/01/2025). The trust holds c. 71% in private companies (as of 31/07/2024) with some well-known names including Elon Musk’s rocket company SpaceX, TikTok owner ByteDance, and payment provider Stripe. However, the valuation of these assets came under question in 2021 and 2022 following the change in the investing backdrop.

Baillie Gifford highlights their process is run by an internal team that regularly updates valuations, as well as for specific events. Over half the portfolio had its valuation reviewed twice in the last interim period, with 30 of the 68 holdings being revalued three times. This level of regular analysis is arguably rigorous. Furthermore, c. 16% of the portfolio is in listed companies and therefore, the valuation of this portion can be considered fair.

MNTN’s rating has been volatile over the past five years. Having traded at a significant premium in the pandemic as investors were keen to gain exposure to the trust’s exciting growth opportunities, this soon unwound, the trust falling to a discount as wide as 57.4% in November 2023. Since then, MNTN’s shares have had a strong recovery. The discount has narrowed to its current level of 16%, with the share price more than doubling in that time frame, as the period of high inflation has passed, interest rates have begun to fall and investor confidence has returned. Despite this, the share price is still down 7% over five years, and trading at a notable discount. This arguably demonstrates all of the positive sentiment built up in the pandemic has come out of the shares, despite the continued growth potential of the underlying portfolio.

MNTN performance

Source: Morningstar. Past performance is not a reliable indicator of future results

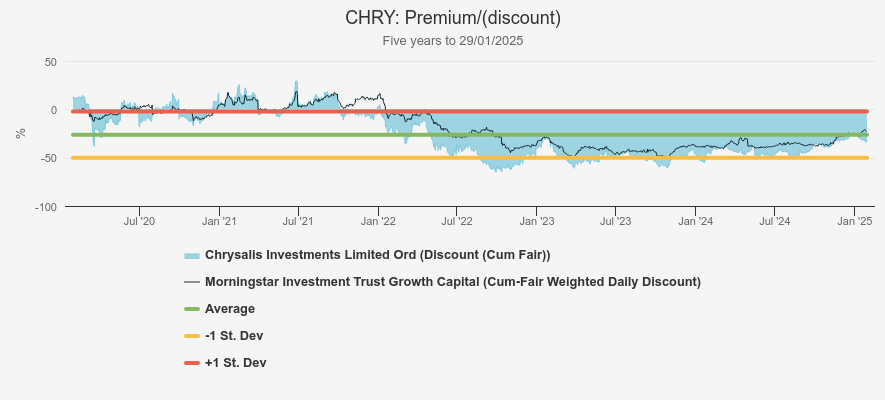

Whilst MNTN’s discount is one element of the investment case, it is actually one of the narrowest discounts in the growth capital sector. By contrast, Chrysalis Investments Limited Ord (LSE:CHRY)currently trades at a discount of 34.2% as of 28/01/2025 despite having also had a strong recovery from the market bottom in late 2023. CHRY is managed by Richard Watts and Nick Williamson and owns a portfolio of companies in the so-called ‘crossover space’ which includes companies in the last stages of their privately held journey before listing on public markets. Current holdings include international payments firm Wise which listed in July 2021 at a valuation of £8 billion. Whilst this has been one success for the trust, both the NAV and the share price struggled recently due to a combination of the weaker investing environment as well as some stock-specific issues. One of these was the digital insurance platform wefox which initially grew quickly to a value of $4.5 billion in 2022, before suffering losses in a number of key markets. However, this issue seems to have been resolved in January 2025, following additional funding which should support wefox’s growth plan going forward.

Furthermore, the trust has benefited from the sale of holding Featurespace to Visa at a price significantly above the carrying value, leading to cash proceeds of £79 million, close to 10% of the trust’s total assets. Not only has this allowed the trust to undertake a significant share buyback programme which has contributed to a strong share price recovery in the past year, but it has also been a good demonstration of the upside potential in the portfolio, and that perhaps the values of the private holdings are accurate, if not modestly valued. One of the trust’s largest holdings is buy-now-pay-later firm Klarna. This is expected to IPO in the next few months and could also provide another indication of the level of value in the portfolio and perhaps a sign of the industry's health more broadly.

Despite the recovery in these holdings leading to good NAV performance, the share price has failed to keep up leading to the discount continuing to be quite wide. It has narrowed more recently however, following the announcement of the share buyback as well as the good underlying performance. This arguably shows the potential impact of large-scale share buybacks on the discount, though there is arguably still value on offer should there be further developments in the status of the underlying portfolio.

CHRY discount

Source: Morningstar

Both MNTN and CHRY are holdings in MIGO Opportunities Trust Ord (LSE:MIGO) managed by Nick Greenwood and Charlotte Cuthbertson. The managers look to capitalise on the broad range of opportunities within the closed-ended space, such as identifying opportunities within deeply discounted trusts and those with idiosyncratic sources of returns. They have taken advantage of the wariness over valuations in the private equity space by adding to these two companies in the past couple of years, taking advantage of the wide discounts on offer which they didn’t believe reflected the strength of the underlying portfolios. This, they believe, was a demonstration of investors considering all unlisted assets as ‘blue sky’ ideas, similar to what was seen in the excess of the SPAC trades, rather than taking a discriminate approach to the sector. These two holdings have contributed significantly to performance over the past 18 months as discounts have narrowed from their nadir. Nick and Charlotte argue the boards of trusts like Chrysalis or Augmentum Fintech will be feeling under pressure to take action to narrow their discounts, particularly in light of the activism of Saba Capital, which has so far focussed on plain vanilla equity trusts. They argue Saba or other activists may be drawn into these sectors by the opportunity to acquire assets on the cheap, so one way or another they expect value to be realised.

Nick and Charlotte also hold smaller positions in some other growth capital trusts. One of these is Schroder British Opportunities Ord (LSE:SBO), which launched in December 2020 and is managed with a team-based approach, leveraging the wide range of expertise at Schroders. The managers focus on small and mid-sized companies and have a mix of private and public equities, split approximately 64% to 27%, with the remainder in cash. The most recent portfolio activity has been focussed on developing the private companies’ portfolio which they believe is likely to be where the majority of the long-term returns are to come from, as it offers an ongoing pipeline of attractive opportunities. The managers believe the recent disposal of a portfolio holding Graphcore above its carrying value is an example of their conservative approach to the valuation of their unquoted holdings. Despite this, the portfolio is currently trading at 1.5x its cost price demonstrating the upside potential on offer. SBO is another growth capital trust trading at a wide discount to NAV of c. 36%. This is despite approximately a third of the portfolio being in public equities. As such, the discount has the potential to add to long-term returns should this narrow, with the upside potential of the exciting growth opportunities in smaller private companies able to add to this.

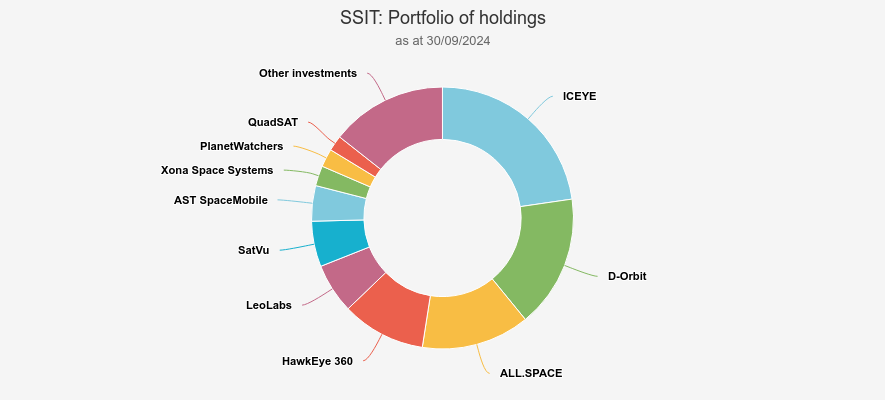

A more specialist trust in the growth capital sector is Seraphim Space Investment Trust Ord (LSE:SSIT). Launched in mid-2021, the trust claims to be the world’s first space tech fund and wishes to capitalise on this first-mover advantage to capture the massive growth potential of the space industry. The trust owns a concentrated portfolio of 25 companies, primarily privately owned, though with c. 6% in publicly listed equities. These holdings operate in a variety of space-based technologies, ranging from miniature satellites to orbital transport logistic services to heat sensors. Due to the early-stage growth nature of many of these industries, many holdings are currently operating at a loss, although the managers forecast that c. 60% of the portfolio does not need any additional funding to achieve profitability. As a result, the managers of MIGO believe the market continues to be wary of SSIT, although they believe the portfolio is growing in maturity, and that the increasing funding for the defence sector could support the growth of many of these companies and make them targets for acquisitions.

SSIT’s shares have been volatile, arguably as a result of its specialist investment area and the early stage of its investments. Shares began selling off in early 2022 before hitting bottom c. 18 months later. At this point, the discount had widened out to over 70%. The shares have since recovered notably, having nearly doubled to their current price of 51p. Despite this, SSIT currently trades at a discount of 45.5%. This level, whilst a recovery from the nadir, arguably provides significant compensation for the risk on offer. Furthermore, with such a concentrated portfolio—the top 10 make up c. 76% of the portfolio—a jump in the value of one holding, whether that be through a valuation uplift through a funding round, a new contract win, or a takeover, could add significantly to NAV, further adding to the upside potential of the investment case.

SSIT Portfolio

Source: Seraphim Space Investment

One of the headwinds the growth capital sector is facing is the weakness in UK markets which has meant that the prospects for IPOs are weak at present. Many of these trusts would normally see an IPO as a potential exit route for their investments, however with UK-listed companies trading at low valuations versus history and international peers, many companies are holding off listing as they don’t believe they’d achieve a fair valuation. This has meant that growth capital trusts have had one route of taking profits and recycling capital into other ideas limited. With all trusts in the sector trading at a discount too, they are unable to raise additional capital which has meant they are waiting for markets to recover before they are able to continue to grow and develop their portfolios.

Conclusion

One factor that could help resolve this is lower interest rates. The period where the sector saw its strongest period of growth, including the areas of excess such as SPACs, was at the time when interest rates were effectively zero. These days are long gone, and as a result, there has been considerable capital flight from markets as investors flock to safety. However, the beginning of 2025 has seen some speculation that further interest rate cuts may be on the horizon. If so, this would improve the prospects for the growth capital sector, and investment trusts more widely. Furthermore, the wide discounts may be a cause of concern for boards due to the heightened level of activism in markets. This may lead to a step up in measures such as tender offers, mergers, or other corporate activity, with the likes of CHRY demonstrating what large-scale buybacks can do. Therefore, with several factors potentially about to change the outlook for the growth capital sector, this year, just like the commute, may become very busy.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.