Buying the best-performing fund so far in 2025

There’s been a shift in market momentum, which has seen Saltydog Investor spring into action and buy a fund that’s made a strong start to 2025.

18th March 2025 09:00

by Douglas Chadwick from ii contributor

In recent months, we've seen a seismic shift in momentum across some of the most-popular fund sectors.

Sectors such as North America and Technology & Technology Innovation, which performed well last year, have suffered a significant downturn.

- Invest with ii: Buy Global Funds | Top Investment Funds | Open a Trading Account

The North America sector rose by 22% in 2024 and gained a further 4.6% in January. However, it fell by -3.9% in February and has lost another -8.3% so far this month.

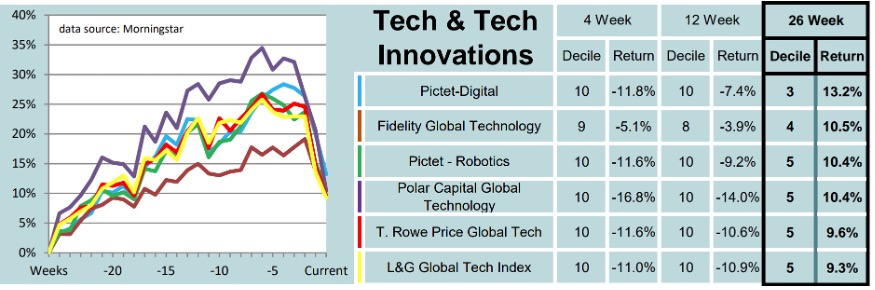

The Technology & Technology Innovation sector did even better last year, rising by 23.5%, and added another 5.0% in January. But it dropped -5.7% in February and has since fallen by a further -8.0% in March.

Looking at one of our tables from last week’s analysis, you can see just how severe the drops have been. Five out of the six leading funds in this sector over the past six months were showing four-week losses of 11.0% or more.

Past performance is not a guide to future performance.

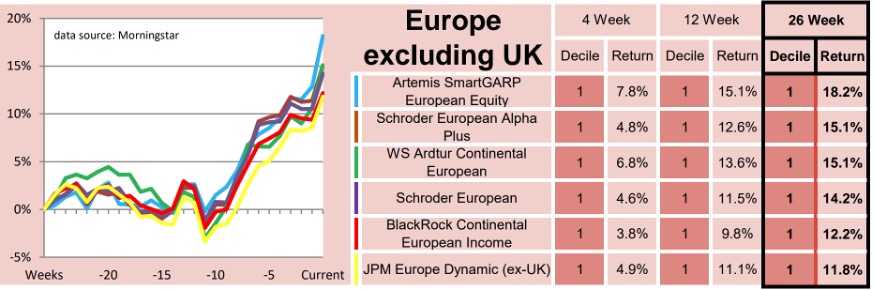

Nearly all the other Investment Association (IA) sectors were also showing four-week losses. However, one exception was the Europe excluding UK sector.

Last year, it only went up by 1.8%, which was less than the Money Market sectors, but it has made an impressive start to 2025. It gained 7.2% in January, followed by a 1.2% rise in February when most sectors were falling. This month, it is up 0.2%, with some of the leading funds performing even better.

Past performance is not a guide to future performance.

Having already reduced our exposure to the US markets and the technology sector, we’ve been looking for other opportunities for our demonstration portfolios.

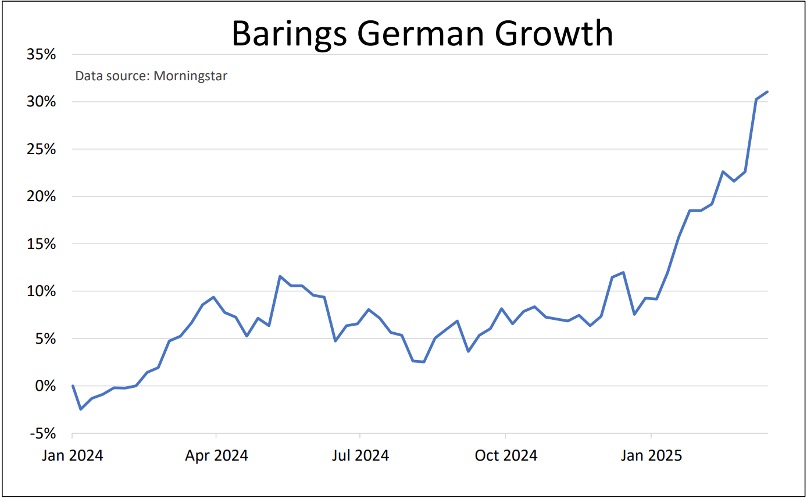

Funds from the Europe excluding UK sector were strong contenders, but in the end, we opted for a fund from the Specialist sector - Barings German Growth A GBP Acc.

Although you might think a fund targeting German growth would naturally sit in the Europe excluding UK sector, it is ruled out on a technicality.

- DIY Investor Diary: I invest so I don’t have to worry about money

- 10 hottest ISA shares, funds and trusts: week ended 14 March 2025

To qualify for the Europe excluding UK sector, a fund must invest at least 80% of its assets in European equities and exclude UK securities. But there is an additional stipulation: the fund must be “broadly diversified across the region”. A fund solely focused on a single country, such as Germany, is placed in the Specialist sector instead.

Barings German Growth was launched in 1990 and has a portfolio value of around £350 million. It invests at least 75% of its assets in companies incorporated, listed, or predominantly operating in Germany. Its largest holdings include SAP SE (XETRA:SAP), Siemens AG (XETRA:SIE), Allianz SE (XETRA:ALV), and Airbus SE (EURONEXT:AIR).

So far this year, the fund has risen by nearly 20%, making it the best-performing fund in our analysis.

Past performance is not a guide to future performance.

This year the STOXX 600 has gone up by 7.6%. This indexis probably the most comprehensive European stock market benchmark. It tracks the 600 largest European companies, offering broad representation of the European markets across different countries and sectors.

In contrast, the FTSE 100 has only gone up by 5.6%, and the more domestically focused FTSE 250 has fallen by -3.0%. Across the Channel, the Paris CAC40 has done better, gaining 8.8%, but the Frankfurt DAX is in a league of its own, showing a year-to date gain of 15.5%.

With a GDP of approximately €3.8 trillion, Germany is the largest economy in Europe and the fourth-largest globally. The UK, with a GDP of about €3.1 trillion, is Europe’s second-largest economy.

- How to invest like the best: Warren Buffett

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Despite Germany being in a recession (its economy shrank by -0.3% in 2023 and 0.2% in 2024), its stock market has continued to perform well. Germany’s economy is heavily export-driven, meaning that even during domestic downturns, German companies can benefit from growth in overseas markets, particularly in the automotive, machinery, and chemicals sectors. Around 80% of DAX-listed companies’ revenues come from outside Germany, with 24% generated in the US.

That is a potential problem, with the US government threatening to impose tariffs on the eurozone. A full-blown trade war could impact Germany’s industrial base, although it may also encourage deeper economic integration within the European Union.

However, Germany’s newly announced €500-billion fiscal package, agreed earlier this month, could provide a boost. The package aims to address critical infrastructure needs, strengthen defence capabilities, stimulate economic growth, and reinforce Germany’s position as a key supplier within the EU.

For more information about Saltydog, or to take the two-month free trial, go to www.saltydoginvestor.com

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.