A buy-the-dip opportunity at this Goliath

This company has experienced explosive growth with the promise of considerable further revenue growth in the near future. Our overseas investing expert Rodney Hobson looks at a big tech stock that has sent shareholders on a roller-coaster ride.

23rd August 2023 09:52

by Rodney Hobson from interactive investor

Companies rarely grow big without upsetting a few people along the way. The question is whether social media giant Meta Platforms Inc Class A (NASDAQ:META) has got too big for its boots and made too many enemies.

Latest results for the Facebook, Messenger, WhatsApp and Instagram owner are very encouraging, thanks to increased spending this summer by advertisers who believe that the possibility of recession has at least receded and may even be averted in most major economies.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Revenue rose 11% to $32 billion in the second quarter, while net income easily beat analysts’ forecasts with a 16% increase to $7.8 billion. The figures prompted Meta to raise its predictions for the third quarter, with revenue now seen at $32-34.5 billion. Well over 90% of revenue comes from advertising on the various social media platforms, mostly from the US, Canada and Europe but more than a third from the rest of the world, demonstrating the global spread of the group.

Meta now has a total of nearly four billion active monthly users across its various platforms, exchanging messages, news of varying degrees of accuracy, photographs and videos. It has survived the risky decision to drop its Facebook name for the whole group – the brand name was widely recognisable around the world – and adopting a corporate name that reflects its ambition to focus on the ill-defined but potentially infinite digital realm of “online connectivity”.

Threads, it’s text-based rival to Twitter, has been launched at what could be an opportune time with Elon Musk alienating and confusing Twitter users by renaming his site X and playing around with its pricing structure.

The one potential cloud is the growing resentment in countries outside the United States at the way giant tech companies have manipulated their accounts to minimise tax bills while maximising profits by using personal data to increase advertising revenue.

Norway’s data protection agency has this month decided to fine Meta nearly $100,000 a day for allegedly defying a ban on using personal information to target ads in a row over data protection. This is a dispute that could quickly spread throughout the European Union and Switzerland.

- Can Nvidia deliver another ‘shock and awe’ quarter?

- IPO outlook boosted as Arm prepares for US listing

Meanwhile, Canada is complaining that Meta is putting profits before people by blocking news content, in this case about the wildfires racing through the Northwest Territories and British Columbia. Meta says it is complying with a new Canadian law that requires tech platforms to pay publishers for linking to or reusing content.

Herein lies the restraint on governments wanting to take on Meta: the use of its platforms is now so well entrenched that it is part of ordinary citizens’ way of life.

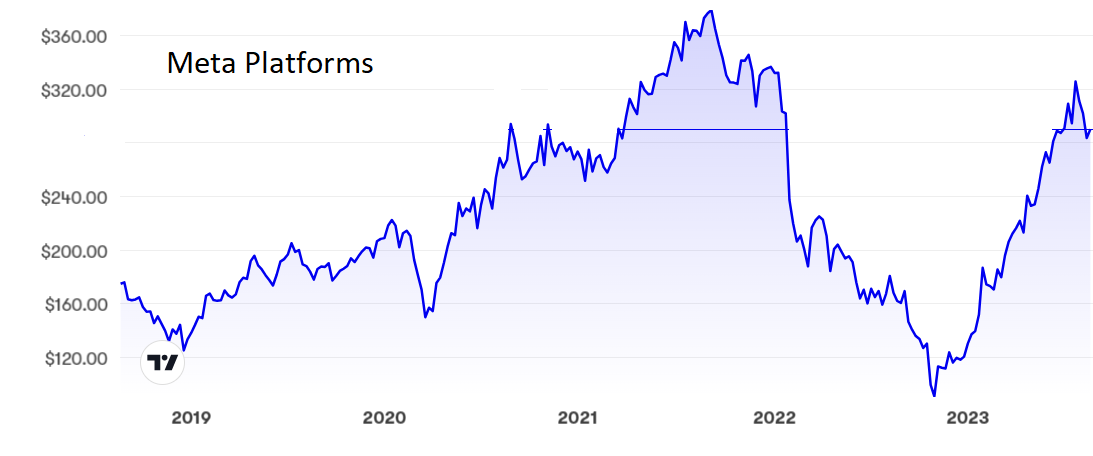

Source: interactive investor. Past performance is not a guide to future performance.

It has been a roller-coaster ride for Meta shareholders, from $150 in March 2020 to a peak of $380 just 18 months later before a slump to below $100 last October. A subsequent strong recovery saw the shares hit $325 but they have come off the boil again to stand just below $300, a level that has proved to be a ceiling in the past and could well be a floor now.

- Can this share’s upward trend continue?

- How Nasdaq-100 ‘special rebalance’ has impacted the big seven tech stocks

However, the price/earnings ratio of nearly 34 assumes considerable further revenue growth in the near future and there is no dividend as profits are ploughed back into expanding the business, notably the Reality Labs metaverse division, which lost $3.74 billion in the latest quarter and will be substantially further in the red for the foreseeable future.

However, there is no denying that this company has grown exponentially since it was established less than 20 years ago and it now has more than 70,000 staff and a stock market capitalisation of more than $700 billion.

Hobson’s choice: This is not a company for dividend seekers nor for the faint-hearted, but over time the share price looks set to rise. The recent dip has created a buying opportunity.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.