The buy case for American bank stocks

19th January 2022 09:01

by Rodney Hobson from interactive investor

An improving interest rate environment for banks should make them an attractive investment, but when should you buy? Our overseas investing expert gives his view.

Fourth-quarter results from US banks have been a bit mixed, reflecting the lingering effects of the pandemic that will have continued into the New Year. The big question is whether a gradual return to something like normality, particularly in terms of interest rates, will make life easier as this 2022 progresses.

Recovery in the US economy faltered last month as 199,000 non-farm jobs were added, well short of expectations of about 400,000 and below the number of new jobs created in previous months. This is seen as a vital indicator of how well the US economy is faring, showing how many people were taken on by private employers excluding seasonal distortions in the agricultural sector.

- Invest with ii: Top US Stocks | US Earnings Season | Open a Trading Account

To add insult to injury, retail sales fell unexpectedly by 1.9% in December after four months of strong growth. Fears over shoppers catching the Omicron variant on top of higher prices and shipping delays, discouraged customers in what is normally the key months in the malls.

The Omicron wave of Covid-19 is expected to restrict job creation in the first two months of 2022, especially as there is a shortage of skilled workers, and the Federal Reserve is unwinding its financial support for the economy. March is widely expected to see the first of several increases in interest rates to cope with inflation hitting 7% last month.

- ii view: JP Morgan profits impress, but shares tumble

- Twitchy times as US earnings season kicks off

- Watch our share, fund and trust tips, plus outlook videos for 2022

- Subscribe for free to the ii YouTube channel for our latest share tips and fund manager interviews

A slowing economy will not help banks but an end to artificially low interest rates certainly will. Rising rates give banks the opportunity to make money by widening the gap between what they pay savers and what they charge borrowers.

On balance, banks can look forward to this year with confidence that it will be better than 2021 and quite a bit better than Covid-hit 2020. In particular, they will be hoping for continued higher fees from investment banking and further releases of provisions made earlier for bad debts that are no longer considered necessary.

The biggest negative for investors to watch out for is the extent to which higher operating costs, mainly resulting from significantly higher wages needed to retain staff, are dampening earnings.

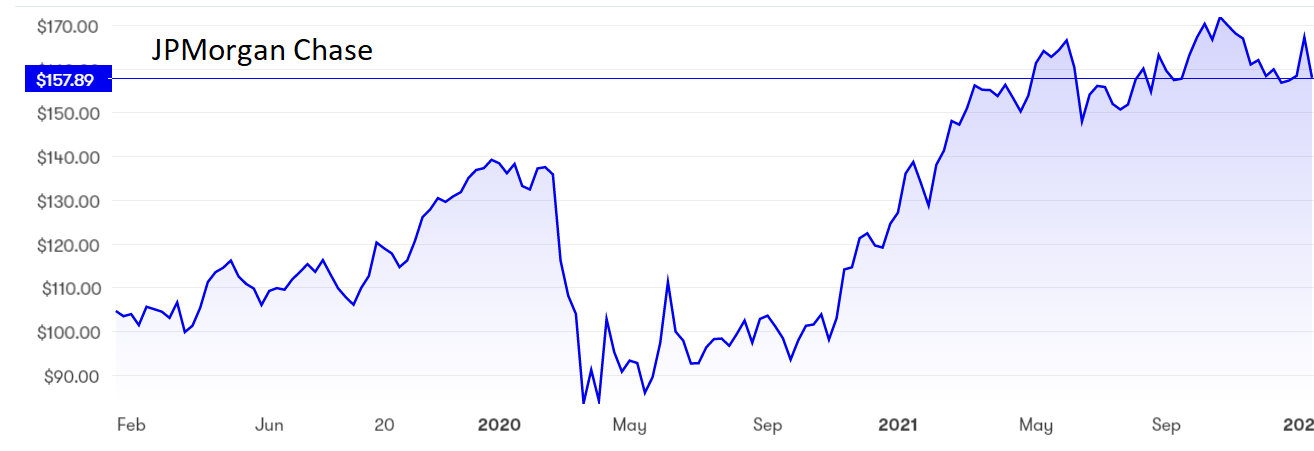

JPMorgan Chase (NYSE:JPM) set the ambiguous tone with results for the fourth quarter showing a 14% drop in net income on revenue only 0.3% lower. Higher salaries and legal expenses took the blame.

This took the shine off a strong 12-month performance, with net income up 66% over 2020 on revenue just 1.4% ahead. With the shares at $151, the yield is 2.41%. interactive investor’s Keith Bowman covered the figures in more detail here.

Source: interactive investor. Past performance is no guide to future performance

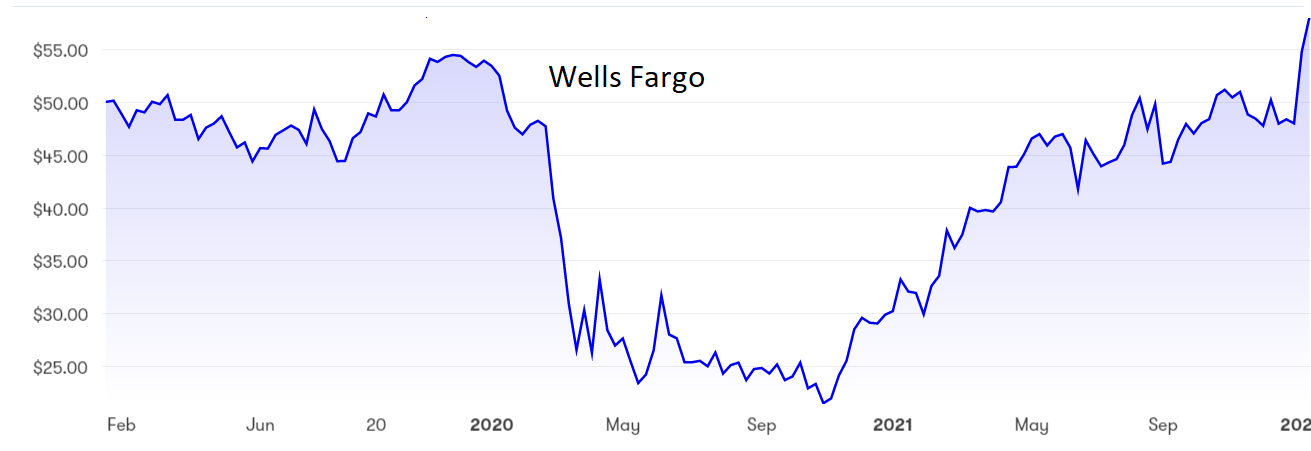

The mood was lightened somewhat by Wells Fargo (NYSE:WFC) reporting a 13% rise in fourth-quarter revenue to $20.9 billion, with net income leaping 86% to $5.75 billion. Earnings per share more than doubled to $1.38.

However, the profit figures were flattered by a $943 million net gain on the sales of the Corporate Trust Services business and Wells Fargo Asset Management plus a $875 million reduction in credit losses, only partly offset by a $268 million impairment charge.

Wells Fargo shares have put in a great performance over the past 15 months, more than doubling from $22 to a four-year high of $58. They are currently $56.50, where the yield is only 1%.

Source: interactive investor. Past performance is no guide to future performance

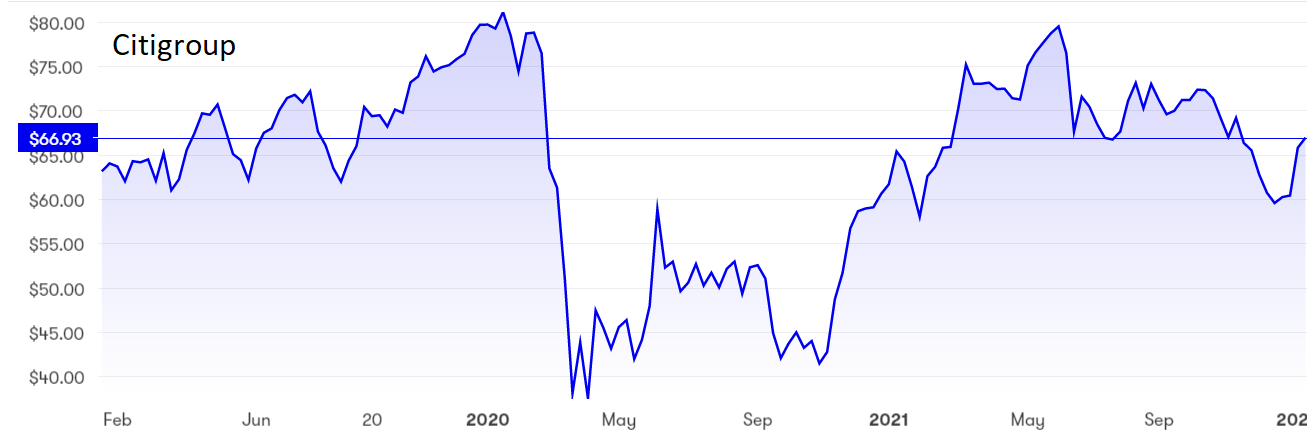

Then Citigroup (NYSE:C) took the shine off the situation by admitting that its operating expenses had jumped by 18%, reducing net income by 26% to $3.2 billion. Total revenue was up just 1% at $17.02 billion with global consumer banking slipping backwards.

Citi has just announced plans to sell its consumer banking franchises in Indonesia, Malaysia, Thailand and Vietnam to Singaporean bank UOB for $690 million more than the value of net assets, which seems a sensible move all round.

Citi shares stand at $65, having fluctuated between $40 and $80 over the past five years. The yield is the best among major US banks at 3.05%.

Source: interactive investor. Past performance is no guide to future performance

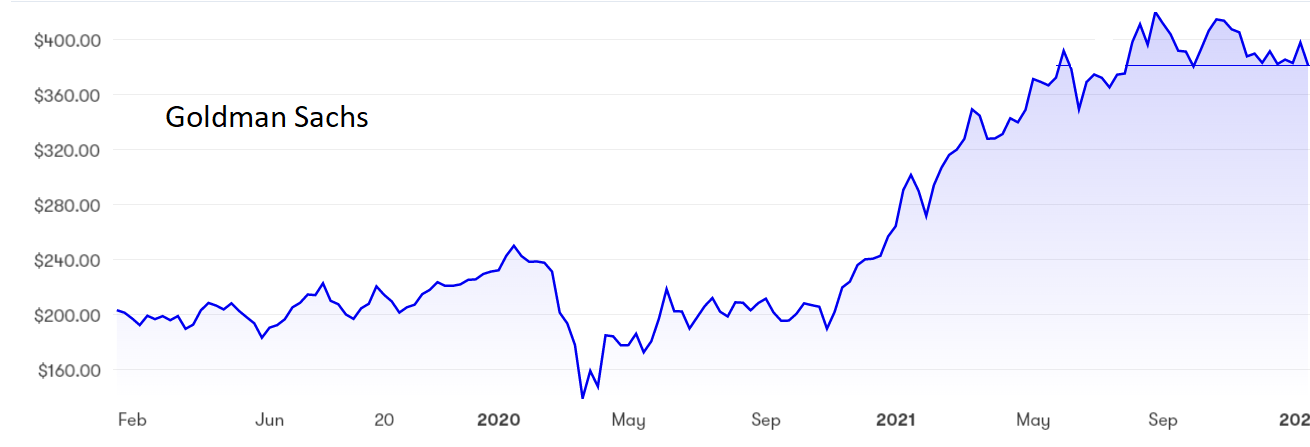

Goldman Sachs (NYSE:GS), like JPMorgan, rounded off what had been a great year with a disappointing quarter. While revenue in the final months rose 9.3% year-on-year, pre-tax profits slumped 9.3%. A 23% rise in operating profits was to blame.

- US stock market outlook 2022: more record highs for Wall Street?

- Apple becomes world’s first $3 trillion company

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

In contrast, revenue for the full year was up by a third and pre-tax profits more than doubled.

Goldman shares hit the bottom at $140 in May 2020 but topped $400 last summer. They currently stand at $353, where the yield is 1.71%.

Source: interactive investor. Past performance is no guide to future performance

Hobson’s choice: Bank shares have been slipping since the latest results so any investor interested in US banks might do well to hold off until they settle. Existing shareholders might as well hold on for better times that should come in mid year.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.