Burberry dumps the dividend as sales plunge

There will be no payout this year, but our head of markets looks at Burberry’s recovery potential.

22nd May 2020 10:26

by Richard Hunter from interactive investor

There will be no payout this year, but our head of markets looks at Burberry’s recovery potential.

As with so many others, Burberry (LSE:BRBY) has its work cut out in this environment, with its exposure to the Asian markets simultaneously falling into both asset and liability territory.

Burberry’s reliance on retail, which accounts for 80% of revenues, is underpinned by the Asian market, not only with the shoppers on their home turf, but also on the travelling consumer, such as Asian tourists in Europe where Burberry has had success in the past.

The severity of the pandemic has unsurprisingly scythed through revenues, with comparable store sales in the fourth quarter dropping 27%, as 60% of stores were closed at the end of March, in stark contrast to the preceding nine months when the figure was up 4%. Pre-tax profits are sharply down, although revenues held up reasonably well and are in line with expectations.

Free cash flow has also been under pressure for a number of reasons, such as increased investment and outflows of working capital, while the 57% decline in operating profit includes a store impairment and inventory provision which totals £244 million.

Quite apart from any Asian tribulations, the trading environment in the likes of the US and Europe have also been understandably harsh, and there will be much debate as to how these markets can recover in isolation after the pandemic and at what speed, let alone when international travel might resume to anything approaching its former levels.

The company’s guidance, such as it is, points to half of its store network still being closed, with this severe impact likely to prevail during the first quarter of the new year at least.

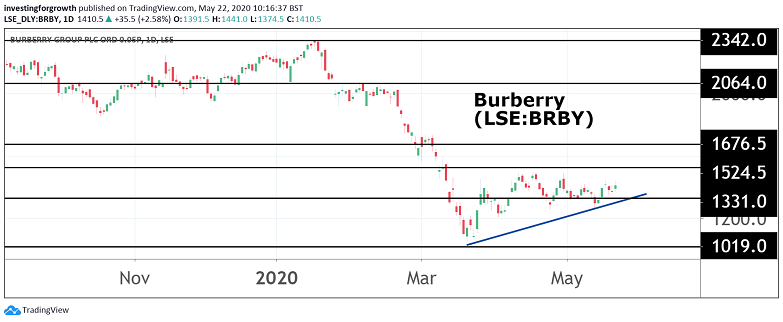

Source: TradingView. Past performance is not a guide to future performance.

However, if the FIFO (first in, first out) rule applies, the fact that Burberry was one of the earliest stocks to be hit by pandemic concerns in January, could also result in a return to form which is ahead of the pack in its key Asian markets.

Indeed, since the end of this reporting period in late March, sales in mainland China and Kores are already ahead of the previous year, although there may be something of a drag since the political unrest in Hong Kong remains live.

In the meantime, Burberry has joined the throng of companies taking a red pen to its outgoings in an immediate effort to preserve cash.

The group had already managed recent cumulative cost savings of £125 million, but in addition has renegotiated rents, abandoned some discretionary spending as well as deciding not to pay a final dividend.

The £325 million saving from the previous dividend and share buyback programme, alongside a drawdown of its credit facility to the tune of £300 million, means that the current net cash position of around £890 million should remain intact.

At the same time, Burberry is ramping up its digital presence in a new era of virtual existence, with the brand heat continuing to grow through its social media channels in particular.

Its new collections and high-end offerings continue to appeal to consumers even in these troubled times, and the longer-term strategy of maintaining its premier product positioning in burgeoning economic regions, is one with which the company is well-versed and has already had some success.

The share price reaction to these numbers reflects some relief, given some of the financial horror stories which other companies have recently reported.

Even so, the shares have far to go in terms of recovery, having dropped 25% over the last year, which compares to a decline of 18% for the wider FTSE 100 index, and having been hit particularly hard over the last quarter.

The timing of the resumption of economic normality is, at the moment, impossible to call, even if Burberry’s Asian experience could provide something of an early signal for any improvements in the region.

With little visibility on immediate prospects, the market consensus of the shares as a ‘hold’ is likely to remain in place for the time being.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.