The bull case for Dart looks pretty clear to me

Shares in this AIM-listed travel company are cheap and should be a good investment over the long term.

6th September 2019 15:09

by Richard Beddard from interactive investor

Shares in this AIM-listed travel company are cheap and should be a good investment over the long term.

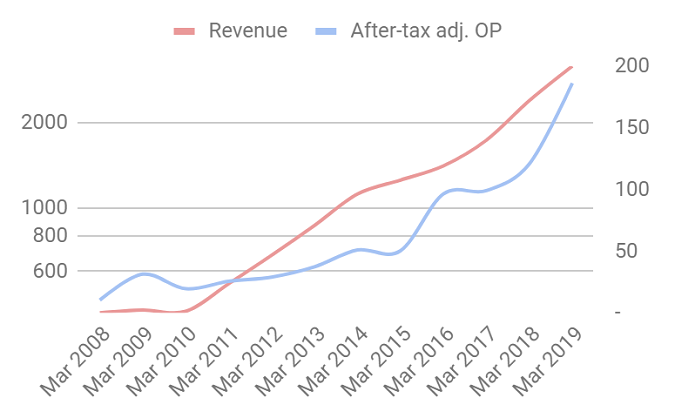

The bull case for Dart looks pretty clear to me. It's grown fast, hasn't it.

Even better than that, it is a growing business that has been getting better at making money:

I have given the vertical axis of this chart a log scale so we can see whether the growth trend has slowed down. So far it has not.

Since 2010, revenue has risen rapidly at a pretty consistent rate and adjusted profit, which initially lagged revenue growth, has accelerated to catch up. Over the period, revenue has increased at a compound annual growth rate (CAGR) of 25%, and adjusted profit has grown at 28% CAGR. Meanwhile, return on capital has increased from 8% to 13% even though the company has been investing in new capital (planes mostly) and spending more to launch new routes.

That's impressive. I thought airlines were supposed to lose money. It is an airline isn't it?

Not exactly...

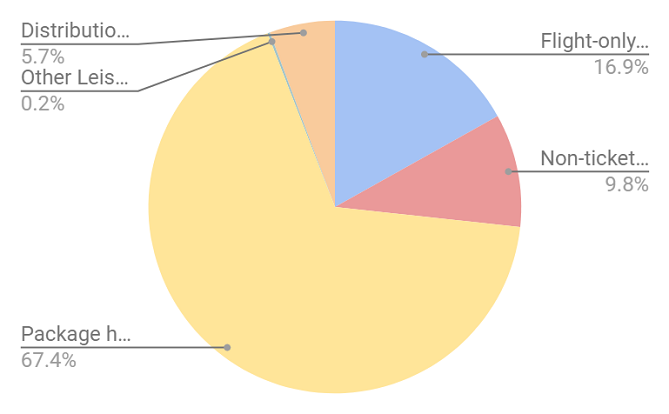

The growth has been due primarily to Jet2's dramatic entry in the package tour market in 2007, when it launched Jet2holidays. Jet2holidays has grown into a £2 billion revenue business second only to TUI (LSE:TUI) in terms of how many passengers its ATOL license allows it to carry. It is responsible for 67% of Dart's total revenue and Dart believes it "continues to have increasing potential".

Most of the rest of Dart's revenue comes from passengers on the same planes, flying to the same destinations, but not as part of a package tour. Six per-cent of revenue comes from Fowler Welch, which warehouses and trucks produce, fruit, veg, and meat, around the country.

But the good news is that Dart's biggest, fastest growing business also earns the highest profit margins because when you put together a package, flights, hotels (or villas), and transfers there are lots of opportunities to differentiate the business and add value.

Dart doesn't break out Jet2holiday's profitability from Jet2's, but the combination brought in 99% of Dart's total operating profit in 2019.

Dart has a bit of a reputation for buying old jalopies. Those new planes. They are actually new are they?

Yep. Jet2 does fly older, less fuel-efficient planes, but in January it took delivery of its 100th plane, the final order of 34 new Boeing 737-800NG's placed two years ago. The NG stands for Next Generation, although confusingly there is an even newer generation of 737, the Boeing 737 MAX. Dart will be glad it didn't buy those from Boeing though. It is thought to have negotiated a very good price for the 737-800s, and the whole fleet of 737 MAX's is grounded following two tragic crashes.

But come on, people are shy of booking holidays because of Brexit, the economic storm clouds are gathering. It is not a good time to be planning a holiday, let alone investing in one surely...

The company says less confident customers have been booking later than they did in the Summer of 2018, which was a buoyant season, so it has kept pricing keen to entice them. Nevertheless as of March, advance sales were 17% higher than in March 2018 and in July the company was hopeful that the Johnny-come-latelies would book over the Summer.

Although Dart may experience an unaccustomed decline in profit in 2019 as it has been discounting, I think a winning strategy and a modest share price trump short-term pressures on profit, because Dart should emerge from any shake-out with a greater market share. This is how I score Dart:

Does Dart make good money?

In 2008, the year of the financial crisis, Dart only made a 4% return on capital. It was a much smaller company then, and only in its second season of selling package holidays so it may not be as susceptible to recession as it was.

Average return on capital is 12%, and though average cash conversion languishes just below 60%, Jet2 has been investing particularly heavily in recent years.

Like all airlines, Dart is required to maintain a large cash balance throughout the year by the Civil Aviation Authority, credit card companies, and counterparties to fuel and currency hedge contracts. The exact amounts vary, but I understand 15% of revenue should cover it. Since this cash cannot be returned to shareholders because it is required for the business to operate, I do not deduct it from enterprise value (which impacts Dart's valuation) or capital employed (which impacts return on capital and the ratio of debt to capital). As these are estimates it means these figures are more subjective than usual.

Score: 1

What could prevent Dart from growing profitably?

Though the company says all-inclusive packages, which fix the cost at the time of purchase, make it easier for families on a tight budget, that is no guarantee revenue and profit margins will hold-up in times of overcapacity, fuel price increases, or recession. Only 40% of packages are all-inclusive and though families need holidays, they may lower their aspirations.

Debt is the traditional murder weapon of inefficient airlines and investment in Jet2's fleet has lifted Dart's borrowings and other financial obligations..

Score: 1

How will it overcome these challenges?

Until recently Jet2's growth was, perhaps, not hotly contested by incumbent package tour operators. It has grown stealthily outwards from its base at Leeds Bradford Airport unencumbered by legacy costs like travel agencies. Perhaps it took Tui and Thomas Cook (LSE:TCG) by surprise, but as they restructure and compete more aggressively (both companies, for example, no longer sell Jet2holidays packages through their travel agencies), Jet2 may find the going tougher.

We cannot ignore the rise of online travel agents like On The Beach (LSE:OTB) either, and attempts by other airlines to become package tour operators. In the last couple of years easyJet (LSE:EZJ) has intensified its efforts to build a package holiday business, poaching Jet2's digital supremo. Ryanair (LSE:RYA) remains something of an enigma, having announced its intention to become an Amazon (NASDAQ:AMZN) of the Airways, but withdrawn its package holiday offer.

But Dart has chosen to focus on different customers and activities than its competitors. Unlike On The Beach, which assembles packages from scheduled flights and room wholesalers known as bed banks, and Tui and Thomas Cook which rely partly on scheduled flights, Dart owns and operates its entire fleet giving it full control of the travel experience and enabling it to fly more frequently to its destinations.

Unlike Tui and Thomas Cook, it does not want to own or even direct the hotels it puts people up in, deferring to successful hotel owners instead, with whom it develops long-standing relationships.

Jet2 does not try to please every potential customer, it tries to please families, and companies that devote all their attention to one type of customer often succeed in winning the lion's share of their business.

Score: 2

Will we all benefit?

As well as being family friendly, the company's core principles are to offer value for money and great customer service. All three principles are widely repeated throughout the annual report, people who fly with Jet2 on the whole agree that it lives up to these principles, and it has also received many accolades.

In 2019, Dart introduced a profit share scheme for employees not already in bonus schemes, and its Lifestyle 2020 programme aims to help aircrews lead a balanced life.

While Dart's three executive directors are well paid, Philip Meeson, the company's founder and essentially the owner of the business with a 37% holding, receives the lowest basic salary. Neither does he receive share options. Perhaps that's good business sense too. Running an airline or package tour operator is a very complex business. He doesn't want to lose the lieutenants who have overseen the growth of a unique business.

Score: 2

Are the shares cheap?

Yes. Although there is more than usual ambiguity in the valuation. A share price of 760p values the enterprise at about £1.1 billion or 10 times adjusted profit. The earnings yield is 10%.

Score: 1.9

A score of 7.9 out of 10 suggests Dart ought to be a good investment over the long term.

Richard owns shares in Dart.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.

Richard Beddard is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.