Brace your income for the self-assessment tax raid

Income tax self-assessment revenues are expected to soar a massive 70% over the next five years. Craig Rickman delves into who this will affect, explains why it’s happening and offers tips to keep your tax bill low.

11th June 2024 14:26

by Craig Rickman from interactive investor

The UK’s rising tax burden is not going unnoticed. HMRC raked in almost £1.1 trillion in taxes and other receipts during 2023-24 – a record high.

While tax revenues creeping up every year suggests a healthy economy, a House of Commons report, published on 11 May, said of last year’s figures: “This is equivalent to around 40% of the size of the UK economy, as measured by GDP, which is the highest level since the early 1980s.”

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | SIPP Account

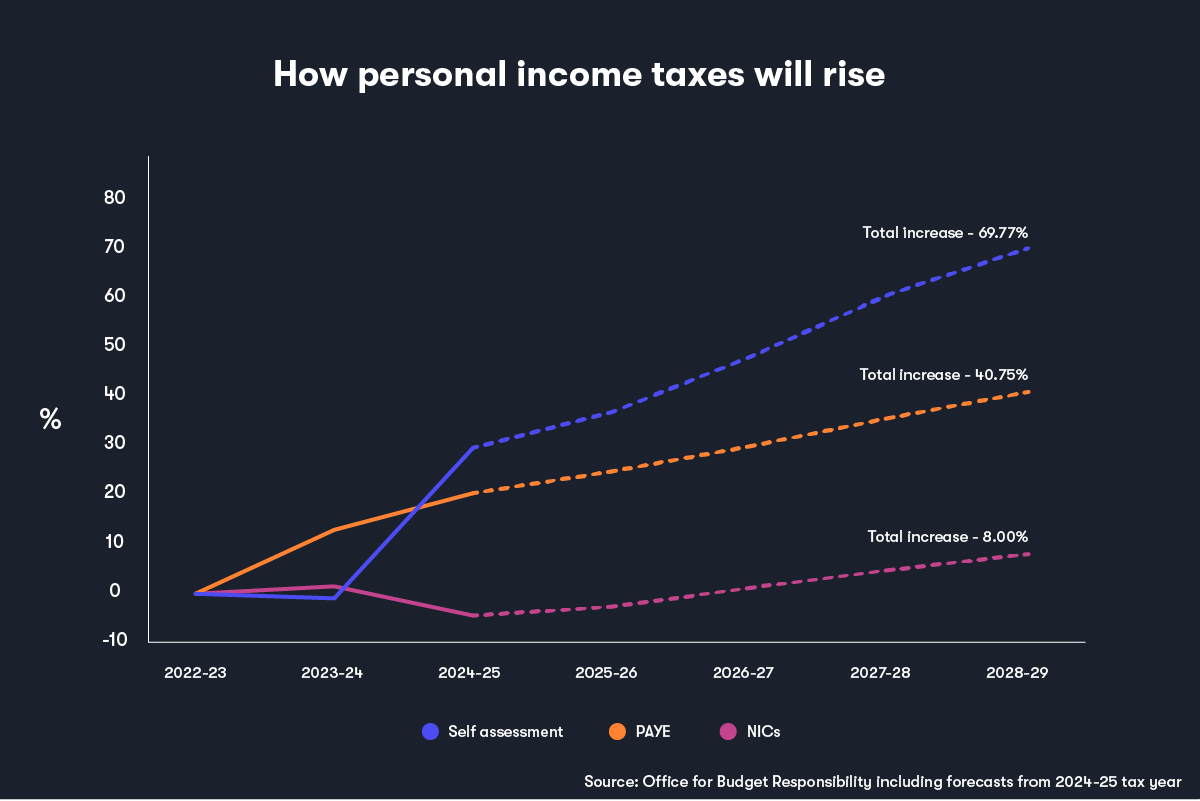

Data published by the Office for Budget Responsibility (OBR) charts the expected future path of UK personal taxes up to and including the 2028-29 tax year, and the trajectory is clear.

Revenues across the board are expected to continue rising, with the ratio to GDP following suit. And the forecast for self-assessment income tax is particularly striking, as the chart below shows.

This chart compares the future percentage increases of the three ways that income is taxed: pay as you earn (PAYE), national insurance contributions (NICs), and self-assessment. Rather than analysing the total annual receipts for each tax, I’ve rebased all three at zero, and shown their previous and expected future increases from 2022-23 to 2028-29.

During this period, annual revenues for income tax self-assessment are expected to soar from £42 billion to £73 billion – a mammoth 70% rise. In comparison, pay as you earn (PAYE) and national insurance contributions (NICs) - are forecast to rise 41% and 8%, respectively, over the same period.

Let’s delve into why this is happening, but first cover who this will affect.

Who must file a self-assessment tax return?

Completing self-assessment isn’t reserved for self-employed workers. High-earners, savers, investors, and landlords often must complete them, too. According to HMRC, more than 12.1 million people file a tax return every year.

These include:

- sole traders who earn more than £1,000 (before deducting anything you can claim tax relief on)

- business partners

- anyone with a total taxable income of more than £150,000

- those who have to pay capital gains tax (CGT)

- anyone who pays the High-Income Child Benefit Charge

- those with untaxed income, such as property rents, and income from savings, investments and dividends.

Why are self-assessment receipts expected to rise so sharply?

Well, there are a few factors at play.

According to the OBR, last year’s fall followed by the large jump for 2024-25 is due to a quirk. It says: “Receipts received so far this year are below the November forecast. However, we expect much of the shortfall relating to payments on 2023-24 liabilities to be offset next year when taxpayers make their final payment in January 2025.”

There are, however, other drivers, as even if we omit the above anomaly, percentage increases in self-assessment revenues are predicted to far outstrip those of PAYE and NICs every tax year between now and 2028-29. We should note that the shallow expected trajectory for NICs revenues is due to the government’s decision to cut rates for employees and self-employed workers at the past two fiscal events - November’s Autumn Statement and the Spring Budget in March.

One piece of the jigsaw behind the forecast rise in self-assessment receipts relates to interest rates.

Between 2009 and 2021, the Bank of England kept interest rates at record lows in a bid to protect the UK economy from the aftershocks of the 2008 global financial crisis. Throughout this period, the amount you could earn on your savings was paltry. And the less interest you earn, the less tax you pay.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- Will your family gain from the child benefit reforms?

In the 2016, the government introduced the personal savings allowance. Set at a level of £1,000 for basic-rate taxpayers and £500 for those in the 40% bracket, the aim was to reduce the amount of tax you had to pay.

These amounts seemed reasonably generous at first, but only because interest rates hovered between 0.25% and 0.75% from 2016 to 2021. This meant you could have north of £100,000 in savings and not pay tax on any interest.

But since December 2021, the Bank Rate has leapt to 5.25% to curb 40-year high inflation. Savings rates have followed suit, meaning roughly only the first £20,000 in savings escapes tax assuming 5% interest, which the top accounts pay right now.

While interest rates will inevitably come down at some point, they will likely still be higher than they were in the previous decade, and there are no plans to raise the savings allowance.

The government’s decision to reduce the level where you start paying 45% tax from £150,000 to £125,140 is also having an impact, as well as the move to cut the dividend allowance.

This allowance was halved from £2,000 to £1,000 in 2023-24 and halved again to £500 from April. The result is that investors will pay more tax on dividends held outside tax wrappers such as pensions and individual savings accounts (ISA).

We couldn’t possibly talk about rising tax revenues without mentioning fiscal drag, although admittedly this isn’t solely affecting self-assessment.

In a blow to taxpayers, the Conservatives and Labour have pledged to keep tax thresholds frozen until 2028. Fiscal drag is a stealthy way for governments to raise taxes without raising the headline rates. Over time as earnings rise, more and more people will either start paying tax or trip into higher brackets; the self-employed are no exception here.

- ISA insights: guides, investment ideas and tax tips

- Lump sum vs regular investing: which is best for my ISA?

According to the OBR, “By 2028-29, there are expected to be around 3.7 million more taxpayers overall, 2.7 million more higher-rate taxpayers, and 600,000 more additional-rate taxpayers than if all allowances and thresholds had been indexed to inflation, and the additional rate kept at £150,000.”

Fiscal drag impacts several elements of our personal taxes – including self-assessment.

For example, it has resulted in more parents being hit with a charge on child benefit payments (although these should reduce in the future after the government made the rules more favourable) and more people will lose their personal income tax allowance which reduces by £1 for every £2 you earn above £100,000.

A further factor is higher tax bills for landlords. The average monthly rent in the UK ticked up 9% last year, and the tax breaks for property owners have thinned dramatically in recent years. For instance, they can no longer deduct mortgage costs from rental income, and instead receive a flat 20% tax relief.

So, what can you do to keep your self-assessment income tax bills low?

To be clear, healthy interest rates and generous dividends are a good thing. Even after paying tax, you still end up with more in your pocket.

But there might be ways to keep the lot. The key is to use your tax-free allowances and tax wrappers effectively.

As a reader noted on a recent episode of Kyle Caldwell’s On the Money podcast, a married couple who are both basic-rate taxpayers can shelter up to £9,000 this year from HMRC. The capital gains tax (CGT) allowance is £3,000, the dividend allowance is £500, while the savings allowance is £1,000 (this, however, drops to £500 if you pay 40% tax, and 45% taxpayers don’t get a savings allowance).

Some forward planning and canny manoeuvring may be required to use these allowances effectively.

If you’re married and have savings that aren’t held in tax wrappers, and the interest you receive uses up your personal savings allowance, it can be savvy to hold the money in the name of the lowest taxpayer. For instance, if one spouse pays 40% tax and the other is a non-taxpayer, switching savings into the latter’s name could enable you to keep all the interest without tax being deducted.

It's also worth mentioning premium bonds as the monthly prizes, which range from £25 to £1 million, are tax free. The drawback here is there's no guarantee you will win, so your annual return could be less than the current prize rate of 4.40%.

When it comes to tax wrappers, you can save and invest £20,000 this year into ISAs, which are exempt from income tax, CGT, and dividend tax. This means as a couple you can save and invest a total of £40,000 tax free. If you have children under age 18 and want to give them a head start in life, you can stick up to £9,000 into a Junior ISA (JISA).

For even greater tax advantages, consider pensions - though you must be prepared to tie the money up until age 55 (rising to 57 in 2028). Not only does the money grow tax free, but you also get upfront tax relief on any contributions at your marginal rate – which could be as much as 45%.

For higher or additional rate taxpayers who make pension contributions where the tax relief isn’t deducted through PAYE, you must make sure you claim the extra 20% or 25% back via your tax return. Hundreds of thousands of people fail to do this every year, and essentially forgo free money.

The maximum amount you can pay into pensions every year and get tax relief on is the lower of £60,000 or 100% of what you earn, although you must be under age 75. You can also carry forward unused allowances from the previous three tax years as long as you stay within the 100% earnings limit.

If you’re fortunate enough to earn more than £100,000 a year, pension contributions can help you to keep your personal income tax allowance and can also swerve the child benefit charge if your salary or self-employed profits top £60,000 a year.

That’s because pension contributions reduce your net adjusted pay. As an example, if you earn £65,000 a year and pay £5,000 into a pension, your earnings drop to £60,000.

For those who are self-employed, keeping on top of your business costs’ records is really important. Make sure you claim everything you can to set against your profits and push down your tax bill.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.