BP triggers earnings downgrade and share slump

It’s been a difficult few months for the oil major and this latest slip-up has caused further disappointment for shareholders. City writer Graeme Evans explains the problem.

9th July 2024 16:19

by Graeme Evans from interactive investor

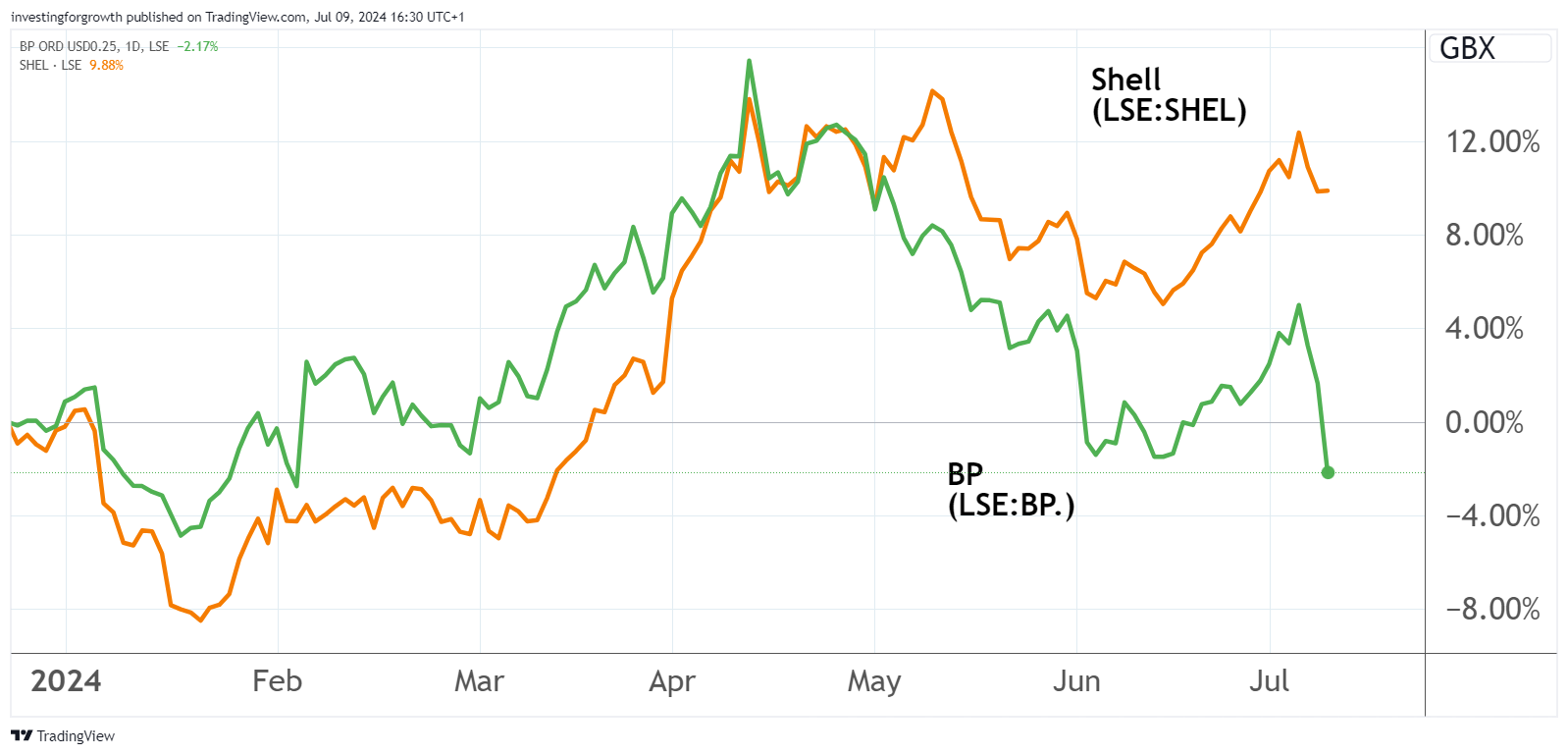

BP (LSE:BP.) shares are back near where they started the year after the oil giant today delivered a big downgrade to City expectations ahead of second-quarter results on 30 July.

The setback left BP at 455p by mid-afternoon, a fall of almost 16% on 2024’s mid-April peak of 541p and similar to the valuation before February’s forecast-beating annual results.

- Invest with ii: What is a Managed ISA? | Open a Managed ISA | Transfer an ISA

Since then, BP has issued a below-par set of first-quarter results and today’s guidance has led US bank Jefferies to estimate a 20% earnings downgrade for the second quarter.

The miss is mainly driven by significantly lower realised refining margins in BP’s products unit, with an adverse impact in the range of $500 million and $700 million.

Second-quarter production is expected to be broadly flat in oil production and operations and slightly lower in gas and low carbon energy.

In addition, BP flagged that second-quarter results will include one-off asset impairments and onerous contract provisions in the range of $1 billion-$2 billion.

This includes charges relating to its Gelsenkirchen refinery in Germany, having recently announced plans to improve the site’s competitiveness.

- Sign up to our free newsletter for share, fund and trust ideas, and the latest news and analysis

- What Labour’s landslide means for investors

Prior to today’s update, Jefferies held a price target of 590p while counterparts at Morgan Stanley had an “Overweight” stance and 650p recommendation. The latter’s calculations assume a total dividend of 35 US cents in 2025, growing at about 10% a year until 2030.

Since the end of 2022 the dividend has grown by 10% to April’s first-quarter payment of 7.270 US cents. That’s been accompanied by $3.5 billion of share buybacks in the first half of 2024, part of BP’s commitment to return at least 80% of surplus cash flow through buybacks.

Given this backdrop of improving shareholder returns, retail investors have taken advantage of the recent share price weakness to make BP the most traded on our platform this morning.

Rival Shell (LSE:SHEL) shares were broadly flat in today’s session and have risen 10% so far this year as the cost-focused strategy of boss Wael Sawan continues to gain traction in the City.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.