Bond Watch: is this a sign the US has finally seen peak inflation?

12th August 2022 08:48

by Sam Benstead from interactive investor

Sam Benstead runs through the most important news stories of the week for bond investors.

Welcome to interactive investor’s new weekly 'Bond Watch’ series, covering the latest market and economic news – as well as analysis – that is relevant to bond investors.

Our goal is to make the notoriously complicated world of bond investing simpler, by analysing the week’s most important news and distilling it into a short, useful and accessible article for DIY investors.

Here’s what you need to know this week.

- Learn about: How Bonds & Gilts work | Free regular investing | Buy Bonds

Inflation may finally have peaked – at least in the US

The big news this week was the July consumer price index in the US rose 8.5% year-over-year, and prices were flat compared with June. Economists expected an 8.7% annual price increase and a 0.2% change month over month.

The significance of this is that it could signal that inflation has peaked in the US, having hit 9.1% in June. This indicates less aggressive interest rate policy, and therefore high prices for bonds (and stocks).

The yield on the 10-year US Treasury bond, a benchmark for bond investors, fell slightly to around 2.75%, while US shares (S&P 500) rose around 2% in response to the news.

But inflation is not beat just yet. Seema Shah, chief global strategist at Principal Global Investors, says: “Within a month or two, there will be clearer evidence that inflation has peaked, but also evidence that the decline is painfully slow.

“Households will unfortunately continue to feel the severe strain of elevated price pressures on their budgets, while wage growth persistence will take its toll on corporate profit margins.”

- Vanguard says ‘bonds are back’ following worst spell for 150 years

- Economic woes mean bonds are finally worth investing in

Energy bills set to soar in Britain

The inflation picture in Britain is not as rosy. Energy prices, which form part of the price basket used in inflation calculations, are set to rise to £5,000 a year for the typical household by January, according to figures from consultancy Auxilione. Toda,y the cap is set at £1,971 for the typical household.

The Bank of England expects inflation to peak at 13% this winter, driven by higher energy costs, before finally settling back to its 2% target in 2024.

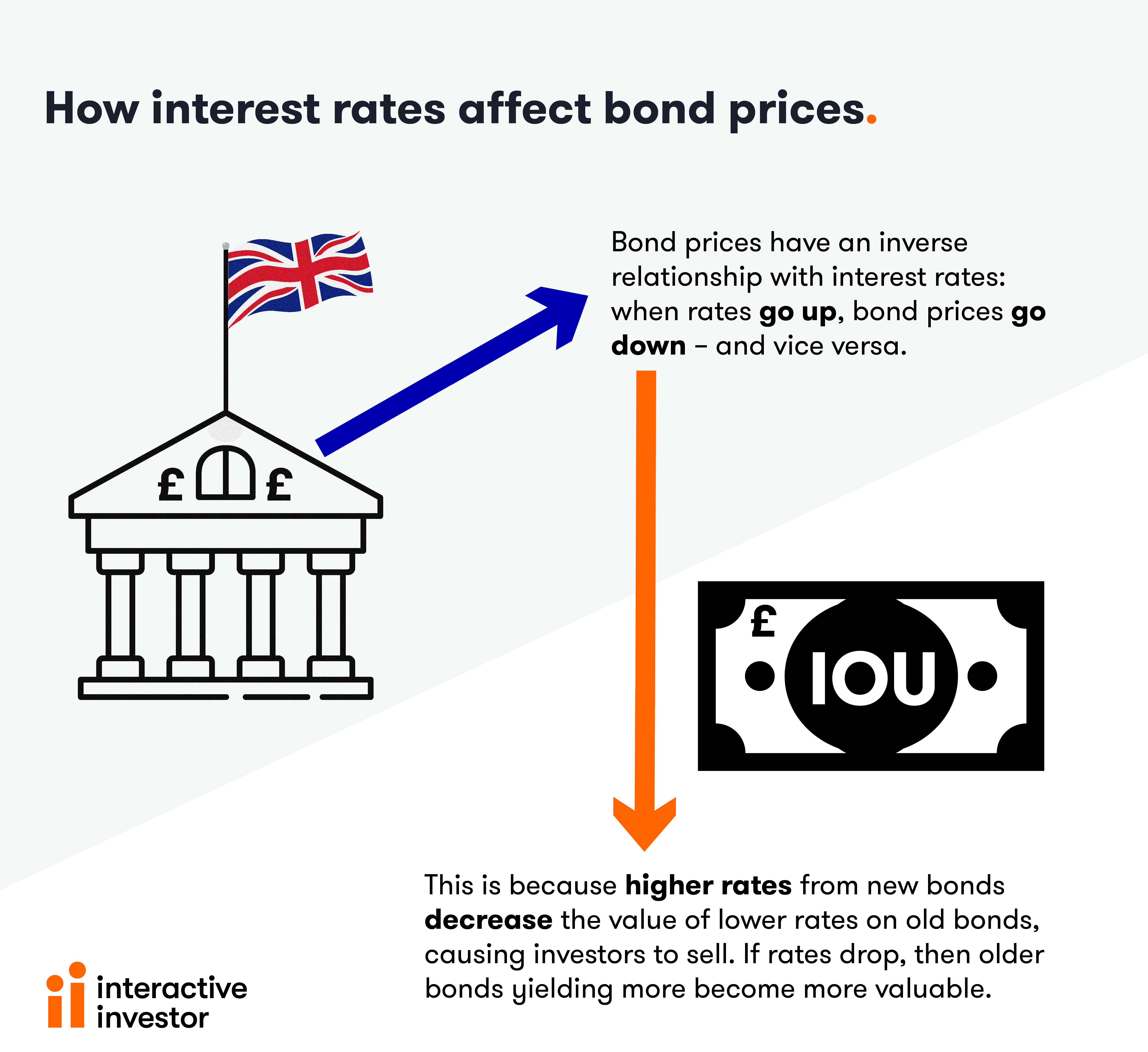

This suggests more rate rises (the Bank Rate is currently at 1.75% versus 2.25% to 2.5% in the US). This means more pain for bonds, as well as the real yield on bonds falling due to the impact of inflation on spending power. Real yield is the yield of a bond minus inflation.

Yields aren’t bad in fixed income

A chart that caught my attention, from BlackRock, showed that the share of bonds globally now yielding more than 4% crossed 50% for the first time since 2009. Just 25% of bonds yielded more than 4% last year, and that all came from emerging market and global high yield, considered risky parts of the market.

Now, global investment grade bonds and US municipal bonds (debt issued by US states to fund spending), also feature in that higher-yielding part of the market.

- Watch our video with Ariel Bezalel: an 8% bond yield and the 'biggest opportunity' for some time

- Watch our video with Ariel Bezalel: why interest rates will fall in 2023 and how we are profiting

This is a result of prices falling this year in response to higher interest rates. When rates go up, investors sell bonds, which in turn send yields higher.

A 4% annual return is nothing to be sniffed at – it is what some financial advisers say is the safe withdrawal rate from a portfolio in order to keep the capital sum consistent over time.

We would love to hear your feedback about our bond coverage. Get in touch with me at sam.benstead@ii.co.uk if you have any comments, suggestions or article ideas.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.