BoE base rate moves to 2.25%: what now for pensions, savings and mortgages?

22nd September 2022 13:01

by Jemma Jackson from interactive investor

interactive investor comments on the impact of the interest rate rise on home owners, pensioners and savers.

- Cost of mortgages mounts, while reprieve in savings decimated by rampant inflation

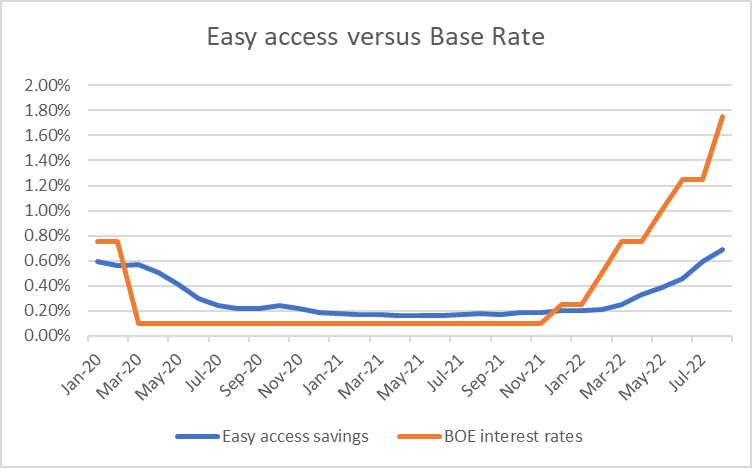

- Inflation hit 9.9% last month, over 14 times more than the average savings rate on an easy access account over the same period, ii’s Myron Jobson says

- Before the latest increase, the base rate was more than 2.5x more than the average savings rate on an easy access account in August (1.75% versus 0.69%), according to calculations by interactive investor.

Pensions and savings

Becky O’Connor, Head of Pensions and Savings, interactive investor, says: “If the rise in the base rate is passed on to savers and has the effect of bringing down inflation, cash savings could start to look genuinely attractive again.

“This could be especially welcomed by older people, who often have more built up in savings and also often prefer the lower risk of cash compared to the stock market for their life savings.

“People with savings have had years of low returns and this latest rate rise, which is significant, could really turn the tables back in their favour.

“Although for as long as inflation remains higher, it’s important to remember that a real return is still likely to be negative and investing still offers the chance for inflation-beating returns over the long term.

“People taking out annuities have already begun to benefit from higher rates on these retirement income products and the rising interest rate environment is only going to improve the outlook.

“Cash might be starting to look interesting, but history shows the importance of equities for boosting long-term investment growth and can make the difference between a modest and comfortable retirement.”

Myron Jobson, Senior Personal Finance Analyst, says: “The likely reprieve in savings rates following a rise in the base rate is good news for savers, but rampant inflation will still be obliterating the purchasing power of cash savings. Inflation hit 9.9% last month, over 14 times more than the average savings rate on an easy access account over the same period. The typical delay between the rise in the base rate and the increase in savings rate means that inflation-savings rate gap is likely to widened in the short term.

“It could take months for the increase in interest rates to trickle through to savers – although there are no guarantees. The acceleration in the frequency of rate rises has meant that some savings providers may still be catching up to past base rate rises. Our research shows that the gap between the base rate and the savings rate of the average easy access account on market has widened during the latest cycle of rate rises. Before the latest increase, the base rate was more than 2.5x more than the average savings rate on an easy access account in August (1.75% versus 0.69%).

“The pummelling of cash savings in real terms provides impetus to invest, which could offer inflation beating return over the long term, for patient investors willing to take the rough with the smooth. The current level of stock market volatility might appear daunting. Investing comes with inevitable risk, but taking a long-term view means you can smooth out some of those highs and lows while benefiting from the long-term potential that comes with this approach.

“No one can save what they don’t have. But if you can afford it, investing can help grow your wealth and hit major financial milestones over the long term. Even modest contributions can make all the difference in the long run.”

Source: Moneyfacts, Bank of England. Calculations by interactive investor to end August 2022

Mortgages

Alice Guy, Personal Finance Editor, interactive investor, says: “The interest rate rise will cause a huge amount of pain for mortgage holders. Someone coming to the end of a fixed-rate deal with a £200,000 mortgage could be paying £4,300 more each year for their mortgage and an extra £358 per month.

“And it’s still a bleak picture for savers as they see their savings eroded by inflation. Banks are extremely slow to pass on interest rate rises to customers. The average easy access account has an interest rate of 0.85%, which is miles below the Bank of England base rate.”

Myron Jobson says: “The estimated 1.1 million borrowers on variable rate mortgages can expect any base rate rises to be passed on swiftly – adding further pressure on the cost-of-living squeeze on household budgets. Borrowers coming off fixed-rate mortgage deals are in for a serious shock when they seek to refinance.

“The window for low mortgage rates is rapidly closing. Anyone looking to buy or remortgage in the near future should consider securing a deal now. Mortgage deals are often valid for a number of months, and it is not too early to start looking for the best deals now.

“Having enough cash for a home deposit amid stubbornly high house price growth is one hurdle, being able to afford mortgage repayments is another. With the Bank of Mum and Dad also counting its pennies amid rising prices, many first-time buyers won’t be able to make their homeownership dream a reality for the time being.

“The much-mooted cut in stamp duty could create more problems than they solve. The real issue is the supply of housings – there is not enough to meet demand. Last year’s stamp duty holiday has shown us how effective the measure is in stimulating demand. Doing so without address one of the key reasons for the red-hot housing market would serve to add coals to the flame.”

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.