Boardroom differences: how trust overseers are stepping up

28th July 2023 14:05

As discounts remain stubbornly wide, boards are doing all they can to help generate returns for shareholders, argues Kepler Trust Intelligence.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

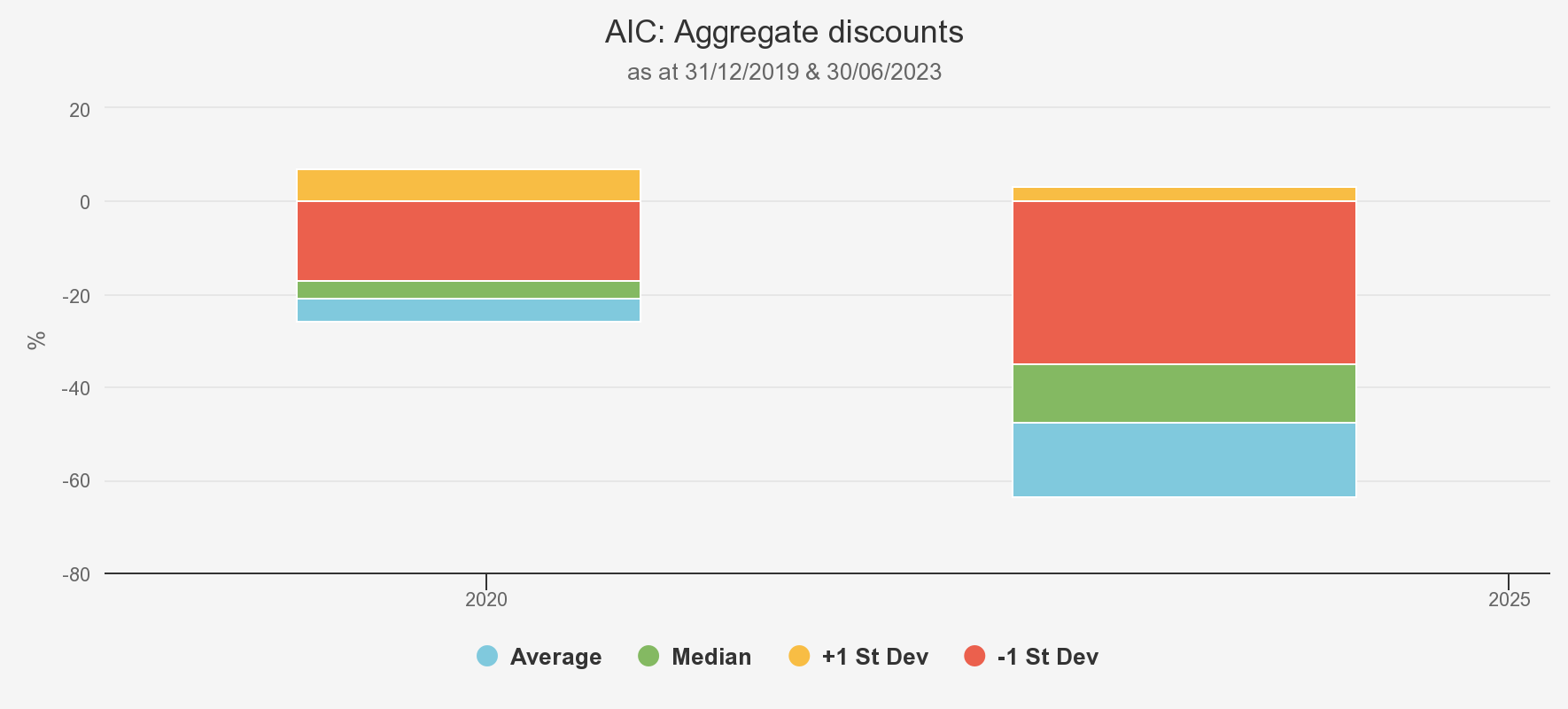

Investors in the trust space must be feeling a case of ‘déjà vu all over again’ after the first half of 2023. Returns in major equity markets haven’t been too bad, but discounts have remained stubbornly wide. The mean average discount in the investment trust universe stood at 15.9% at the end of June 2023, compared to 13.6% at the start of the year — and just 4.9% at the turn of 2020, before the pandemic.

- Invest with ii: Invest in Investment Trusts | Top UK Shares| Interactive investor Offers

While this has been a testing period for shareholders, we think boards have really stepped up and shown their ability to add value, using all the tools available to them to help generate returns for shareholders.

AGGREGATE DISCOUNTS

Source: Morningstar

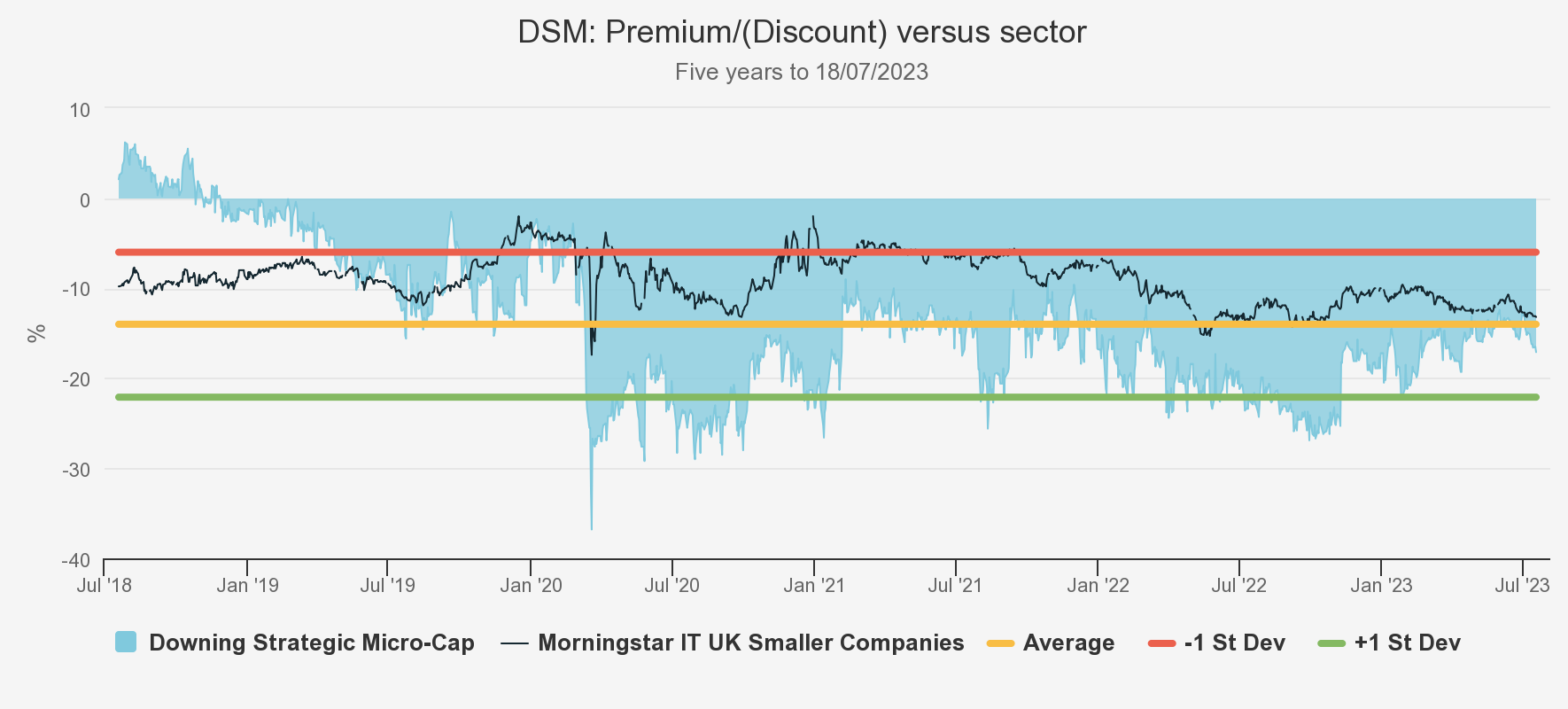

Boards have a lot of levers they can pull. A fairly well-worn strategy is to buy back shares, thereby creating a boost in NAV per share and ideally also narrowing the discount. According to figures from Numis, buybacks in the first half of 2023 totalled £1.7 billion, versus £2.7 billion for the whole of 2022. The board of Downing Strategic Micro-Cap (LSE:DSM), for example, have bought back an amount equivalent to circa 4% of the number of current shares in issue over the past 18 months and this has contributed to the discount narrowing from a nadir of circa 26% in October 2022 to circa 16% at the time of writing.

However, there are other more radical steps a board can take which have the potential to add significant amounts of value in the case of a stubborn discount. DSM’s board has gone one step further by reaffirming its commitment to a cash redemption point in May 2024 and promising a strategic review of the trust if this is fully subscribed. Next year’s cash exit facility will allow investors an opportunity to redeem half of their shares in cash at NAV in just 10 months. With the recent news that inflation in the UK seems to be cooling, and therefore potentially easing the headwinds on UK small caps, we think there is lots of value in the sector, both on a NAV basis and a discount basis. DSM’s board have ensured there is a path to good shareholder returns even if our optimism is misplaced.

DSM’S DISCOUNT HISTORY

Source: Morningstar

This kind of radical action is a way for boards to ensure that shareholders benefit from the real value in the NAV when discounts are stubborn, for whatever reason that is. The board of Ediston Property (LSE:EPIC) announced a strategic review earlier this year with the aim of merging with another REIT or taking other action. EPIC has a portfolio of high-quality assets in one of the more successful sectors of the commercial property market, but has struggled to get scale as investors have been wary of property and rate hikes have weighed on discounts.

The strategic review has helped pull in the discount, but the ultimate prize for shareholders could be a takeover at a narrower discount or a sale near to NAV. This was achieved by the board of Industrials REIT in June when Blackstone bought their whole portfolio at a 42% premium to the share price. In our view, this is only indicative of the sort of value that can be found in the trust sector by long-sighted or strategic buyers and speaks to the potential value of getting involved at deep discounts when others are fearful.

In May 2022, the merger of Secure Income and LXI REIT Ord (LSE:LXI) was agreed. This has resulted in a £2 billion trust in NAV terms, which offers investors the benefits of greater diversification of tenants, access to lower-cost capital, and lower management fees as economies of scale have improved. The acquisition of a whole portfolio meant that various costs associated with purchasing properties directly were saved. The chairman of LXI has argued the sector should look for further consolidation due to the level of discounts in the sector and the number of sub-scale vehicles. In our view, there are a number of obvious candidates for similar activities, where the wide discounts that good quality assets are trading on could tempt boards or other strategic investors to bid. One example is Tritax EuroBox Euro (LSE:BOXE). It is currently trading at a discount of circa 40% despite owning a suite of high-quality European logistics assets which should benefit from the structural growth of online shopping in Europe. However, the share price is depressed, perhaps due to concerns over asset valuations, narrow margins, and refinancing, and perhaps just due to technical reasons as investors have fled yielding assets for cash. We believe a solution could be a merger. Tritax itself is 60% owned by abrdn who also manages a similar trust, abrdn European Logistics Income PLC (LSE:ASLI). The merger of the two might offer synergies similar to that of Secure Income and LXI. The boards would create a much larger trust with complementary assets which could then help EBOX reduce its high charges and help it negotiate better terms for its expiring debt. Alternatively, we would not be surprised to see a large investor like Blackstone look to benefit from the wide discount these logistics assets trade on.

Similarly, there are two trusts in the digital infrastructure sub-sector which could arguably benefit from a combination. Despite both being launched in 2021, Cordiant Digital Infrastructure (LSE:CORD) and Digital 9 Infrastructure (LSE:DGI9) hold different and complementary assets. CORD is focused on legacy assets such as TV and radio broadcast infrastructure, whereas DGI9 holds assets such as subsea cables and data storage facilities.

DGI9 has collapsed in price and sits on a wide discount of over 40%. The management team recently quit, and there are questions about how it will fund its next project. CORD has performed better, though remains at a discount in part to market perceptions of its NAV. Both are arguably subscale and could benefit from combining their assets to create a large, diversified portfolio of complementary assets. We believe this would help lower charges, increase the ability to borrow at lower cost, and financially support the future of both trusts, which would, in turn, narrow the discounts over time. Whether the boards wish to take such drastic action is up to them.

Conclusion

Despite the malaise in the sector, boards have shown they can add value to investment trusts by creating catalysts for discounts to narrow and value to be realised. Other examples of corporate activity this year include strategic reviews by abrdn Diversified Income & Growth (LSE:ADIG), RM Infrastructure Income (LSE:RMII), US Solar Fund (LSE:USF), and abrdn Smaller Companies Inc (LSE:ASCI).

Last week, the boards of abrdn New Dawn andAsia Dragon (LSE:DGN)announced their intention to merge. This should cut costs and increase liquidity, while the proposals also offer the option for investors to exit a portion of their investment close to NAV. We believe that there remain a lot of undervalued assets out there as a result of negative sentiment and technical reasons and there is plenty of scope for further activity. These are not easy decisions for boards to take, but we salute their valuable role in providing multiple routes for shareholders to make good returns from buying assets at wide discounts.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.