Bitcoin and the 65,000% profit

9th November 2017 13:39

by Emil Ahmad from interactive investor

At 8½ years, this stockmarket bull run is second in length only to the era prior to the dot-com boom of 1990-2000. The meteoric rise of bitcoin, however, is another matter: a bull run on steroids and then some. Even this description does the cryptocurrency a disservice as it broke through the $7,400 barrier last week, a gain of almost 700% in 2017 alone.

Over the last year and the course of its history, there have been some spectacular crashes too. For a currency which is as unpredictable as it is controversial, bears forecast a crash to rival any of the past. The question for them is how deep the rabbit hole could be.

If there is one thing the digital currency has in common with the 17th century tulip craze, it is the way it seems to feed speculative investor hysteria and artificial demand. If one believes the bulls, the future path is one of Everest-esque proportions and beyond.

Ronnie Moas, analyst and founder of Standpoint Research, predicted in July that the currency would hit $5,000 in months. At the time it was valued around the $3,000 mark. A subsequent prediction of a rise to $7,500 in 2018 has been revised to $11,000 per coin!

And Moas has made an even bolder forecast, claiming that rapid adoption over the next five years will see bitcoin catch Apple in market capitalisation. For those who would dismiss overtaking a $900 billion tech giant as a flight of fancy, consider this; last week, bitcoin's $122 billion market cap saw it catch banking behemoth Goldman Sachs. While we all take a collective pause for breath, it is worth examining how the cryptocurrency got here.

The birth of a new monetary dawn

It seems appropriate that there is only a pseudonym for the creator of bitcoin, as it appears that 'Satoshi Nakamoto' does not want to be found. Actually, Satoshi Nakamoto could be an individual or a group of people, but let's assume he is the former. Yet he has been immortalised in monetary terms, with the smallest denomination officially recognised as the 'Satoshi' (1 bitcoin contains 100 million Satoshis).

Quite possibly the most reclusive billionaire since Howard Hawks, Satoshi disappeared from the internet community in 2011 and has maintained his vow of silence since. Sergio Lerner, head of cryptocurrency firm RSK, traced the first coins ever mined in 2013 and correlated the source with an additional 19,600 'blocks'. This account of 980,000 bitcoins has remained untouched since its inception.

Lerner was convinced that this acts as evidence that the miner has "shown complete trust in bitcoin" and is in all probability Satoshi. No-one has disproved this theory in subsequent years which has seen the account's value rocket to over $7 billion.

While bitcoin's creator may be shrouded in mystery, there is more clarity surrounding the first transaction in the digital currency. The 7th anniversary of that precedent was celebrated in May this year, a period of time over which bitcoin's value had been subject to a multiplier of 880,000.

"Pizzas for two" was the pressing matter of the day in 2010, with software programmer Lazlo Hanyecz offering 10,000 bitcoins for the Italian specialty. It took several days for someone to bite, with Hanyecz commenting on the Bitcointalk chat form, "So nobody wants to buy me pizza? Is the bitcoin amount I'm offering too low?"

With the cryptocurrency having a value of $0.25 a coin back then, those two pizzas cost Hanyecz about $25. In today's bitcoin terms, the value of that transaction is slightly more mouthwatering than the pizza on offer; $70 million and 'change'.

A brief yet tumultuous history

The rise of bitcoin has been a turbulent affair, with the peaks and troughs characteristic of a currency viewed as a game-changer and pyramid scheme in equal measure. As this financial soap opera endures more twists and turns than most of its TV counterparts, it is perhaps prudent to focus on key events in its nine-year history.

In 2010, the launch of the Mt. Gox exchange in Japan provided a degree of liquidity for bitcoin, ultimately handling 70% of all global transactions by 2014. Vulnerabilities in the currency code caused a crash in value despite being patched quickly. 2010 was also notable for emergence of pooled mining, enabling the use of combined computing power to generate blocks. The year ended with the fledgling currency reaching and surpassing the landmark $1 million market cap.

As a decentralised currency with associated benefits of anonymity, criminals were quick to catch on. The Silk Road opened on the 'dark web' in 2011, an online market in illicit goods endorsing bitcoin as its currency of choice. As trading in drugs and other illegal goods grew, bitcoin rallied and achieved parity with the US dollar in February.

A year later, Coinbase, an exchange which also offered a storage facility, was introduced. Coinbase has now expanded to support 32 countries and has facilitated $40 billion in total cryptocurrency transactions since inception.

Despite the closure of The Silk Road by the FBI in late 2013, bitcoin continued to gain traction and broke through $1,000 resistance levels shortly thereafter. A two-year bear market was triggered after Mt Gox was hacked in early 2014, resulting in 850,000 bitcoins being stolen. The under-fire exchange subsequently closed, acting as a harsh reminder about the importance of secure storage.

Microsoft approval in December 2014 was a heavyweight endorsement of 'The Future of Money' as a legitimate payment method.

When the new bull market emerged in 2016, the world of digital currency had significantly evolved. Hundreds of altcoins (bitcoin 'successors') are now listed on innumerable exchanges. Although the longevity and security of many platforms remained a concern, bitcoin was now more resilient to shocks.

The road to acceptance?

This year has been an unprecedented year. Perhaps the biggest factor behind the recent spike above $7,000 has been the Chicago Mercantile Exchange's announcement that it will start offering bitcoin futures contracts.

This has really captured Wall Street's imagination, as futures are an essential component of mainstream trading and could offer the digital currency genuine legitimacy. The real breakthrough for the investment world as a whole would be the introduction of a bitcoin ETF. However, the SEC is currently unconvinced about this possibility, recently noting that bitcoin's "fundamental flaws" make it a "dangerous asset class to force into an exchange traded structure".

As the SEC plays a stalling game, bitcoin continues to move forward this year despite headwinds.

China banned ICOs (Initial Coin Offerings) and bitcoin exchanges in September, while JP Morgan CEO Jamie Dimon continues his verbal attack on the currency. Nevertheless, demand for bitcoin is soaring in Asia, as Japan formally recognised the currency as legal tender in April via legislative changes. Money-transfer services are also giving bitcoin added momentum in Asia, with Chris Burniske, formerly at ARK Invest but now partner at Placeholder Venture Capital, pointing to month-on-month growth of 10-20% in Q2 2017.

Putting bitcoin into perspective

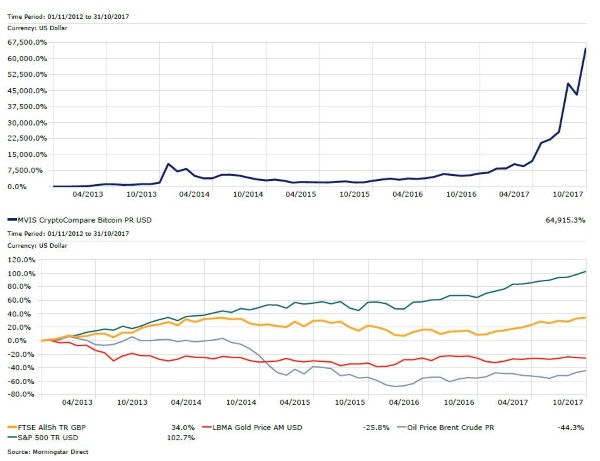

The five-year picture is no less extraordinary than considering 2017 in isolation. For purposes of comparison, let's take a look at some more traditional investments. The current S&P 500 bull run is the second-longest in history, yet has 'only' delivered a five-year return of 102%.

Gold, the traditional safe haven asset, has struggled over the period. A weaker commodity market backdrop, surging equity markets, dollar strength and a tightening Fed have all contributed to the precious metal's losses of over 25%.

While the FTSE 100 has soared since Brexit, with a weaker pound inflating overseas earnings, the All-Share index has maintained its steady climb. It has delivered 34% over five years. Oil is in gradual recovery mode in a tightening market, as OPEC's efforts to reduce production and inventory levels start to pay off. However, despite recently hitting two-year highs of $63 a barrel, Brent crude is still down 44% over the period. The rise of bitcoin is so astronomical over this time frame, it earned the right to a chart of its own; a five-year return of approximately 65,000%.

For retail investors wishing to find a more traditional method of gaining exposure to bitcoin, the introduction of an ETF will provide that opportunity any may happen in 2018. There's already the XBT Provider Bitcoin Tracker exchange traded note (ETN) available on the Nasdaq Nordic exchange, and a similar product for ether, the digital currency that powers the Ethereum blockchain.

As the cryptocurrency makes huge strides towards becoming a legitimate investment vehicle in 2017 alone, it is surely a case of 'when' rather than 'if' an ETF is launched. Nevertheless, the future of bitcoin remains so unpredictable and is presently characterised by great excitement and huge risk. The next tulip craze or a true game-changer? Only history will be the judge.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.