Big upgrades for UK bank stocks

In the week before Chancellor Rachel Reeves announces her Budget, a City expert is even more optimistic about prospects for domestic lenders and their share prices.

24th October 2024 12:16

by Lee Wild from interactive investor

Results season is in full swing and domestic lenders have already posted strong results, reflected in a further boost to share prices. But one analyst didn’t even wait for the numbers, or next week’s Budget, before upgrading price targets on all the major UK banks.

“We remain positive on UK banks through the UK budget; through Q3 results; and in the medium term,” wrote Deutsche Bank research analyst Robert Noble earlier this week.

- Our Services: SIPP Account | Stocks & Shares ISA | What is a Managed ISA?

The broker believes that, overall, the UK Budget on 30 October should be a positive for bank share prices. “Fear of bank taxes is often worse than the actual impact and examples in other countries show share prices quickly move on after the event,” says Noble.

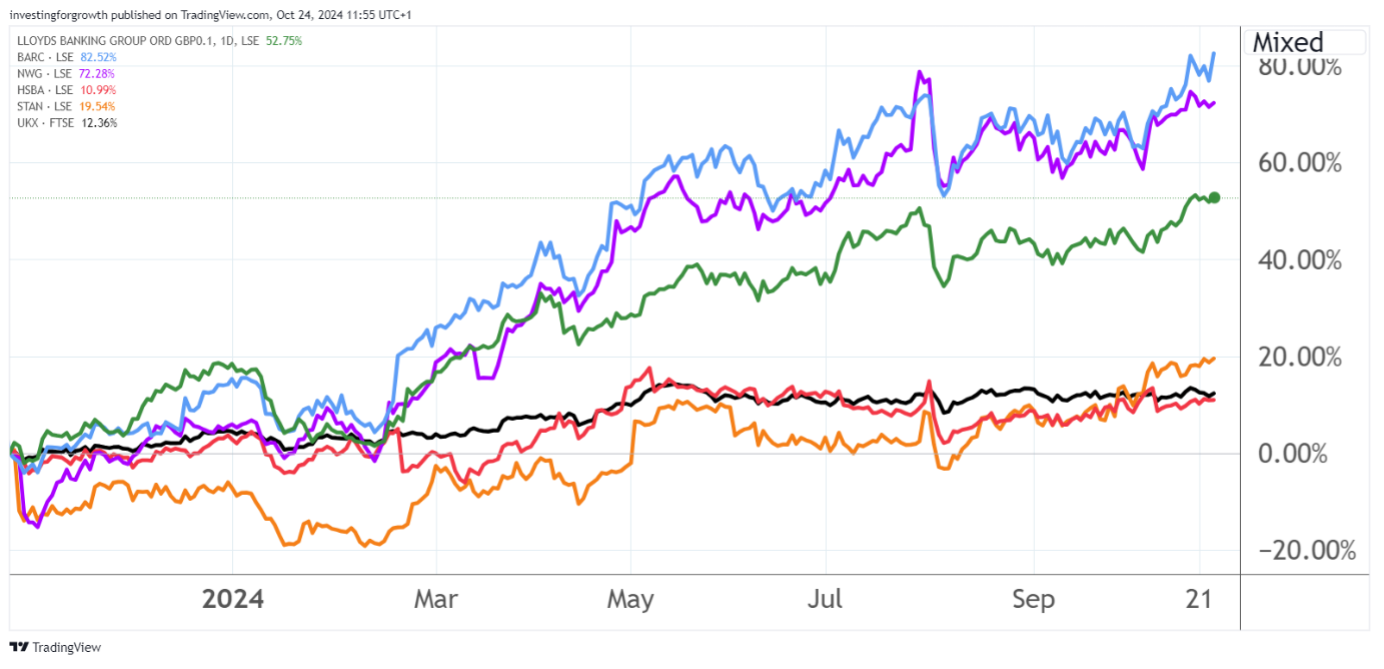

Source: TradingView. Past performance is not a guide to future performance.

There’s talk that Reeves is planning another windfall tax on the sector following record profits last year.

A bank tax could help fill the Treasury’s £22 billion black hole, and it would certainly be politically easy to deliver. But the analyst points out that UK banks are already heavily taxed - the total tax rate (including levies) for UK banks in 2023 was 46% versus New York at 28%.

Far better to focus on money growth supported by government borrowing and investing, argues Deutsche. It thinks this will lead to further improvement in deposit and loan growth in the UK closer to nominal GDP growth rates.

“We expect that clearing up tax uncertainty will end up positive for share prices and focus can turn to improving money growth trends supported by government debt,” says Noble.

- Wild’s Winter Portfolios 2024-25: another season of big profits?

- Bank stocks: one to buy, one to hold and one to sell

As growth picks up and interest rates normalise, a rebalancing of product spreads should support margins for mortgage business. It’s why Deutsche Bank prefers the more predictable revenue and tangible book value growth of the domestic UK banks over HSBC Holdings (LSE:HSBA) and Standard Chartered (LSE:STAN).

Lloyds Banking Group (LSE:LLOY) is Deutsche’s most preferred UK bank, but it sees 26% average upside for the sector.

The broker, which has ‘buy’ ratings on most of its bank coverage, upgrades its price target for Barclays (LSE:BARC) from 280p to 320p, Lloyds from 64p to 83p, NatWest Group (LSE:NWG) from 350p to 460p, and HSBC from 825p to 830p. Standard Chartered remains a ‘hold’, although the target ramps up from 825p to 970p.

Lloyds published third-quarter results yesterday which beat profit forecasts, driven by a boost to borrowing following recent interest rate cuts. Credit card use and unsecured loans both increased, and the mortgage book grew by £3.2 billion in a “slightly more robust mortgage market,” according to Lloyds’ finance director William Chalmers.

- Barclays shares hit 9-year high after bumper Q3

- Lloyds Bank Q3 results offer large element of comfort

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

He's also supportive of next week’s Budget if Labour stocks to its promises.

Chalmers said: “Whatever the tax changes might be, we believe that they will be pursued in the context of a constructive, pro-growth agenda. And it’s that overall balance that we’re really looking for, and indeed it’s that overall balance, that pro-growth agenda, that we would seek to be a part of going forward.”

And today’s results from Barclays have been well received, sending its share price to prices not seen since 2015.

Third-quarter earnings exceeded City estimates, due in part to the investment banking division where Barclays reported an improvement in deal making and fee income.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.