A big stock that will break the ceiling rather than the floor

It’s one of the 20 largest companies in America and overseas investing expert Rodney Hobson believes there’s great likelihood of further upside. He also updates his view on three previous share tips.

1st May 2024 09:02

by Rodney Hobson from interactive investor

Sales are flat but profits are up at consumer goods giant Procter & Gamble Co (NYSE:PG) in the latest quarter. At least that is the right way round, and a big improvement on the previous quarter.

Net income rose 10% to nearly $3.8 billion in the three months to 31 March, although sales edged up only 1% to $20.2 billion. Higher prices have been passed on to consumers in North America, Latin America and Europe, such is the strength of the P&G brands, so margins improved despite the difficult economic circumstances that prevailed in many markets. Slightly more favourable commodity prices helped, but the main improvement came from higher productivity.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Three months ago, P&G lowered its guidance for the year to the end of June, saying sales would be flat or even lower. This time it raised its forecast for earnings per share by two percentage points, while indicating that sales growth would be 2-4%, despite the strong US dollar taking a similar percentage off the conversion rate. In constant currencies, sales will be up 4-5%.

Sales volumes are in fact up 2-3% in most parts of the group, not great but a solid performance after a tough time last year. The future is looking much brighter as consumer spending patterns return to pre-pandemic levels and P&G continues to gain market share.

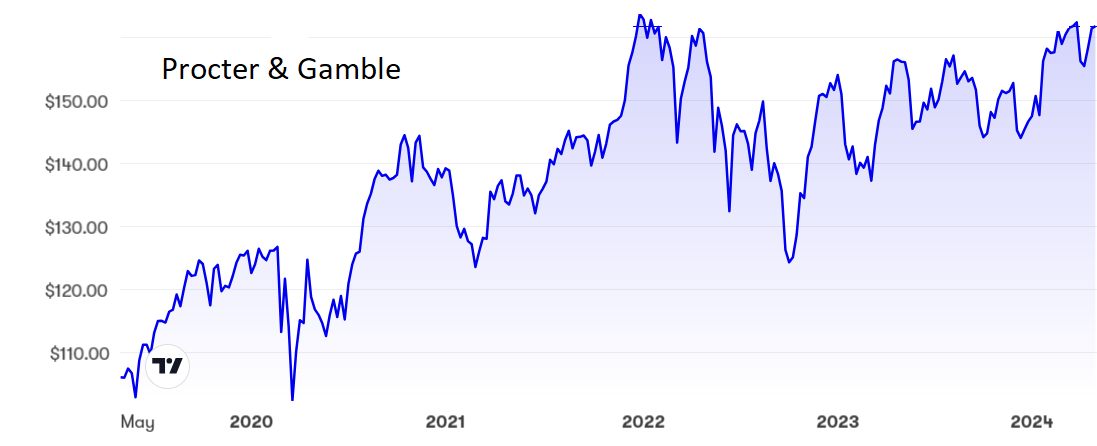

P&G shares have quite rightly held up well. They are bumping up against what has been a solid ceiling just over $160, where the price/earnings (PE) ratio is challenging at 26 and the yield is reasonable if unexciting at 2.4%. However, shareholders have been enjoying a dividend increase of 7% introduced in January – an upgrade for the 68th year in a row – and the prospect of continuing higher payouts year by year is very real.

The group has an excellent cash flow, prompting management to propose to return $15 billion to investors this year, including $6 billion worth of stock repurchases but most of the cash going into dividends.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: While the shares will have difficulty breaking higher, there is a potential floor at $156. In my view they will break the ceiling rather than the floor. Hold for the moment but be prepared to buy on any weakness.

Updates: Revenue was down and there was another massive, albeit reduced, loss at Boeing Co (NYSE:BA) in the latest quarter. The shares have fallen again, dropping below $170. I rated the shares a sell in February at $204 even though there seemed to be a floor at $200, and again in March at $190, warning that the floor at $180 might not be as solid as it looked then. There is simply no attraction here and the next floor looks to be as low as $120. Sell before it is too late.

Johnson & Johnson (NYSE:JNJ) disappointed markets when revenue from its blockbuster psoriasis drug Stelara was flat at $2.45 billion in the first quarter. Total revenue, however, was only just shy of analysts’ expectations at just under $21.4 billion. J&J raised its dividend and upgraded its full-year projections. The shares have slipped a little since I recommended them as a buy for ISA portfolios last month, making them even more of a buy now.

- US shares to put in your ISA in 2024

- The UK stocks just as good as America’s Magnificent Seven

- Stockwatch: a US tech share with 130% upside potential?

Better news from Heineken (EURONEXT:HEIA), where revenue rose 7.2% to €8.2 billion in the first quarter. Early worries that price rises were discouraging drinkers have been assuaged by news that it is the premium brands that are outperforming. Investors should bear in mind my earlier warning that Heineken has struggled to turn higher sales into higher profits, but at €91 the shares merit a hold, with the advice to buy below €90 still standing.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.