This is the big risk for AI investors

Industries are racing to add supply for this can't-get-enough-of-it tech wave. But some will inevitably add too much. Russell Burns breaks down where the risks are.

24th May 2024 09:13

by Russell Burns from Finimize

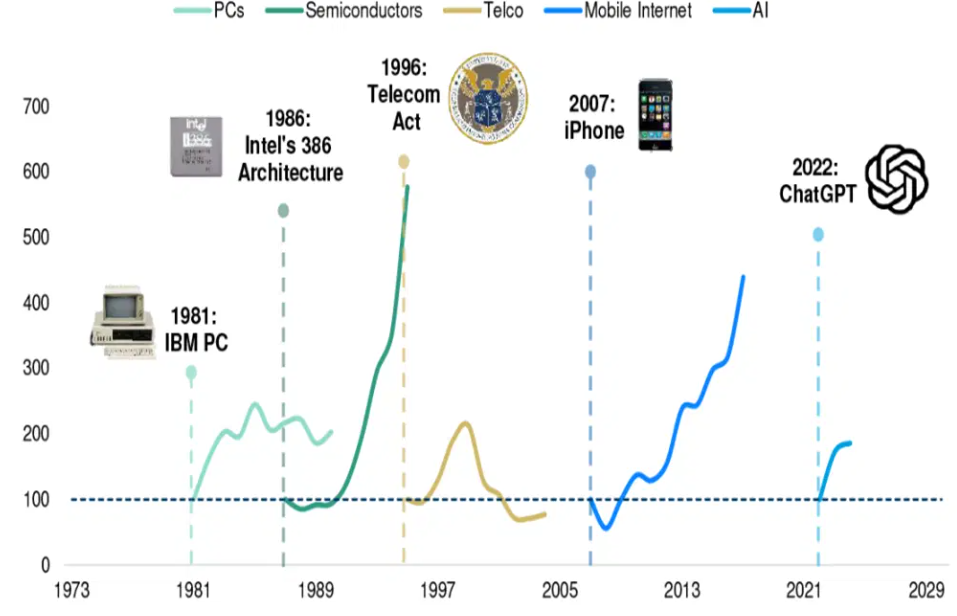

- The team at Morgan Stanley looked at earlier technology revolutions like the personal computer and semiconductors, the internet revolution, and mobile phone and compared them to the current AI revolution to see which of today’s winning industries might be at risk of oversupply.

- Oversupply leads to falling profits and share prices, so tracking the supply and demand matchup can help you understand which industries face the most risk. In turn, that can help you make better investment choices.

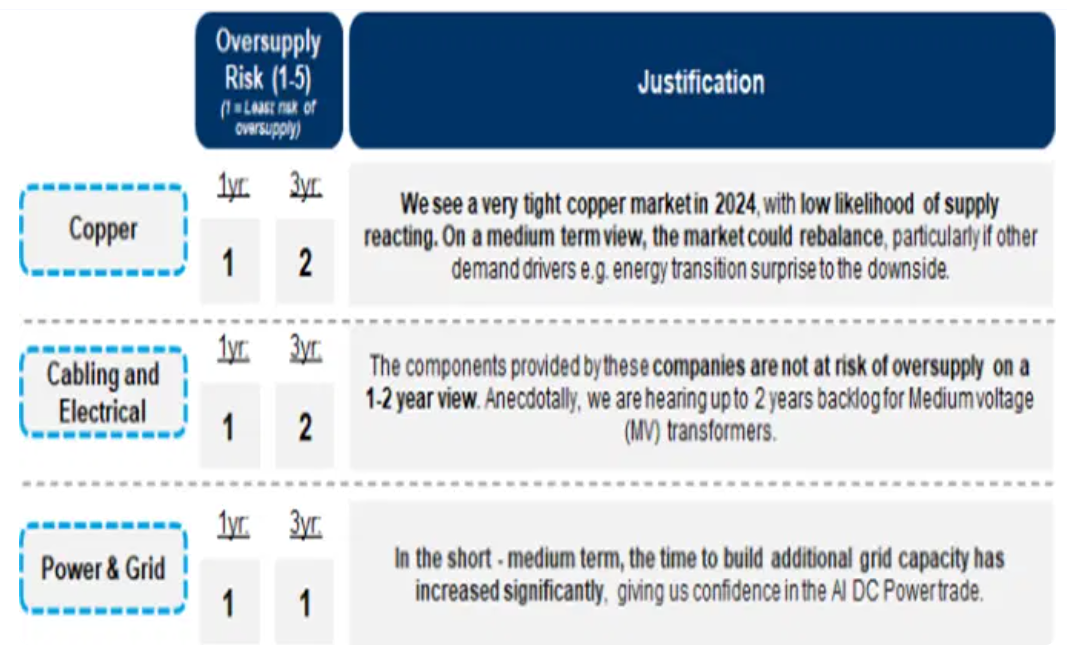

- A lot of AI winners look well positioned to continue rallying over the next year, but Morgan Stanley’s research finds that copper and power companies are in the strongest position – and least likely to risk seeing an oversupply in the next three years.

As investment themes go, nothing’s hotter than AI. Stocks and sectors related to the technology have been rallying heavily on their profit growth and their anticipated profit growth. And that can be a fun ride, of course, but the risk is that the market takes things too far, pushing some stocks higher than their outlook dictates and leading to a sharp move lower. That’s why the experts at Morgan Stanley recently put their thinking cap on – or maybe consulted AI – to figure out which assets could be at risk of a fall.

So, what did they find?

Well, there’s that old saying: history doesn’t repeat itself, but it often rhymes. So the folks at Morgan Stanley started by looking at the current AI frenzy and four other game-changing technologies that have popped up since 1980: the personal computer revolution in 1981, semiconductors in 1986, telecoms in 1996, and mobile phone software and services in 2007.

Four historical tech catalysts and their subsequent 10-year sector returns. Sources: Datastream, FactSet, Morgan Stanley. Past performance is not a guide to future performance.

They found that the AI rise has had the most striking similarity to the semiconductor wave, with increases in both profit growth and stock valuations (as measured by its price-to-earnings ratio). And in what they admit is a crude comparison – they stood the the mobile phone/internet revolution’s winners beside the AI revolution’s winners, and estimated that AI stocks have delivered only 17% of the potential decade-long upside so far. All sounds pretty encouraging: with so much upside believed to be left in the tank, it’s no wonder those stocks and sectors are all moving higher.

Still, all good things will come to an end – eventually – and so the team looked for the asset that are most at risk of oversupply – because that will undermine future profits and share prices. To be a successful investor, it helps to understand not just what’s happening now, but also what’s likely to happen next.

Which sectors are at the most and least risk?

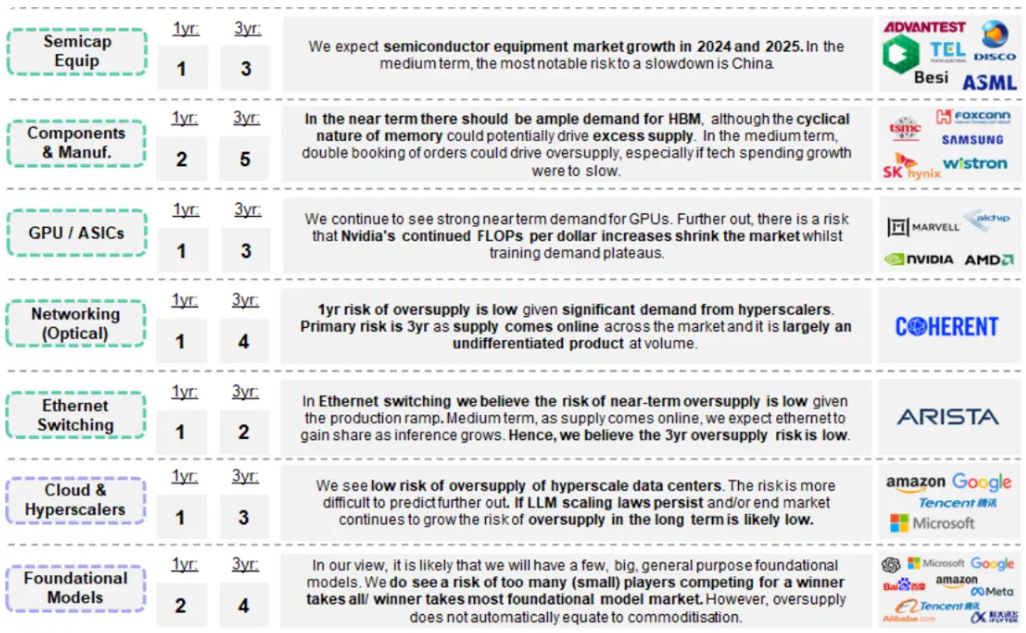

The Morgan Stanley pros ranked the oversupply risk from one to five – with one being the lowest risk and five the highest – across both a one-year and three-year view.

First, let’s look at the lowest risk of oversupply.

They determined that the corners of the market with the least risk of oversupply are copper, power and grid, and cabling and electrical.

Oversupply risk on a one-year and three-year basis for copper, cabling and electrical, and power and grid. Source: Morgan Stanley.

Power and the grid (risk rating 1). These areas have historically experienced fairly predictable changes in demand, but AI is changing that. And the time needed to build additional grid capacity has been getting longer,

The bank highlights a mix of companies that provide a range of power solutions – including power generator and distributor Vistra, clean energy supplier Constellation Energy, and fuel cell manufacturer Bloom Energy. If ETFs are more up your street, you could invest in the Utilities Select Sector SPDR Fund which would give you broad exposure to utilities that could benefit from increased demand.

Copper (risk level 2). This AI-essential metal is expected to remain in tight supply. By 2027, the data centers that AI depends on are likely to drive 3.3% of copper demand. And because it takes years for new copper mines to be developed, Morgan Stanley thinks the only way the market could rebalance is if there were a sharp drop in demand. That could come from a big slowdown in the energy transition or if China’s demand were to crumble, since the country accounts for about 55% of global demand. And with China expected to announce a string of new measures to boost the economy, that seems unlikely. The bank highlights Freeport, CMOC Group, and Lundin Mining as attractive copper opportunities.

For investors outside of the US, the Global X Copper Miners UCITS ETF (COPG) provides broad exposure to copper miners.

Cabling and equipment (risk level 2). This stuff ties it all together. Morgan Stanley’s experts concluded that over the next two years, oversupply risks appear minimal for medium voltage equipment and medium and high voltage cables. These products are key to keeping the energy balance across regions, and these pros see Prysmian and Legrand as two companies that are well-positioned to benefit.

Next, let’s look at the higher risk group.

These next industries might not face any big short-term risks. But, if you look a bit further out, the picture gets a bit murky, Morgan Stanley says.

Oversupply risk on a one-year and three-year basis for semiconductor equipment, electronic components, GPUs, networking equipment, and ethernet switching, and cloud and hyperscalers. Source: Morgan Stanley.

Semiconductor capital equipment (risk level 3). Growth looks like a sure thing for 2024 and 2025, but after that point, the bank says things could slow. The bank highlights China demand as it accounts for more than 40% of equipment shipments. Applied Materials, ASML, and Tokyo Electron are the leading companies in this highly specialised area.

Components and manufacturing (risk level 5). Sure, demand is robust now, but demand for memory is often choppy, and when it dips, investors get itchy to sell. Micron and SK Hynix are two companies that may struggle if this all goes down.

Graphics Processing Units (GPUs) and ASICS (risk level 3). Demand is strong right now and GPU capacity is in short supply. And the bank thinks that Nvidia’s strong market positioning and constant innovation will ensure demand remains strong, but notes the risk that the costs of AI will surge as models get more and more complex. Advanced Micro Devices, and Marvell are the companies Morgan Stanley will be keeping an eye on.

Most of those companies are included in the iShares Semiconductor ETF. And that’s because they have exposure to the semiconductor supply chain. While you can be sure that there will be winners and losers in these industries, their share prices often move in the same direction. So the ETF could be a sensible way to go if you’re not sure who’ll come out on top or if you just don’t want to keep constant tabs on how things are going. For non-US investors, there’s the iShares MSCI Global Semiconductors UCITS ETF (SEMI).

Networking (risk level 4). For the next year, networking firms are going to be hopping. But Morgan Stanley sees some turbulence in 2027 as additional supply comes online across the market. Morgan Stanley says you might want to keep an eye on the New York-listed Coherent in this industry.

Ethernet switching (risk level 2). Ethernet demand will be strong this year and next, Morgan Stanley predicts, and new supply won’t likely pop up until there’s demand for it. Arista is a standout in this crowd.

Cloud and hyperscalers (risk level 3). Hyperscaler data centres are huge cloud service providers and they drive a ton of demand for GPUs. That’s sure to continue for the next year, but the bank says the longer term is more difficult to forecast. If demand for AI applications continues to grow, this industry will continue to chug along. But if it doesn’t, well, there’s the risk. See, companies like Amazon, Google, and Microsoft are laying out tons of money to expand their cloud and data centre capabilities, but they need companies to pay for the service.

That’s what is so exciting about the potential for AI and its impact on the stock market. If companies start to adopt AI on a massive scale over the next few years, there is likely to be a sharp pick-up in productivity and profits across the wider economy, that makes for a positive outlook for the stock market.

Russell Burns is an analyst at finimize.

ii and finimize are both part of abrdn.

finimize is a newsletter, app and community providing investing insights for individual investors.

abrdn is a global investment company that helps customers plan, save and invest for their future.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.