Beyond Meat: catching a falling knife?

19th November 2021 08:00

by Rodney Hobson from interactive investor

It was the poster boy for ‘fake’ meat, and remains optimistic about 2022, but things haven’t gone to plan. Here’s what our overseas investing expert thinks about the shares.

Rodney Hobson is an experienced financial writer and commentator who has held senior editorial positions on publications and websites in the UK and Asia, including Business News Editor on The Times and Editor of Shares magazine. He speaks at investment shows, including the London Investor Show, and on cruise ships. His investment books include Shares Made Simple, the best-selling beginner's guide to the stock market. He is qualified as a representative under the Financial Services Act.

Providing vegetable-based alternatives to meat seemed a sure-fire winner as restaurants and food chains rolled out vegan dishes. Customers have returned to eating out as lockdowns have been lifted, yet somehow the benefits are not flowing through to Beyond Meat (NASDAQ:BYND). It is beyond belief why it cannot make profits in the current climate.

Beyond Meat sought to play down expectations a month ago, but revenue in the third quarter still came in below forecasts and, even more alarming, the loss widened. Guidance for the fourth quarter suggests sales will continue to be weak. That will mean a third consecutive quarter of disappointing figures.

The third-quarter loss of $54.8 million was nearly three times as large as in the same quarter of 2020, and it took the total loss so far this year to $101.7 million compared with only $27.6 million last year. Sales growth of 12.7% was way down on stellar growth last year and, alarmingly, the fourth quarter is likely to see a decline, which was unthinkable just a few months ago.

This raises worries that what looked to be a big growth market is in fact reaching saturation some five years after the alternative meat market took off in earnest. At the same time, the sector has become increasingly competitive, with a number of smaller but active competitors arriving on the scene alongside established food producers branching out into vegan lines.

Several factors are working against Beyond Meat, including severe weather in the United States, the spread of the delta variation of Covid-19 and the difficulty that restaurants face in recruiting staff. However, we still have to eat, and a fall in restaurant sales should have been compensated for in grocery sales.

- Why I’m buying ‘value’ stocks and other top tips

- Ian Heslop's outlook for the US stock market in 2022

- Bill Ackman: hot sectors and the economy in 2022

Yet demand for meat alternatives in grocery stores has slowed, statistics suggest. This is a particular blow to Beyond Meat, which has dominated the supermarket sector for plant-based protein food.

Beyond Meat is optimistic about prospects for 2022, but it could well be mistaken in suggesting that its problems will ameliorate when the short-term adverse factors are behind it. Much will depend on partnerships with restaurant chains, particularly regarding the McPlant burger that McDonald’s (NYSE:MCD) is testing in a few US restaurants and has begun to sell in other countries. Another version of the burger is being rolled out in Pizza Hut outlets in the US.

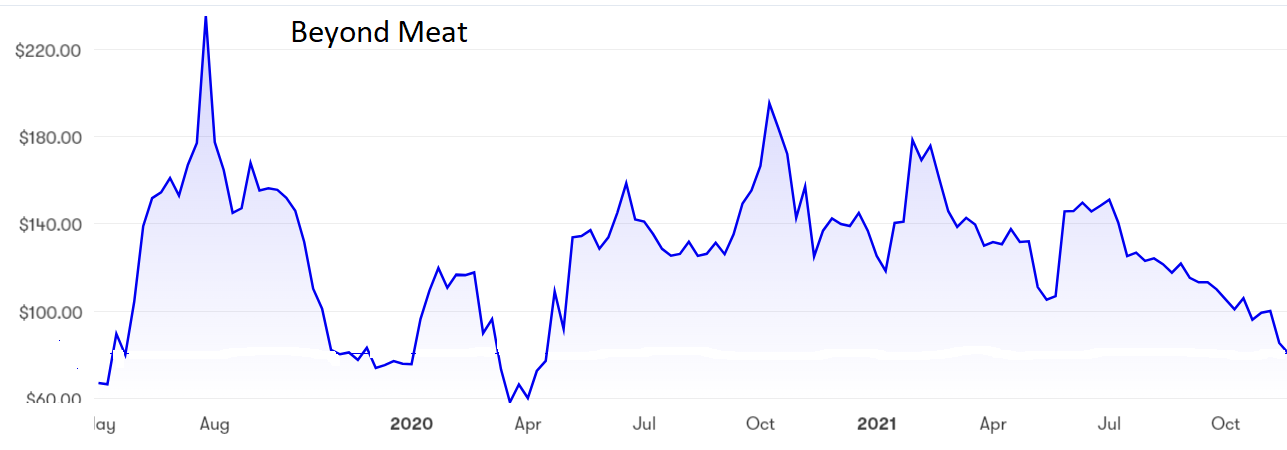

Source: interactive investor. Past performance is no guide to future performance

In the meantime, Beyond Meat has some catching up to do in terms of developing a plant-based chicken alternative that tastes and has the same consistency as the real thing, which is what consumers tend to want. Kellogg (NYSE:K), among other competitors, had already built up a lead before Beyond Meat started its much smaller than expected rollout in July.

Analysts are now wondering if the company has outgrown the abilities of founder and chief executive Ethan Brown, who led the company to a highly successful stock market launch in May 2019. He is considered to have vision but what is needed now is an administrator prepared to knuckle down with day-to-day operational details. This year has seen the departure of several second-tier executives, including those in charge of finance, operations and marketing.

- Bill Ackman: an industry as certain as food and oxygen

- Bill Ackman: why I've bet $100 billion on this event

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

After a remarkable rollercoaster ride the shares are now back to the $80 level. The downward trend looks entrenched.

Hobson’s choice: I warned in January and in November 2019 that the shares should be treated with caution but did not expect them to fall back so sharply. They are now below my original $89 tip price, but buying now would be trying to catch a falling knife. Sell if you didn’t take profits when you had the chance.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.