Best year ever for this shares portfolio

Our companies analyst explains exactly how he discovers shares to buy and hold for years, even decades.

20th December 2019 14:54

by Richard Beddard from interactive investor

Our companies analyst explains exactly how he discovers shares to buy and hold for years, even decades.

On Tuesday night I watched “It’s a Wonderful Life” at the cinema with my daughter, who is just back from University. This morning I opened the 18th door on my advent calendar and ate my 18th plain chocolate duck (I don’t know why they’re ducks either) and added the 103rd song to my Christmas playlist.

Although I’m writing this article six days in advance of Christmas Day, thoughts are turning to bonhomie (to be honest they have been for a while), and it’s already difficult to focus on companies.

It is a good time to take stock.

An alternative view of the stock market

The purpose of the Decision Engine is to give us an alternative view of the stock market. To focus our attention on a group of profitable businesses with superior strategies run in the interests of customers, employees and shareholders, and show us which are the best value at the moment.

I want to discover shares we can buy and hold for many years, perhaps decades, because they are resilient. Resilience strikes me as a most valuable quality in turbulent times, which is always, in my experience.

So how is the Decision Engine doing? Is it helping me identify good companies at reasonable prices and has it given me the fortitude to hold on to them through thick and thin?

I shall consider the second question next week. Many people would answer the first question by measuring the performance of the shares, but there are two problems with that. The first is that short-term movements in share prices do not tell us anything about the prospects of investments to be held indefinitely. The second is that the Decision Engine isn’t a portfolio, it is a tool to guide the creation of a portfolio, so I do not measure its performance.

To see whether the Decision Engine has helped me, we will have to examine a portfolio derived from it through an alternative lens to the share price. Fortunately, I have such a portfolio, the Share Sleuth portfolio, a model portfolio I write about monthly for interactive investor’s sister magazine Money Observer.

“Boris” bounce

Year to date, the portfolio has risen 46%, which may be the biggest annual increase in its 10-year history. It is remarkable because I cannot ever remember feeling less confident in the prospects of the economy and more circumspect on the occasions I have added shares to the portfolio. If I had followed my instincts, I would have taken money out of the market.

You may be thinking this gloom has been resolved by an election. As a reader commented in an email the Monday after the Conservatives won a clear majority, “somebody’s put a rocket under the market today”. But on the day of the election the Share Sleuth portfolio was already up 38% since the beginning of the year, so this extraordinary surge is not all about one day in December. Maybe people saw Boris’ election victory coming. All I can tell you is that I was not one of those people and had I been, it wouldn’t have affected my investment decisions.

Surges in my portfolios are as surprising as setbacks, which is why I pay them as little attention as possible and certainly do not try to explain them. However, they do have an impact.

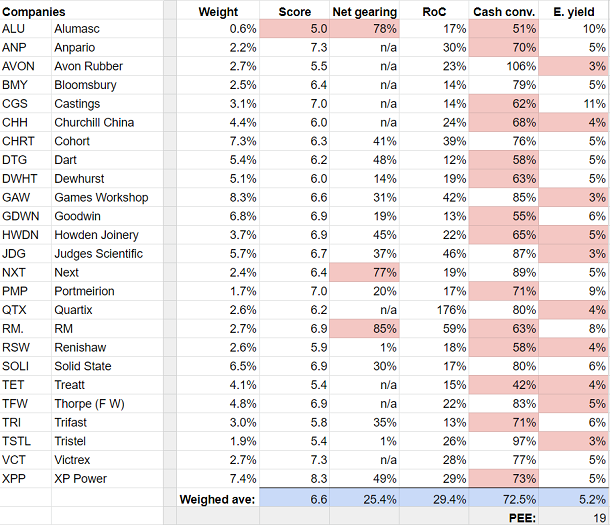

The table below shows the members of the Share Sleuth portfolio. They are all ranked by the Decision Engine except for Alumasc (LSE:ALU), which I removed recently. It’s the smallest holding in the portfolio anyway, with a weight of just 0.6%, and it is almost certainly heading out.

The “weight” column shows the value of each share as a proportion of the portfolio’s total value. I use the Decision Engine to determine ideal portfolio weights based on a company’s “score” in the second column (the higher the score, the more attractive the share for long-term investment) and in this way the Decision Engine guides me not only in selecting shares, but determining how much to invest in them. (For more on how the shares are scored see last week’s article)

The following three columns show the most important financial metrics that help me determine a company’s quality. “Net gearing” is a strict measure of indebtedness that compares the value of borrowings, operating lease obligations and pension deficits to the investment required to run the business. Companies that are reliant on external funding are highlighted in pink.

Next is average after-tax return on capital (“RoC”), profit as a proportion of the investment required to run the business averaged over a representative number of years. Any company earning less than 10% return on capital would be highlighted, but there aren’t any. The third column is cash conversion (“Cash conv.”), the amount of money earned in cash as a proportion of adjusted operating profit. Companies earning less than 75% of profit in cash terms on average are highlighted.

The final column is the earnings yield (“E. yield”), adjusted profit as a proportion of the value of the enterprise (its price, the value of the shares plus the firm’s financial obligations). At just over 5%, or 19 times adjusted after-tax profit, the ratio is just on the right side of 20 times profit, which is when I start to get really tetchy. Not much more than three months ago, when I reviewed the portfolio on its tenth anniversary, the portfolio was more modestly valued at 17 times adjusted profit.

The blue row at the bottom shows the weighted average of all these calculations. If the portfolio were one conglomerate, these would be its consolidated financial statistics.

Super-enterprise

If you could buy the Share Sleuth super-enterprise, it wouldn’t, I think, be a bad long-term investment. It’s only reliant on external sources for about a quarter of its funding. It earns a return on capital of nearly 30%. Cash conversion at 72.5% is a tad below my arbitrary level of 75%. Although I have some doubts, all of these businesses have credible strategies that should earn them more money in the future.

But my super-enterprise is on the pricey side of good value at 19 times adjusted profit. The Decision Engine has guided me to invest in good companies at cheap prices, but the market has inflated the prices, giving me something to mull over in the New Year.

That’s a slightly more chilly conclusion than I was reaching for, but I won’t dwell on it over Christmas! Have a good one.

Contact Richard Beddard by email: richard@beddard.net or on Twitter: @RichardBeddard.