Best trusts for pandemic immunity revealed

20th August 2021 15:42

Analysts at Kepler Trust Intelligence identify the trusts able to consistently outperform global equity markets during the pandemic.

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

Since the start of 2020 global equity markets have been on a pandemic-driven roller-coaster ride, with many phases of an economic cycle condensed into the last 19 months. Yet thanks to the effective roll-out of vaccines we are beginning to see the light at the end of the tunnel. As equity markets show signs of normalisation we take the opportunity to review the AIC’s Global sector, examining how its constituents performed over the four major periods of the pandemic and identifying which trusts, if any, were able to consistently outperform the MSCI All Cap World Index, our proxy for global equity markets.

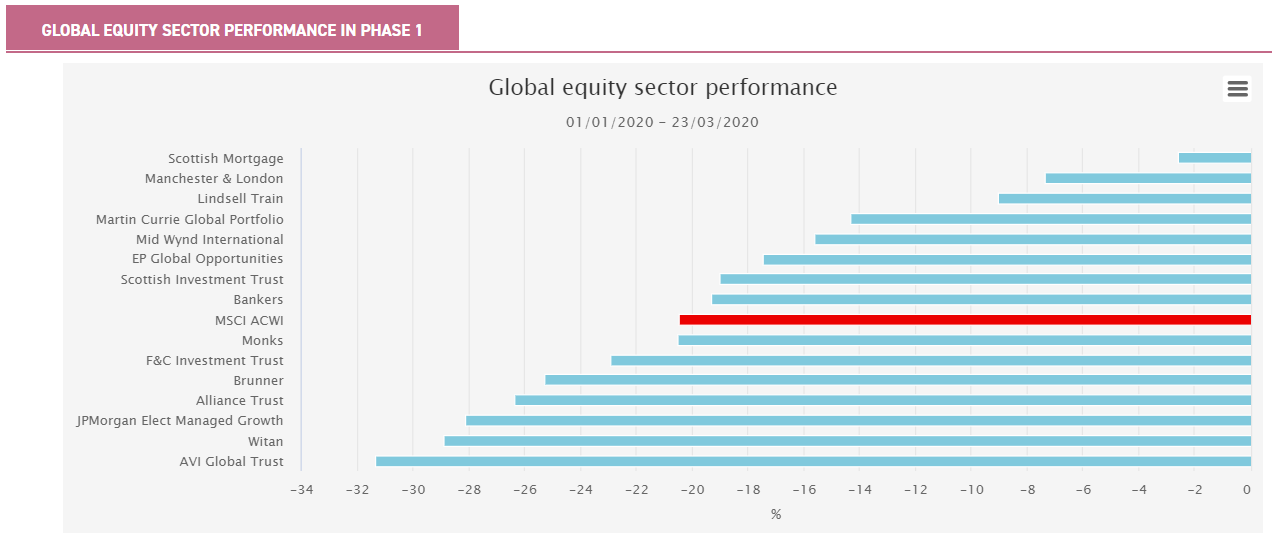

Phase 1 – The calm and the storm, 01/01/2020 - 23/03/2020

The first two months of 2020 saw the tail end of what would be the longest bull run in history, with markets pricing in increasingly strong economic outlooks, especially in the US. In fact, there was even talk of markets begging to overheat, as such a prolonged period of bullish sentiment was feared likely to give way to overconfidence. Yet such sentiment was swept aside at the end of February, as we witnessed one of the greatest black swan events in market history: the outbreak of COVID-19.

The subsequent market crash would be the most violent rout since the Great Depression (in both speed and size). During such an indiscriminate sell-off all correlations move to one, with virtually no assets spared. Even gold, often seen as one of the truest hedges against economic hardship, saw its price fall as investors scrambled to sell anything they could to cover their leveraged positions. This pain was also felt in the AIC Global sector, where the average trust lost 19.3% in NAV total return terms over the period, compared to the 20.5% fall in the MSCI ACWI.

GLOBAL EQUITY SECTOR PERFORMANCE IN PHASE 1

Source: Morningstar, as at 10/08/2021 Past performance is not a reliable indicator of future returns

While no trust was able to shield itself from the sell-off, there were those whose earlier rally helped their overall return to be superior to global equities, while some also fell less during the crash.

Scottish Mortgage (LSE:SMT) scored highly on both counts, and through the combination of a strong rally prior to the crash as well as suffering from less of a fall than its peers, it was the best-performing trust over this period, having lost its investors a mere 2.6%. Other top-quartile performers – such as Manchester & London (LSE:MNL), Martin Currie Global Portfolio (LSE:MNP) and Mid Wynd International (LSE:MWY) – had growth-oriented portfolios which were also able to utilise the pre-crash bull run to offset a subsequent fall.

During the actual market rout between 18th February and 23rd March, it would be the relatively value-oriented strategies such as AVI Global Trust (LSE:AGT) that fell the most as investors reflected on the impact a global pandemic would have on the economically sensitive areas of the market. Conversely, the more growth-focussed trusts fell the least, as investors perhaps began to prize any company that could offer earnings growth in the forthcoming recession. This either happened through companies own high-quality business models, or by their being able to capitalise on the boost to home working or home entertainment, which favoured growth sectors such as technology.

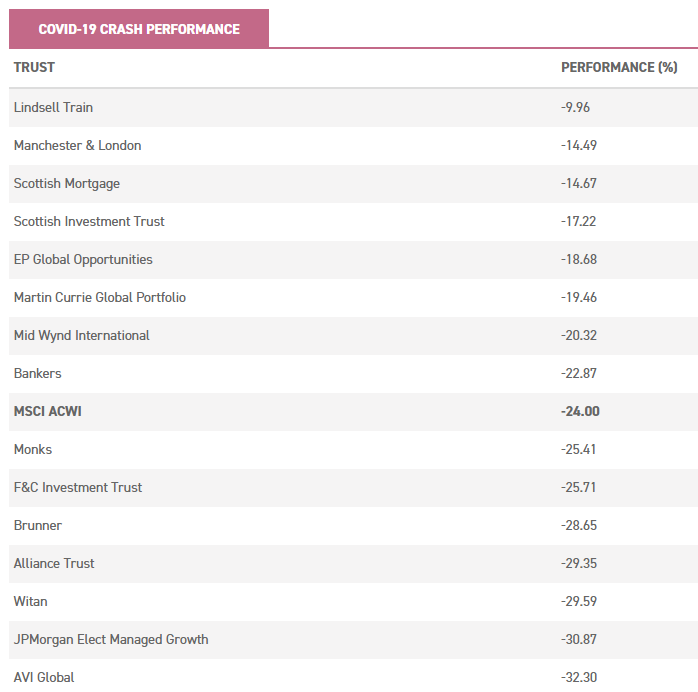

The strategy which shielded its investors best during the market crash was Lindsell Train (LSE:LTI), which fell a mere 10% between 18/02/2020 and 23/03/2020. This was partly due to its c. 48% unlisted holding in its own asset management company Lindsell Train, which was revalued down by 19%, but after our period under consideration. LTI’s listed equity holdings did provide a cushion during the downturn, given the managers’ allocation to consumer franchises, media and finance (the manager’s own definitions), with a particular focus being placed on companies which may become digital winners. These attributes became all the more valuable during the pandemic, given their ability to capitalise on the trend towards a digital economy.

SMT also benefitted from the effects of delayed valuation, as it contains a c. 20% allocation to unlisted equities, dampening the impact of the crash on its NAV. Excluding SMT and LTI, which were boosted by unlisted holdings, Scottish Investment Trust (LSE:SCIN) was the top performer during the crash, helped by its positions in healthcare and gold miners. MNP, MWY and MNL also outperformed as the market fell.

COVID-19 CRASH PERFORMANCE

Source: Morningstar, 18/02/2020-23/03/2020 Past performance is not a reliable indicator of future returns

Phase 2 – The recovery, 23/03/2020 - 31/10/2020

The reprieve from the crash came in late March, as markets rallied on the back of the first signs of stimulus in response to the impact of the pandemic. The Federal Reserve was the first to react, cutting rates to near zero and priming the release of further monetary stimulus. The recovery was not equal though, with the MSCI ACWI Growth Index returning 38.5% over this period, compared to the 15.9% of the value equivalent. This trend was echoed in the AIC Global sector, with the best-performing trusts being those with the strongest growth bias. The ‘pandemic winners’ were largely growth-focussed companies, specifically those within the communications, technology and consumer sectors. Such sectors benefit from changing consumer and business patterns, and offered the services necessary to adapt to the pandemic, such as e-commerce, remote-working software and digital entertainment. So great was the momentum behind these trends that Apple (NASDAQ:AAPL), Amazon (NASDAQ:AMZN) and Microsoft (NASDAQ:MSFT) alone accounted for 53% of the S&P 500’s total return over 2020.

GLOBAL EQUITY SECTOR PERFORMANCE IN PHASE 2

Source: Morningstar, as at 10/08/2021 Past performance is not a reliable indicator of future returns

SMT was the standout performer during this period, generating an NAV total return of 83.4%, making the period the best seven months in the trust’s history and placing it more than two standard deviations above the global sector average over this period (indicating how extreme an outlier SMT’s performance was relative to its peers). The only other trust which could compare to SMT over this period was Monks (LSE:MNKS), which is also managed by Baillie Gifford. Like SMT, MNKS also follows a growth-focussed approach to global equity investing and has been able to capitalise on changing trends resulting from the pandemic (albeit while not being as aggressive in its approach as SMT).

There was also a strong rebound effect, whereby the likes of Alliance Trust (LSE:ATST) and AVI Global would go from being two of the prior period’s worst performers to performing well during the lockdowns. Unlike the growth-focussed strategies, these trusts contained companies which were arguably unfairly sold off during the market rout, which was indiscriminate in the companies it affected.

ATST and AGT reflect two very different styles, with ATST having a more balanced portfolio whereas AGT offers a more valuation-sensitive approach to investing. Relative to many of their peers these two strategies also had greater exposure to higher-quality value stocks. Some of these companies operated in regions or industries which the market initially perceived as being pandemic ‘losers’, with AGT having a large allocation to Japanese value stocks.

However, as sentiment recovered, the companies’ strong balance sheets and resilient business models perhaps made it seem more likely that they would survive the pandemic and therefore that they need not have been priced for failure before. AGT also benefitted from tilting the portfolio towards digitally enabled stocks over this period, including adding to existing holdings and purchasing new ones.

These still fit the value mould the managers were looking for, but were benefitting from the lockdown trends. One example of this is Prosus, the holding company, with its c. 30% stake in Tencent. Such companies were coveted during 2020 and contributed strongly to AGT’s post-crash recovery.

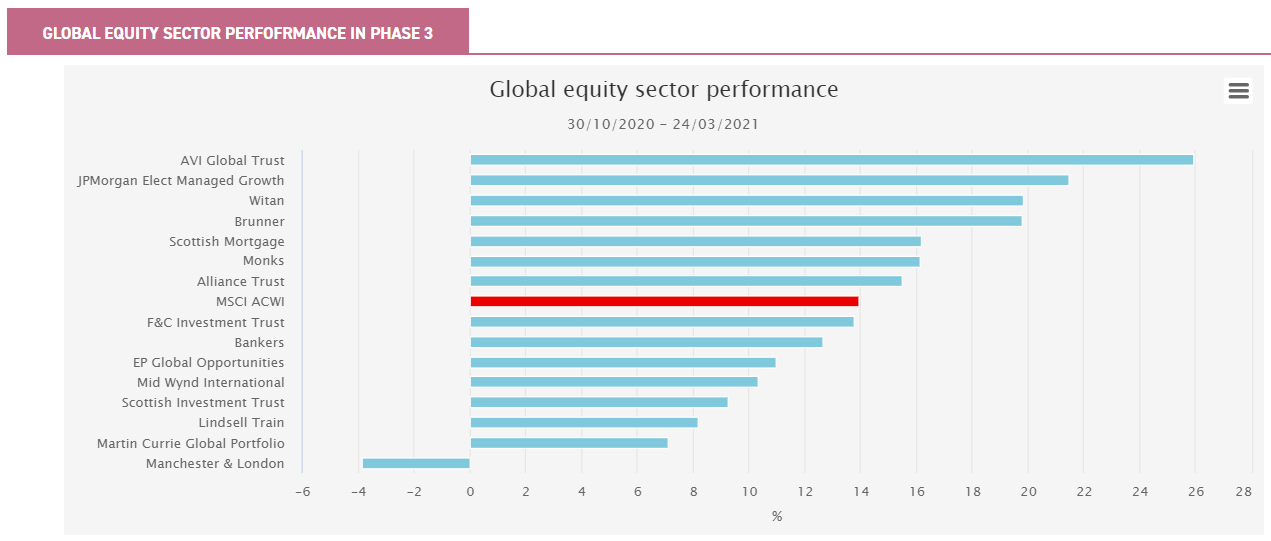

Phase 3 – Value in value, 31/10/2020 - 24/03/2021

November saw the completion of phase 3 trials of the COVID-19 vaccine, with the UK being the first country in the world to approve a vaccine for use, giving the Pfizer (NYSE:PFE) vaccine the okay on December 8. By November markets had already begun to price in the normalisation of economic activity which would result from this, something which disproportionately favoured value stocks, often at the cost of growth.

GLOBAL EQUITY SECTOR PERFOFRMANCE IN PHASE 3

Source: Morningstar, as at 10/08/2021 Past performance is not a reliable indicator of future returns

This change in momentum was also reflected in the global equity sector, with the growth-focussed trusts being knocked off their pedestal as market leaders. They were instead replaced by the ‘one-stop shop’ strategies, such as Witan (LSE:WTAN), JPMorgan Elect Managed Growth (LSE:JPE) and Brunner (LSE:BUT), which ranked in the top quartile. This does not imply that these are value-oriented strategies, but rather that their balanced approach to investing led them to having greater exposure to value stocks than their growth-focussed peers.

Yet the overall winner in this period was AGT, which continued its post-crash recovery. AGT’s market-leading performance during this period was not unexpected, as while it does aim to buy high-quality companies, it still retains a strong valuation sensitivity and a dedicated allocation to companies which trade at a deep discount to their intrinsic value. According to Morningstar, AGT ranks amongst the most value-oriented trusts in the AIC Global sector, with the roll-out of the COVID-19 vaccines having been the catalyst for the trust’s re-rating.

The losers during this period were not the out-and-out growth strategies, however, but instead the ‘quality growth’ styles like MNP and MWY, which moved from the top to the bottom quartile over the period. While the reliable earnings of quality growth companies were highly prized during the peak of the crisis, the signs of a potential recovery seem to have seen investors sell out of these positions in order to fund the reflation trade, recycling their capital into value stocks.

MNL, with its portfolio of predominantly mega-cap technology names, fared the worst, as its large holdings in known pandemic winners were amongst the most sold off in the rotation. Such a drastic shift does not reflect on the managers’ actions, however, because the management team behind MNL increased their allocation to value stocks to the maximum that their investment process allows, and rather this reflects the rapid change in market sentiment during this period.

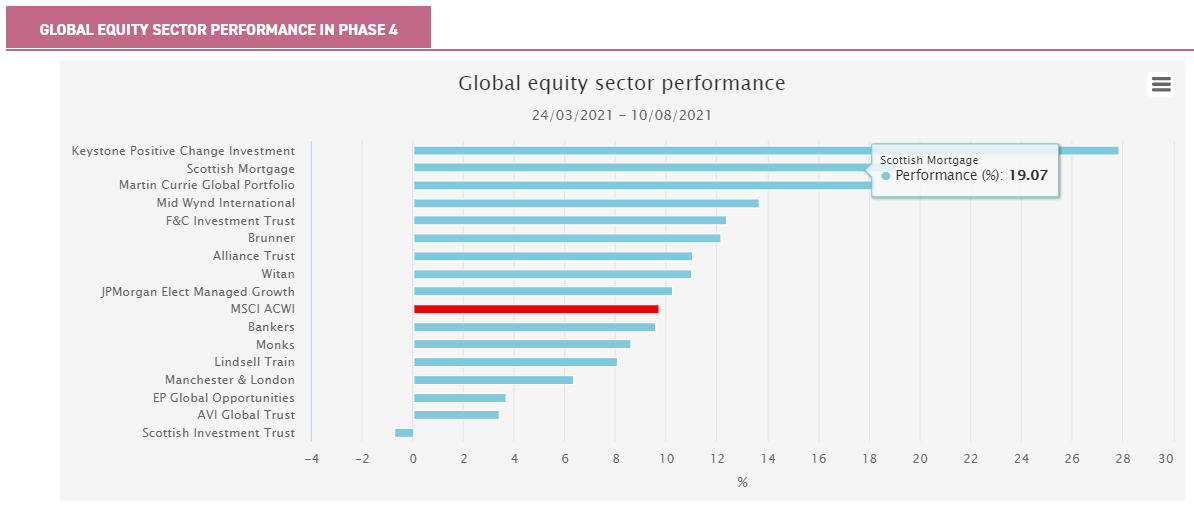

Phase 4 – Grinding higher, 24/03/2021 - today

By the second quarter of 2021 many investors had become wary of the expansion of global equity markets. Once the euphoria of the vaccine roll-out and stimulus began to wane, investor sentiment weighed on the stretched valuations in certain parts of the market, such as expensive renewable and technology stocks, as well as on the impact COVID-19 continues to have on the emerging world.

However, this period also marked the end of the COVID-19 recession, with March 24 marking the commencement of a period of slow recovery for equity markets, buoyed by the recovery of the global economy. We chose March 24 as this was the approximate end of the value rotation, and just after a COVID-19 scare saw markets sell off before they began to grind higher.

GLOBAL EQUITY SECTOR PERFORMANCE IN PHASE 4

Source: Morningstar, as at 10/08/2021 Past performance is not a reliable indicator of future returns

*Keystone Positive Change Investment Trust (LSE:KPC) changed managers in February 2021, with Baillie Gifford taking over from Invesco. This resulted in the strategy moving from the AIC UK All Companies to the AIC Global sector.

The current conditions are arguably becoming increasingly difficult for trend-following investors, as while the MSCI ACWI is up 9.7% over the period, there is no clear tailwind supporting any one style. This fact is being increasingly reiterated by the fund managers we speak to, who believe that stock-picking rather than trend-following will prove more conducive to returns in such an environment. They argue that global equity markets will be driven by the strength of individual companies, supported by upward-trending global growth, rather than by pandemic-induced tailwinds.

We have already begun to see this sentiment reflected in the performance rankings of the global equity sector as the top third of the rankings are predominantly composed of concentrated global stock-pickers, with the poster children of quality growth stock-picking, MNP and MWY, ranking amongst the top four. Even Brunner, whose structural overweight to the UK had hampered its relative performance in past periods, was able to demonstrate the benefits of stock-picking over stylistic bets.

Likewise, the less concentrated portfolios of ATST and F&C Investment Trust (LSE:FCIT) also showed relatively strong performance. These are strategies which offer investors a multi-manager approach, preserving the benefits of active management while offering more diversified portfolios.

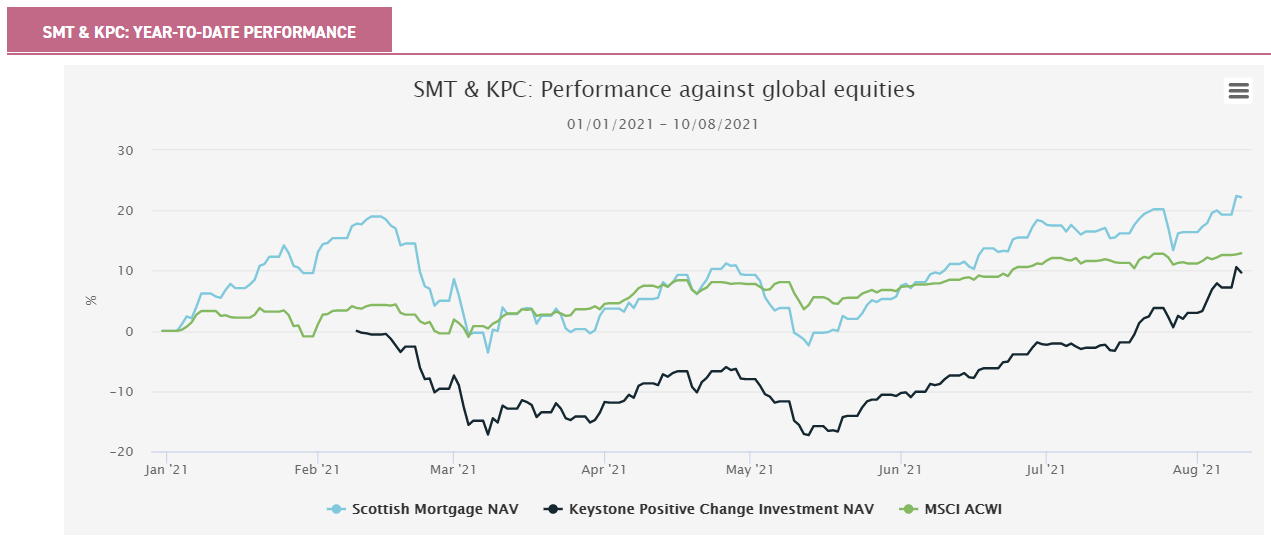

The number one and number two spots in this post-pandemic period belong to two Baillie Gifford strategies, SMT and Keystone Positive Change, with the latter entering the AIC Global sector in February 2021 after a change in mandate. Although SMT saw aggressive sell-offs during the first quarter of 2021, the bounce following this drawdown was enough to generate outperformance of the index.

Companies with strong environmental or sustainable themes came into 2021 with stretched valuations and sold off aggressively in late Q1 2021 due to fears of an overheating renewables market, impacting KPC’s NAV in the process. KPC would nevertheless go on to benefit as these rebounded, given the ongoing support for addressing climate change.

Both strategies would see investors return during this period as global growth began to show signs of normalisation. Perhaps this is because investors saw that they were able to buy into companies with long-term sectoral growth trends (such as those held by SMT and KPC) at relatively attractive valuations, thanks to the prior drawdown.

SMT & KPC: YEAR-TO-DATE PERFORMANCE

Source: Morningstar Past performance is not a reliable indicator of future returns

Who were the overall winners?

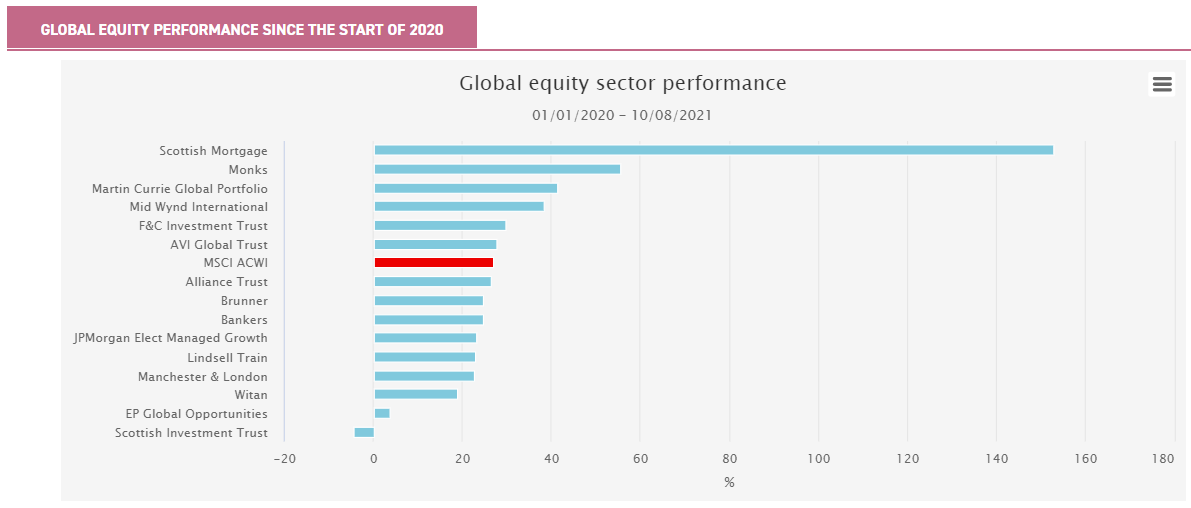

While each period saw various styles move in and out of favour, only one strategy was able to outperform the MSCI ACWI in every period: Scottish Mortgage. It should come as no surprise that SMT’s growth-focussed strategy was able to capitalise on the COVID-19 tailwinds, which often helped to advance the trends underpinning many of its companies, such as Deliveroo (LSE:ROO) and HelloFresh (XETRA:HFG).

SMT’s performance was so strong during 2020 that it was the second best-performing investment trust in any sector, beaten only by its sister trust Baillie Gifford US Growth (LSE:USA), which is managed by one of SMT’s co-managers. While SMT’s returns are impressive, it came at the cost of high volatility, with SMT being the second most volatile strategy over our sampled period.

Although SMT was able to outperform global equities during the reflation trade, it saw a vicious 18.7% drawdown over the period, the largest drawdown in the global equity sector outside of the March crash. It took the first two quarters of 2021 for SMT to return to its previous high, a period in which global equity markets would continue to touch new highs almost weekly.

Remarkably, SMT still outperformed during the reflationary rally despite this drawdown thanks to its strong rally during the first two months of 2021. It achieved this through capitalising on the last remnants of vaccine euphoria, as well as by being able to quickly recover from its reflation-rally drop.

GLOBAL EQUITY PERFORMANCE SINCE THE START OF 2020

Source: Morningstar, as at 10/08/2021 Past performance is not a reliable indicator of future returns

But which trusts are our runners-up? We have found four trusts, split across two clear styles, which have been able to beat the MSCI ACWI in three of the four periods. The first two are Martin Currie Global Portfolio (LSE:MNP) and Mid Wynd International, reflecting the quality growth style which performed so well over the pandemic, with MNP and MWY respectively the third and fourth best-performing trusts over the whole period.

Both of these trusts were able to outperform in all periods, with the exception of the reflationary rally. While their managers’ commitment to quality growth investing is a positive attribute, it meant they were ultimately unable to capitalise on the rotation into value stocks, lest they deviate from their fundamental approach to investing (style drift is rarely desired from professional managers). While on the surface the managers follow very similar philosophies, the pandemic has demonstrated the differences in their approaches to quality growth investing.

Over the last 19 months MNP has offered investors a greater exposure to the market than MWY, whereby it had a beta of 0.98 compared to MWY’s 0.88, leading it to having a greater upside and downside capture. This in essence leads both trusts to offer investors near-identical risk/return profiles over the period, with MNP having both a higher return and higher volatility than MWY, resulting in the trusts having an identical Sharpe ratio of 0.7 over the 19 months.

Thus, with the benefit of hindsight the choice between the two trusts is arguably more reliant on an individual investor’s risk appetite than the relative performance of the two quality growth trusts during the pandemic.

The other two noteworthy trusts are Alliance Trust and JPMorgan Elect Managed Growth, which have both outperformed the MSCI ACWI in all periods except for the initial crash. Though both follow balanced approaches to global equity investing, each offers investors a very different type of portfolio with equally varying return characteristics.

ATST follows a multi-manager approach to investing, with its delegated investment manager Willis Towers Watson selecting up to 20 managers to each run a 20-stock portfolio of their best ideas, and then weighting the allocation to each manager in a manner which diversifies away almost all sector and regional deviations from the MSCI ACWI.

JPE offers investors a more conventional fund-of-funds strategy utilising a portfolio of open- and closed-ended funds and making heavy use of strategies offered by JPMorgan. Unlike ATST, the managers of JPE have the ability to make active bets on sectors and regions which they believe will outperform, with JPE having a structural overweight to the UK compared to the MSCI ACWI (using a custom benchmark that is 50% UK equities and 50% global).

As a result, over the last 19 months JPE offered investors a global equity strategy with some of the lowest downside participation (70%), but also forgoing upside participation, having only 71%. This defensive characteristic served the trust well, dampening its exposure to many of the market routs during the period. On the other hand, ATST had an upside participation of 113% and downside participation of 115%, and thus a more volatile return profile than JPE, but one that was better able to capitalise on the recovery, which resulted in its higher overall return.

Regardless of their participation in the global equity market roller coaster, both demonstrated the benefits of a balanced approach to investing, as besides SMT they were the only two trusts to outperform global equities in both the growth- and value-driven markets. This was something that ATST achieved through effective stock-picking alone, while JPE was also able to capitalise on the benefits of tactical allocations during fast-moving markets. These qualities may also vindicate their ‘one-stop shop’ approach to global equity investing, as at least over the last 12 months their investors did not have to worry about running afoul of market trends.

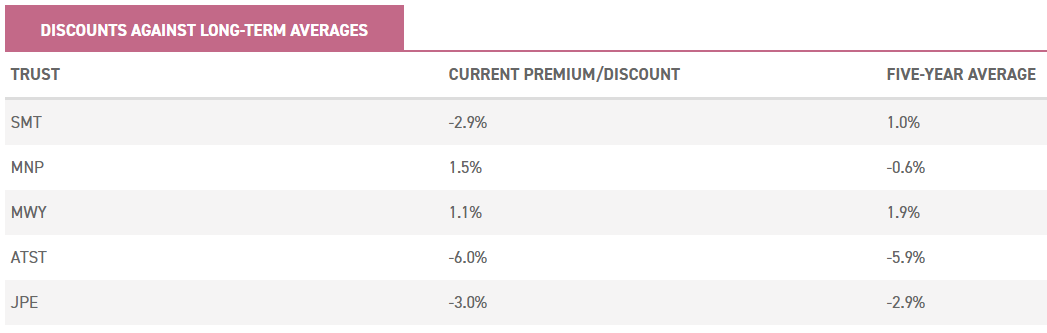

Given the track record of these trusts, one would be forgiven for expecting that their discounts would have narrowed post-pandemic, but as the below table shows, the premiums and discounts of many of these trusts are close to their five-year averages. This means that despite their impressive track records, they are not overly expensive. Yet there are also no clear discount opportunities here.

DISCOUNTS AGAINST LONG-TERM AVERAGES

Source: Morningstar, as at 10/08/2021 Past performance is not a reliable indicator of future returns

Conclusion

The pandemic disrupted not only our daily lives but also the flow of global markets, creating turbulent phases that few managers were able to navigate successfully. As we have shown, SMT seems to have earned its reputation, being the only trust to outperform global equities in each phase of the pandemic despite many of its growth-oriented peers struggling. Yet there have also been promising runners-up, able to demonstrate the benefits both of a balanced approach to investing and of quality stock-picking.

While past performance does not guide future returns – and we hope that such a black swan event as COVID-19 will never occur again – the last 19 months have been a proving ground for many managers. However, for a select few the time has allowed them to prove not only the effectiveness of their strategies in varying economic environments, but at times their discipline as well.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.