Best trusts to benefit from short term inflation

13th May 2022 15:13

As inflation bites harder than it has done for decades, analysts at Kepler Trust Intelligence consider the best ways for investors to hang on to their capital.

Catch a tiger by the tail

It’s the topic on everyone lips. Yes, Inflation. It is thirty years since the UK has seen inflation at a higher level. Will it subside, or will it persist?

Not possessing a crystal ball, this isn’t something we are going to determine here. However, what we will discuss are the various trusts that investors might like to consider as a reaction to this very novel environment. We consider how one might most directly benefit from rising inflation, and potentially protect capital or income in real terms as a result.

Here's Johnny

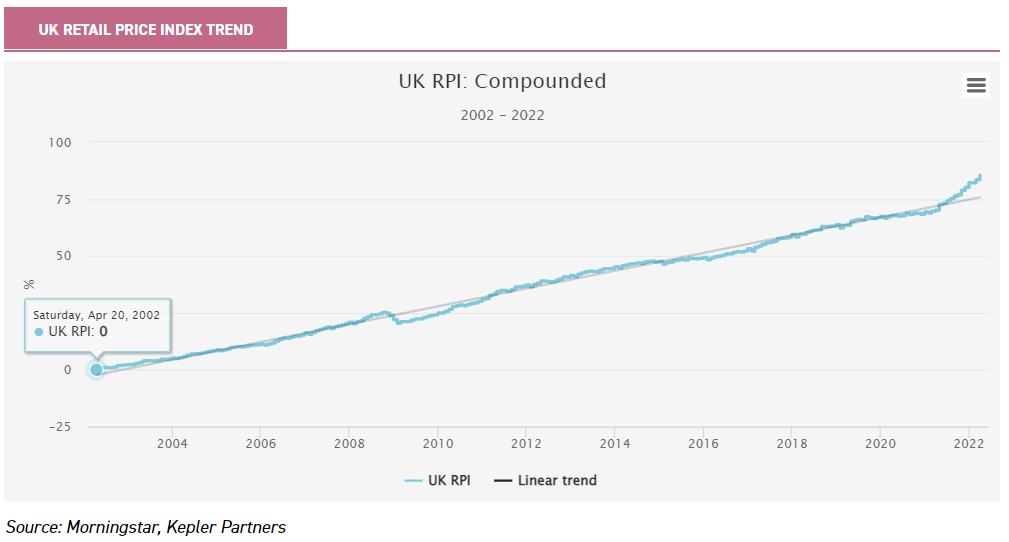

First, confirmation that we are indeed in an unusual environment. The graph below shows the last twenty years of the UK retail price index, illustrating that we are accelerating away from a longstanding trend of low inflation. At the same time, the era of declining bond yields is at an end, which upends another very longstanding trend that we all got very used to as equity investors. The combination is likely to result in a period of enhanced uncertainty, and potentially very rapid repricing of certain assets as the full implications are felt in different corners of financial markets.

Where is it coming from?

Inflation is something that affects everything, yet for investors its origins may be as important as the quantum. Many investors and commentators have been positioning for inflation ever since western economies started the process of quantitative easing (QE) during the global financial crisis of 2008. Yet QE was first coined by the Bank of Japan as an attempt to counter deflation in the early 2000’s. Despite all the intervening years of QE – first in Japan and then elsewhere, inflation has not been evident.

Like stopped clocks, inflationeers are finally telling the right time. But possibly for the wrong reasons. Most economists lay the blame for the current spate of inflation at the feet of the legacy of Covid’s impact on supply chains, a marked shortage of labour (in Europe, the UK and the US – possibly a result of societal changes arising from Covid), and from the impact of Russia’s invasion of Ukraine, which is having a direct impact on the price of many crucial commodities.

Being multi-pronged, one might argue that it is more likely to be persistent. And the continued lockdowns in China are unlikely to mean there is any return to supply-chain normality any time soon, meaning these inflationary forces aren’t going away soon.

Medium term, it is possible that other factors may feed the fire of inflation including climate change, which is likely to see more volatile agricultural commodity markets as a result of changing weather patterns. The shift to a low carbon economy is also a potentially inflationary trend, given that it affects almost every area of economic activity and will burden businesses and consumers with significant additional costs, and drive up demand for the metals and materials required to shift to green energy sources.

Another mega-trend which may also make its effect felt is demographics, in that most developed markets will see their supply of labour reduce as populations age, but also those of some emerging markets such as China being similarly affected. Coming at a time when globalisation is arguably in retreat, with a return to protectionism, xenophobia and less geographic mobility for workers, labour costs are potentially a significant inflationary pinch point.

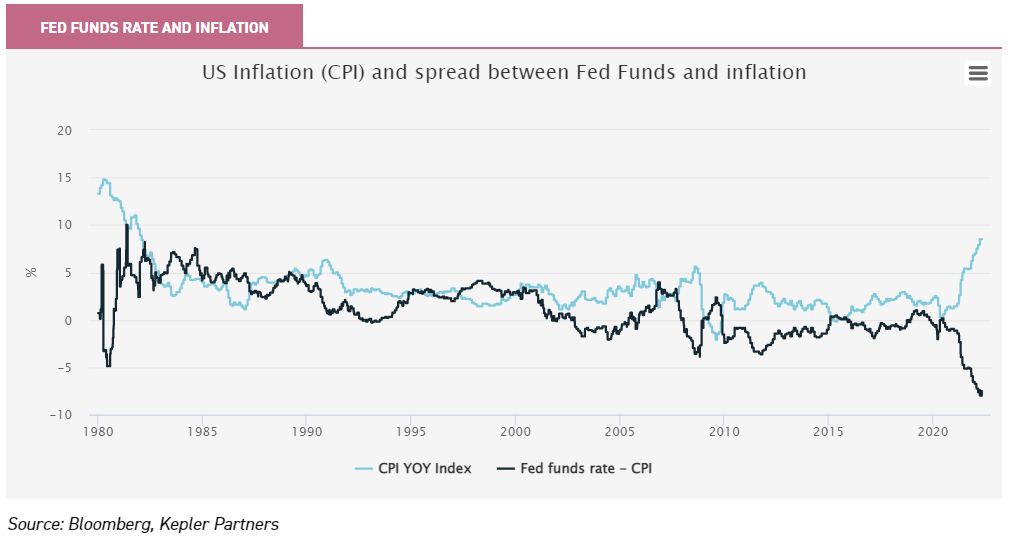

Ultimately, given the parlous state of public finances, might not the only solution to huge government debt piles be to erode it away by inflation? What real incentive do governments have to get on top of inflation, with this incentive at the forefront of their minds and when memories of the pain that inflation can inflict on societies is so distant? The graph below makes an important point in this regard, with the spread between the Fed Funds rate and CPI now the largest it has ever been. This suggests the Federal Reserve – even after the increases to the Fed Funds Rate in 2022 - remains well behind the curve.

So what trusts have an angle in an inflationary environment?

Value

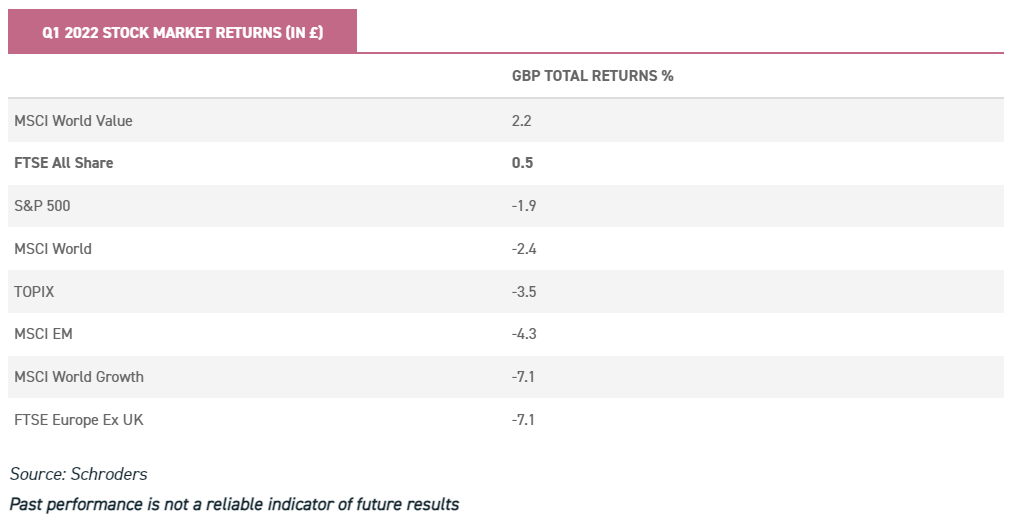

Rising inflation, all things being equal, should mean higher interest rates. Certainly, interest rate expectations have risen, and central banks in the US and the UK have started to act. As we have all seen, rising interest rates have had a big impact on the valuations of high growth companies, and a rapid rotation from growth stocks towards value.

Rising interest rates means that stocks with high free cashflow yields or dividend yields become more valuable relative to those who rely on future growth to justify their share prices. This has meant that the UK equity market has performed relatively strongly by comparison to other markets (see table below). Likely this is a result of the UK having the highest exposure (c. 60%) to value stocks of any major equity market according to JP Morgan statistics.

Trusts such as abrdn Equity Income (LSE:AEI), Aberforth Smaller Companies Ord (LSE:ASL), and Temple Bar Ord (LSE:TMPL) offer a clear value bias for investors. Aberforth is one of the best performing UK small cap trusts year-to-date, albeit by losing less than its peers in a falling market. This follows it having delivered sector-leading returns of 32.5% in 2021. The trust trades on a 13.8% discount which could provide an interesting entry point. We will be updating our note on the trust in the coming weeks.

For those who want to take a more nuanced approach without going ‘all out’ on value, investors may be interested in JPMorgan Claverhouse Ord (LSE:JCH), which offers a pure exposure to UK equities and a strong focus on the FTSE 100. It has the fifth highest exposure to the value style (as defined by Morningstar) of all the UK equity trusts. The managers take a balanced approach to their portfolio construction meaning that whilst offering active management and a consistent track record of outperforming the benchmark, investors are not exposed to any ‘heroics’ (aka significant outperformance in one year, to be met with underperformance in another).

The advantage of having exposure to both growth and value stocks is probably not lost on investors in the current uncertain environment. However, the trust employs many advantages that investment trusts can harness, including tending to be geared over the cycle, and using revenue reserves to smooth dividends. The board’s policy remains to seek to increase the total dividend each year (which it has done over 49 consecutive years) and, taking a run of years together, to pay dividends that at least match the rate of inflation.

Investors may consider that a combination of the board aiming to protect and increase the real value of the dividend over time, added to the benefit from active management of a resurgent UK equity market, may be a good medium-term combination to beat inflation.

Commodities

As we highlight above, the clearest driver of near-term inflation has been commodities such as crude oil, fertiliser, sunflower oil, and wheat. Many of the indirect drivers are also linked to commodities, such as the desire for a low carbon economy (requiring huge quantities of copper and steel, not to mention specialist metals for batteries). Historic low capex by energy and base metals producers over recent years means their limited ability to react to higher prices with greater supply means this could be a continued source of future inflation.

BlackRock World Mining Trust's (LSE:BRWM)managers observe that the mining sector has historically performed strongly in absolute terms and relative to broader equity markets during periods with ‘significant increases’ in inflation expectations. Certainly, the performance of the trust relative to wider equity markets has been strong – not just year to date, but since the rebound from mining sector’s annus mirabilis in 2016.

Sister trust BlackRock Energy and Resources Income (LSE:BERI) has performed even more strongly over the short term, having a significant exposure to energy as well as mining stocks. In 2020 the board formally changed the mandate to include energy transition stocks, representing a more growthy set of stocks to the portfolio. With a ‘target’ of around a third in each, BERI is currently overweight mining stocks (46.4%), in line traditional energy (31.8%) and underweight energy transition stocks (21.9%).

Alternatives

The era of steadily declining bond yields over the past two decades has undoubtedly been a key contributor to the success of growth equity strategies but also the growth of the listed alternatives sector. Yet despite the challenges potentially posed by rising bond yields to alternative trusts, we believe several sections of the alternatives universe provide good direct or indirect exposure to higher inflation.

HICL Infrastructure PLC Ord (LSE:HICL) is one of them. Aside from the high income that HICL offers to shareholders (dividend yield of 4.8%), one of the key selling points for investors over the years has been the link with inflation. With inflation becoming increasingly prevalent, we believe that HICL’s final results, due to be announced at the end of May, will be closely followed by inflation watchers.

An examination of the trust’s portfolio shows that it has strong inflation correlation, but we must be clear, is not a direct link. It is important to realise that time-lags involved in contracts will mean any direct inflation link in revenues may take time to feed through.

The managers have stated that in a scenario where inflation was 1% higher than currently assumed in all future periods, HICL’s annual total (gross, before fee) returns would increase from 6.6% to 7.4%. HICL’s cashflows have already benefitted in the first half of the financial year ending March 2022 from higher levels of inflation. Perhaps of more immediate relevance is the fact that HICL has announced that it will be reviewing the appropriateness of its short-term inflation assumptions ahead of its year-end, which will be announced in late May 2022.

HICL’s inflation assumptions currently are for UK RPI at 2.75% to 2030 and 2% thereafter (CPI), and 2% across all other regions. This means that if inflation does become entrenched at a higher level than currently assumed, there is a clear upside for investors in terms of the net asset value (NAV) as well as potentially dividends. As such, for those investors wishing to access an investment expected to benefit from rising and/or persistent inflation, HICL is clearly a strong candidate. The current share price premium to NAV of 9% compares to the five-year historic average of 7.5%, suggesting that the market is already anticipating an increase HICL’s inflation assumption.

Renewable energy funds also have elements of direct and indirect linkage to inflation. The direct link comes from subsidies, which are typically contractually linked to inflation. Depending on the time the project was built, the country of its location and the technology employed, subsidies can provide from around half to two-thirds of revenues. The balance of revenues comes from sales of power, which managers may or may not sell forward, meaning the direct link to current high wholesale energy prices may be more muted for some trusts.

Over the long term, many managers argue that power prices are indirectly related to inflation. Currently they are directly affecting inflation. Of the Renewable Energy Infrastructure trusts, Greencoat UK Wind (LSE:UKW) is the most exposed to wholesale power prices. It also has an exposure to RPI inflation through subsidies. The contractual link with inflation, as well as the high projected dividend cover, is what has given the managers and board the confidence to continue to peg the dividend to inflation since launch.

Since listing in 2013 to date, UKW’s dividend target has risen by 28.7% cumulatively, which compares to the Retail Price Index rise of 26.3% over the same period. More recently, whilst the inflation link is undeniably attractive, the trusts unhedged exposure to the energy price has marked it apart from peers (which in many cases sold forward energy production, exchanging the positive impact that recent strength would have conferred, for more visibility on revenues into the future). This puts UKW in an unrivalled position to benefit from continued elevated energy prices, not to mention inflation. The 2022 dividend target of 7.72p means the shares offer a prospective dividend yield of 4.9% at current prices.

“Multi-asset”

Several fund managers have been positioning for high inflation for many years. Amongst them are Hamish Ballie and Duncan MacInnes, co-managers of Ruffer Investment Company Ord (LSE:RICA) which aims to grow investors capital over the long term whilst protecting against risks. The Ruffer approach requires the managers to be flexible and adaptable, but perhaps more importantly to be set up for more than one financial or economic outcome. Their central case is that we have entered a new regime of ‘persistent and malign inflationary pressures’.

However, the Ruffer house view is that there are two likely scenarios depending on whether policymakers try to tame inflationary pressures. The first scenario sees a ‘tightening induced slump’, in which inflation stays high but governments tighten monetary and fiscal policies. In this scenario, most asset classes would decline in value, most especially highly priced growth stocks. In this scenario, they believe that RICA’s equity puts and credit protections would support the portfolio, as they did in Q1 2020.

The second scenario sees an inflationary boom, in which inflation rises but monetary and fiscal policy remains accommodative. In their view, bonds and bond proxies look vulnerable in this environment, but their inflation-linked bonds with the duration hedged via payer swaptions and gold exposure should in their view contribute positively. They believe value stocks and those sensitive to real GDP growth would also do well.

The RICA portfolio has exposure to bad outcomes (index-linked bonds, credit protection, payer swaptions, gold exposure, and equity put options), as well as good (attractively priced GDP- and inflation-sensitive equities). As a result, year to date (as at 26/04/22), RICA has performed well and the NAV is +5.2% over a period in which bonds and equities are both in negative territory.

The mechanics in March illustrates how the diversified portfolio tends to offer positives that will offset negatives. During March long-dated inflation-linked bonds (‘linkers’) fell in value as yields rose faster than inflation expectations, but the interest rate options – which profit from rising yields – more than offset this fall in value. Gold exposure (now stands at close to 10%, including and gold mining equities) were the largest positive performance driver during the month.

TROY, managers of Personal Assets Trust (LSE:PNL), aims to protect and increase (in that order) shareholders capital. Managed by Sebastian Lyon and Charlotte Jonge, the team aim to ensure that the portfolio is resilient for a variety of short-term scenarios without compromising on its ability to generate long-term returns. They have long seen inflation as a coming threat, and currently have exposure to short duration assets, including cash and T-bills of c.19% of NAV, and equities of companies with resilient business models where revenue and earnings growth will be long-lived, but also where the valuations do not overstate the company’s potential (c 36% of NAV).

Index linked bonds representing 33% and gold bullion and gold related investments at 12% of NAV represent their direct inflation hedge. That said, exposure to index linked bonds does not necessarily guarantee profits in an inflationary environment, as shareholders in Personal Assets discovered during Q1. The team at Troy explain it well, to paraphrase their quarterly update: whether index-linked bonds actually make money depends on the degree to which nominal rates and inflation expectations move.

If market expectations for inflation increase more than nominal bond yields, real yields will fall and index-linked bonds will generate positive returns. However, if markets start to price in an increase in nominal yields without a commensurate increase in inflation expectations, real yields will rise and index linked bond values decline. During Q1 the latter happened, causing index-linked bond prices to fall.

They believe that in coming months and years, the US in particular will find it hard to raise rates as much as is necessary and that inflation expectations currently priced in are too low. As such, they have a positive outlook for their portfolio of index linkers (duration of 5 years) going forward.

Peter Spiller and team at CG, who manage Capital Gearing Trust (LSE:CGT) also worry about inflation. CGT’s objective is to preserve, and over time to grow shareholder’s real wealth. The team share Troy’s view that inflation expectations in the market are too low, and so the portfolio is invested in linkers with “moderate” duration. They have a slightly different approach to the equity element of the portfolio, despite having a similar 35% invested in index linkers.

Four per cent of the portfolio is invested in energy and materials stocks, the largest position being a European energy ETF. They also see renewable infrastructure trusts (5% of the portfolio) as attractive, for the same reasons as we observe above. Finally, CG continue to think that residential accommodation (c. 10% of the portfolio) looks well placed. We will be publishing an updated profile on CGT soon.

Conclusion

Relatively few market participants will have had a proper view of financial markets when we had ‘proper’ inflation, so it probably makes sense to have a range of different exposures which should mitigate the risk that ‘this time it’s different’.

However, in our view, the most direct exposures one can take to benefit from short term inflation are the likes of HICL or Greencoat UK Wind. Both have contractually linked inflation protection as elements of their underlying revenues. Commodity and related exposures are also likely to perform strongly, although clearly at risk of the impact of a potential global recession denting demand.

At the other end of the spectrum, several multi-asset trusts exist offering differing recipes for similar cakes and each aiming to provide long term preservation of real wealth. Each of these offers a relatively neat way to outsource the problem to the teams of powerful thinkers that sit behind each one.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.