The best investment trusts to escape the UK

We look at global sector trusts to see which offer the best diversification prospects for UK investors.

25th October 2019 15:18

This content is provided by Kepler Trust Intelligence, an investment trust focused website for private and professional investors. Kepler Trust Intelligence is a third-party supplier and not part of interactive investor. It is provided for information only and does not constitute a personal recommendation.

Material produced by Kepler Trust Intelligence should be considered a marketing communication, and is not independent research.

We look under the hoods of global sector trusts to see which offer the best diversification prospects for UK investors.

Sail away: The best trusts to escape the UK

We look under the hoods of Global sector trusts to see which offer the best diversification prospects for UK investors...

William Sobczak, analyst at Kepler Trust Intelligence.

Investors are increasingly turning to global funds. We suggest that concerns around Brexit are most likely leading investors to seek diversification overseas. In terms of retail sales the global sector has been comfortably the most popular among investors over the past few quarters. In 2018 global funds had close to twice the level of retail sales of any other sector, as can be seen in the chart below.

A similar trend has emerged in the investment trust sphere, where the average discount within the 16-strong AIC Global sector sits at 4.7%. Only North America trades at a narrower average. While Brexit may be the cause of this increased appetite, diversifying overseas is a sensible strategy in all economic environments; although investors typically still overweight their own market, a tendency known as 'home bias'.

The AIC Global sector consists of a diverse collection of trusts, which are suitable for a range of different investment purposes. In this paper, we consider the diversification benefits of investing in overseas equities and the options available in the sector. As well as scrutinising each option, we aim to explore which trusts offer genuine diversification.

The importance of diversification

Diversification in asset allocation is generally considered to be a key part of the investment process, with returns differing among regions over time. There has, however, been some pushback on this concept from notable industry figures: Charlie Munger noted that "the idea of excessive diversification is madness".

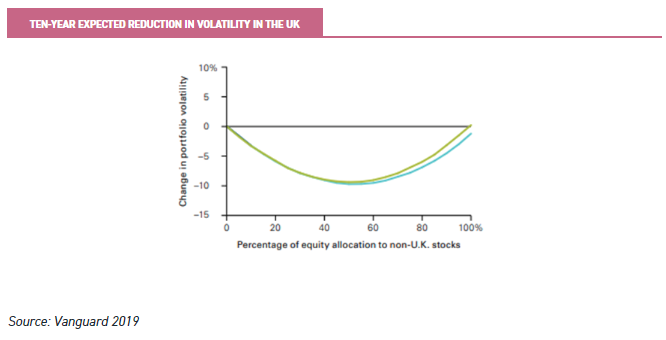

In simple terms, though, including multiple markets in a portfolio can help reduce volatility without necessarily sacrificing returns. In one study conducted by Vanguard, a portfolio of 60% UK and 40% global stocks was compared to a portfolio that held only UK or only international equities.

The diversified portfolio reflected consistently lower volatility, and produced a greater risk-adjusted return (or higher return per unit of risk). The study also illustrated this tendency by analysing the impact on portfolio volatility when incremental allocations of international equities are added to a domestic equity portfolio, as shown in the chart below.

The combination of imperfectly correlated returns across countries and lower global market volatility suggests that investors who make incremental allocations to international stocks will tend to realise benefits from that diversification.

But how do investors gain a combination of imperfectly correlated returns across countries?

The common answer: The Global Sector

Global managers based in the UK have dramatically reduced their exposure to the UK over the past ten years. The current average UK exposure of the Global AIC sector currently sits at a little over 20% (Morningstar). This is still considerably higher than might be anticipated, given that the UK actually makes up only 5% of the FTSE World index.

The phenomenon of investors overweighting their domestic market is often referred to as 'home bias', and is prevalent among both retail and professional investors. Research conducted by Pool, Stoffman and Yonker in 2012 identified that the average US fund tends to be overweight in stocks from its managers' home states. This bias was more apparent amongst less experienced managers.

Some might argue that multinational companies, for example those in the FTSE 100, offer ample exposure to overseas revenues. Many companies, however, will hedge away currency fluctuations arising from their foreign operations, further diminishing diversification. Investors with a pronounced home bias will additionally miss out on leading global companies outside the UK, which could also be in sectors less prominent in the UK (e.g. tech).

The chart below represents AIC Global sector exposures to the UK:

This reveals a wide range of levels of UK exposure across the sector. The highest comes from Lindsell Train (LSE:LTI), at 78%. The trust is a unique beast in the sector, with an extraordinarily high concentration of just 15 holdings in the portfolio. This has helped the trust outperform peers over the long term, though it offers UK investors few opportunities for diversification of returns. Similarly groups such as Majedie Investments (LSE:MAJE), Witan (LSE:WTAN) and AVI Global use a 'fund of funds' approach.

These are normally considered one-stop shop companies, rather than diversifiers. Majedie's largest fund allocation is towards its UK Equity fund, with almost 30% of the trust's assets. The company also has 8% in its UK Income fund, and nearly 30% in Majedie Asset Management. Witan has three UK Managers, making up 21% of its NAV.

In addition to this the trust also has 6.3% in the UK through other managers. Over the past five years Witan has a correlation of 0.85 to the FTSE All Share. In comparison the MSCI World index has an equivalent correlation of 0.62. AVI Global, we believe, is a slightly different case; its distinctive approach and investment universe means that it can diversify most investors' style biases.

The trust buys closed-ended funds, holding companies and asset-backed companies, trading on a significant discount to their net asset value. AVI Global's correlation to the FTSE All Share over the past three years is 0.63, while Majedie has an equivalent correlation of 0.42. At the other end of the spectrum, trusts such as Manchester & London (LSE:MNL), Scottish Mortgage (LSE:SMT), Monks (LSE:MNKS), Mid Wynd International (LSE:MWY) and Martin Currie Global Portfolio (LSE:MNP) hold UK exposure that is far closer to neutral. However, it is important to recognise that a low exposure doesn't mean that investors will not still have a high crossover between the fund and the positions they already hold.

What's underneath the hood?

To fully understand the diversification a trust might offer, it is important to examine its underlying positions in comparison to those that investors will already hold. After all, diversification will only benefit investors if the stock prices of the underlying companies behave differently from their existing holdings.

"Most investors think diversification consists of holding many different things; few understand that diversification is effective only if portfolio holdings can be counted on to respond differently to a given development in the environment."

Howard Marks.

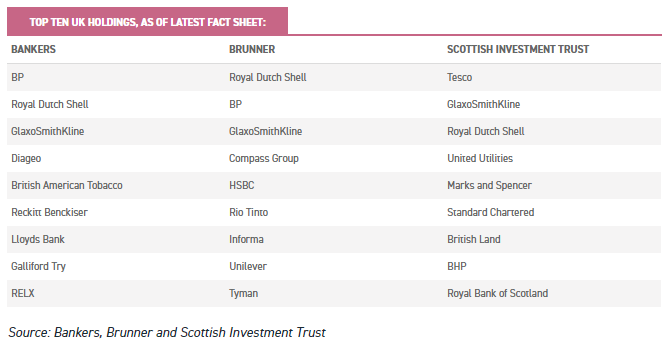

We set out to investigate whether global managers tend to buy the same UK stocks that UK investors are already likely to hold. This was analysed by comparing the top ten UK holdings of the Global sector to the FTSE 100 top ten; these are companies that any passive investor in the UK is likely to hold. The table below shows each of the trusts in the sector, and the number of holdings in their respective ‘top tens' that also feature in the FTSE 100 top ten.

Aside from the one-stop shop companies previously discussed, the Bankers Investment trust (LSE:BNKR) and Brunner (LSE:BUT) stood out in the sector for their high level of holdings in the top segment of the FTSE 100.

Bankers included five of the FTSE 100 top ten in their top ten UK holdings, amounting to nearly 25% of their UK portfolio. Brunner also had five of their top ten UK holdings in the FTSE 100 top ten, equating to a little over 10% of their total portfolio NAV.

Scottish Investment Trust (LSE:SCIN) was another company that stood out. Around 90% of their top ten UK holdings were in the overall FTSE 100, with a total UK exposure at 27%, despite only having positions in two of the top ten FTSE 100 companies. In fact, over five years the three trusts have respective correlations of 0.78, 0.80 and 0.72 to the FTSE All Share (versus an equivalent correlation of 0.62 for the MSCI World index).

We then did the same analysis for the largest open-ended UK equity funds. With almost £20 billion in AUM, these are companies many UK investors are likely to already hold. The table below shows the top ten holdings for LF Lindsell Train UK Equityy (the largest non-ETF fund), Invesco High Income and Liontrust Special Situations. N.B. we didn't consider the AIC UK All Companies sector. These trusts are overwhelmingly mid- and small-cap dominated and so are likely to offer decent diversification to holdings in the AIC Global sector.

The crossover between the open-ended funds and the likes of Bankers, Brunner, and Scottish Investment Trust is clear. Five of the six funds hold Royal Dutch Shell (LSE:RDSB) and four hold BP (LSE:BP.) or Diageo (LSE:DGE) in their 'top tens'. These crossovers are reflected in the correlations of returns among the companies, which can be seen below.

Where can you look for diversification?

Putting all of the above together, we believe that investors who are looking to diversify out of the UK need to consider a number of factors. First, they need to consider whether a fund is set up to offer a global equity or multi-asset allocation itself (i.e. is a one-stop shop).

Second, if they are already invested in the UK, they need to make sure they do not compound this by increasing the home bias in their portfolio. Third, they need to consider whether the UK exposure in their global fund doubles up the holdings they already own in their UK funds, or offers something new. The following trusts are those we think offer the purest diversification on the above considerations:

Monks

Monks Investment Trust (LSE:MNKS) aims to deliver long-term capital growth through a well-diversified, actively managed, global equity portfolio. The company has just 7.8% of its portfolio in the UK, a marginally higher percentage than that of the MSCI World.

Of their top ten UK holdings, none are in the FTSE All Share top ten by market cap, so they are less likely to be held in UK investors’ portfolios. Rigorous, bottom-up analysis is at the heart of the Monks investment process.

The managers, Charles Plowden, Spencer Adair and Malcolm MacColl, focus on identifying growth companies with above-average earnings growth. Over the past five years the trust has enjoyed annualised returns of 15.5%, the fifth highest in the AIC Global sector. Over this period the trust’s returns have had a 0.72% correlation with the FTSE All Share. Currently the trust is trading on a premium of 4.8%.

Martin Currie Global Portfolio

Martin Currie Global Portfolio Trust (LSE:MNP) aims to achieve long-term outperformance of the FTSE World Index from a portfolio of 25-40 high-growth companies from around the world.

According to JPM Cazenove, the trust has 9% of its assets in the UK, though in revenue terms the number is closer to 6% as at 30 June 2019. The trust has no companies in both its top ten UK holdings and the FTSE All Share top ten holdings by market cap.

Zehrid Osmani took over sole management of the portfolio in October 2018. Osmani uses a proprietary toolkit, whereby financial models are built and qualitative and thematic research is then conducted and evaluated.

The trust has long been one of the standout performers in the Global sector, and has offered annualised returns of 13.36% over the past five years. The trust also offers investors a small but not insignificant dividend of 1.5%. Currently the trust trades at a premium of 1%.

Mid Wynd International

Mid Wynd International (LSE:MWY) is run by managers Simon Edelsten, Alex Illingworth and Rosanna Burcheri. MWY seeks to identify areas of longer-term growth around the world, and companies that can invest and grow in value even when economies are dull. These ideas are then grouped into broad industry themes.

This is to ensure the managers have spread their investments between different themes with different drivers, as well as holding stocks exposed to this growth which trade on attractive valuations, often less well-known companies.

The trust has just 6.2% of its assets invested in the UK, with only Diageo in both the top ten UK holdings and the FTSE All share top ten holdings by market cap.

MWY has a correlation of just 0.67% with the FTSE All Share, illustrating the diversified nature of the returns. Recently performance for the trust has been strong; over five years the trust has the fourth strongest annualised return of any in the Global sector (16.5%). Currently the trust is trading at a premium of 4.7%.

Scottish Mortgage

Scottish Mortgage (LSE:SMT) is a global equity portfolio run with a long-term investment timeframe, via a highly concentrated, growth-orientated stock picking approach.

It is the largest 'conventional' UK-listed investment trust with net assets of close to £7 billion. This does mean that, although the NAV exposure to the UK is just 3%, the share price could be impacted with the rest of the UK as flows vary in and out of the FTSE 100.

The company has no overlap of holdings in the FTSE All Share top ten by market cap. The managers aim to invest in the most promising growth companies across the globe, whether publicly listed or private. The trust has the second strongest returns of any in the Global peer group, with annualised returns of 18.7% over the past five years. Over this period the trust has a correlation of just 0.63% with the FTSE All Share. Currently the trust is trading at a discount of 2.1%.

Manchester & London

Manchester & London (LSE:MNL) aims to offer both capital appreciation and a reasonable level of income for investors. The trust does this through a portfolio of equities and fixed interest securities across the globe.

They typically hold just 20-40 securities, currently 27, making MNL one of the most concentrated portfolios of the sector. The trust has just 5% of its portfolio in the UK, and no overlap with the FTSE All Share top ten holdings.

This includes a 1.5% holding in Scottish Mortgage, described above. The trust is trading at 4.2%, the widest discount of the companies we have discussed. Performance in recent years has been strong, however: over the past five years MNL has delivered annualised returns of 15.6% while at the same time yielding 2.7%.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

Kepler Partners is a third-party supplier and not part of interactive investor. Neither Kepler Partners or interactive investor will be responsible for any losses that may be incurred as a result of a trading idea.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important Information

Kepler Partners is not authorised to make recommendations to Retail Clients. This report is based on factual information only, and is solely for information purposes only and any views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment.

This report has been issued by Kepler Partners LLP solely for information purposes only and the views contained in it must not be construed as investment or tax advice or a recommendation to buy, sell or take any action in relation to any investment. If you are unclear about any of the information on this website or its suitability for you, please contact your financial or tax adviser, or an independent financial or tax adviser before making any investment or financial decisions.

The information provided on this website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation or which would subject Kepler Partners LLP to any registration requirement within such jurisdiction or country. Persons who access this information are required to inform themselves and to comply with any such restrictions. In particular, this website is exclusively for non-US Persons. The information in this website is not for distribution to and does not constitute an offer to sell or the solicitation of any offer to buy any securities in the United States of America to or for the benefit of US Persons.

This is a marketing document, should be considered non-independent research and is subject to the rules in COBS 12.3 relating to such research. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research.

No representation or warranty, express or implied, is given by any person as to the accuracy or completeness of the information and no responsibility or liability is accepted for the accuracy or sufficiency of any of the information, for any errors, omissions or misstatements, negligent or otherwise. Any views and opinions, whilst given in good faith, are subject to change without notice.

This is not an official confirmation of terms and is not to be taken as advice to take any action in relation to any investment mentioned herein. Any prices or quotations contained herein are indicative only.

Kepler Partners LLP (including its partners, employees and representatives) or a connected person may have positions in or options on the securities detailed in this report, and may buy, sell or offer to purchase or sell such securities from time to time, but will at all times be subject to restrictions imposed by the firm's internal rules. A copy of the firm's conflict of interest policy is available on request.

Past performance is not necessarily a guide to the future. The value of investments can fall as well as rise and you may get back less than you invested when you decide to sell your investments. It is strongly recommended that Independent financial advice should be taken before entering into any financial transaction.

PLEASE SEE ALSO OUR TERMS AND CONDITIONS

Kepler Partners LLP is a limited liability partnership registered in England and Wales at 9/10 Savile Row, London W1S 3PF with registered number OC334771.

Kepler Partners LLP is authorised and regulated by the Financial Conduct Authority.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.