Best and worst-performing asset classes of 2022

6th December 2022 15:38

by Jemma Jackson from interactive investor

Commodities top the list, while bitcoin plummets amid a more challenging landscape, FTX debacle and looming UK regulation.

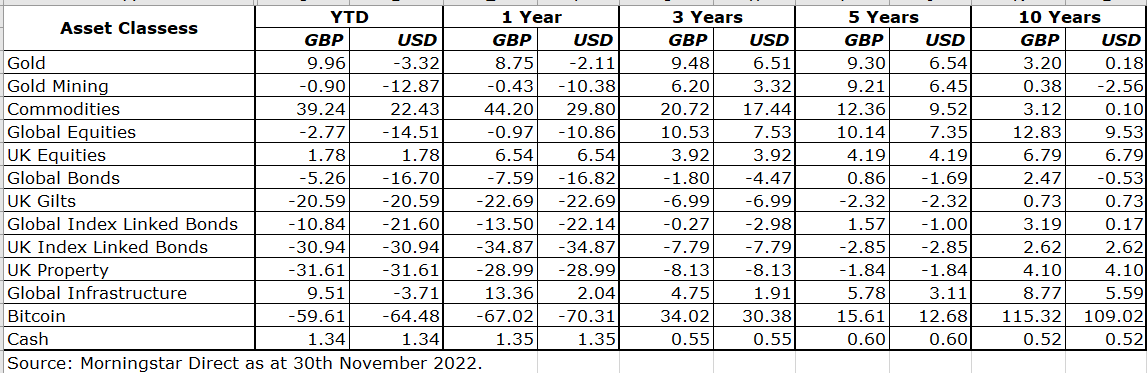

- Only three out of the 13 asset classes generated a positive return since the start of the year

Commodities has been the top-performing asset this year, with the strong US dollar (in which commodities are priced) and the surge in the prices of grains and livestock driving returns, according to new analysis by interactive investor.

Commodities returned 22% over the year to the end of November (in US dollar terms) – the only asset on the list to generate a double-digit return, according to ii data using Morningstar Direct as at 30 November 2022. Commodities includes hard commodities, natural resources that must be mined or extracted like gold and oil, and soft commodities – agricultural products or livestock such as corn, wheat, coffee and pork.

- Find out about: Free regular investing | Interactive investor Offers | ii Super 60 Investments

At the bottom of the performance table is bitcoin, which fell by -64% year to date in US dollar terms, weighed down by the same inflation and interest rate hike fears that have hindered stock markets, and, more recently, the collapse of FTX, the second-largest crypto exchange.

When taking into account the currency in which some overseas and global asset classes are assessed, only three out of the 13 major asset classes selected by interactive investor using Morningstar data generated a positive return over the period. If everything was priced in Sterling, for illustrative purposes, that number still only rises to five.

Commenting on the tough year to date for stock markets, Lee Wild, Head of Equity Strategy, interactive investor, says: “It’s never been wrong for investors with a longer-term horizon to hold on to their shares, keep investing and wait for the trouble to pass. Indeed, history shows that markets can and do recover from dramatic falls. Some of the best years can follow some of the worst, so it is worth hanging on in there”.

Gold as a separate asset, which is often viewed as a hedge against inflation, was down -3% in US dollar terms, with Global Infrastructure, also often seen as a diversifier, down -4% in US dollar terms.

UK Equities managed to just make positive territory, up 2%, slightly ahead of Cash (1%).

It was also a tough year for fixed income. Rarely at the bottom of the performance charts, 2022 was the year that saw a dramatic reset. Global Bonds were down -17% and Global Bonds linked to an index down -22%. UK Gilts and UK Index Linked Bonds also suffered, down by -21% and -31%, respectively.

UK Property, meanwhile, was the second-worst performer on the list, returning -32% over the year, with an economic backdrop that continues to throw plenty of headwinds at the sector.

Richard Hunter, Head of Markets, interactive investor, says: “Commodities being at the top of the pile in performance terms may surprise some. The oil price is ahead by just 5% in the year to date (earlier in the year it was up around 50%), while the prices of both gold and copper are down.

“One of the reasons for this has been the strength of the US dollar, in which commodities are priced, and which has an inverse relationship to commodity prices (a higher dollar can buy more of the commodity, so the price falls). At the same time, Chinese demand for commodities (perceived and actual) has drastically reduced on the back of local Covid-19 outbreaks and subsequent restrictions, placing something of a stranglehold on the economy.

“These so-called “hard” commodities are not the reason for the 33.8% rise overall. The outperformance is driven by the strength of “soft” commodities, which is basically a term for those which are grown rather than mined – sugar, corn, wheat, cocoa, fruit and coffee, for example, as well as livestock. The likes of coconut oil, maize and wheat have had particularly strong price hikes.

“Supply chain blockages – particularly in Europe and exacerbated by the Russia/Ukraine conflict – have elevated prices sharply, affecting the overall returns from “commodities”.

On bitcoin, Myron Jobson, Senior Personal Finance Analyst, interactive investor, says: “Bitcoin has gone from hero to zero when it comes to performance after soaring to record highs during the pandemic. Unlike past crypto boom and bust cycles, the current malaise in performance is underpinned by factors that have rattled the bedrock of the cryptocurrency industry. The collapse of FTX, which was the second largest crypto exchange and other lesser-known exchanges had a destabilising effect on the broader crypto market, sending bitcoin and other crypto coins into a downward spiral. Meanwhile, the cost-of-living squeeze on budgets has meant that many people have not been able to afford to speculate on risky assets such as cryptocurrency as they are forced to spend more on everyday essential such as food and energy bills

“The case for bitcoin as digital gold has all but been diminished as the price of the first and best-known cryptocurrency has followed and exceeded falls in global stock markets.

“Price swings are to be expected, but they can leave investors whipsawed. Bitcoin and the broader crypto market have typically rebounded from steep falls in the past, although in some cases it took several years to recover. But past performance is not indicative of future results, and the market environment now is very different. The crypto industry appears set for a regulatory crackdown both home and abroad. In the UK, the Treasury is reportedly finalising a package of sweeping reforms to regulate the crypto market which could weigh on performance.

“Whatever your approach to risk, cryptocurrency should be treated with caution.”

Onbonds, Sam Benstead, Collective Specialist, interactive investor, says: “Rising interest rates this year have turned the argument that bonds are a “safe” investment on its head. Government and corporate bonds – which are prized for their reliable income payments – are rarely at the bottom of the performance charts, but 2022 was the year that bond prices reset following more than a decade of steady returns as interest rates fell.

“When rates go up, it means that investors can get a better deal from newly issued bonds, so they sell bonds. When rates go down, this has the opposite effect. The sharp change in policy from central banks this year as inflation proved not to be “transitory” is what caused the bond market crash.

“However, with interest rates expected to peak in early 2023, bond prices could benefit from interest rate cuts next year if inflation is contained.

“Yields on government and corporate bonds are much higher than a year ago, so the “income” in fixed income has returned. This is tempting in new buyers in search of yield and helped boost bond prices over the past couple of months.

“Poor returns for bonds this year could therefore set the asset class up for strong returns next year.”

Source: interactive investor using Morningstar Direct to 30 November 2022.

Past performance is no guide to the future.

See notes to editors for longer-term comparisons.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.