Benstead on Bonds: three predictions for gilt investors in 2025

From what to do after TN25 matures, to where interest rates are heading, Sam gives his tips for gilt investors this year.

7th January 2025 11:57

by Sam Benstead from interactive investor

This time last year, fixed-income investors were predicting lots of interest rate cuts. They were wrong, and bond markets fell.

At the start of 2024, markets were pricing in 1.5 percentage points of cuts in the United States and UK. This would have taken interest rates to around 4% in both countries.

But in the US, they got three 0.25 point moves, taking the range to between 4.25% and 4.5%. In the UK, there was just two, taking rates to 4.75%.

- Invest with ii: Investing in Bonds | What is a Managed ISA? | Open a SIPP

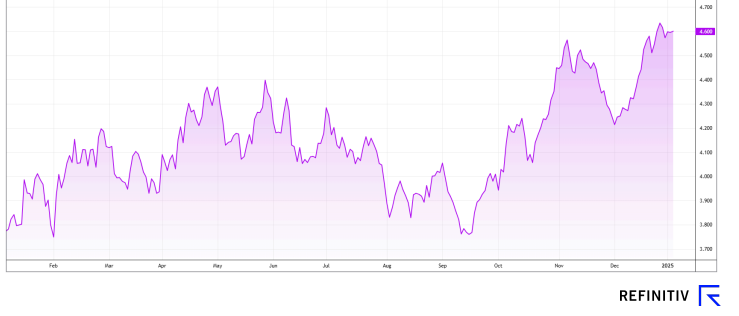

To reflect the rosy forecasts for interest rates, 10-year gilt yields were at about 3.5% at the start of 2024. But because interest rates did not move as much as anticipated, gilt yields rose and the 10-year gilt now yields 4.6%.

The graph below shows that movement.Remember, when a bond yield line rises, this means that bond prices are falling – bad news for existing investors but good news for those looking to deploy capital at higher yields.

The 10-year gilt yield has risen over the past 12 months

Past performance is not a guide to future performance.

Taking into account coupons but also capital losses, gilt investors lost about 4% last year.

This shows how difficult fixed-income investing can be because of the large role that the economy plays in outcomes, rather than the performance of individual companies.

As the new year begins, there are three important things that are on my mind when thinking about outcomes for bond investors.

I’ve tried not to predict specifically what will happen, but instead highlight three themes I think will be important over the next 12 months from the perspective of retail investors.

Interest rates may not fall that much

UK interest rates are again expected to fall in the coming year, with the Bank of England itself predicting four cuts, to take the base rate down to 3.75%.

But I am not so sure that this is what will happen. As we entered 2024, the market overestimated rate cuts and thought the Bank of England would cut more than it was saying it would.

As we enter 2025, the opposite could come true and the Bank of England may be over-optimistic about cutting rates this year. Bloomberg reports that the market expects just two rate cuts this year, half the Bank of England’s forecast.

- Bond Watch: Bank of England expects four rate cuts in 2025

- Bond Watch: new five-year gilt auction comes to ii

- How bonds performed in 2024: best and worst funds

This is because inflation has risen in the last two months, hitting 2.3% in October and 2.6% in November. Moreover, investors are also worried that tax increases by the new government in the UK may lead to higher inflation, as employers pass on the extra cost of employers’ National Insurance increases.

The minimum wage has also increased, which puts even more pressure on companies to raise prices in order to protect their profits. If they don’t think they can raise prices, then the other outcome would be job losses.

So, inflation could again become a core theme for investors – this would mean fewer interest rate cuts and a higher yield that investors demand from bonds to protect their “real” return.

Investors are showing their lack of confidence in the Labour government to effectively manage the economy.

But gilts can still make you money

Investors in bonds make money in two ways: coupons and changes in the capital value of their bonds.

This means that even if bonds fall in value (pushing up yields) as a result of fewer than expected rate cuts, the income they generate acts as a buffer and can still lead to a positive return for investors.

If the current gilt used as the 10-year benchmark (4¼% Treasury Stock 2036 (LSE:T4Q)) saw its yield rise from 4.6% today to 5% this year, this would indicate a roughly 3% drop in the value of the bond. But accounting for the bond's yield, the return would still be positive.

This protects investors if bonds fall in value. If gilt prices don’t move, then generating about 4.5% is not a bad return. If gilt prices rise then returns would be greater.

- My bond market tip for 2025

- Watch our Jupiter Strategic Bond video: a 7% yield from global bonds

- Bond Watch: why investors got 2024 wrong

This shows that the income that bonds now generate, which you may hear fund managers refer to as “carry”, gives investors some protection from falling bond prices. This was not the case when interest rates were near zero in 2021.

So, investors now get paid to wait when they own gilts. If the economy turns south, then gilts are likely to be an effective insurance policy to balance out falling equity valuations.

The popularity of direct gilts will keep growing

One of the most exciting themes over the past couple of years has been the rise in participation of retail investors in the gilt market.

It’s by far the easiest bond market to participate in directly for retail investors, with each gilt trading on the London Stock Exchange’s Order Book for Retail Bonds maturing at £100. In contrast, most corporate bonds are only available to institutional investors as they trade in £100,000 blocks normally.

In fact, on our platform we’ve seen the amount invested in direct gilts grow 29-fold in the past three years!

I think that elevated yields will continue attracting investors to gilts, particularly shorter-term bonds trading below £100 that can be held to maturity and used as a proxy for a savings account.

- Everything you need to know about investing in gilts

- Sign up to our free newsletter for investment ideas, latest news and award-winning analysis

Capital gains on gilts are tax-free, so the difference between the £100 redemption value of a gilt and the purchase price is tax-free if held in a General Investment Account. This makes gilts a very tax-efficient investment if they are held outside an ISA or SIPP and bought at a discount to their redemption value.

The gilt with the most assets on our platform is UNITED KINGDOM 0.25 31/01/2025 (LSE:TN25), which matures on 31 January this year, paying investors back £100 per gilt they own and a final semi-annual coupon.

A significant amount of cash is therefore about to be deposited into customer accounts, and could be looking for a new home.

I’d expect to see this cash flow into gilts with a similar profile to TN25: low coupons and short maturity dates.

These gilts fit this profile and could be worth looking at for investors holding TN25.

UNITED KINGDOM 0.125 30/01/2026 (LSE:T26 )– Maturing on 30 January 2026, this gilt has a 0.125% coupon and costs around £96 to buy. Its yield-to-maturity (the expected annualised return if bought today and held until maturity) is 3.97%, according to Tradeweb.

UNITED KINGDOM 0.125 31/01/2028 (LSE:TN28) – Matures on 31 January 2028, this gilt also has a 0.125% coupon and trades at £88.70 per gilt. The yield is 4.1%.

UNITED KINGDOM 0.25 31/07/2031 (LSE:TG31) – Matures on 31 July 2031, this gilt has a 0.25% coupon and trades at £77. It yields 4.29%.

UNITED KINGDOM 0.375 22/10/2026 (LSE:T26A) – Maturing on 22 October 2026, this gilt pays a 0.375% coupon and trades at £93.50. The yield-to-maturity is 4.17%.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Important information: Please remember, investment values can go up or down and you could get back less than you invest. If you’re in any doubt about the suitability of a Stocks & Shares ISA, you should seek independent financial advice. The tax treatment of this product depends on your individual circumstances and may change in future. If you are uncertain about the tax treatment of the product you should contact HMRC or seek independent tax advice.

Important information – SIPPs are aimed at people happy to make their own investment decisions. Investment value can go up or down and you could get back less than you invest. You can normally only access the money from age 55 (57 from 2028). We recommend seeking advice from a suitably qualified financial adviser before making any decisions. Pension and tax rules depend on your circumstances and may change in future.