Battle of the big three multi-manager trusts: who comes out on top?

22nd June 2022 09:49

by Jennifer Hill from interactive investor

Alliance Trust, F&C and Witan – three big investment trusts that give investors access to a range of managers in one fell swoop. But how do they differ, and which has given investors the most bang for their buck?

Three global multi-manager investment trusts – Alliance Trust (LSE:ATST), F&C (LSE:FCIT) and Witan (LSE:WTAN) – offer a one-stop shop for investing, with a significant degree of diversification that should allow investors to sleep more easily at night. But how do they compare?

Longevity

For a start, they are all long-lived. “Whether one looks at F&C, Witan or Alliance Trust there is the reassurance of well over a century of backstory that should give confidence to the most nervous or less-experienced investor,” says John Newlands, founder of Newlands Fund Research.

F&C is the oldest investment trust at 154 years old, having been established in 1868. Alliance Trust is the middle child of our trio at 134 years old and Witan is the relative baby at a mere 113 years.

“While they have had challenges along the way, these funds have been able to reinvent themselves and remain relevant to investors – there are plenty of other funds that have fallen along the way,” says Matthew Read, a senior analyst at QuotedData.

- Watch our video on five reasons why investment trusts are different from funds

- Looking to invest a £1,000? Watch our video

- Top investors share their biggest investment lessons

Size

All are a good size and have decent liquidity in their shares. F&C is the biggest of the three by some margin with a market capitalisation of £4.2 billion. Alliance Trust ranks second with £2.8 billion and Witan third with £1.5 billion.

They are the biggest trusts in the global sector except for the Goliath of them all, Scottish Mortgage (LSE:SMT), which has a market cap of more than £10 billion.

“While Scottish Mortgage’s performance has been incredible over the longer term, its explicit growth focus and investment style makes its performance inherently more volatile than these multi-manager vehicles – its shares have more than halved from their November 2021 peak,” says Read.

Management

Alliance Trust is externally managed. Its investment manager, Willis Towers Watson (WTW), has selected nine active managers. The three biggest are GQG, Veritas and Black Creek, together accounting for half of assets. Manager changes are not frequent, but do happen.

F&C is also externally managed. The trust’s manager, Paul Niven of BMO Global Asset Management, oversees the strategic and tactical asset allocation. He selects managers to run various strategies. These are predominantly within BMO, giving him the flexibility to quickly tune the portfolio.

“In fact, F&C has only two external managers, both managing US equities, with the rest of the world handled in-house by BMO,” says David Liddell, a director of IpsoFacto Investor.

Witan is self-managed. It has a chief executive, Andrew Bell, and employs other staff directly. However, most of its investment activities are outsourced to third-party managers. The top three are currently Veritas, Lansdowne and Lindsell Train, collectively accounting for half of assets. Witan also uses GQG.

Portfolio

Selecting managers with a balance of investment styles means Alliance Trust effectively takes style risk off the table.

Pascal Dowling, a partner at Kepler Trust Intelligence, says: “There is no significant divergence from the global equity benchmark in terms of style, eliminating the risk of finding yourself in a rout for growth funds if the market shifts toward value, for example, but retaining all the other benefits of active management because each is a concentrated portfolio of ‘best ideas’ designed to deliver alpha.

“If you aren’t sure which way the market is heading, this might be an interesting proposition.”

At the end of April, it held 189 stocks, skewed towards the US and technology “where the valuation is still rich and could face some headwind in the near term”, cautions Tracy Zhao, a senior fund analyst at interactive investor.

- The investments that will keep growing – even during a recession

- Watch our video on how to invest £10,000

F&C is the most diversified of the three, with around 400 holdings. Typically, 10% is in unquoted securities, an aspect appreciated by interactive investor, which has the trust in its Super 60.

“The allocation to unlisted and private equity gives investors added diversification and exposure to an asset class not widely available to retail investors,” says Zhao.

Witan has 260 holdings and splits its assets 75/25% between a core and specialist portfolio. The latter provides exposure to areas such as climate change, private equity and life sciences.

“Such exposures tend to have superior long-term growth prospects and might be underrepresented in a typical global portfolio due to the specialist knowledge needed,” says Read.

Sustainability

Since the management of Alliance Trust moved to WTW, there has been a strong emphasis on sustainability.

“This was a key reason why WTW was selected,” continues Read. “The manager has more than 70 experts focusing exclusively on the risks of climate change.”

The other trusts have also taken up the sustainability gauntlet. Witan has committed to having only sustainable investments by 2030, and all three aim to transition their portfolios to net-zero emissions by 2050.

Yield

While all three focus mainly on capital growth, they are Association of Investment Companies (AIC) dividend heroes, having raised their dividends every year for more than 20 years.

“The trusts’ stable and rising dividends, even during the global pandemic, can provide investors with much-needed income, which is particularly pertinent with the current cost of living crisis,” says Zhao.

Alliance Trust has the longest record of dividend growth at 55 years, an honour shared with Bankers (LSE:BNKR) and City of London (LSE:CTY). F&C has grown its dividend for 51 years and Witan for 47 years.

Shares in Witan yield 2.8%, offering “comfort in an uncertain world”, says Newlands, while Alliance Trust and F&C yield 2.7% and 1.7%, respectively.

- Why bonds are back after a record-breaking sell-off

- Why world’s biggest fund manager isn’t buying the dip

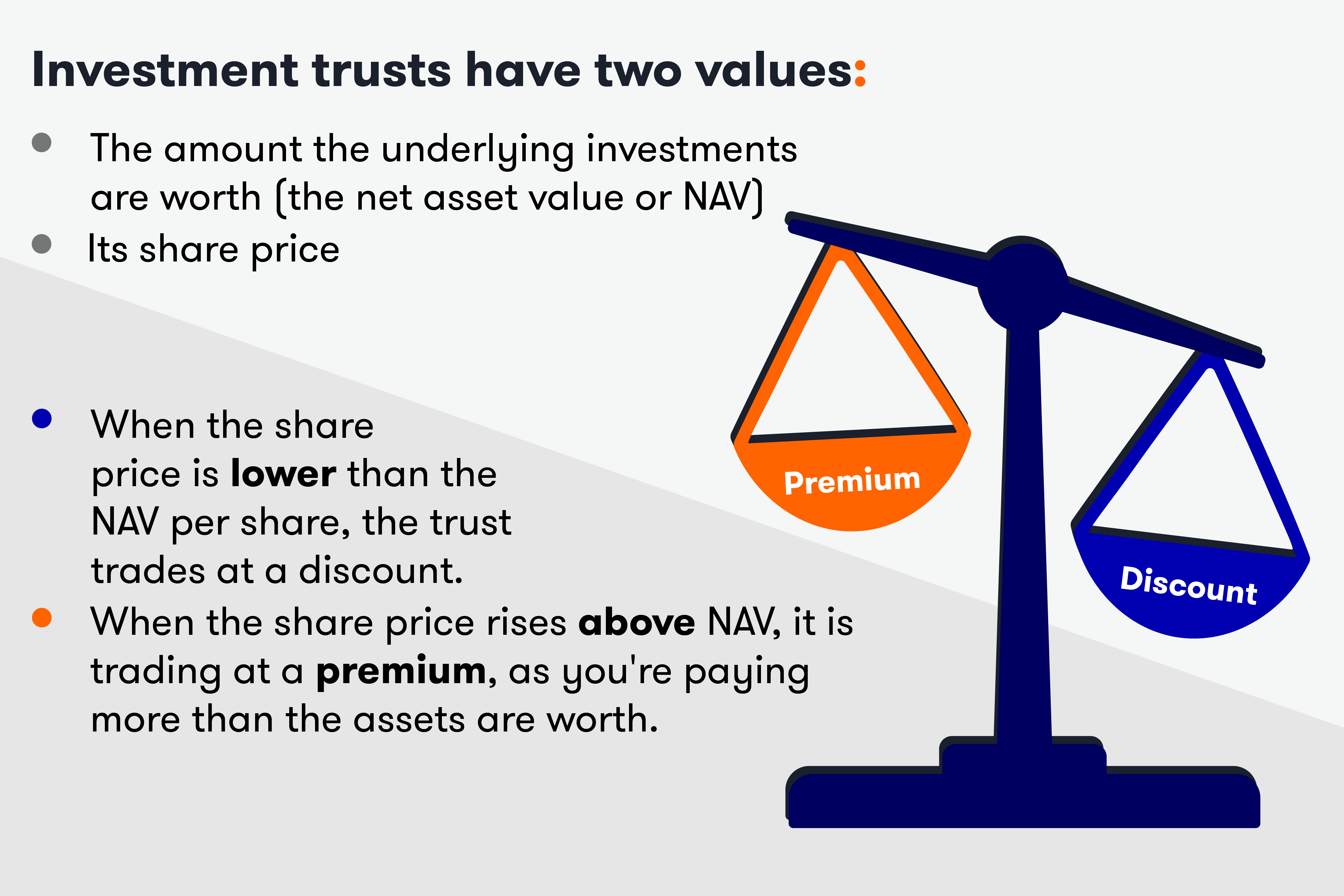

Discount

All three trusts tend to trade at a discount to net asset value (NAV). As at 21 June, Alliance Trust was trading at a 5% discount, while F&C and Witan’s discounts were hovering closer to 10%.

“Alliance Trust has made clear its intention to repurchase shares when the discount is greater than 5%, which seems to be keeping its discount in check,” says Read.

“In comparison, F&C does not have a firm target and the discount is wider than it used to be. Similarly, Witan is active in the market for its own shares but its board also seems prepared to tolerate a wider discount.”

A wide discount can provide an attractive entry point for new investors.

Performance

Alliance Trust’s manager of managers approach has been in place for just over five years and, during this time it has made an average NAV total return of 8.8% per year.

F&C has provided a little more at 9.8%, while Witan is the laggard, having returned an annualised 5%. All performance figures at time of writing in late May.

Part of the underperformance is down to style considerations. “Witan has historically had a value bias but under the pressure of extremely poor performance in 2019 and the early months of the pandemic, it dropped its deep value manager Penza and reoriented towards a growth style – arguably at just the wrong moment,” says Liddell.

- How and where to invest £50k to £250k for income

- Witan underperforms but raises dividend for 47th year in a row

Geographic and sector allocations are another big factor. They typically drive performance given the trusts’ high level of diversification at a stock level.

Monica Tepes, investment companies research director at finnCap, says: “Witan is structurally overweight the UK – its benchmark is 15% FTSE All-Share and 85% MSCI FTSE All-World versus global indices for the other two trusts – and based on the most recent disclosures Witan’s UK allocation is much higher at 26% versus 12% and 7% for Alliance and F&C, respectively.

“Given the S&P 500 has strongly outperformed the FTSE All-Share over the last five years, it’s understandable that its returns have lagged.”

As risks abound, a higher allocation to the UK may provide some near-term downside protection given the resilience of the UK versus other markets, says Zhao.

Prospects

For Dowling, all three trusts are industry stalwarts that have added value for investors who want a “fire and forget” investment.

The key, says Newlands, is to hold for at least a decade, allowing investors to “safely shrug off the economic crisis of the moment and get on with their lives”.

“Nobody who sets aside a lump sum, or say £100 per month, with dividend reinvestment in any or all of these vehicles would be likely to regret it in a decade’s time,” he adds.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.