Barratt Developments: Big profit, big dividend

22nd February 2017 14:01

by Harriet Mann from interactive investor

Britain's decision to leave the EU didn't give the best start to the year. But eight months later and the housebuilder has just reported a decent half-year, with financial strength and a record order book triggering an upgrade to its dividend policy.

After resetting dividend cover from 3 times to 2.5 times, shareholders will receive an interim payout of 7.3p, up 22% on last year, plus a special dividend which will take the payout for the 12 months to November to 39.3p. That gives a highly attractive prospective yield of 7.5%. Next year it will be 40p.

While completions outside London have reached a nine-year high, an increase in new affordable homes failed to offset a slip in the number of private and joint ventures Barratt built last year, knocking total completions in the six months to December down 5.8% to 7,180. This tipped revenue down 3% to £1.8 billion, despite an increase in the average selling price.

But, with more profitable sites and underlying inflation, gross margin rose 2.1% to 20.7% and return on capital employed (ROCE) increased by 1.5 percentage points to 27%. Pre-tax profit jumped 9% to £321 million, slightly better than expected at the January trading update, giving earnings per share (EPS) of 25.9p, up 8%.

Surging from £24.2 million to £196.7 million, as expected, Barratt's cash pile should double to £350-£400 million by the end of the financial year, it says. The drop from £592 million in June reflects normal seasonal trends, investment in land and dividends.

Second-half trading is strong so far, with forward sales up 17% at a record above £3 billion. Management have held fire on increasing full-year forecasts, an existing ROCE target of 25% and 20% gross margin looks within easy reach.

It's not been an easy six months for the housebuilder, with Britain's decision to leave the European Union forcing it to rein in spending. Only £328 million was spent on land during the period, compared to £558.7 million the year before. This should pick up, however, and 15,000 plots should be approved for purchase in 2017.

Barratt's landbank portfolio is made up of lower-margin land bought before 2009 and more profitable sites acquired since.

Of course, the housebuilder has been working through this portfolio to transform profitability - Barratt has built over 77,100 homes in the last five years - and now 94% of its sites were acquired in the last eight years.

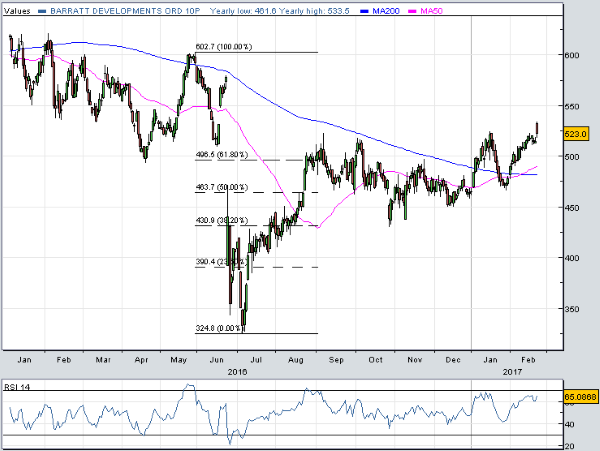

Up 3.8% to 534p in early trade, the share price has settled at 523p, up 1.6%. Filling the gap-down triggered by the referendum sell-off, Barratt's shares have jumped 60% since and now trade above the 62% Fibonacci retracement of last summer's slump.

Trading on 10 times forward earnings and with a 7.5% prospective yield, the shares remain attractive. With management sticking to forecasts, UBS analyst Gregor Kuglitsch repeats his 'hold' rating and 515p target price for now.

This article is for information and discussion purposes only and does not form a recommendation to invest or otherwise. The value of an investment may fall. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.