Bargain Hunter: three big discounts tipped as a buy

17th May 2022 11:30

by Kyle Caldwell from interactive investor

Investment trust analysts are finding value in this part of the market, but there’s a difference in opinion over which is the best bargain opportunity.

UK smaller company trusts have been hit hard by investors turning cautious in response to various headwinds overhanging stock markets.

Investors have turned bearish in response to Russian’s invasion of Ukraine, inflation at its highest level in decades, and rising interest rates. In addition, the bond market recently signalled that the prospect of a recession occurring in the next 12 to 18 months is becoming more likely.

Greater caution is reflected in just over £7 billion being withdrawn from funds in the first three months of this year. In contrast, funds received inflows of £10 billion in the first three months of 2021.

Smaller-sized shares have fallen out of favour as investors move to reduce risk. Such companies tend to produce higher returns over the long term compared with larger firms (such as those in the FTSE 100), but given that they are riskier to back, this part of the market is more vulnerable to sharp, short-term falls when investor sentiment turns sour.

- One in three funds have posted double-digit losses so far in 2022

- The funds delivering when both growth and value stocks do well

- Top-performing fund, investment trust and ETF data: May 2022

Another factor at play is that smaller-sized businesses are more domestically focused than their larger peers and are therefore more in tune with the health of the economy. Therefore, during times when a country’s economic growth is sluggish or contracting, which makes investors more cautious, smaller companies fall out of favour. Larger companies generate most of their profits abroad, so they are less impacted by the performance of the domestic economy.

For UK smaller company investment trusts, the one-year share price performance makes for grim reading. The average trust is down 19.7%. This is notably higher than the open-ended UK smaller company fund sector, which shows an average loss of 13.8%. The difference between the two will largely be down to investment trusts being able to gear (borrow to invest). In a falling market, gearing goes into reverse and causes greater losses per share.

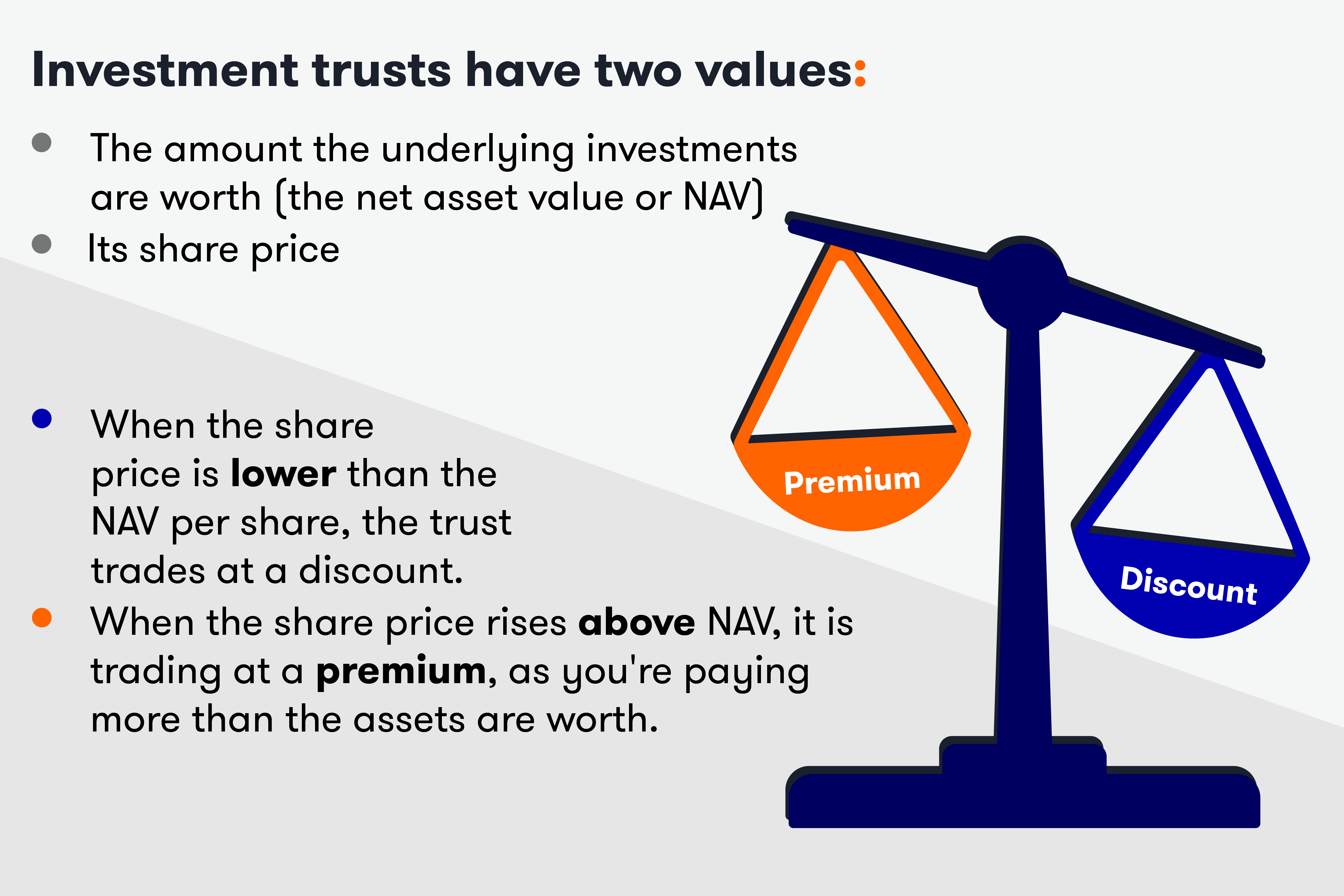

The share price total return for trusts has also been negatively impacted by widening discounts. Figures from investment trust analyst Winterflood show that a year ago the average UK smaller company trust discount was 9.1%. The average discount in the sector now stands at 15%.

A trio of cheap UK smaller company trusts

Three investment trust analysts, Winterflood, Investec Securities and Kepler Trust Intelligence, have all in recent weeks highlighted a UK smaller company trust they see as an opportunity following increases in its discount.

In late April, Winterflood tipped abrdn UK Smaller Companies Growth (LSE:AUSC), which since 2003 has been managed by smaller companies veteran Harry Nimmo. The trust is trading on a discount of 12% versus a 12-month average discount figure of 7%.

Emma Bird, research analyst at Winterflood, points out that over the last 10 years the trust has delivered a net asset value (NAV) total return of 237%. This is ahead of its benchmark, the Numis Smaller Companies plus AIM (excluding Investment Companies) index, up 127%, as well as the UK Smaller Companies peer group return of 206%.

Bird notes that the trust has also outperformed both the index and the peer group over the past three and five years. However, over the last 12 months, the fund’s NAV has fallen by 6% in total return terms, slightly better than the benchmark (-7.0%), but representing a marginal underperformance of the peer group (-5.6%).

Bird explains that “these negative returns have coincided with a period of market rotation from ‘growth’ to ‘value’, which the managers note is the most challenging market environment for the fund.

“We rate Harry Nimmo and the wider management team highly and believe that abrdn UK Smaller Companies Growth has a well-established and consistent investment approach, including the use of a proprietary screening tool.”

Bird says it is an interesting time to take advantage of the trust’s discount due to the trust having a discount control mechanism whereby the board is committed to buying back shares to ensure the discount does not exceed 8% “in normal market conditions”. She adds that the discount is “an attractive entry point”, given that it is “notably wider than its own five-year historical average discount of 6%”.

- Funds Fan: the Scottish Mortgage interview

- Five reasons why investment trusts are different from funds

- Eight star fund managers who can buy on the cheap

Investec Securities highlighted (on 5 May) a different UK smaller company trust that also boasts a strong long-term track record: BlackRock Smaller Companies (LSE:BRSC). This trust, which since June 2019 has been managed by Roland Arnold, focuses on quality growth shares.

Investec points out that it is a “proven philosophy and process” as the company has outperformed its benchmark in 18 of the last 19 years, which is also the Numis Smaller Companies plus AIM (excluding Investment Companies) index.

It says: “The manager notes that portfolio companies have emerged from the pandemic even stronger, and are well placed to take further market share. The company has suffered from an indiscriminate (in our view) de-rating in recent weeks, but we regard this as an opportunity to acquire a core strategic holding on a distressed discount.”

The current discount for BlackRock Smaller Companies is 13.5%, compared to 5.9% for its 12-month average.

Investec notes that “the management team is well resourced, working closely with a network of brokers”. In addition, it says that “BlackRock’s depth of resource, including strategists, economists and industry-leading risk analytics, represents a strong competitive advantage”.

Trading on a bigger discount than the two trusts tipped above is Downing Strategic Micro-Cap (LSE:DSM). Its discount is 20.9% versus 16.1% for its 12-month average.

William Heathcoat Amory, of Kepler Trust Intelligence, thinks the discount is unjust. He points out that the recent publication of the trust’s yearly results (to 28 February 2022), show that the NAV increased by 5.3% versus the FTSE AIM All‐Share, which was down 12%. Its share price fell short of the NAV, up 1%, owing to its discount widening over that 12-month period.

Heathcoat Amory says that the trust’s lead manager Judith MacKenziesummarises her investment approach as investing “in small, unloved, and overlooked UK companies under £150 million market capitalisations (at the time of investment). These are typically good businesses with a core asset or earnings quality which is unrecognised by the market.”

- How and where to invest £50K to £250K for income

- Find out what is being tipped to be the best investment of 2022

Heathcoat Amory adds: “This is a ‘value’ strategy, in that the portfolio constituents' quoted prices are significantly below the value at which Downing Strategic Micro-Cap’s managers place their achievable market value.”

Its approach has benefited from the market rotation that’s taken place since the beginning of the year. Year-to-date NAV returns (as of 6 May) show a gain of 4.6% versus a loss of 16% for the UK Smaller Companies sector.

However, as Heathcoat Amory notes “despite this strong performance, DSM’s discount has widened from the average level during the last financial year, and is currently wider than 20%”.

He adds: “In our view, this offers clear attractions given the resilience shown so far this year during very difficult markets and the deep value characteristics of the underlying holdings.”

Heathcoat Amory says that the board aims to manage the discount of shares to NAV by “taking up loose stock where necessary”. He also notes that plans for 2024 to offer shareholders a chance to sell some of their shares could be a catalyst for the discount to narrow.

The smaller company effect explained

A powerful long-term investment trend is smaller shares’ outperformance of larger companies.

There is plenty of logic behind the argument. Smaller companies have higher potential for growth – as the late Jim Slater said, “Elephants don’t gallop”.

In addition, this part of the market is less intensively researched by analysts, giving investors and fund managers who do invest in smaller companies greater chance to gain an edge.

The numbers speak for themselves: research by the London Business School found that £1 invested in 1955 in UK smaller companies would have grown to £7,933 by the end of 2020. In contrast, £1 invested in UK large companies over that 65-year period would have grown to £1,054.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.