Barclays shares surge to one-month high

After Q1 results, our head of markets explains why the bank remains the preferred play in the sector.

29th April 2020 10:45

by Richard Hunter from interactive investor

After Q1 results, our head of markets explains why the bank remains the preferred play in the sector.

Barclays (LSE:BARC) is in good shape, according to these first-quarter results, and therefore well prepared to make its contribution to keeping the wheels of the UK economy oiled.

Prior to the impact of the coronavirus outbreak, this had been a good quarter for the bank, and its actions since have anticipated the issues yet to come, particularly during what is likely to be a dire second quarter for global economies generally.

The increase in the credit impairment figure from £450 million to £2.1 billion includes £1.2 billion of a directly-related coronavirus reserve. This number is predicated on a sharp contraction of GDP and a significant upturn in unemployment in both the UK and the US.

But it does not detract from the bank’s willingness to lend, as evidenced by some of its immediate steps such as its activity through the Covid Corporate Financing Facility and £740 million of Coronavirus Business Interruption Loans.

In addition, it has approved over 238 000 mortgage and loan payment holidays, with 6 million customers currently seeing the benefit of no personal overdraft or business banking charges.

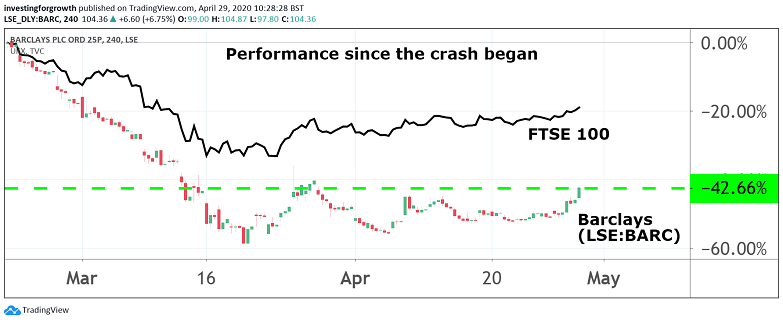

Source: TradingView Past performance is not a guide to future performance

Alongside these measures, Barclays’ financial performance has led to a robust platform from which to progress further.

The capital cushion has reduced slightly but remains at a comfortable level of 13.1%, the Net Interest Income and Net Interest Margin metrics are holding up well despite a challenging interest rate environment, and the Return on Tangible Equity (ROTE) number is also respectable, coming in at 5.1%, shy of the previous 9.2% figure and still with a 10% target in mind longer term.

Meanwhile, the dividend payment holiday has freed up some additional capital, and a rise in group income of 20% allied to stable operating expenses has resulted in a much-improved cost/income ratio of 52%, as compared to the 62% number previously quoted.

Within the units, the standout performer is clearly the Corporate and Investment Bank, where income has surged 44% and where the ROTE has jumped from 9.5% to 12.1%.

Market volatility has clearly played into the hands of the investment bank during the quarter, which provides more ammunition for the group’s overall financial objectives.

The overall net profit figure of £605 million is above expectations, although down from £1 billion, with the pre-tax figure showing a similar decline.

- HSBC profits dive: is there any hope?

- Chart of the week: FTSE 100 could do something spectacular very soon

- Take control of your retirement planning with our award-winning, low-cost Self-Invested Personal Pension (SIPP)

Of course, the strongest challenges are yet to come, with the second quarter likely to herald reduced customer activity, a potential increase in bad debts, generally recessionary economic environments and all at a time when historically low interest rates continue to crimp margins.

From an investment perspective, the loss of the dividend (previously yielding around 10%) is a significant loss to income-seekers, and signs of some weakening trends in the Credit Card and Payments unit will need to be monitored and addressed.

Even so, the bank has remained in the black despite a sharp upturn in its credit impairment provisions, which seem prudent given the circumstances.

The share price has unsurprisingly been victim to a broad markdown of financial shares of late, having dipped 43% over the last three months.

Over the last year, a 39% decline compares to a drop of 20% for the wider FTSE 100 index, with a proportion of the bad news now factored in.

As such, should Barclays continue to make its contribution to the economy while at the same time benefiting from both its geographical and business diversification, it will continue as the preferred play in the sector, with the market consensus currently standing at a “strong buy”.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.