Barclays: CEO probe overshadows decent results

It’s easily the best-performing domestic bank of the past year, but what does our head of markets think?

13th February 2020 10:16

by Richard Hunter from interactive investor

It’s easily the best-performing domestic bank of the past year, but what does our head of markets think?

Barclays (LSE:BARC) has delivered a largely impressive set of full-year numbers, especially given the wider challenges facing the global economy and, therefore, the banking sector as a whole.

All is not plain sailing, however, and the group’s complicated and ambitious transformation plan still requires some refinement.

The historically low interest rate environment is a constant pressure on net interest margins, general economic uncertainty and subsequent cost emanating from Asia has yet to be defined and, on its home turf, the UK’s negotiations with the EU are unlikely to be a smooth ride.

In terms of the numbers themselves, there was a decline in the return on capital number from the usually reliable Consumer, Cards and Payments unit, while the 30% increase in the credit impairment charge is something of a red flag, particularly given the generally benign consumer environment in terms of interest rates and inflation.

Meanwhile, the announcement of a regulatory inquiry to investigate chief executive Jes Staley’s relationship with disgraced financier Jeffrey Epstein, is an unwelcome distraction at a time when the bank is spinning so many plates.

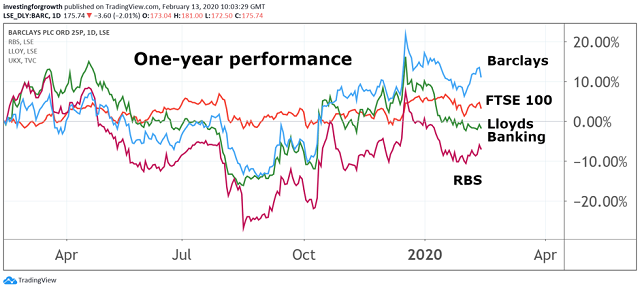

Source: TradingView Past performance is not a guide to future performance

Even so, for the most part, Barclays is reaping the rewards of previous belt-tightening, which has been boosted by some pleasing growth figures. Despite the continued investment in its digital presence, for example, the cost/income ratio has been contained at 63% with a future target of 60% in place.

A combination of strong cost control and some useful income contributions from most of its units, such as the investment bank, which has probably seen some benefit following the demise of the Deutsche Bank equivalent, has culminated in a pre-tax profit figure which has surged by 26%.

The earnings per share metric is also notably stronger, the capital cushion remains perfectly adequate at 13.8% versus a 13.5% target and the overall return on tangible equity figure is comfortable at 9%, although the bank concedes that this year’s 10% target may be something of a stretch.

Elsewhere, future share buybacks remain a distinct possibility dependent on the macro-environment, although in the meantime a projected dividend yield of 5.4% is attractive to income-seekers, with the increase announced by Barclays a sign of confidence in prospects.

The reaction to the results has been hampered by a generally weaker market, although, given the recent run where the shares have added 27% over the last six months, there could be an element of profit taking exerting some downward pressure.

There is still some way to go to regain former glories – the share price remains down 22% over the last three years – but there are certainly glimmers of hope, with the bank more recently adding 13.5% over the last year, which compares to a 4.8% gain for the wider FTSE 100 index.

The UK banking sector, in particular, has been something of a minefield for investors in recent times and the results should be recognised against this backdrop. For the moment, Barclays remains the preferred play in the sector and the consensus of the shares as a “strong buy” is likely to remain in place after this generally strong showing.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.