This bank share is a money spinner and still a buy

Despite having already had a strong run, this stock is on a long-term upward trajectory, and overseas investing expert Rodney Hobson thinks the shares look remarkably cheap.

15th May 2024 08:43

by Rodney Hobson from interactive investor

It’s an ill wind that blows nobody any good and the ill wind that blew Swiss banking group Credit Suisse apart last year has certainly been good for arch rival UBS Group AG (SIX:UBSG), even if the Swiss government has erected a belated windbreak.

First-quarter results for Zurich-based lender and wealth manager UBS are naturally heavily distorted by the acquisition of Credit Suisse, producing a 75% leap in net profits from just over $1 billion to $1.76 billion. That was considerably better than analysts had expected, in fact nearly three times the level that had been forecast.

- Invest with ii: Buy US Stocks from UK | Most-traded US Stocks | Cashback Offers

Revenue also rose sharply, though by less than profits, by 46% to $12.7 billion. That was slightly better than the 42% rise in operating expenses. Wealth management fared particularly well in the first quarter, attracting $27 billion of net new assets. Investment banking also starred.

A double-edged sword was the fine performance by non-core operations acquired through the Credit Suisse deal. These assets are being sold off, so they will not contribute to future profits. On the other hand, they will prove very attractive to potential buyers.

As so often with mergers or acquisitions, cutting costs is the key to success, and the enlarged UBS chopped its combined bills by $1 billion in the quarter. It has already saved an impressive $5 billion and should have no difficulty in achieving its target of a further $1.5 billion by year end.

UBS was strongarmed into rescuing Credit Suisse by the Swiss Government but may not have been as reluctant as it made out at the time. UBS paid a knockdown price and ended up with an even more dominant position in Switzerland.

Admittedly, the merger has been particularly complicated and is taking some time to complete. A single US holding company will be achieved by the end of June and joint Swiss entities will be in place in the third quarter of this year.

With a seeming lack of gratitude, the Swiss government has imposed stricter financial strength requirements on the monster it has created, fearful that UBS truly is too big to fail. Its assets are twice the size of the entire country’s gross domestic product.

There were fears that meeting these requirements would restrict UBS in returning cash to shareholders. Also, the rest of this year will be a bit tougher as net interest will be reduced by a quarter-point lowering of interest rates in the country in March. However, the bank has declared a 70 US cents dividend and stuck to its previously announced plan for a $2 billion share buyback programme over the next two years.

- GameStop and AMC Entertainment shares rocket again

- Morgan Stanley’s five cutting-edge ‘long shot’ investment ideas

- Sellers swamp Arm Holdings after results miss

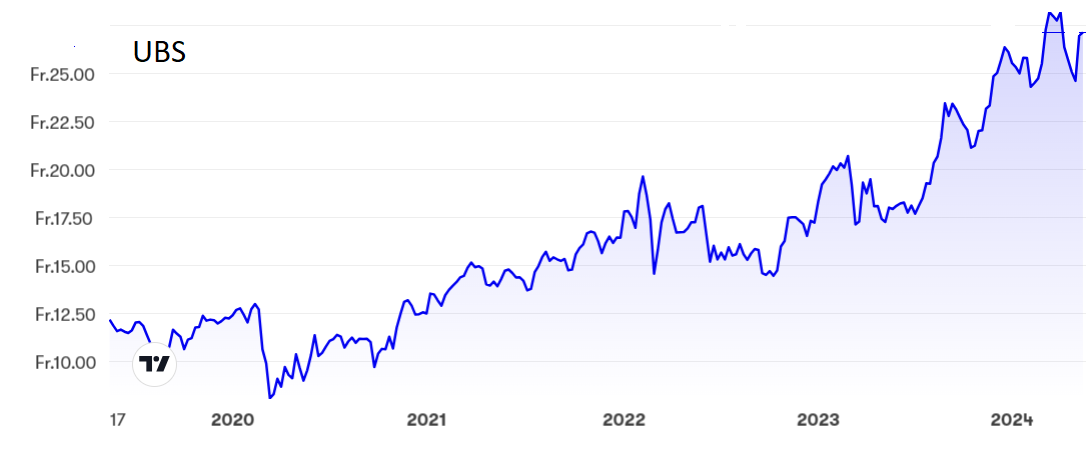

UBS shares slumped when the additional financial strength rules were introduced but shot higher after the first-quarter results. They now stand just above 27 Swiss francs (SFr), having pushed as high as SFr28.50 at the beginning of April. They stood at only SFr8 in the depths of the pandemic in March 2020, but it has been pretty much an upward journey ever since.

The price/earnings ratio is almost unbelievably low at only 3.5 while the yield is a reasonably decent 2.35%.

Source: interactive investor. Past performance is not a guide to future performance.

Hobson’s choice: While the best chance to buy UBS shares has long since gone, they still look remarkably cheap. An awful lot has to go wrong to justify the ridiculously low rating. While banking is an international business for an operation as large as UBS, it always helps to have a dominant position in your home market, and they don’t come more dominant than this one. Two recent dips found solid support at $24.50, and that level is unlikely to be tested again. This money spinner is still a buy. If you had the presence of mind to buy earlier, it is far too early to take profits.

Rodney Hobson is a freelance contributor and not a direct employee of interactive investor.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.

Disclosure

We use a combination of fundamental and technical analysis in forming our view as to the valuation and prospects of an investment. Where relevant we have set out those particular matters we think are important in the above article, but further detail can be found here.

Please note that our article on this investment should not be considered to be a regular publication.

Details of all recommendations issued by ii during the previous 12-month period can be found here.

ii adheres to a strict code of conduct. Contributors may hold shares or have other interests in companies included in these portfolios, which could create a conflict of interests. Contributors intending to write about any financial instruments in which they have an interest are required to disclose such interest to ii and in the article itself. ii will at all times consider whether such interest impairs the objectivity of the recommendation.

In addition, individuals involved in the production of investment articles are subject to a personal account dealing restriction, which prevents them from placing a transaction in the specified instrument(s) for a period before and for five working days after such publication. This is to avoid personal interests conflicting with the interests of the recipients of those investment articles.