Bank sector Q1 2023 results preview: three favourite stocks

12th April 2023 13:59

by Graeme Evans from interactive investor

Just days before US banks kick off first-quarter results season, a group of analysts has slashed price targets and tweaked profit forecasts. Here are the banks to watch in the coming weeks.

Earnings season in the US banking sector gets under way this week, with major lenders facing an uphill battle to rebuild investor confidence following a turbulent start to the year.

While last month’s collapse of Silicon Valley and Signature banks provided only a temporary setback for markets, the KBW Nasdaq Bank index remains 19% lower so far this year.

- Invest with ii: Top US Stocks | US Earnings Season | Interactive investor Offers

Shares in Bank of America Corp (NYSE:BAC), Citigroup Inc (NYSE:C) and Wells Fargo & Co (NYSE:WFC) tumbled by as much as a fifth at the height of the banking turbulence in March, with their valuations slow to recover since then.

JPMorgan Chase & Co (NYSE:JPM) has been one of the more resilient performers, but its shares are still 10% lower than the start of March despite standing to benefit from inflows as consumers and corporates switch to larger institutions following the failures.

On Friday, the heavyweight lender will join Citigroup and Wells Fargo in posting first-quarter results. However, the focus of Wall Street is likely to be more on the 2023 outlook and the commentary of chief executive Jamie Dimon than on the actual figures.

In particular, analysts will want to see how net interest margins are likely to fare as increased competition for deposits makes it harder for lenders to keep their rates low.

- Good times return for this respected global brand

- 11 US shares for your ISA in 2023

- 11 ways to invest your ISA like Warren Buffett

- Listen to our podcast: banking turmoil: why we’re in a mini crisis and not another global crash

There will also be interest in how far lending standards have been tightened in the wake of the recent crisis, as well as in projections for loan impairments as the US economic outlook weakens and higher interest rates begin to leave their mark.

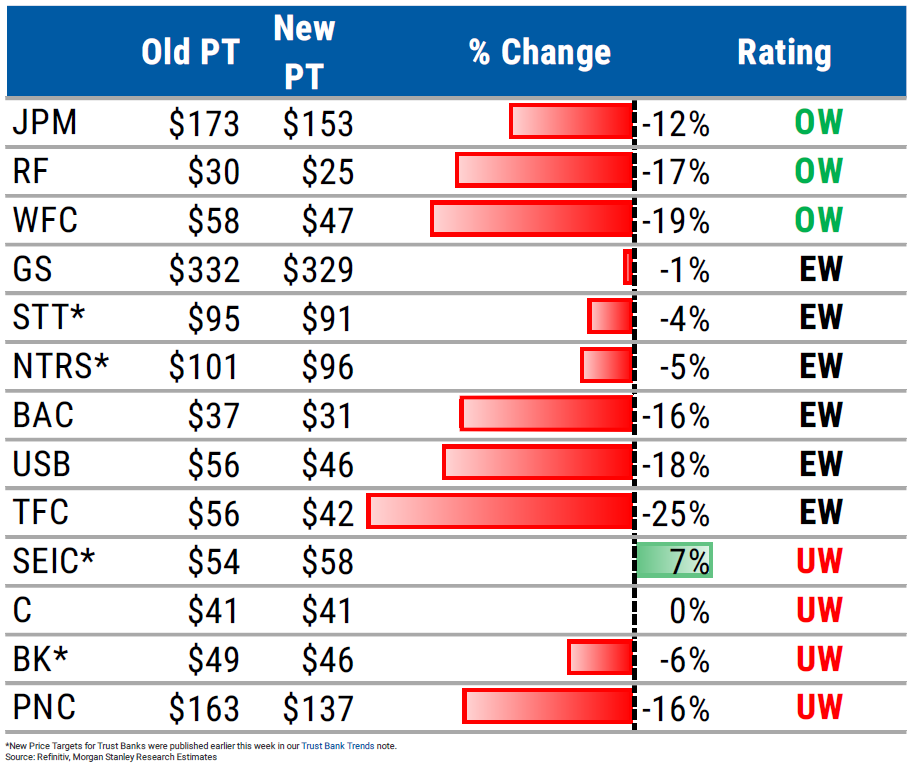

Analysts at Morgan Stanley are in no doubt that investors need to be cautious after the bank recently downgraded price targets on a range of stocks by as much as 25%.

It also lowered earnings forecasts to reflect the likely pressure on net interest margins, slower loan growth and the potential for share buybacks to come under pressure.

Adding that it is still too early for investors to go long on large-cap banks, Morgan Stanley said that every income statement line is in flux and the degree of confidence in its forecasts now lower as the probability of a sharper slowdown increases.

The bank’s analysts wrote last week: “We've been saying for well over a year that high inflation coupled with quantitative tightening (QT) is a tough environment for banks. Inflation is driving up loan growth and QT is shrinking deposits.”

“That's what the banks were dealing with even before Silicon Valley Bank failed, with loans growing 10% and deposits shrinking 3%.”

- What 120 years of stock market data tells us about where to invest today

- The funds, investment trusts and ETFs most exposed to bank shares

JP Morgan is one of Morgan Stanley’s three preferred banks going into earnings season, although it still downgraded the heavyweight’s price target by 12% to $153. It is also overweight on Wells Fargo, but with a new price target 19% lower at $47.

It also likes Regions Financial Corp (NYSE:RF), which lost a quarter of its value in the weeks following SVB. Morgan Stanley takes its price target on the lender down 17% to $25, or 11.8 times forecast earnings for 2024, although that still implies potential 35% share price upside.

Morgan Stanley expects 15% growth in net interest income in 2023, “materially above peers” and at the upper end of Regions’ own forecast for 13-15%. You can check out progress when Q1 results are published on 21 April.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.