Bank of England raises interest rates again to battle inflation surge

17th March 2022 12:50

by Graeme Evans from interactive investor

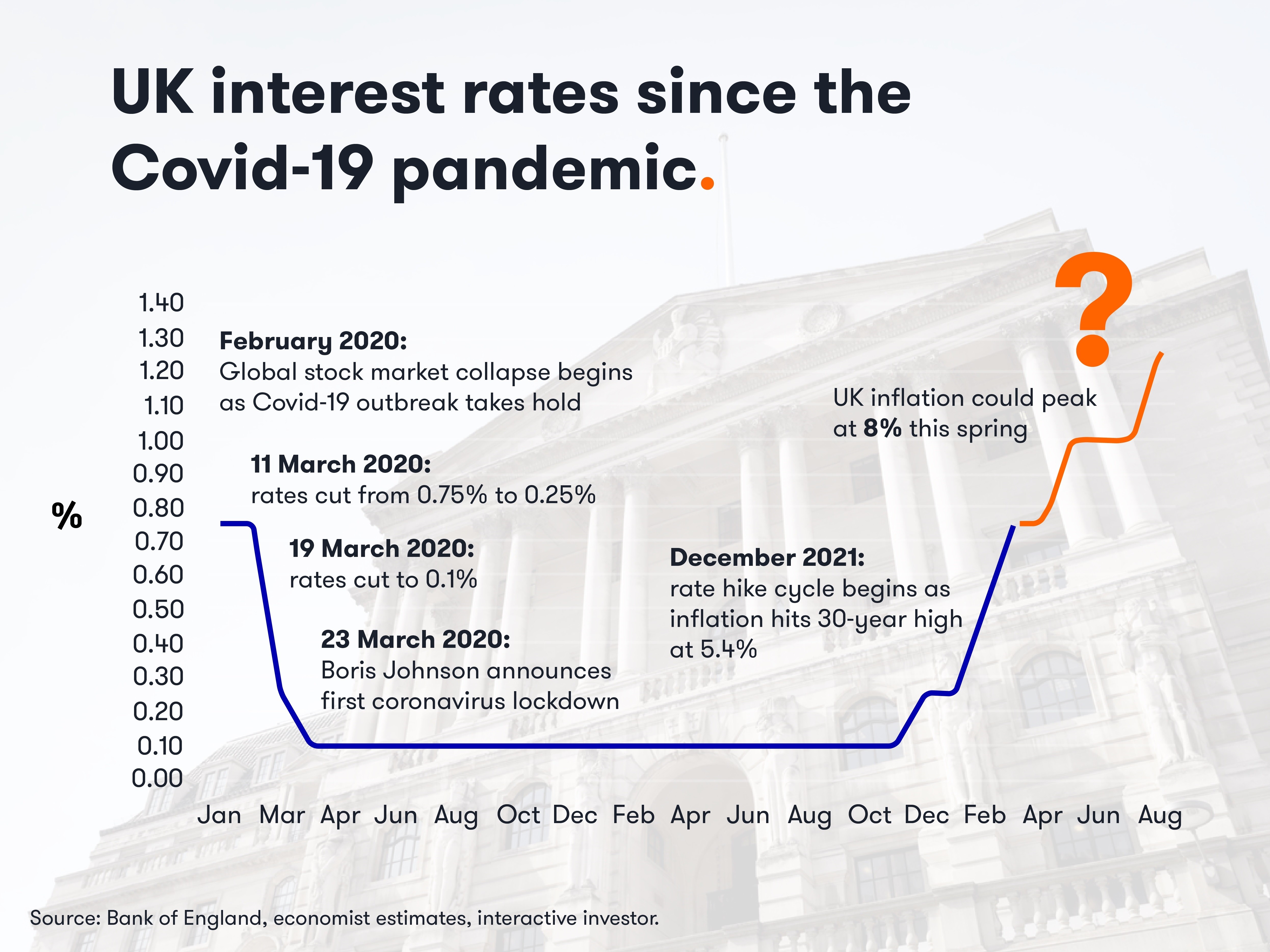

After a period of record low interest rates during the pandemic, the Bank of England has raised borrowing costs at every meeting since December. Our City expert talks us through the battle against inflation and the likelihood of further rate rises to come.

Interest rates are today back at their pre-pandemic level of 0.75% after the Bank of England sounded the inflation alarm with a third increase in borrowing costs since December.

It warned that today’s quarter-point increase may be followed by further rises this year, although its projections are hugely uncertain amid soaring energy costs, a tight labour market and the economic shock of the Ukraine war and sanctions against Russia.

Eight of the nine members on the monetary policy committee voted for the quarter point increase as the Bank made it clear that its remit to meet a 2% inflation target should continue to be its primary focus.

The consumer price index reached 5.5% for January but the Bank thinks it will top 8% by the second quarter of the year following April’s 54% hike in Ofgem’s price cap.

If energy market futures stay high, the Bank warns there’s a possibility that Ofgem’s October price review will mean inflation ends the year above the peak projected for April.

- The pros are fleeing to cash and buying commodities as markets plunge

- Commodities shock: wild times as scarcity looms

- New video: inflation, dividends and a new commodities supercycle

- New video: Russia, Ukraine and the mining sector

It expects “further modest tightening” in monetary policy in the months ahead but admits that the tools at its disposal may not be sufficient to bring prices back under control.

The Bank said: “The economy has recently been subject to a succession of very large shocks. Russia’s invasion of Ukraine is another such shock.

“In particular, should recent movements prove persistent, the very elevated levels of global energy and tradable goods prices, of which the UK is a net importer, will necessarily weigh further on UK real aggregate income and spending.

“This is something monetary policy is unable to prevent.

Today’s rate rise was in line with expectations and followed yesterday’s move by the US Federal Reserve, which raised rates for the first time since December 2018 and said as many as six more increases may follow this year.

The FTSE 100 index edged about 20 points higher in the immediate aftermath of the Bank’s decision, although for banking stocks there was a negative reaction after the Bank charged its tone on future rate rises from “likely” to saying they “might be appropriate”. One member voted for no change on interest rates this month.

NatWest Group (LSE:NWG), which is regarded as the most geared in the UK to higher rates, went ex-dividend today so its shares were already about 3.5% lower. This became a fall of 4.5% after the Bank of England decision, while Lloyds Banking Group (LSE:LLOY) went from being 0.5% lower to down more than 2%.

- Interest rate hike means savers are damned if they do, damned if they don't

- Nine things to watch for in the chancellor’s Spring Statement 2022

- Tips from three pros on fighting inflation

- Shares, funds and trusts for your ISA in 2022

The pound traded about 0.3% lower at 1.31 versus the US dollar as traders compared the Bank’s tone with the Federal Reserve’s pledge to raise rates six more times this year.

Fed chairman Jerome Powell highlighted the need for a return of price stability and said Fed policymakers were “determined to use our tools to do exactly that”.

UBS analyst Paul Donovan pointed out earlier that the Bank of England’s policy path differs from the US, given that the UK tax burden is already the highest in over 70 years and “households exited the pandemic with less spending firepower than US households.”

With the pound continuing to trade at near its lowest level in a year, dollar and overseas earning companies in the FTSE 100 were boosted today. The biggest gainers in the top flight were drinks giant Diageo and credit checking firm Experian.

The Bank of England’s assessment on the UK economy did few favours for the housebuilding sector, which is already under pressure from factors including supply chain costs and the potential bill for cladding remediation. The prospect of higher rates and a darker economic outlook sent Persimmon (LSE:PSN) 58p lower to 2244p and Taylor Wimpey (LSE:TW.) down 1.4p to 141.1p.

The focus will now be on the level of support offered by Chancellor Rishi Sunak in his Spring Statement on 23 March, with Capital Economics predicting that half of a fiscal package worth about £10 billion will go towards easing the cost of living crisis.

The UK’s rate hiking cycle is the first experienced by many households and borrowers, given that the financial crisis in 2007-09 ushered in a period of cheap money that still exists today.

The base rate went from 5.75% in the summer of 2007 only to fall to 0.5% two years later. In 1992, rates briefly touched 15% when Britain fell out of the European Exchange Rate Mechanism.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.