Bank of England approves another £100bn stimulus to prop up UK economy

Stock markets have staged a recovery, and another pile of cash is earmarked to boost the economy.

18th June 2020 15:07

by Graeme Evans from interactive investor

Stock markets have staged a recovery, and another pile of cash is earmarked to boost the economy.

The emergency support underpinning the stock market recovery since mid-March was boosted today when the Bank of England pumped an extra £100 billion into the UK economy.

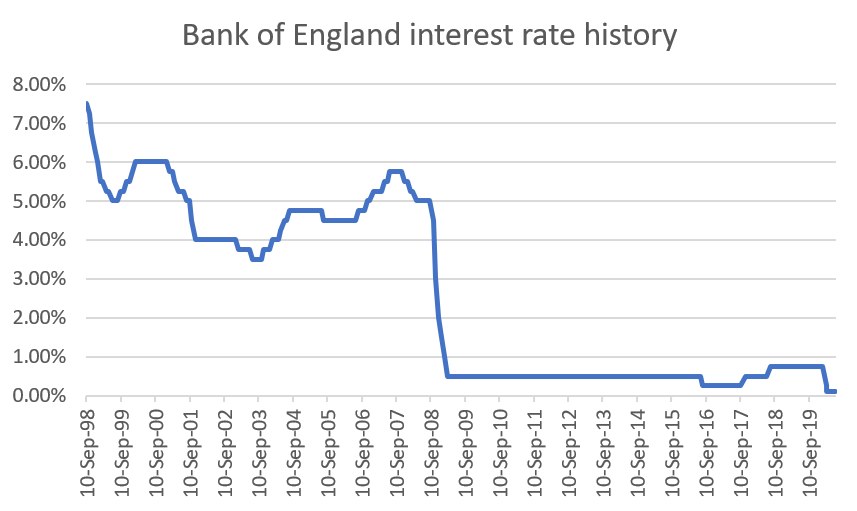

The need for additional stimulus is in contrast with the more optimistic mood of global stock markets, with the FTSE 100 index up 25% since the Bank slashed interest rates to a record low of 0.1% on 19 March.

The blue-chip index is now at 6,200, albeit 1% down this afternoon in a sell-off for global markets caused by continuing fears of a second wave of Covid-19. The recent rally has been stoked by the intervention of central banks, with the latest example on Monday after the US Federal Reserve said it would start using newly-created money to buy the bonds of corporations.

Source: Bank of England

Quantitative easing (QE) programmes - the Bank of England's bond buying is now set for £745 billion - have meant a continuation of the TINA effect - There Is No Alternative - where shares have remained attractive due to poor returns on cash and government bonds.

Today's £100 billion of additional stimulus from the Bank was as predicted in the City, with investors no doubt relieved that the minutes of the latest monetary policy committee contained no discussion on the need for negative interest rates.

That remains an option should economic performance deteriorate further after the 20% slump in output reported for April. The Bank will also be keen to ensure it keeps some firepower in reserve in case the economy is rocked by a second spike in Covid-19 infections.

For the timebeing, the Bank has been encouraged by some recent indicators on economic activity pointing to very early signs of recovery. These were sufficient for chief economist Andy Haldane to lobby against further QE, although he was outvoted by the other eight committee members including new Bank governor Andrew Bailey.

- Can the stock market really keep going up?

- How it’s possible to justify this stock market rally

- How FTSE 100 rally reached 1,200 points, or 25%

The slightly improved outlook also means the Bank will be able to carry out its bond buying at a slower rate, up until the end of the year.

The Bank said: “The emerging evidence suggests that the fall in global and UK GDP in 2020 Q2 will be less severe than set out in the May report.

“Although stronger than expected, it is difficult to make a clear inference from that about the recovery thereafter. There is a risk of higher and more persistent unemployment in the United Kingdom.”

- A common sense approach amid the stock market chaos

- Bank of England cuts rates to record low: How the market reacted

- ECB promises emergency cash to save eurozone economy

This week, it emerged that the number of workers on UK payrolls dived more than 600,000 between March and May, with those claiming work-related benefits up 126% to 2.8 million. The Government's wage support schemes are due to run until October, meaning there's still very little visibility about the outlook beyond then.

The Bank warned that the economy, and especially the labour market, will take some time to recover towards its previous path. CPI inflation is well below the 2% target and is expected to fall further below it in coming quarters, largely reflecting the weakness of demand.

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.