Awkward! ii on investment platform charge scenarios

24th January 2022 11:26

by Jemma Jackson from interactive investor

We turn the spotlight on the cost of investing.

- Research suggests the same investment choices and time horizon can still mean different outcomes in portfolio value terms, due to different platform charges

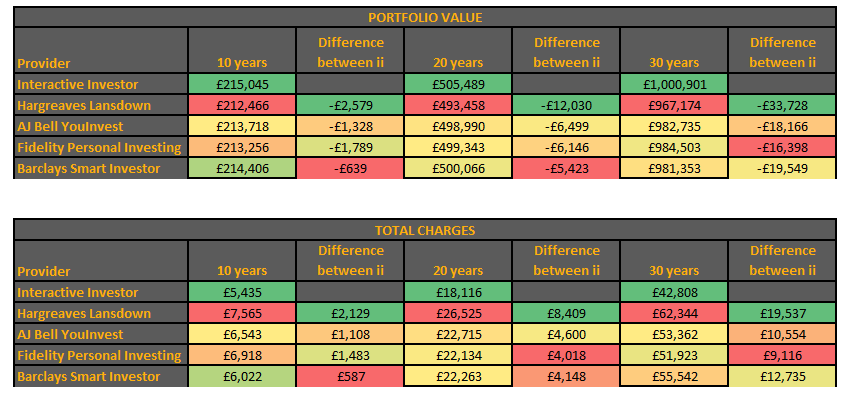

- These differences between ii and its largest competitor can add up to over £2,500 over 10 years, £12,000 over 20 years, and over £33,000 over 30 years in portfolio value terms

- This is based on ii’s scenarios looking at larger pot sizes

Money can be a sensitive subject, especially when it comes to sharing costs - perhaps even more so given the current cost of living crisis.

Investors are unlikely to notice investment platform costs in the same way they notice day-to-day costs such as food – but they are real and tangible, and investment providers have been dining out on them for years.

To bring some of the issues closer to home, interactive investor, the number one flat fee provider, has explored a couple of awkward scenarios.

Imagine you’d invested the same amount as your partner, and made the same investments and over the same time frame. Yet one of you has a portfolio worth thousands of pounds less as the years have rolled by. You’d be pretty annoyed, most likely – and in need of some answers. And it can boil down to costs.

Charges: same strategy, different outcome

It might sound unlikely, but it isn’t. Assuming a starting value of £50,000 in a stocks and shares ISA – which is lower than the UK average ISA value of £61,707*, Lang Cat research for interactive investor then assumed an annual ISA investment of £10,000 (not insignificant, but a long way short of the £20,000 annual allowance), spread out on a monthly basis.

The research then imagined a portfolio split equally between funds and shares, reflecting the mix of funds and equities in customer portfolios. The research assumes an annual return of 5%, and two trades a year. See notes to editors for the full research.

There’s no question that anyone putting this amount of money away is very fortunate – but they are far from super-wealthy. Yet over time, the differences between the percentage fee and fixed-fee charging structure is striking.

In the early years, the differences might not seem so great, but even over 10 years investors with ii’s largest competitor would have a portfolio value worth £2,579 less than the ii customer (see notes to editors with some wider platform comparisons).

But fast forward 20 years, and there’s even more of a sting: investors with ii’s largest competitor would have a portfolio value worth £12,031 less than the ii customer.

Over 30 years, ii customers would be £33,727 better off in portfolio value terms under those same scenarios, with the ii customer an ISA millionaire, with a portfolio value of £1,000,901. Customers with ii’s largest competitor would have fallen short, with £967,174.

For smaller pots, a percentage fee will often work out cheaper – in the early days at least. So investors need to bear that in mind, too. Also, these growth assumptions are scenarios only. But it is nevertheless thought provoking.

Are you subsidising other investors?

Moira O’Neill, Head of Personal Finance, interactive investor, explains: “Many of us will be familiar with the end of a group meal, as the bill arrives. No matter how pleasant the meal and the company, there can be disputes around how best to split the bill. Should everyone pay the same amount? Should each pay for what they ordered? There’s always someone who ‘forgets’ about their dessert and that extra side dish.

“This is an example of potential cross-subsidies, where one group of consumers pays a higher price for a particular product or service than another group – even if they might have consumed the same amount.

“Investors are often subsidising others too - although they may not be aware of it. For example, most investment platforms charge customers a percentage of the amount they invest. It means that when any investment - large or small - grows in size, so does the charge, effectively penalising the very growth we all hope to achieve when we invest. On the flip side, percentage fees can work out far more most effective for small pots.

“A flat fee will work out more expensive for smaller investment pots, at least in the early years. But for larger pots, and as your wealth grows, flat fees can be a great way to keep more of your hard-earned money.

“Investors using services that charge flat fees know they are paying the same as everyone else for the same service. That’s fair, transparent, and easy to understand.

“So, no hidden subsidies, no headaches trying to work out how to split the bill and no one resenting paying for a dessert they didn’t get to enjoy.”

Notes to editors

The lang cat research:

Lang Cat assumed a starting value of £50,000 in a stocks and shares ISA.

Then assumed an annual ISA investment of £10,000, drip fed on a monthly basis.

The research then imagined a portfolio split equally between funds and shares, with an annual return of 5%. An inflation rate of 2.00% throughout the period. Inflation is applied to regular contributions and to instances of fixed fees, but not used to adjust final projected values.

It assumed 2 trades a year.

Returns are scenarios only. The value of investments can go down as well as up and you may not get back the full amount invested.

Ongoing Charges Figure (OCF)

The analysis assumes a typical portfolio of active funds, with an average OCF of 0.66%.

Each provider shown may offer a different range of investments.

Investment returns

These articles are provided for information purposes only. Occasionally, an opinion about whether to buy or sell a specific investment may be provided by third parties. The content is not intended to be a personal recommendation to buy or sell any financial instrument or product, or to adopt any investment strategy as it is not provided based on an assessment of your investing knowledge and experience, your financial situation or your investment objectives. The value of your investments, and the income derived from them, may go down as well as up. You may not get back all the money that you invest. The investments referred to in this article may not be suitable for all investors, and if in doubt, an investor should seek advice from a qualified investment adviser.

Full performance can be found on the company or index summary page on the interactive investor website. Simply click on the company's or index name highlighted in the article.